Complete Guide: Credit Card Minimum Payments

Paying just the minimum on your credit card is the most expensive way to manage debt. While it keeps your account in good standing, it can turn a small $3,000 balance into a 15-year repayment marathon costing double what you originally spent.

How Minimum Payments Are Calculated

Credit card issuers don't just guess your minimum payment. They use a specific formula outlined in your Cardmember Agreement. While every bank is different, almost all use one of these two standard methods:

Method 1: The Flat Percentage

The issuer charges a flat percentage of your total statement balance, usually with a dollar floor.

Method 2: Interest + 1%

You pay all interest accrued that month, plus 1% of the principal balance, plus any fees.

Why this matters: Both methods are designed to lower your payment as your balance decreases. This sounds good, but it's a trap. As your payment drops, you pay less principal each month, stretching the debt out for decades.

The Mathematical Trap of Minimum Payments

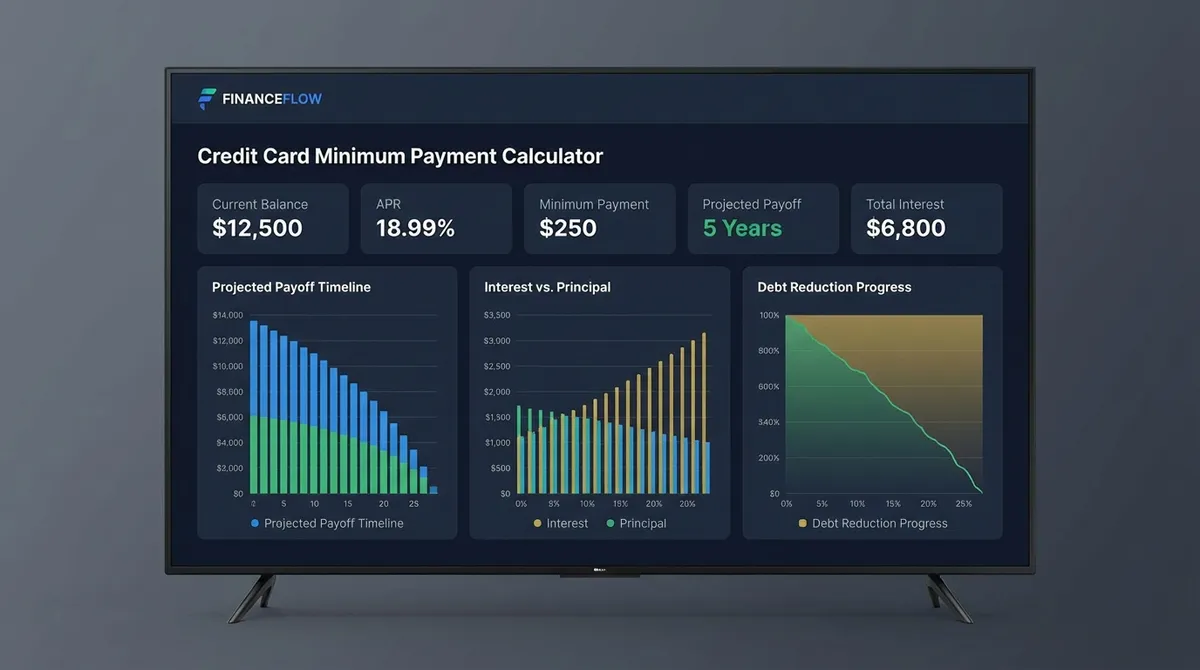

Let's look at a real scenario. Imagine you have a $5,000 balance on a card with a 20% APR. Your minimum payment policy is Interest + 1% of balance.

- Month 1: Interest is ~$83. 1% of balance is $50. Minimum payment is $133.

- Result: You pay $133, but $83 goes to interest. Only $50 reduces your debt. (Verify this breakdown with our Interest Calculator).

- Year 5: Your balance is lower, so your minimum payment drops to maybe $75. You feel relief, but you are barely chipping away at the principal.

If you stick to the minimums, that $5,000 purchase could take over 20 years to pay off and cost you $10,000+ in interest alone.

3 Strategies to Escape the Minimum Payment Trap

You don't need to win the lottery to get out of debt faster. You just need to change how you calculate your payment. Use our Payoff Calculator to see the difference.

1The Fixed Payment Strategy

This is the most effective method. Take your minimum payment from today (e.g., $133) and lock it in. Even when the bank says you can pay less next month, pay the $133 anyway.

By keeping the payment fixed, every dollar of interest you save in the future becomes an extra dollar of principal reduction. This creates a "snowball" effect that can cut your payoff time by half or more.

2The "Plus $50" Rule

If you can't afford a large fixed payment, just add $50 (or even $20) to the minimum every month. Because the minimum covers all the interest, 100% of that extra $50 goes directly to destroying your principal balance.

3Balance Transfer

If you have good credit, move the debt to a card with a 0% intro APR period (usually 12-18 months). This stops the interest clock, ensuring every dollar you pay reduces the debt. Just make sure to pay it off before the promo period ends.

The Psychology Behind the Minimum

Why do so many smart people get stuck paying only the minimum? It's not just about money; it's about behavioral psychology. Banks rely on the "Anchoring Effect."

When you open your bill, the first number you see is the Minimum Payment Due (e.g., $35). Your brain unconsciously "anchors" to this number. It feels like the "price" of the credit for that month. Even if you intended to pay $500, seeing $35 makes $100 feel like a "large" payment, so you might pay $100 and feel responsible.

The Fix: Ignore the minimum entirely. Before you open your bill, decide what you can afford (e.g., $400). That is your anchor. The minimum is irrelevant—it's just the fee to avoid a lawsuit, not a suggested payment amount.

The "Minimum Payment Warning" Box

Have you noticed a black-and-white table on your credit card statement titled "Minimum Payment Warning"? It was mandated by the Credit Card Accountability Responsibility and Disclosure (CARD) Act of 2009.

Before this law, banks didn't have to tell you how long payoff would take. Now, they are legally required to show you two scenarios:

Scenario 1: Minimum Payments

Shows the terrifying number of years (often 10-20+) it will take to pay off the balance if you make no extra payments.

Scenario 2: The 3-Year Plan

Shows exactly how much you need to pay each month to be debt-free in 3 years. This is often the best number to use as your goal payment.

Case Study: The 30-Year Nightmare

To truly understand the danger, let's look at the math of "Negative Amortization" or near-negative amortization.

Imagine you owe $10,000 at 25% APR. Your minimum payment is Interest + 1% ($308). You pay the $308. $208 goes to interest. $100 goes to principal.

Next month, your balance is $9,900. Your minimum payment drops to $305. $206 goes to interest. $99 goes to principal.

Because the payment drops as the balance drops, you never pick up momentum. This dynamic is why a $10,000 debt can cost $25,000+ in total payments if you follow the bank's "suggested" plan.

The Sweet Spot: When Minimums Help You

There is one tiny silver lining. Most banks have a "floor" for minimum payments, usually $25 or $35.

When your balance gets low enough (e.g., $500), your calculated minimum might be only $15. But the bank will still charge you the $25 floor. In this specific end-stage scenario, the minimum payment actually becomes an "aggressive" payment because it is higher than the math requires. However, relying on this to pay off the last few dollars is lazy—just pay it off!

Frequently Asked Questions (FAQ)

Does paying only the minimum hurt my credit score?

Directly, no. Paying the minimum counts as an "on-time payment," which is good for your history. However, carrying a high balance affects your Credit Utilization Ratio (30% of your score). If your balance stays high for years because you only pay minimums, your score will suffer. If you are truly struggling, ask your issuer about a "Hardship Program," which may freeze interest for 6 months without hurting your score.

Why is my minimum payment getting smaller?

Because the minimum payment is calculated based on your current balance. As you pay down the debt, the balance drops, and the required payment drops with it. This extends your repayment time unless you voluntarily pay more.

What happens if I pay less than the minimum?

You will likely be charged a late fee (up to $41), and you may trigger a Penalty APR (often 29.99%). If you are 30 days late, it will be reported to credit bureaus, significantly damaging your credit score.

How can I lower my interest rate?

Call your credit card issuer and ask. If you have a history of on-time payments, they may lower your APR by 1-3%. Alternatively, look into a debt consolidation loan or a balance transfer card, which usually offer rates much lower than typical credit cards.

Is interest calculated daily or monthly?

Most credit cards use the Average Daily Balance method. They calculate interest every single day based on that day's balance and add it up at the end of the billing cycle. This means making a payment early in the month saves you more money than paying on the due date.