Complete Guide to Accounts Receivable Turnover

Accounts receivable turnover shows how efficiently your business converts credit sales into cash. Instead of looking only at revenue, this ratio focuses on how quickly customers settle their invoices, which directly affects payroll, vendor payments, and growth investments.

A higher turnover ratio generally indicates faster collections and healthier cash flow. A lower ratio can signal loose credit policies, operational bottlenecks, or customers experiencing financial stress from rising costs. The goal is not just to increase the number, but to align it with your industry, business model, and risk tolerance.

When you use the Accounts Receivable Turnover Calculator, you are measuring how many times per period you collect your average receivables. This turns abstract financial statements into a practical cash flow metric you can monitor every month or quarter.

What this accounts receivable turnover calculator does

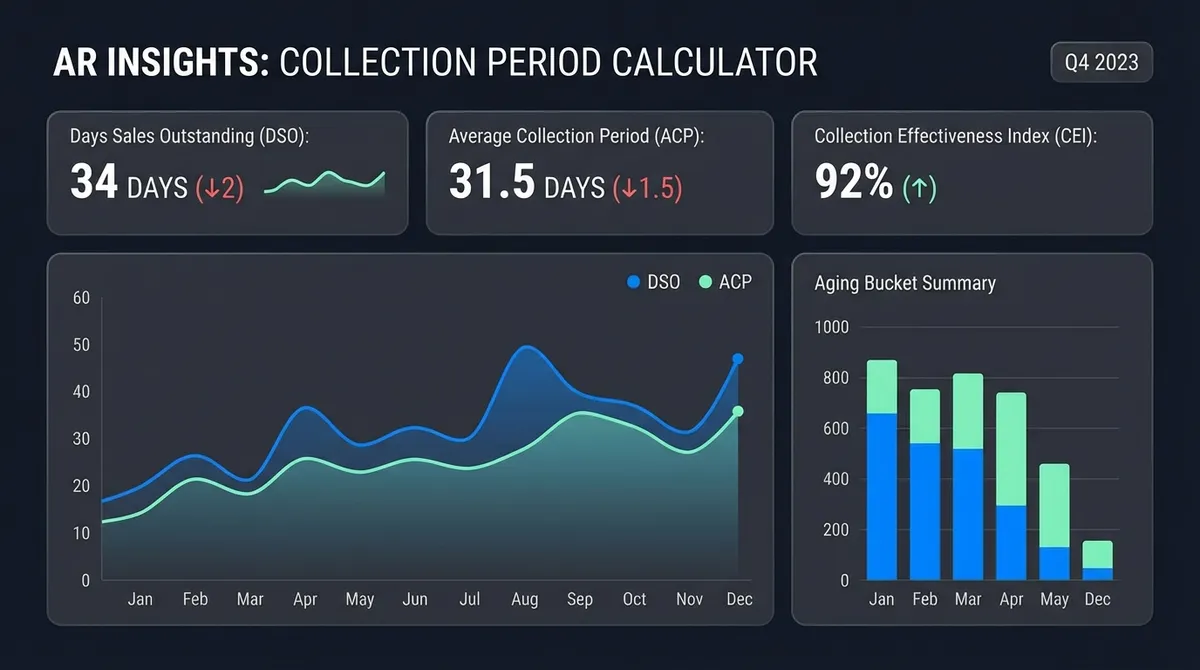

This calculator focuses on three practical outputs: the accounts receivable turnover ratio, the average collection period in days, and a high-level efficiency assessment. By combining your net credit sales with beginning and ending receivable balances, it provides a single, interpretable view of how quickly customers pay and how reliable your current cash inflows are.

You can also model different scenarios by adjusting the analysis period, trying industry presets, or testing stricter credit policies. This lets you estimate the impact of operational changes before you implement them in your billing and collections process.

Turnover ratio

See how many times you collect your average receivables during the selected period, based on established accounting formulas.

Average collection period

Convert the ratio into a more intuitive metric: the typical number of days it takes customers to pay their invoices.

Efficiency insights

Interpret your results using guidance tailored to common ranges for retail, manufacturing, healthcare, construction, and wholesale businesses.

Accounts receivable turnover formulas and key definitions

The calculator uses standard accounting formulas that you can also apply manually. Understanding the components behind the ratio makes it easier to spot data issues and explain the results to colleagues or lenders.

Core turnover ratio

Accounts Receivable Turnover = Net Credit Sales ÷ Average Accounts Receivable- Net credit sales: total sales on credit minus returns, allowances, and discounts.

- Average receivables: beginning receivables plus ending receivables, divided by two.

Converting the ratio to days

Average Collection Period (Days) = Days in Period ÷ AR Turnover RatioFor annual analysis, most businesses use 365 days. For quarterly or monthly analysis, adjust the period accordingly so that the ratio and the time frame stay consistent.

How to interpret your accounts receivable turnover results

There is no single "perfect" turnover ratio. A retailer with mostly card transactions will naturally collect faster than a manufacturer offering 60-day terms. Instead of chasing a universal target, compare your results to your own history and relevant industry benchmarks.

Higher ratios

Higher turnover ratios usually indicate faster collections and stronger cash flow. This can reduce reliance on short-term borrowing and make it easier to fund inventory, payroll, and growth initiatives.

However, extremely high ratios may suggest that credit policies are so restrictive that you are turning away otherwise reliable customers. Use the calculator to test how more flexible terms might affect both sales volume and cash flow.

Lower ratios

Lower turnover ratios often indicate slow collections, weak follow-up on overdue invoices, or customers under financial pressure. This can create liquidity challenges even when reported sales look strong.

If your ratio is trending downward, use the calculator monthly and combine it with aging reports to identify which segments or customers are driving the slowdown.

Example: Calculating accounts receivable turnover step by step

Imagine a wholesaler with net credit sales of 1,200,000 dollars for the year. Beginning receivables are 160,000 dollars and ending receivables are 200,000 dollars. Average receivables are therefore 180,000 dollars.

- Compute the turnover ratio: 1,200,000 ÷ 180,000 = 6.67. The company collects its average receivables about 6.7 times per year.

- Convert that ratio to days using a 365-day year: 365 ÷ 6.67 ≈ 55 days. On average, customers take roughly 55 days to pay their invoices.

- Compare the result to your target terms and industry norms. If the wholesaler offers 30-day terms, a 55-day collection period suggests that collections need attention even though reported sales are healthy.

The calculator performs these computations automatically and adds narrative context so that non-accounting stakeholders can understand what the numbers imply for cash flow.

Proven strategies to improve accounts receivable turnover

Improving turnover is rarely about a single change. It usually comes from small, consistent improvements across your credit policy, invoicing process, and collections follow-up.

Strengthen credit policies

Use clear approval criteria, perform basic credit checks, and review limits periodically. Align terms with the risk profile of each customer segment rather than applying one standard across the board.

Make it easier for customers to pay

Offer modern payment options such as ACH, online portals, and card payments, and send invoices immediately when goods or services are delivered.

Create a structured collections routine

Schedule reminders before and after due dates, standardize escalation steps, and assign clear ownership for following up on overdue balances.

Use data to coach your sales and finance teams

Share turnover and collection period metrics regularly so teams can adjust negotiation tactics, customer onboarding, and follow-up processes.

Leverage specific automation tools

Modern accounting software (like QuickBooks or Xero) can automatically send "dunning" emails—gentle reminders 3 days before due date, and firmer notices 7 days past due. Automating this low-level follow-up frees your finance team to call the high-value accounts personally.

Common mistakes when analyzing accounts receivable turnover

Misinterpreting turnover can lead to poor decisions, such as tightening credit too aggressively or ignoring early warning signs of customer distress.

- Mixing cash and credit sales when calculating net credit sales.

- Comparing ratios that use different period lengths or seasonal patterns.

- Using ending receivables only instead of an average balance.

- Ignoring write-offs, credit memos, and disputed invoices.

- Looking at the overall ratio without reviewing aging reports by customer.

Accounts receivable turnover FAQ

How often should I review my accounts receivable turnover?

Most businesses benefit from reviewing the ratio at least monthly, with a deeper analysis each quarter and at year end. Frequent monitoring helps catch problems early, before they impact major decisions.

What if my turnover ratio looks solid but cash flow still feels tight?

Use the calculator together with cash flow forecasts, AR aging reports, and customer concentration data. It is possible to have an acceptable overall ratio while a few large customers routinely pay late and absorb most of yourworking capital.

Can I use this calculator for scenario planning?

Yes. Adjust sales volumes, receivable balances, and period length to test how changes in policy, pricing, or collections tactics might affect your turnover and collection period before you make operational changes.

Does a higher turnover ratio always mean better financial health?

Not always. An extremely high ratio can indicate that credit terms are too strict, which may limit revenue growth. Use the calculator as a starting point and interpret results within the context of your strategy and customer relationships.

How should I present turnover analysis to stakeholders?

Pair the calculator outputs with simple charts, historical trends, and written explanations. Focus on what has changed, why it changed, and the specific steps you plan to take next, rather than only quoting a single ratio. Loan requirements often mandate this clarity.