Bonus Taxes in 2025: Why Your Take-Home Is Less Than You Expect

Bonus Taxes in 2025: Why Your Take-Home Is Less Than You Expect

Receiving a bonus is exciting, but seeing the take-home pay hit your bank account can be a shock. Employers are required to withhold taxes on "supplemental wages" (bonuses, commissions, overtime) differently than regular pay. In 2025, the IRS mandates a flat 22% federal withholding rate on bonuses under $1 million, plus 7.65% for FICA taxes (Social Security and Medicare), and potentially state taxes.

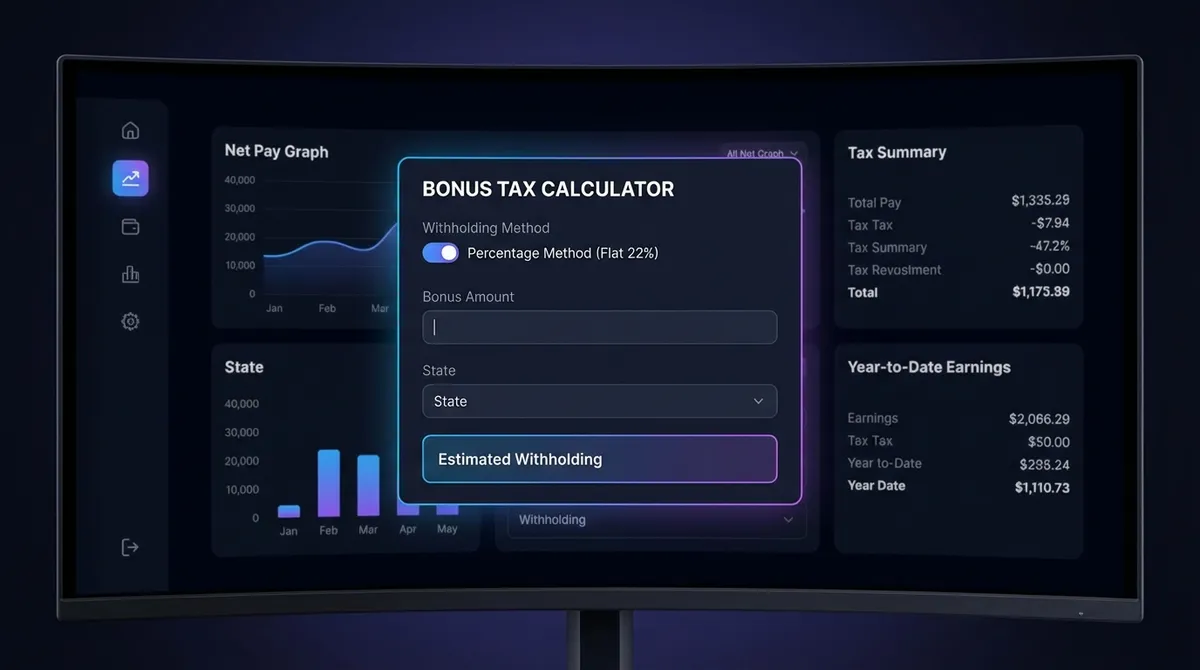

This calculator helps you estimate exactly how much of your hard-earned bonus you'll actually keep. It accounts for the Social Security wage base limit ($176,100 for 2025) and the Additional Medicare Tax needed for high earners, giving you a precise picture of your tax liability.

The "Percentage Method": The Flat 22% Rule

For most employees, bonuses are taxed using the Percentage Method. The IRS considers bonuses as "supplemental wages" and requires a flat withholding rate regardless of your actual tax bracket.

- 1Bonuses Under $1 Million:

Witheld at a flat 22% rate. This is simple but can sometimes result in under-withholding if your actual marginal tax bracket is higher (e.g., 32% or 35%).

- 2Bonuses Over $1 Million:

The first $1 million is withheld at 22%. Any amount exceeding $1 million is withheld at the highest individual tax rate, currently 37%.

Don't Forget FICA: Social Security & Medicare

In addition to federal income tax, you must pay FICA taxes. These are flat rates and apply to your bonus just like your regular paycheck.

Social Security (6.2%)

You pay 6.2% on earnings up to the Wage Base Limit. For 2025, this limit is $176,100.

Example: If you've already earned $180,000 this year, your bonus is EXEMPT from this 6.2% tax. If you've earned $170,000, only the first $6,100 of your bonus is taxed.

Medicare (1.45% +)

All wages are subject to a 1.45% Medicare tax. There is no income limit.

High Earners: If your total income exceeds $200,000 (Single) or $250,000 (Married), an Additional Medicare Tax of 0.9% applies to the excess, bringing the total to 2.35%.

Tips for Saving on Taxes

1. Boost 401(k) Contributions: Ask your payroll department if you can contribute a percentage of your bonus to your 401(k). This is pre-tax money, meaning it bypasses the 22% federal withholding and lowers your taxable income for the year.

2. Max Out HSA: Contributing to a Health Savings Account (HSA) is another way to shield bonus money from taxes (FICA taxes are also exempt on HSA contributions if made via payroll deduction).

3. Prepare for Tax Time: If your regular tax bracket is 24% or higher, the 22% withholding on your bonus might not be enough. You could owe money in April. Consider making an estimated tax payment or increasing standard withholding on your regular paycheck to cover the gap.

The "Aggregate Method" Exception

Sometimes, employers use the Aggregate Method. This combines your bonus with your regular paycheck and taxes the total amount as if it were your normal salary for that period.

This often results in much higher withholding because the payroll software assumes you earn that "bonus + salary" amount every single pay period, pushing you into a phantom higher tax bracket. The good news? You get the excess back as a refund when you file your tax return.

Frequently Asked Questions

Why was 40% of my bonus taken out?

It feels like 40%, but that's usually a combination of taxes. 22% Federal + 7.65% FICA + 5-10% State Tax can easily add up to 35-40%. Also, some employers may over-withhold to be safe, which you'll get back as a refund.

Can I ask my employer to use the Aggregate Method?

You can ask, but payroll policies are usually rigid. Most employers prefer the Percentage Method (flat 22%) because it's simpler and less prone to errors.

Does a bonus push me into a higher tax bracket?

A bonus increases your total taxable income, which might push a portion of your income into a higher bracket. However, America uses a progressive tax system. Only the dollars within the higher bracket are taxed at that higher rate, not your entire income.

Is a signing bonus taxed differently?

No. Signing bonuses, retention bonuses, severance pay, and commissions are all considered "supplemental wages" by the IRS and are subject to the same withholding rules.

Bonus vs. Commission: Is there a difference?

From a tax perspective, no. Both are supplemental wages. However, commissions paid regularly (e.g., monthly sales commissions) might be treated as regular wages by some payroll systems if they are included in your standard paycheck, which would subject them to standard withholding tables rather than the flat 22% rate.

Final Takeaway

While you can't control the tax rates, you can control where the money goes. By understanding the withholding rules, you can plan ahead—whether that means increasing your 401(k) contribution to lower your tax bill or simply setting realistic expectations for your net payout so you don't overspend before the money hits your account.

Historical Bonus Tax Rates (2020-2025)

Understanding how bonus taxation has evolved helps in planning. While the federal flat rate has remained stable at 22% following the TCJA, the Social Security wage base—which determines when you stop paying the 6.2% tax—has risen significantly.

| Year | Federal Flat Rate | Social Security Wage Base | Max SS Tax |

|---|---|---|---|

| 2025 | 22% | $176,100 | $10,918.20 |

| 2024 | 22% | $168,600 | $10,453.20 |

| 2023 | 22% | $160,200 | $9,932.40 |

State-Specific Bonus Tax Rules

Most people focus on the 22% federal bite, but state taxes can take another 5% to 13% of your bonus depending on where you live. States typically follow one of two methods for supplemental wages, but some have unique (and higher) rates.

- New York (11.7%)New York requires employers to withhold 11.7% on supplemental wages, which is often higher than the regular income tax rate for many residents. This ensures you don't owe a massive bill in April, but it reduces your immediate payout significantly.

- California (10.23%)California mandates a flat 10.23% withholding on bonuses and stock options. For high earners (over $1M), this ensures the state captures revenue upfront.

- The Zero Tax StatesIf you live in TX, FL, TN, NV, WA, SD, WY, NH, or AK, you pay 0% state income tax on your bonus. Your only liability is the federal 22% + 7.65% FICA.

Advanced Strategy: Timing Your Bonus

If you have some control over when your bonus is paid (common for executives or sales owners), you can use timing to your advantage.

Defer to January

Pushing a December bonus into January pushes the tax liability a full year into the future. It also helps if you expect your income to be lower next year (lower bracket).

Accelerate to December

If you expect tax rates to rise next year or you need to maximize deductions (like 401k) for the current year, taking the money now makes sense.

Advanced Strategy: The "Gross-Up" Negotiation

If you are negotiating a signing bonus or a performance bonus, consider asking for a "gross-up." This means your employer pays the taxes for you so that the net amount hitting your bank account matches the promised figure.

How It Works

To give you a net bonus of $10,000, your employer must calculate the total amount needed to cover the 22% federal tax, 6.2% SS, 1.45% Medicare, and applicable state taxes.

*Figures are estimates based on standard federal + FICA rates. Employers absorb the extra ~$5,300 cost.