Complete Guide to Arkansas Paycheck Calculations

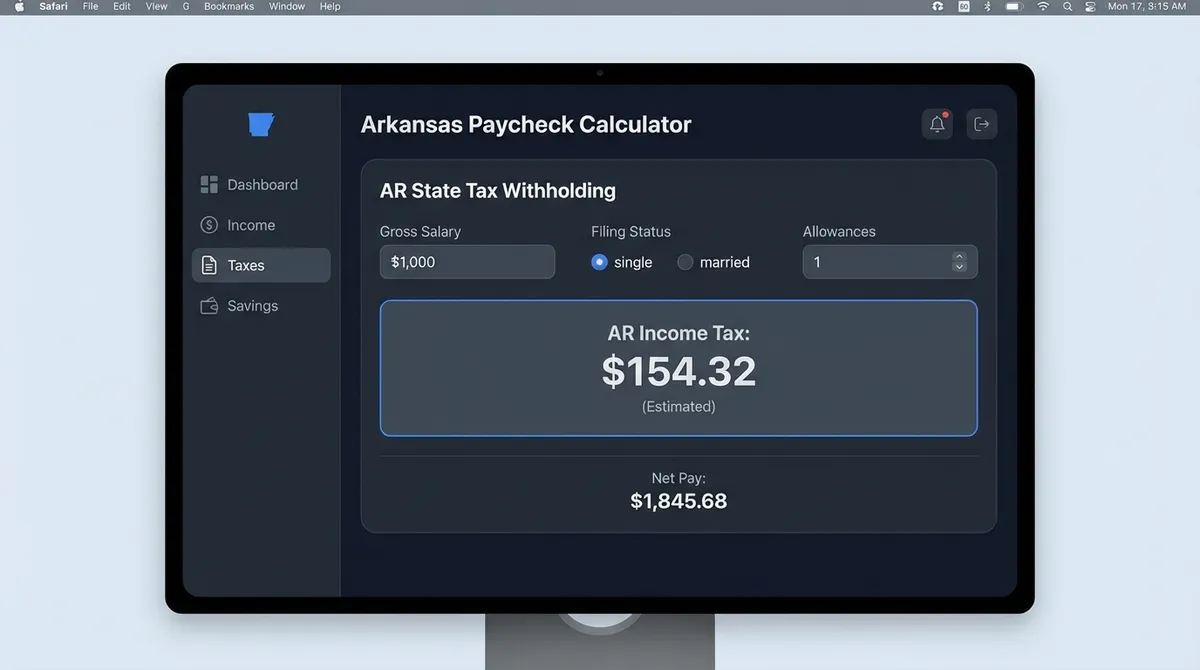

Understanding your paycheck in Arkansas goes beyond just looking at the final number. Whether you're working in the bustling professional hubs of Little Rock, running a small business in Fayetteville, or navigating the unique payroll landscape of Texarkana, knowing exactly where your money goes empowers you to make better financial decisions. Our Arkansas Paycheck Calculator breaks down every dollar—from federal and state taxes to FICA withholdings—giving you the clarity you need for 2025 and beyond.

Arkansas Paycheck At a Glance (2025)

- State Income Tax: Progressive rates from 0% to just 3.9% (lowered for 2025).

- Standard Deduction: $2,410 (Single) / $4,820 (Married Filing Jointly).

- Social Security Tax: 6.2% on earnings up to $176,100.

- Medicare Tax: 1.45% on all earnings (plus 0.9% for high earners).

- Special Exemption: Texarkana residents may be exempt from state income tax.

Arkansas State Income Tax: Rates & Rules

Arkansas has made significant moves to become more tax-friendly, recently lowering its top marginal income tax rate to3.9%. The state uses a progressive bracket system, meaning you only pay higher rates on the portion of your income that falls into higher brackets. Uniquely, Arkansas applies the same tax brackets to all filers, regardless of whether you are single or married.

2025 Arkansas Tax Brackets

| Taxable Income Range | Tax Rate | How It's Calculated |

|---|---|---|

| $0 - $5,500 | 0% | Tax-free |

| $5,501 - $10,900 | 2.0% | 2% of excess over $5,500 minus $109.98 |

| $10,901 - $15,600 | 3.0% | 3% of excess over $10,900 minus $218.97 |

| $15,601 - $25,700 | 3.4% | 3.4% of excess over $15,600 minus $281.37 |

| Over $25,700 | 3.9% | 3.9% of excess over $25,700 minus $409.86 |

Living in Texarkana?

Residents of Texarkana, AR who also work within the city limits are exempt from Arkansas state income taxon those wages. This unique border city exemption requires you to file Form AR-TX with your employer.

The Federal Chunk: What Uncle Sam Takes

While Arkansas taxes are relatively low, federal taxes usually take the biggest bite out of your paycheck. For 2025, the IRS has adjusted income brackets and standard deductions for inflation, which might slightly increase your take-home pay. The 2025 standard deduction is $15,000 for single filers and $30,000 for married joint filers.

2025 Federal Tax Brackets (Single Filer)

- 10% on income up to $11,925

- 12% on income over $11,925 to $48,475

- 22% on income over $48,475 to $103,350

- 24% on income over $103,350 to $197,300

- 32% on income over $197,300 to $250,525

- 35% on income over $250,525 to $626,350

- 37% on income over $626,350

FICA Taxes: Investing in Your Future

FICA taxes are the mandatory contributions for Social Security and Medicare. Unlike income tax, these are flat rates shared by you and your employer.

Social Security

- • Rate: 6.2%

- • Limit: Up to $176,100 of income (2025)

- • Max Deduction: $10,918.20

- • Purpose: Retirement & Disability benefits

Medicare

- • Rate: 1.45%

- • Limit: No income limit

- • Surtax: Additional 0.9% for earnings over $200k

- • Purpose: Health coverage for seniors

Example Scenarios

Example 1: The Little Rock Professional

Jordan earns $55,000 a year working in marketing. Single, one pre-tax health deduction of $100/month.

*Estimates based on standard deductions and 2025 rates.

Smart Ways to Increase Your Take-Home

Optimize W-4 Allowances

Over-withholding limits your monthly cash flow. If you get a huge refund every year, adjust your W-4 form to match your actual tax liability more closely.

Maximize Pre-Tax Contributions

Contribute to a 401(k), HSA, or FSA. These deductions come out before taxes are calculated, lowering your taxable income and your tax bill simultaneously.

The Texarkana Exemption: A Deep Dive

The Consolidated Incentive Act of 2003 created a unique tax situation for residents of Texarkana. It is often misunderstood, so here is exactly how it works for 2025.

Qualifications

To claim the exemption from Arkansas state income tax, you must meet BOTH criteria:

- You must maintain your primary residence within the city limits of Texarkana, Arkansas.

- Your employer must be located within the city limits of Texarkana, Arkansas (or Texarkana, Texas).

How to Claim It

This is not automatic. You must file Form AR-TX with your employer to stop state withholding. At the end of the year, you will still file an Arkansas return but will exclude these wages from taxable income.

Decoding Your Pay Stub Codes

Arkansas employers use various payroll processors, but standard codes often appear. Don't let them confuse you:

Self-Employed in Arkansas? Read This

If you are a freelancer, contractor, or business owner in Arkansas, you don't have an employer withholding taxes for you. You are responsible for paying them yourself via Estimated Tax Payments.

The "SE Tax" Reality

On top of regular income tax, you pay the full 15.3% FICA tax (called "Self-Employment Tax"). Employers usually pay half of this, but you pay both halves.

Arkansas Estimated Due Dates

You must file Form AR1000ES and pay quarterly. The 2025 deadlines are:

- Q1: April 15, 2025

- Q2: June 16, 2025

- Q3: September 15, 2025

- Q4: January 15, 2026

Need Help? Arkansas Tax Contacts

Some payroll questions require direct answers from the source. Here is who to contact for specific issues:

Historical Arkansas Tax Rates

| Year | Top Rate | Notes |

|---|---|---|

| 2025 | 3.9% | Legislated rate cut taking effect. |

| 2024 | 4.4% | Previous top marginal rate. |

| 2023 | 4.7% | Reduction from 4.9%. |

| 2021 | 5.9% | Significant drop from historic 6.6-7% highs. |

Arkansas Payroll FAQs

My employer withheld too much Arkansas tax. How do I get it back?

You will receive a refund when you file your state income tax return (Form AR1000F or AR1000NR) in early 2026. Arkansas typically processes electronic refunds within 2-4 weeks.

Do I pay Arkansas tax on out-of-state income?

If you are a full-year resident of Arkansas, all your income is subject to Arkansas tax, regardless of where it was earned. However, Arkansas will give you a "Credit for Taxes Paid to Another State" (Schedule AR1000TC) to avoid double taxation if you already paid income tax to that other state.

Are 401(k) contributions tax-free in Arkansas?

Yes. Arkansas follows federal law regarding "qualified deferred compensation plans." Your 401(k) contributions are subtracted from your income before Arkansas tax is calculated, lowering your state tax bill immediately. See our 401(k) contribution calculator for details.

What is the "Border City Exemption"?

This refers specifically to the Texarkana exemption discussed above. It does not apply to other border cities like Fort Smith or West Memphis.

Does Arkansas tax bonuses differently?

Arkansas allows employers to withhold tax on bonuses at a flat supplemental rate, but ultimately, bonuses are taxed as ordinary income. You might see a higher chunk taken out upfront, but it balances out when you file your annual return.

How do I file my Arkansas taxes online?

The Arkansas Taxpayer Access Point (ATAP) is the state's free online portal. It allows you to file your return, check your refund status, and make payments directly from your bank account. It is the fastest way to process your return.

What if I made a mistake on my W-4?

If you realize you've been under-withholding, you can submit a new AR4EC form to your employer immediately. You can also make an estimated tax payment via ATAP before the end of the year to catch up and avoid penalties.

Author: Jurica Šinko | Last Updated: January 1, 2025 | Sources: Arkansas Dept of Finance

Disclaimer: This tool is for informational purposes. Tax laws vary by individual circumstances. Consult a CPA for professional tax advice.