Colorado Income Tax Calculator - 2025 Estimate

Whether you call the Rockies home or just moved to Denver, understanding your tax bill is essential. For 2025, Colorado continues its tradition of a simple, flat income tax—but with a few critical updates, including the new FAMLI premiums, that you need to know about.

How Colorado Taxes You in 2025

Unlike the federal government or states like California causing calculation headaches with progressive brackets, Colorado keeps it straightforward. Everyone pays the same flat rate on their taxable income.

For tax year 2025, the Colorado state income tax rate is 4.40%.

This rate applies to your Colorado Taxable Income. Importantly, Colorado uses yourfederal taxable income as the starting point. This means if you take the standard deduction on your federal return, you automatically get that benefit for state taxes too. However, you must also account for specific Colorado additions and subtractions.

The Formula: From Gross to Net

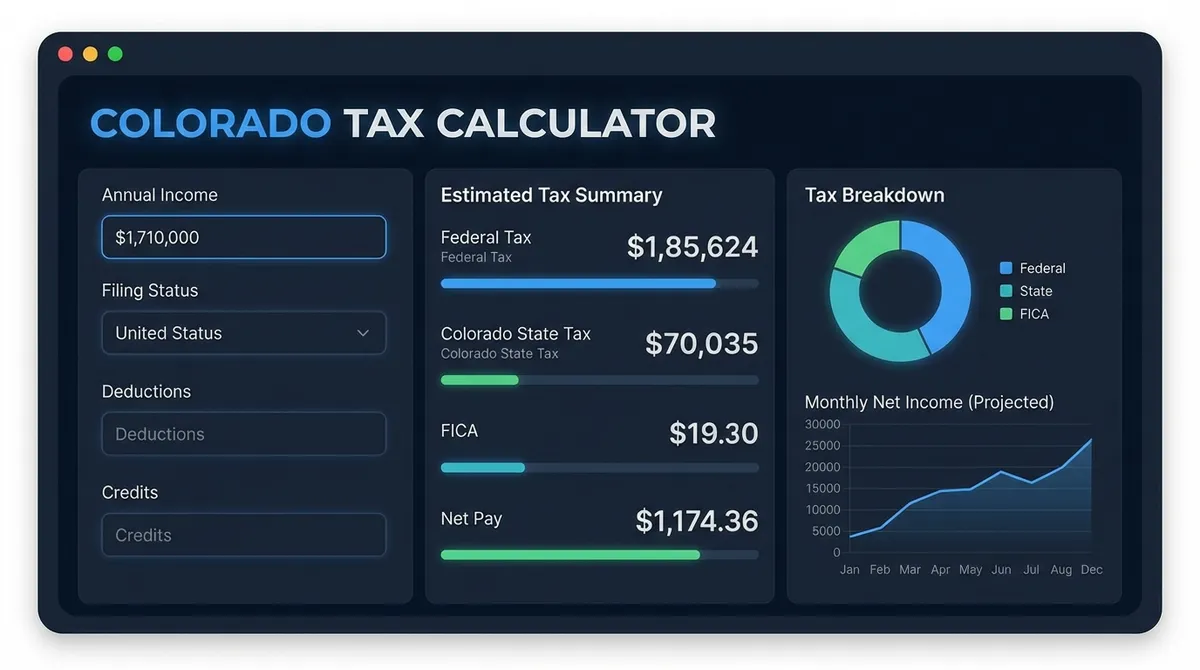

Here is the exact logic our calculator uses to estimate your liability:

- Start with Gross Income: Your total wages, salaries, and bonuses.

- Subtract Pre-Tax Contributions: 401(k), 403(b), and HSA contributions reduce your income before it's even touched.

- Subtract FAMLI Premiums: The new "Family and Medical Leave Insurance" (FAMLI) program deducts 0.45% from your wages (up to a wage cap).

- Apply Standard Deduction: We use the 2025 federal standard deduction amounts ($15,300 for singles, $30,600 for joint filers) to lower your taxable base further.

- Calculate Tax: Multiply the result by 4.40%.

- Subtract Credits: Any specific Colorado tax credits (like the TABOR refund mechanism or Child Tax Credit) come off the final bill.

The "Hidden" Cost: Local Taxes

While the state income tax is low, Colorado relies heavily on local sales and use taxes. However, some cities (like Denver, Aurora, and Glendale) also have an "Occupational Privilege Tax" (OPT), often called the "Head Tax."

- Denver OPT: If you work in Denver and earn over $500/month, you pay $5.75/month. Your employer pays pays an additional amount.

- Aurora OPT: $2.00/month deduction for employees.

Always budget for these small but recurring deductions if you work in major metro areas.

The TABOR Factor

Colorado is unique because of the Taxpayer's Bill of Rights (TABOR). When the state revenue exceeds a specific cap, the surplus must be returned to taxpayers.

In previous years, this has resulted in:

- Flat Tax Rate Reductions: The rate has temporarily dropped (e.g., to 4.25% or 4.40%) depending on the surplus size.

- Direct Cash Refunds: The famous "Colorado Cash Back" checks.

- Sales Tax Refund: A mechanism on the income tax return to claim your share.

Note: This calculator uses the baseline statutory rate of 4.40%. If a TABOR trigger lowers the rate later in the year, your actual liability might be even lower. Check the Department of Revenue.

Real-World Examples

Scenario A: The Denver Single

- Income: $65,000

- 401(k): $5,000

- FAMLI (0.45%): ~$292

- Status: Single

- Taxable Income: ~$44,400

- CO Tax (4.4%): ~$1,953

- Effective Rate: 3.00%

Scenario B: Boulder Couple

- Income: $140,000 (Combined)

- 401(k): $15,000

- FAMLI (0.45%): ~$630

- Status: Married Joint

- Taxable Income: ~$93,770

- CO Tax (4.4%): ~$4,125

- Effective Rate: 2.94%

Moving to Colorado? What You Need to Know

If you are relocating, remember that Colorado taxes are based on residency. You are considered a resident if you maintain a permanent home here or spend more than six months of the tax year in the state.

The "Part-Year" Resident Rule

If you moved in 2025 (e.g., arrived in July), you will file as a part-year resident. You calculate your tax based on your apportioned income—essentially, the percentage of your total income that was earned while living in Colorado. This prevents you from being double-taxed on income earned in your previous state (though you must still check that state's rules!).

Strategies to Lower Your CO Tax Bill

- 1Maximize Pre-Tax Accounts: Because Colorado starts with federal taxable income, every dollar you put into a 401(k) or HSA avoids state tax too (saving you 4.40% instantly).

- 2529 Education Savings: Colorado offers a state income tax deduction for contributions to a Colorado 529 plan. This is a "subtraction" you can take on your state return.

- 3Check for Credits: Don't miss the Colorado Child Tax Credit or the Earned Income Tax Credit which can significantly reduce what you owe.

Hidden Gems: Colorado Tax Credits You Might Miss

Colorado offers several unique tax credits that can significantly lower your bill. Unlike deductions (which just lower taxable income), credits reduce your tax owed dollar-for-dollar.

Enterprise Zone Credits

If your business is located in a designated Enterprise Zone, you could be eligible for credits on new equipment, job training, and even health insurance coverage for employees.

Electric Vehicle (EV) Credit

Colorado offers one of the most generous state-level EV credits in the country. For 2025, purchasing or leasing a qualifying new plugin vehicle can net you a refundable tax credit.

Heat Pump & Solar

Combined with federal incentives, Colorado provides additional rebates and credits for electrification (heat pumps, solar panels) to help verify the state's green energy goals.

First-Time Homebuyer Savings

The interest earned on a designated First-Time Homebuyer Savings Account (FHSA) is free from state taxation, encouraging young residents to save for a down payment.

The TABOR Refund: A Colorado Uniqueness

The Taxpayer's Bill of Rights (TABOR) is a constitutional amendment that limits the amount of revenue the state can retain. When revenue exceeds the cap (adjusted for inflation and population growth), the state must refund the surplus to taxpayers.

How You Might Get Paid in 2025

- Flat Sales Tax Refund: Effectively a standard refund on your income tax return (often tiered by income level).

- Temporary Rate Cut: The income tax rate might drop from 4.40% to a lower figure (e.g., 4.25%) temporarily.

- Direct Checks: In rare robust years, the state sends physical checks ("Colorado Cash Back") to all filers.

Colorado vs. Other States

How does the Centennial State stack up?

| State | Income Tax Type | Top Rate |

|---|---|---|

| Colorado | Flat | 4.40% |

| California | Progressive | 13.3% (plus surcharge) |

| Utah | Flat | 4.65% |

| Texas | None | 0% |

*While Texas has no income tax, its property taxes are significantly higher than Colorado's, which are among the lowest in the nation. This balances the overall burden for homeowners.

Frequently Asked Questions (FAQ)

Do seniors get a tax break in Colorado?▼

Yes! The Pension/Annuity Subtraction allows qualifying taxpayers age 65+ to deduct up to $24,000 of pension or annuity income from their state taxes. Plan your retirement.

Does Colorado tax Social Security?▼

For taxpayers age 65 and older, Social Security benefits are generally fully deductible on the Colorado state return, meaning they are tax-free at the state level.

When are Colorado taxes due?▼

State income tax returns are due on April 15th, the same day as federal returns. If you need more time, Colorado grants an automatic 6-month extension to file (until Oct 15), but you must still pay at least 90% of your tax by April 15 to avoid penalties.

Do I pay Colorado tax if I live in another state but work remotely for a CO company?▼

Generally, no. Colorado income tax is based on where the work is performed, not where the employer is headquartered. If you live and work in Florida for a Denver company, you typically do not owe Colorado income tax. However, if you are a telecommuter who spends significant time working physically within Colorado, you may have a filing requirement for those days.