Complete Guide: CD Calculator

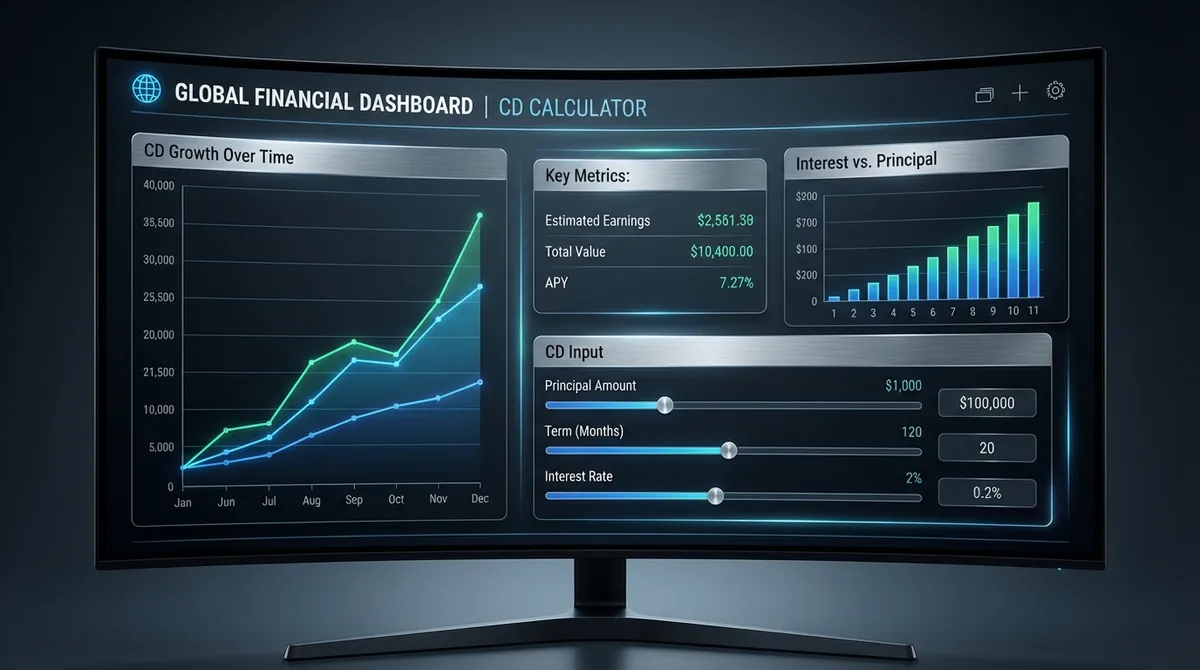

Calculate CD maturity value and interest with our free calculator. Includes APY, compounding, and penalty estimates. See your savings grow.

CDs offer a fixed interest rate for a fixed term, shielding your savings from market volatility.

APY includes the effect of compounding. A higher APY means your money grows faster.

Unlike stocks, bank CDs are insured up to $250,000 per depositor, making them extremely safe.

What IS a Certificate of Deposit?

A Certificate of Deposit (CD) is a savings account that holds a fixed amount of money for a fixed period of time, such as six months, one year, or five years. In exchange for "locking up" your money, the bank pays you a higher interest rate than you would earn in a standard savings account.

CDs are issued by banks and credit unions and are considered one of the safest investments available. They are ideal for funds you do not need immediately but want to grow without risk. The trade-off for this safety and higher return is liquidity: you typically cannot withdraw your funds before the maturity date without paying a penalty.

Historical Context: CD Rates Through Time

CD rates accumulate history like tree rings, telling the story of the broader economy. To understand where rates might go, it helps to see where they have been.

- The 1980s: The era of ultra-high inflation saw CD rates soar into the double digits. It wasn't uncommon to find a 5-year CD yielding 12% or more, as the Federal Reserve fought to tame inflation.

- The 1990s and Early 2000s: Rates moderated but remained healthy, often in the 4-6% range. This was a "normal" environment for savers.

- Post-2008 Financial Crisis: The Fed slashed rates to near zero to stimulate the economy. For over a decade, CD yields struggled to break 1-2%, forcing savers into riskier assets like stocks to find returns.

- Post-2022 Inflation Fight: As inflation returned, the Fed raised rates aggressively. We effectively returned to a "normal" rate environment, with high-yield CDs once again offering 4-5%+ returns, making them a viable competitor to the stock market for conservative investors.

How CD Interest Works (APY vs APR)

When comparing CDs, you will see two acronyms: APR (Annual Percentage Rate) and APY (Annual Percentage Yield). While they sound similar, the difference can mean real money in your pocket.

Nominal Rate (APR)

The simple interest rate without considering compounding. This is the "base" rate the bank pays on your principal each period. It does not account for interest earning interest.

Effective Yield (APY)

The total amount you actually earn in a year, including compound interest (interest earned on interest). This is the most important number for comparison because it reflects the true growth of your money.

Advanced Strategy: CD Laddering Guide

The biggest downside of a CD is liquidity—your money is stuck. If interest rates rise while you are locked into a 5-year CD at a low rate, you lose out (this is called "interest rate risk"). A CD Ladder solves this by staggering maturity dates. Instead of putting $50,000 into one 5-year CD, you split it into five $10,000 CDs maturing at different times.

Example: $50,000 Ladder Setup

| Tranche | Amount | Term | Strategy |

|---|---|---|---|

| CD #1 | $10,000 | 1 Year | When it matures, renew into a 5-year CD. |

| CD #2 | $10,000 | 2 Years | When it matures, renew into a 5-year CD. |

| CD #3 | $10,000 | 3 Years | When it matures, renew into a 5-year CD. |

| CD #4 | $10,000 | 4 Years | When it matures, renew into a 5-year CD. |

| CD #5 | $10,000 | 5 Years | Keep cycling. |

Result: After the first year, you have one CD maturing every single year. This gives you annual access to 20% of your portfolio cash (liquidity) while keeping the bulk of your money earning the higher rates typically associated with 5-year terms. It blends the high yields of long-term CDs with the liquidity of short-term saving.

The Tax Bite: What You Need to Know

CD interest is tax-inefficient. Unlike stock buybacks (tax-deferred until sold) or municipal bonds (often tax-free), CD interest is taxed as ordinary income at your federal (and often state) marginal tax rate.

Phantom Income Warning

Even if you do not withdraw the interest (e.g., you let it compound inside the CD), you still owe taxes on it each year. The bank will send you a 1099-INT form. You must have cash on hand from other sources to pay this tax bill if the CD interest is locked away and compounding.

Strategic Tip: Because of this tax drag, CDs are often best held in tax-advantaged accounts like an IRA or 401(k). In these accounts, the interest grows tax-deferred (Traditional) or tax-free (Roth), allowing the full power of compounding to work for you without annual tax friction. Use our retirement calculator to plan.

CD vs. Other Cash Investments

| Investment | Liquidity | Risk | Best For |

|---|---|---|---|

| Standard CD | Low (Penalty) | None (FDIC) | Money not needed for 1-5 years. |

| No-Penalty CD | High | None (FDIC) | Uncertain timelines; slightly lower rates. |

| High-Yield Savings | Immediate | None (FDIC) | Emergency funds; short-term savings. |

| Treasury Bills | Medium | Near Zero | Tax savings (State tax exempt). |

| Money Market Funds | High | Low (Not FDIC) | Brokerage cash handling; slightly higher risk. |

Frequently Asked Questions

Can I lose money in a CD?

Generally, no. If the bank is FDIC-insured, your principal is protected up to $250,000. This protection is absolute—even if the bank fails, the government guarantees your deposit. Learn more at FDIC.gov. The only way to "lose" principal is if you withdraw early and the early withdrawal penalty exceeds the interest you have earned, eating into your original deposit.

What are Brokered CDs?

Brokered CDs are bought through a brokerage account (like Fidelity, Schwab, or Vanguard) rather than directly from a bank. They often offer higher rates because these brokerages negotiate bulk deals. A key difference is liquidity: Brokered CDs can be sold on a secondary market before maturity. However, if interest rates have risen since you bought the CD, the market value of your CD will have dropped, and you might have to sell it for less than you paid.

What happens when my CD matures?

Most banks have a grace period (usually 7-10 days) after maturity. During this time, you can withdraw the money or move it to a different CD without penalty. If you do nothing, the bank often automatically renews the CD for the same term at the current market rate (which might be significantly lower or different than your old rate!). Always set a reminder for your maturity date so you stay in control of your cash.

Are longer terms always better?

Not necessarily, and definitely not currently. Historically, longer terms (3-5 years) offered higher rates to compensate you for locking deeper. However, in an inverted yield curve environment (common before recessions), short-term CDs (6-12 months) might actually pay more than long-term ones. Always check the full spectrum of rates before committing. Also consider emergency funds.

What is a Jumbo CD?

A Jumbo CD is a certificate of deposit that requires a large minimum deposit, traditionally $100,000 or more. In the past, banks offered significantly higher interest rates for these large deposits. Today, with the rise of online banking, the "Jumbo" premium has largely disappeared, and normal high-yield CDs available to everyone often pay rates just as competitive as Jumbo CDs. Use the Rule of 72.

How are Credit Union share certificates different?

They are functionally identical to bank CDs but use different terminology. In a credit union, you aren't depositing cash; you are buying a "share" of the coop. So, they call them "Share Certificates" instead of Certificates of Deposit. Dividends are paid instead of interest. They are insured by the NCUA (National Credit Union Administration) up to $250,000, offering the same safety level as FDIC-insured bank CDs.