Complete Guide: 401k Match Calculator & Maximizing Your Employer Contributions

A 401k match calculator helps you understand exactly how much free money your employer contributes to your retirement account based on your salary and contribution rate. With over 86% of employers offering some form of 401k match, understanding and maximizing this benefit can add hundreds of thousands of dollars to your retirement savings over your career.

Key Statistics

What Is a 401k Match Calculator and Why Does It Matter?

A 401k match calculator is a specialized financial tool that calculates the exact amount your employer will contribute to your 401k retirement account based on your salary, contribution percentage, and your employer's specific matching formula. This isn't just simple multiplication—employer matches follow specific formulas that can significantly impact your lifetime retirement savings.

Why It Matters: The average employer match is worth 4.8% of your salary annually. For someone earning $75,000 per year, that's $3,600 in free money each year—potentially growing to over $285,000 over a 30-year career with compound interest.

Unlike basic percentage calculators, our 401k match calculator is built around how real-world plans work:

- Common match formulas: Safe harbor (100% on 3% + 50% on next 2%), enhanced 100% matches, dollar-for-dollar, and partial matches you can model with presets or custom settings

- Annual contribution limits: IRS limits ($23,500 for 2025) that can affect your ability to receive full match

- Compounding growth: How your match grows over time with investment returns

- Salary increases: Annual raises that increase both your contributions and employer match

- True-up provisions: Year-end adjustments some employers make to ensure you receive full match

How Does 401k Employer Matching Work?

Employer matching contributions follow specific formulas defined in your company's 401k plan document. Understanding these formulas is crucial to maximizing your "free money."

Common Match Formulas

Basic Safe Harbor Match

Most common formula

• 100% match on first 3% of salary

• 50% match on next 2% of salary

• Maximum employer contribution: 4%

Enhanced Match

More generous option

• 100% match on first 4% of salary

• Maximum employer contribution: 4%

• Requires immediate vesting

Dollar-for-Dollar

Simplest structure

• 100% match up to 3-6% of salary

• Maximum varies by employer

• Easy to understand

Partial Match

Less common today

• 50% match up to 6% of salary

• Maximum employer contribution: 3%

• Requires 6% contribution for full match

Real Example: Sarah's 401k Match

Sarah's Situation:

- Annual salary: $75,000

- Employer formula: 100% match on first 3%, 50% match on next 2%

- Her contribution: 5% of salary ($3,750/year)

Employer Match Calculation:

- First 3%: $75,000 × 3% = $2,250 × 100% match = $2,250

- Next 2%: $75,000 × 2% = $1,500 × 50% match = $750

- Total annual employer match: $3,000

Key Insight: Sarah's $3,000 annual match, invested at 7% annual return for 35 years, grows to approximately $396,000 by retirement—more than her total contributions!

What Factors Affect Your 401k Match?

Your Contribution Rate

The percentage of your salary you contribute directly impacts your match. Most formulas require you to contribute a minimum percentage to receive the full match.

Critical Point: Contributing below the match threshold is like taking a voluntary pay cut. For example, if your employer matches 4% but you only contribute 2%, you're leaving half your free money on the table.

Employer Match Formula

Different formulas dramatically change your match amount. A 100% match on 4% of salary is more valuable than a 50% match on 6% of salary.

Comparison: On a $75,000 salary, 100% match on 4% = $3,000/year. 50% match on 6% = $2,250/year. The difference is $750 annually, or $66,000+ over 30 years with growth.

Annual Salary

Since matches are percentage-based, your salary directly affects the dollar amount. Raises increase both your contribution and your employer's match.

Impact: A 3% annual raise on a $75,000 salary means your match grows by $90 in year one, $93 in year two, and so on—compounding over your career.

IRS Contribution Limits

The 2025 employee contribution limit is $23,500 (under age 50). Hitting this limit early in the year can cause you to miss out on later matching contributions.

Warning: If you max out your 401k by September, you won't contribute in October-December, and your employer won't match during those months unless they offer a "true-up" provision.

Common 401k Match Mistakes to Avoid

Mistake #1: Not Contributing Enough for Full Match

The Problem: 25% of employees don't contribute enough to receive their full employer match, leaving an average of $1,336 in free money on the table annually.

Solution: Always contribute at least enough to get the full match. This is literally free money with a guaranteed 50-100% immediate return.

Mistake #2: Maxing Out Too Early in the Year

The Problem: Contributing 20% of salary might seem aggressive and smart, but if you hit the $23,500 IRS limit by September, you miss out on October-December matching contributions.

Solution: Calculate your contribution percentage to spread contributions evenly across all 12 months. For example, at $75,000 salary, contribute 31.3% to max out in December, not September.

Mistake #3: Ignoring Vesting Schedules

The Problem: Leaving your job before you're fully vested means you forfeit some or all of your employer match. With cliff vesting, leaving one month early could cost you thousands.

Solution: Understand your vesting schedule. If you're close to a vesting milestone, consider timing your job change to avoid losing employer contributions.

Mistake #4: Not Accounting for True-Up Provisions

The Problem: Many employees don't know if their employer offers a "true-up" provision, which ensures you get your full annual match even if you max out early.

Solution: Check your plan documents or ask HR about true-up provisions. If available, you can front-load contributions without penalty.

401k Match Strategies for Different Situations

Early Career (Ages 22-35)

- Contribute at least enough for full match immediately

- Consider Roth 401k for tax-free growth

- Increase contribution 1% each year with raises

- Time job changes around vesting schedules

Goal: Establish the habit of saving and never leave free money on the table.

Mid-Career (Ages 36-50)

- Maximize match while increasing total savings to 15%

- Consider catch-up contributions after age 50

- Evaluate after-tax contributions if available

- Monitor IRS limits to avoid front-loading

Goal: Build substantial retirement savings while maximizing all available employer benefits.

Pre-Retirement (Ages 50-65)

- Take advantage of $7,500 catch-up contributions

- Coordinate with spouse's contributions and matches

- Consider Roth conversions in low-income years

- Plan around required minimum distributions (RMDs)

Goal: Maximize all tax-advantaged savings opportunities while planning for distribution strategies.

High Earners ($150,000+)

- Watch for HCE (Highly Compensated Employee) limits

- Coordinate with after-tax contributions

- Consider mega backdoor Roth if available

- Monitor $345,000 compensation limit for matches

Goal: Navigate complex IRS rules while maximizing all available employer contributions.

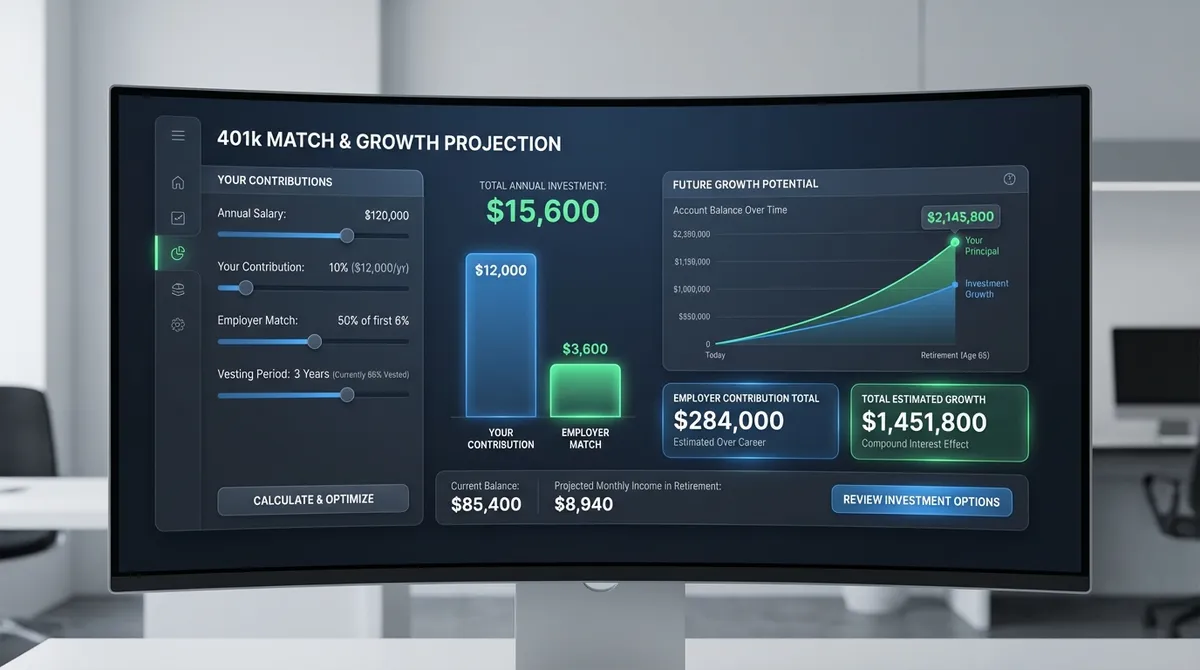

How to Use Our 401k Match Calculator

Our 401k match calculator simplifies complex calculations to show you exactly how much your employer contributes and how that match grows over time.

Enter Your Personal Information

Input your annual salary, current age, and planned retirement age. These basics determine your contribution timeline and amounts.

Set Your Contribution Rate

Enter the percentage of your salary you contribute to your 401k. Remember the 2025 limit: $23,500 (under 50), $31,000 (50+).

Select Employer Match Formula

Choose from common formulas (Basic safe harbor, Enhanced, Dollar-for-Dollar, Partial). For enhanced, dollar-for-dollar, and partial matches, you can fine-tune the match percentage and limit fields to mirror your specific plan.

Review Your Results

See your annual contribution, employer match, total annual savings, and projections showing how your match grows over time.

Pro Tip: Use the "Quick Scenarios" buttons to see how different contribution rates and match formulas affect your results. Experiment with conservative, moderate, and aggressive scenarios to find your optimal strategy.

Key Takeaways

Your 401k employer match is one of the most valuable benefits your employer offers—literally free money that can grow to hundreds of thousands of dollars by retirement. Using a 401k match calculator helps you understand exactly how much you're getting and identifies opportunities to maximize this benefit.

What to Do Now:

- Contribute at least enough to get your full employer match

- Use our calculator to see your specific match amount

- Spread contributions across all 12 months

- Increase contributions 1% annually with raises

What to Avoid:

- Leaving free money on the table

- Maxing out contributions too early

- Ignoring vesting schedules

- Not understanding your match formula

Remember: Your 401k match is part of your compensation package. Not maximizing it is like accepting a pay cut. Use our calculator regularly to ensure you're getting every dollar you deserve.

About the Author

Jurica Šinko, Finance Expert and Founder of EFinanceCalculator, has over 15 years of experience in personal finance and investment management. He specializes in retirement planning and is passionate about making financial planning tools accessible to everyone. Jurica has helped thousands of individuals maximize their employer benefits and build secure retirement futures.