Complete Guide: Bond Pricing and Valuation

Understanding bond pricing is fundamental to fixed-income investing. With over $50 trillion in global bond markets, knowing how to calculate bond prices helps investors make informed decisions about their portfolios. Whether you're evaluating Treasury bonds, corporate bonds, or municipal securities, accurate bond valuation is crucial formaximizing returns and managing risk.

What Is Bond Price and Why Does It Matter?

A bond's price represents the present value of all its future cash flows, including periodic coupon payments and the final principal repayment. Unlike stocks, which trade based on company performance expectations, bond prices are primarily driven by interest rates, credit quality, and time to maturity.

In 2025, with Treasury yields ranging from 3.5% to 4.5% and corporate bond spreads fluctuating, understanding bond pricing has never been more critical. A bond trading at $950 versus $1,050 can significantly impact your portfolio's yield and total return.

How Bond Pricing Works: The Time Value of Money

Bond pricing is based on the time value of money principle: a dollar today is worth more than a dollar in the future. When you buy a bond, you're essentially lending money to the issuer. The price you pay reflects the present value of all future payments you'll receive.

The key insight is that bond prices move inversely to interest rates. When market rates rise, existing bonds with lower coupon rates become less attractive, causing their prices to fall. Conversely, when rates fall, existing bonds with higher coupons become more valuable, pushing their prices up.

The Bond Pricing Formula Explained

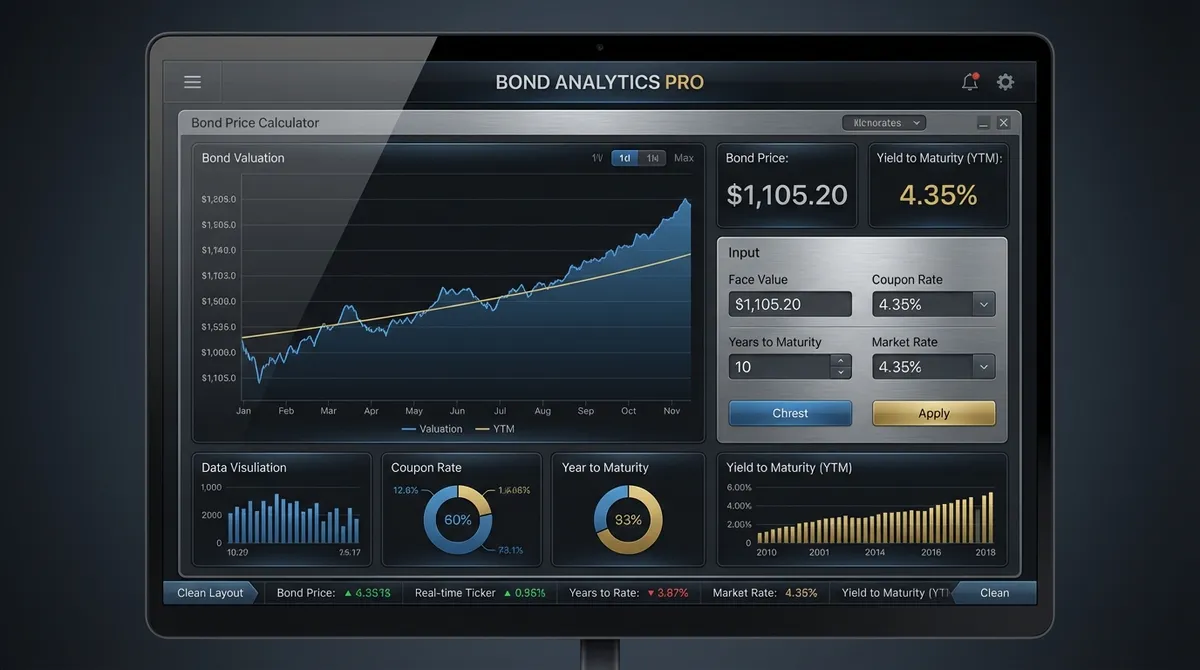

Our bond price calculator uses the standard present value formula:

Bond Price = Σ(C/(1+r)^t) + F/(1+r)^n

Where:

- C = Coupon payment per period

- r = Periodic yield to maturity (YTM ÷ payment frequency)

- t = Time period (1, 2, 3, ... n)

- F = Face value (par value)

- n = Total number of periods

What Factors Affect Bond Prices?

1. Interest Rates (Most Important)

The relationship between a bond's coupon rate and current market rates determines whether it trades at a premium, discount, or par. A 1% change in interest rates can cause a 5-15% price change depending on the bond's duration.

2. Time to Maturity

Longer-term bonds are more sensitive to interest rate changes. A 30-year bond will experience larger price swings than a 2-year bond for the same change in yields.

3. Credit Quality

Bonds from issuers with lower credit ratings (like high-yield corporate bonds) trade at higher yields to compensate for default risk. AAA-rated bonds trade at lower yields due to their safety.

4. Coupon Rate

Higher coupon bonds provide more cash flow early, making them less sensitive to interest rate changes. Zero-coupon bonds are the most sensitive to rate movements.

Understanding Premium, Discount, and Par Bonds

Premium Bonds

Price > Face Value. Occurs when coupon rate > market yield. Investors pay more upfront but receive higher coupon payments.

Par Bonds

Price ≈ Face Value. Occurs when coupon rate = market yield. The bond trades at its face value.

Discount Bonds

Price < Face Value. Occurs when coupon rate < market yield. Investors pay less but receive lower coupons.

Real-World Example: Calculating a Corporate Bond Price

Let's calculate the price of a 10-year corporate bond with a $1,000 face value, 5% annual coupon, and current market yield of 6% (semi-annual payments):

Given:

• Face Value: $1,000

• Coupon Rate: 5% annually (2.5% semi-annually)

• Market Yield: 6% annually (3% semi-annually)

• Years to Maturity: 10

• Payment Frequency: Semi-annual (20 periods)

Since the coupon rate (5%) is lower than the market yield (6%), this bond will trade at a discount. Using our calculator, the bond price comes to approximately $925.61, representing a $74.39 discount from face value. This discount compensates investors for the lower coupon payments relative to current market rates.

Common Bond Pricing Mistakes to Avoid

❌ Confusing YTM with Current Yield

Current yield only considers coupon payments, while YTM includes both coupons and capital gains/losses. For accurate pricing, always use YTM.

❌ Ignoring Payment Frequency

Semi-annual payments require different calculations than annual payments. Always adjust the yield and periods for the payment frequency.

❌ Using Simple Interest Instead of Compound Interest

Bond pricing requires compound interest calculations. Simple interest understates the true present value of future cash flows.

Bond Pricing Strategies for Different Market Conditions

Rising Rate Environment

Focus on shorter-duration bonds or floating-rate securities. Consider bond laddering to reinvest maturing principal at higher rates.

Falling Rate Environment

Lock in higher yields with longer-term bonds. Premium bonds may offer better total returns as they appreciate toward par.

How to Use Bond Price Information in Your Investment Strategy

Bond prices tell you more than just what to pay—they reveal market expectations about interest rates, inflation, and economic conditions. A bond trading at a significant discount might indicate credit concerns or simply that it was issued when rates were much higher.

Use our bond price calculator to:

- Evaluate whether a bond is fairly priced before purchasing

- Calculate potential capital gains or losses

- Compare bonds with different coupon rates and maturities

- Determine the impact of interest rate changes on your portfolio

- Assess the value of callable or putable bonds

Types of Bonds and Their Pricing Differences

Different types of bonds have unique characteristics that influence their pricing and risk profile:

U.S. Treasury Bonds

Back by the full faith and credit of the U.S. government. Considered risk-free regarding default, so their yields are generally lower. Pricing is primarily driven by interest rate expectations.

Corporate Bonds

Issued by companies involved in various sectors. They carry higher risk than Treasuries, reflected in a "credit spread" added to the yield. Price is sensitive to both rates and the company's financial health.

Municipal Bonds

Issued by state and local governments. Often tax-exempt, which is a key pricing factor. Investors accept lower nominal yields for the tax advantage.

Agency Bonds

Issued by government-sponsored enterprises (GSEs) like Fannie Mae. They offer yields slightly higher than Treasuries but with some implied government backing.

Risks Associated with Investing in Bonds

While bonds are often considered safer than stocks, they are not without risk. Understanding these risks is crucial for accurate valuation:

- Interest Rate Risk: The risk that rising interest rates will cause bond prices to fall. This is the most significant risk for high-quality bonds.

- Credit/Default Risk: The risk that the issuer will fail to make interest or principal payments. This is a major factor for corporate and high-yield bonds.

- Inflation Risk: The risk that inflation will erode the purchasing power of the bond's fixed interest payments. TIPS (Treasury Inflation-Protected Securities) are designed to mitigate this.

- Liquidity Risk: The risk that you won't be able to sell the bond quickly at a fair price. This is more common with municipal or high-yield bonds compared to Treasuries.

- Call Risk: The risk that the issuer will redeem ("call") the bond before maturity, usually when rates fall. This limits the investor's upside and forces reinvestment at lower rates.

Key Takeaways

Bond pricing combines the present value of coupon payments and principal repayment. The key factors are interest rates, time to maturity, credit quality, and coupon rate. By understanding these relationships, you can identify undervalued bonds, manage interest rate risk, and build a more resilient fixed-income portfolio.

Remember: bond prices and yields move in opposite directions. In today's dynamic rate environment, regular bond price calculations are essential for successful fixed-income investing.