Complete Guide: Contribution Margin Calculator

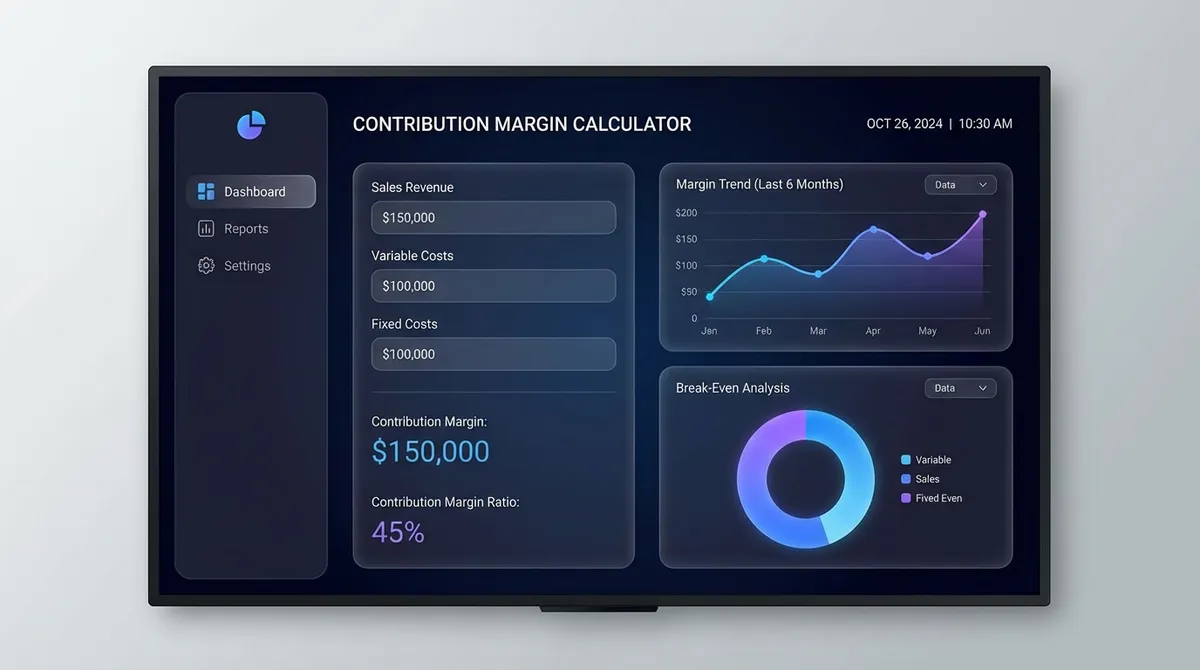

Calculate contribution margin, ratio, and break-even. Analyze profitability and pricing power efficiently with our free calculator.

What Is Contribution Margin?

Contribution margin is a fundamental metric in managerial accounting that reveals how much revenue from each unit sold is available to cover fixed costs and generate profit. It is calculated as Selling Price minus Variable Costs.

Think of it this way: Every time you sell a product, money comes in (Revenue). Some of that money immediately goes out to pay for the materials and labor to make that specific unit (Variable Costs). What is left over is the "Contribution" to the business pile. This pile first pays the rent and salaries (Fixed Costs). Once the rent is paid, every additional dollar of contribution is pure profit.

Key Formulas

- Unit CM:

Price − Unit Variable Cost - CM Ratio:

(Unit CM ÷ Price) × 100 - Break-Even (Units):

Fixed Costs ÷ Unit CM - Operating Income:

Total CM − Fixed Costs

Why It Matters

If your Contribution Margin is positive, you can eventually turn a profit by selling enough volume. If it is negative, you are losing money on every single sale; no amount of volume will save you. You must raise prices or cut variable costs immediately. See Net Profit.

Contribution Margin vs. Gross Margin

This is the most common confusion. They look similar depending on how you classify costs, but they serve different purposes.

| Metric | Formula | Variable Costs? | Fixed Production Costs? |

|---|---|---|---|

| Contribution Margin | Sales − Variable Costs | Excluded (Subtracted) | Included (Not Subtracted) |

| Gross Margin | Sales − COGS | Excluded (Subtracted) | Excluded (Subtracted) |

Variable vs. Fixed Costs: The Classification Game

To use this calculator effectively, you must correctly classify your costs.Variable costs change in direct proportion to volume.Fixed costs remain constant regardless of production volume (within a relevant range).

Typical Variable Costs

- Raw Materials

- Direct Labor (Hourly/Piece-rate)

- Sales Commissions

- Shipping/Freight-Out

- Credit Card Processing Fees

- Packaging

Typical Fixed Costs

- Rent & Lease Payments

- Salaries (Management, Admin)

- Insurance

- Software Subscriptions (SaaS)

- Depreciation (Calc)

- Advertising (Flat retainer)

Case Study: SaaS vs. Manufacturing

SaaS Company (High Contribution Margin)

Software companies often have 80-90% contribution margins. The variable cost to serve one new customer (server bandwidth, support) is tiny compared to the subscription price. Check SaaS Metrics.

Var Cost: $5/mo (server + support)

CM: $45

CM Ratio: 90%

Strategy: Scale aggressively. Fixed costs (engineering salaries) are huge, but once covered, nearly every dollar is profit.

Retail Store (Low Contribution Margin)

Retailers like grocery stores have thin margins. They buy a product for $4 and sell it for $5.

Var Cost: $4.00 (Purchase price)

CM: $1.00

CM Ratio: 20%

Strategy: Focus on high volume and inventory turnover. You need to sell 5x as many units as the SaaS company to make the same gross profit.

Operating Leverage

Contribution Margin is the key to understanding Operating Leverage. A company with high fixed costs and high contribution margin (like an airline or software firm) has high operating leverage. This means a small increase in sales leads to a massive jump in profit. Conversely, a small drop in sales can lead to massive losses. It is a high-risk, high-reward structure.

How to Use This Calculator

- Enter your Selling Price per Unit.

- Enter your Variable Cost per Unit. Be precise—include commissions and payment fees!

- Add Fixed Costs for the period (Monthly or Annual) to see your Break-Even Point.

- Optionally enter Target Units Sold to estimate your total operating income.

Strategic Analysis: Using CM to Scale

The power of the contribution margin lies in its ability to predict the future profitability of your business as it scales. By isolating variable costs, you can determine exactly how much cash each new sale generates to "feed" the fixed costs.

Scenario: The Pricing Paradox

Imagine you sell a software subscription for $100. Your variable cost (server/support) is $10. Your fixed costs are $50,000.

- Option A (Status Quo): Sell 1,000 units. Revenue $100k. CM $90k. Profit = $40k.

- Option B (Discount 20%): Price drops to $80. CM drops to $70. You now need to sell 1,285 units just to keep the same profit.

Insight: A 20% price cut requires a 28.5% volume increase just to break even on the decision. Contribution margin analysis makes these trade-offs visible instantly.

Common Calculation Mistakes

Even experienced managers trip up on these nuances. Avoiding these three errors ensures your contribution margin analysis actually reflects reality.

Confusing "Unit" vs. "Total"

Never subtract total fixed costs from unit contribution margin. You must either work entirely on a per-unit basis (Price - Unit Variable Cost) or entirely on a total basis (Total Revenue - Total Variable Costs). Mixing the two leads to nonsense numbers.

Ignoring Sales Commissions

Sales commissions are almost always a variable cost because they occur only when a sale happens. Many companies wrongly dump them into "SG&A" fixed costs, artificially inflating their contribution margin and overestimating profitability on discounted deals.

The "Labor Trap"

Is your factory labor variable or fixed? If you send workers home when there are no orders (hourly), it is variable. If you pay them a salary regardless of output, it is a fixed cost. Misclassifying this changes your break-even point drastically.

The Contribution Margin Income Statement

Traditional income statements (GAAP) organize costs by function: Manufacturing vs. Selling/Admin. This is great for taxes but terrible for decision-making.

Internal management often uses a Contribution Margin Income Statement, which organizes costs by behavior (Variable vs. Fixed).

Industrial Applications

Manufacturing

Constraint Focus: Unlike software, factories have limited capacity. CM per Machine Hour is the critical metric. If Product A has a higher CM but takes twice as long to produce, Product B might actually be more profitable per hour of factory time.

Retail & E-Commerce

Inventory Focus: Shelf space is the constraint. Retailers look at GMROI (Gross Margin Return on Investment), but CM is vital for deciding free shipping thresholds. If shipping is $5 (variable), the order size must cover that plus item cost.

Service Agencies

Time Focus: For consultancies, "Variable Cost" is the billable rate of the employee. If a junior consultant costs $50/hr and bills $150/hr (CM $100), and a senior costs $150/hr and bills $300/hr (CM $150), the senior adds more contribution per hour despite the higher cost.

Frequently Asked Questions

Can contribution margin be greater than 100%?▼

No. Contribution margin is a portion of the sales price. It can be at most 100% (if variable costs are zero, which is impossible in reality). If you are calculating something greater than 100%, check if your price input is per unit but costs are total.

How do I calculate for multiple products?▼

You need the "Weighted Average Contribution Margin." Calculate the CM for each product, then weight them by their percentage of total sales units. The calculator above focuses on a single product line or average unit.

Should I drop a product with a negative contribution margin?▼

Generally, yes. If CM is negative, you lose cash on every sale. However, sometimes companies keep "loss leaders" to attract customers who then buy high-margin products (e.g., cheap printers to sell expensive ink).