Complete Guide to Understanding APR

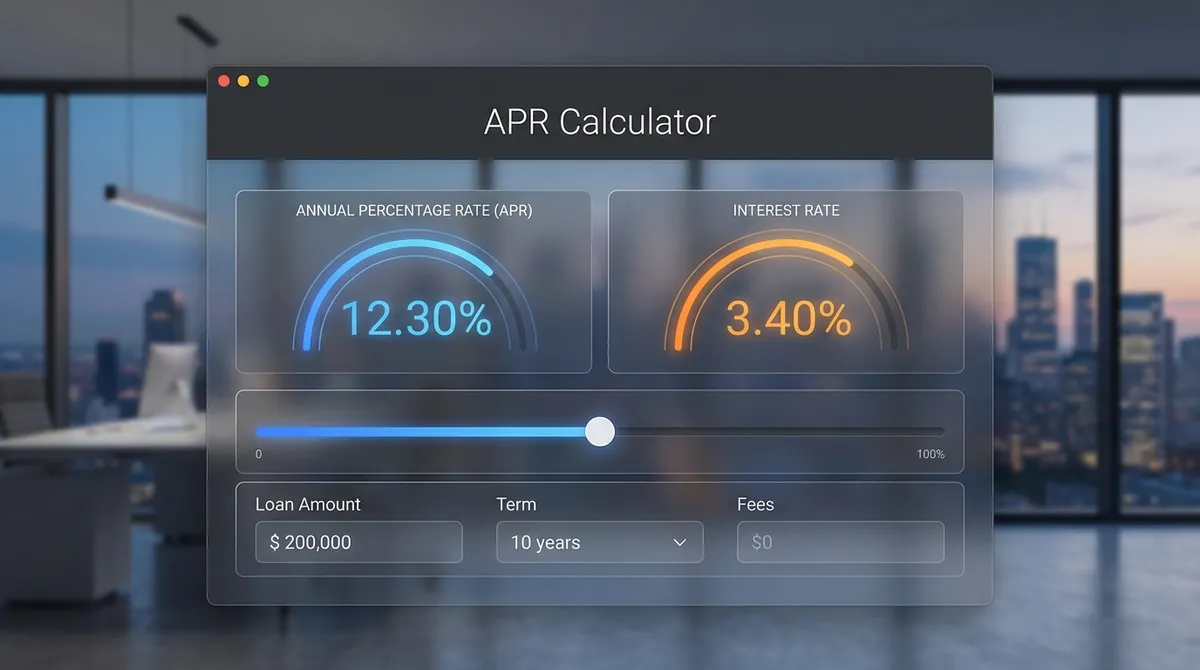

When shopping for a loan, the interest rate rarely tells the whole story. Hidden fees, points, and origination costs can make a "low rate" loan much more expensive than it appears. That's where the Annual Percentage Rate (APR) comes in—it is the single most important number for comparing the true cost of borrowing.

APR vs. Interest Rate: What's the Difference?

Many borrowers confuse APR with the interest rate, but they measure two different things:

- Interest Rate: This is simply the cost of borrowing the principal amount. It determines your monthly payment but ignores the upfront costs of getting the loan.

- APR (Annual Percentage Rate): This is the effective rate you pay when all loan fees (origination fees, closing costs, points) are spread over the loan term. It represents the true cost of credit.

Key Takeaway: Always compare loans using APR, not the interest rate. A lower interest rate with high fees can often result in a higher APR than a slightly higher rate with no fees.

How Is APR Calculated?

Calculating APR is complex because it involves solving for the internal rate of return (IRR) of the loan's cash flows. In simple terms, the formula takes the total interest you will pay, adds all the prepaid fees, and calculates an annual rate as if those fees were part of the interest.

The math considers three main variables:

- Loan Principal: The amount you borrow.

- Interest Rate: The nominal rate charged on the principal.

- Fees & Costs: Any charges you pay to get the loan (e.g., $500 origination fee, $1,000 closing costs).

Real-World Example: The Impact of Fees

Let's say you are comparing two mortgage offers for a $200,000 loan with a 30-year term.

| Offer | Interest Rate | Upfront Fees | APR | Monthly Payment |

|---|---|---|---|---|

| Loan A | 6.5% | $0 | 6.50% | $1,264 |

| Loan B | 6.25% | $6,000 | 6.64% | $1,231 |

Analysis: Loan B offers a lower monthly payment and interest rate, but because of the hefty $6,000 fee, its APR is actually higher (6.64%) than Loan A (6.50%). Unless you plan to stay in the home for the full 30 years, Loan A might be the better deal despite the slightly higher monthly payment.

Which Fees Are Included in APR?

Under the Truth in Lending Act (TILA), lenders must include most costs of credit in the APR. However, not every fee is included.

Included in APR:

- Origination fees

- Discount points

- Processing and underwriting fees

- Private Mortgage Insurance (PMI) premiums

- Closing agent fees (in some cases)

Usually NOT Included:

- Appraisal fees

- Credit report fees

- Title insurance

- Home inspection fees

- Attorney fees

Why Is APR Higher on Short-Term Loans?

You might notice that a $500 fee on a 2-year loan spikes the APR much more than the same fee on a 30-year loan. This is because you have less time to "spread out" the cost of that fee. On a short-term loan, upfront fees effectively act as a massive interest charge, skyrocketing your APR. This is why payday loans often have APRs of 400%+, even if the fee seems small in dollar terms.

The Limitations of APR

While APR is the gold standard for comparison, it isn't perfect. Here are scenarios where it might mislead you:

- If you plan to move soon: APR assumes you keep the loan for the full term (e.g., 30 years). If you sell your house in 5 years, a "Low APR / High Fee" loan might actually cost you more than a "High APR / No Fee" loan. This is because you paid all those upfront points but didn't stay long enough to recoup the savings from the lower interest rate.

- Adjustable Rate Mortgages (ARMs): For ARMs, the APR is based on a composite of the initial teaser rate and the fully indexed rate. It can be confusing because the future rate is unknown.

Nominal APR vs. Effective APR (EAR)

There is a subtle but important distinction in finance. The Nominal APR is the simple interest rate calculated annually. The Effective Annual Rate (EAR) accounts for compounding (interest on interest).

Example: A credit card with 24% APR compounding daily.

- Nominal: 24%

- Effective: (1 + 0.24/365)^365 - 1 = 27.1%

This is why credit card debt grows so fast. Most consumer protection laws require lenders to disclose the Nominal APR, but the math of compounding means you are often effectively paying more.

APR by Loan Type

Mortgages

APR includes points, broker fees, and insurance. It's the best way to compare lenders who structure closing costs differently.

Credit Cards

APR determines your monthly interest charge if you carry a balance. Purchase APR, Cash Advance APR, and Penalty APR are often different rates.

Auto Loans

APR is critical here because dealers often mark up the interest rate. A "0% APR" deal effectively means the manufacturer is subsidizing the interest cost.

Payday Loans

Lenders quote "fees," not rates (e.g., "$15 for every $100"). When annualized, this equals nearly 400% APR. Always calculate the APR to see the true horror of these loans.

Historical APR Trends (1980 - 2025)

Understanding today's APR requires looking at the past. Many borrowers panic when rates rise above 6%, but historically, that's quite normal.

| Decade | Average Mortgage APR | Context |

|---|---|---|

| 1980s | 12% - 18% | The Volcker era. Inflation fighting led to sky-high rates. |

| 1990s | 7% - 9% | Stable growth. 8% was considered a "great" rate. |

| 2000s | 5% - 7% | The housing bubble and subsequent crash lowered rates. |

| 2010s | 3% - 5% | Post-recession quantitative easing kept money cheap. |

| 2020-2022 | 2.5% - 3.5% | Pandemic lows. A historical anomaly unlikely to return soon. |

| 2023-2025 | 6% - 8% | Return to historical norms. "Normal" money costs money. |

The Mathematics of Amortization

APR dictates the speed at which you build equity, but amortization dictates when you build it.

In a standard amortizing loan (like a mortgage), your payment is constant, but the split changes.

- Year 1: On a 7% loan, roughly 83% of your payment goes purely to interest. Only 17% pays down debt.

- Year 15: You reach the "tipping point" where principal payment exceeds interest payment.

- Year 30: Your final payment is almost 100% principal.

This is why refinancing resets the clock. Even if you lower your APR by 0.5%, resetting to a new 30-year term might cost you more because you go back to paying 83% interest again.

Final Verdict: How to Shop

armed with this knowledge, here is your shopping checklist:

- Ask for the Loan Estimate (LE): This is a standardized government form. Page 1, top right corner—that is your official APR.

- Check the "TIP": Page 3 of the LE shows "Total Interest Percentage." This tells you how much interest you pay over the life of the loan as a percentage of the loan amount.

- Break Even Calculation: If buying "points" costs $4,000 but saves you $50/month, it takes 80 months (6.6 years) to break even. If you move in 5 years, do not buy the points.

Frequently Asked Questions

What is a good APR for a personal loan?

It depends on your credit score. Excellent credit (720+) might see 10-13%, while average credit could see 18-25%. Anything under 10% is exceptional for an unsecured loan in 2025.

Can APR change after I sign?

Only if you have a variable-rate loan (like a credit card or ARM). Fixed-rate loans lock in your APR for the life of the loan, regardless of market changes.

Why is my APR higher than my interest rate?

This is normal. APR includes the interest rate PLUS fees. If they are the same, it means you paid zero fees to get the loan (which is rare for mortgages).

Does a lower APR always mean a cheaper loan?

Usually, yes. However, if you plan to pay off the loan very early, a loan with a slightly higher APR but zero closing costs might actually be cheaper than a low-APR loan with high upfront fees.