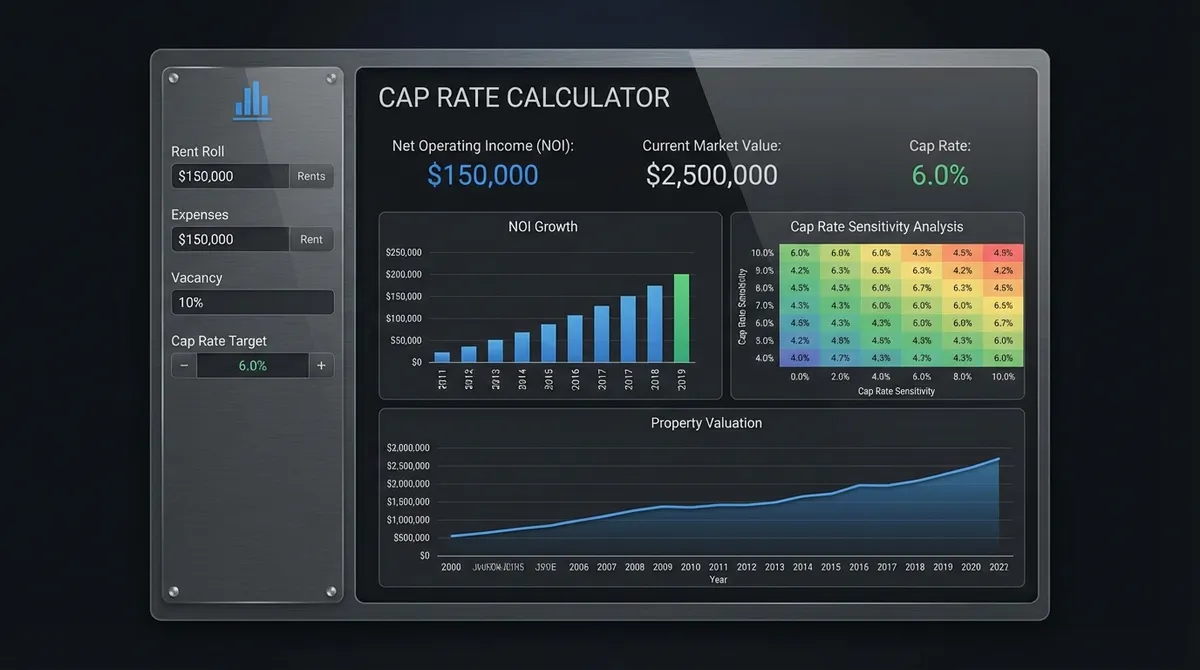

Mastering Real Estate Investment with Cap Rate Analysis

In the high-stakes world of real estate investing, emotions can be expensive. That’s why seasoned investors rely on the Capitalization Rate (Cap Rate)—a brutally honest metric that cuts through the sales fluff. It doesn't care about the "potential" of the neighborhood or the charm of the architecture; it cares about one thing: the raw income-generating power of the asset relative to its price. See Investopedia for more definitions.

Effectively, the cap rate tells you what your annual yield would be if you bought the property with all cash. In 2025, with interest rates fluctuating and market dynamics shifting, understanding how to accurately calculate and interpret cap rates is not just a skill—it's a survival mechanism for your portfolio.

The Cap Rate Formula Decoded

The formula is deceptively simple, but the devil is in the details. Getting it right requires precision with your inputs.

Cap Rate = (Net Operating Income ÷ Property Value) × 100%

1. Net Operating Income (NOI)

This is the engine of the calculation. Start with Gross Annual Income, subtract Vacancy Losses, and then subtract all Operating Expenses (taxes, insurance, maintenance, management). Crucial: Do NOT subtract mortgage payments. Cap rate measures the property, not your financing. Use our NOI Calculator to get this number precise.

2. Property Value

This is usually the current market value or the purchase price. If you are evaluating a potential deal, use the asking price or your offer price. If you already own it, use the current appraisal or estimated market value.

Real-World Example: The "Main Street" Duplex

Let’s say you’re looking at a duplex listed for $500,000. Here is how you would run the numbers to see if it makes sense.

Financial Breakdown

Calculation: ($36,000 ÷ $500,000) = 0.072 = 7.2% Cap Rate

This means for every dollar you invest, the property returns 7.2 cents annually before debt service.

What is a "Good" Cap Rate in 2025?

The answer, frustratingly, is "it depends." A good cap rate is relative to the risk you are taking. Just like a savings account pays less interest than a junk bond, a safe property pays a lower cap rate than a risky one.

Typically Class A properties in prime locations (e.g., NYC, San Francisco). Stable, reliable tenants, but lower cash flow. You buy these for appreciation and safety.

Class B properties or secondary markets (e.g., Austin, Nashville). The "sweet spot" for many investors, balancing decent cash flow with reasonable appreciation.

Class C/D properties or rural areas. High cash flow on paper, but often comes with headache tenants, deferred maintenance, or declining neighborhoods.

Understanding Market Dynamics: Compression vs. Expansion

Cap rates are not static; they move with the economy. Understanding "Compression" and "Expansion" is key to predicting property values.

Cap Rate Compression (Bull Market)

When demand for real estate is high, buyers are willing to pay more for the same income stream. This drives prices UP and Cap Rates DOWN.

Example: NOI stays $50k. Price goes $500k → $600k. Cap Rate drops 10% → 8.3%.

Cap Rate Expansion (Bear Market)

When interest rates rise or the economy slows, buyers demand a higher return for their risk. Prices must come DOWN for the Cap Rate to go UP.

Example: NOI stays $50k. Price falls $500k → $400k. Cap Rate rises 10% → 12.5%.

Cap Rates by Property Type

Not all buildings are created equal. Risk profiles dictate the typical cap rate for different asset classes.

| Asset Class | Typical Cap Rate Range | Risk Profile |

|---|---|---|

| Multifamily (Apartments) | 4.5% - 6.0% | Low. Everyone needs a place to live. Recession-resistant. |

| Industrial (Warehouses) | 5.0% - 6.5% | Low/Medium. Booming due to e-commerce, but tenants are large. |

| Retail (Strip Malls) | 6.0% - 8.0% | Medium. Vulnerable to e-commerce; relies on economic strength. |

| Office Buildings | 7.0% - 10.0%+ | High. Post-COVID "Work From Home" trends have decimated value. |

| Hospitality (Hotels) | 8.0% - 12.0% | Very High. Income resets every night; extremely volatile. |

Advanced Theory: The Gordon Growth Model

Why do investors accept a 4% cap rate on a luxury apartment when Treasury bills pay 5%? The answer is Growth. The generic Cap Rate formula assumes income stays flat forever. The Gordon Growth Model accounts for rent increases.

Total Return = Cap Rate + NOI Growth Rate

If you buy a property at a 5% Cap Rate, but you expect to raise rents (and thus NOI) by 4% per year, your expected total annual return is actually 9%. This explains why high-growth markets (like Austin or Phoenix) often have the lowest cap rates—buyers are pricing in the future growth.

The Trap: What Beginners Get Wrong

Ignoring the "True" Vacancy Rate

Don't assume 0% vacancy because "it's always rented." Use at least 5% (8% in weaker markets) to account for turnover time and bad debt.

Underestimating Maintenance

The "50% Rule" suggests that over time, operating expenses tend to average 50% of gross income. If your pro-forma shows expenses at only 20%, you are likely missing big-ticket items like roof repairs or HVAC replacement.

Confusing Cap Rate with Cash-on-Cash Return

Cap Rate ignores debt. Cash-on-Cash Return calculates your return based on the actual cash you put down. If you leverage a 6% cap rate property with a 7% interest loan, your cash-on-cash return might be near zero (negative leverage). Always calculate both, alongside Internal Rate of Return (IRR) for a complete picture.

Frequently Asked Questions

Can a Cap Rate be too high?

Yes. If you see a property with a 15% Cap Rate, be suspicious. The market is efficient; a return that high usually signals massive risk (e.g., the major employer in town is closing, the building has structural foundation issues, or it's in a war zone). High reward always equals high risk (ROI).

Does Cap Rate include mortgage?

No. Cap Rate is a measure of the asset's performance, not your financing. It assumes an all-cash purchase. This allows you to compare the profitability of two buildings side-by-side without worrying about whether one buyer has a better loan than the other.

How do I verify the Seller's NOI?

"Trust but verify." Sellers often inflate NOI by hiding expenses or showing "Pro Forma" (imaginary) rents. Always ask for the "Trailing 12" (T-12) profit and loss statement and the Schedule E from their tax returns. Tax returns don't lie, because no one wants to pay more taxes than they have to.

What is an "Exit Cap Rate"?

This is the Cap Rate you assume you will sell the property for in the future (e.g., in 5 or 10 years). Conservative underwriting usually assumes the Exit Cap Rate will be slightly higher (worse) than the Entry Cap Rate to account for the building getting older.

Pro Tip: The "Spread" Strategy

Sophisticated investors watch the spread between the Cap Rate and the 10-Year Treasury Yield. Historically, real estate should trade at a 300-400 basis point spread above the risk-free rate. If Treasuries are payings 4% and Cap Rates are 5%, real estate is historically expensive. If Cap Rates are 8%, you are getting a healthy risk premium. Always check the macro context before buying!