Complete Guide: Mastering Your Credit Card Payoff

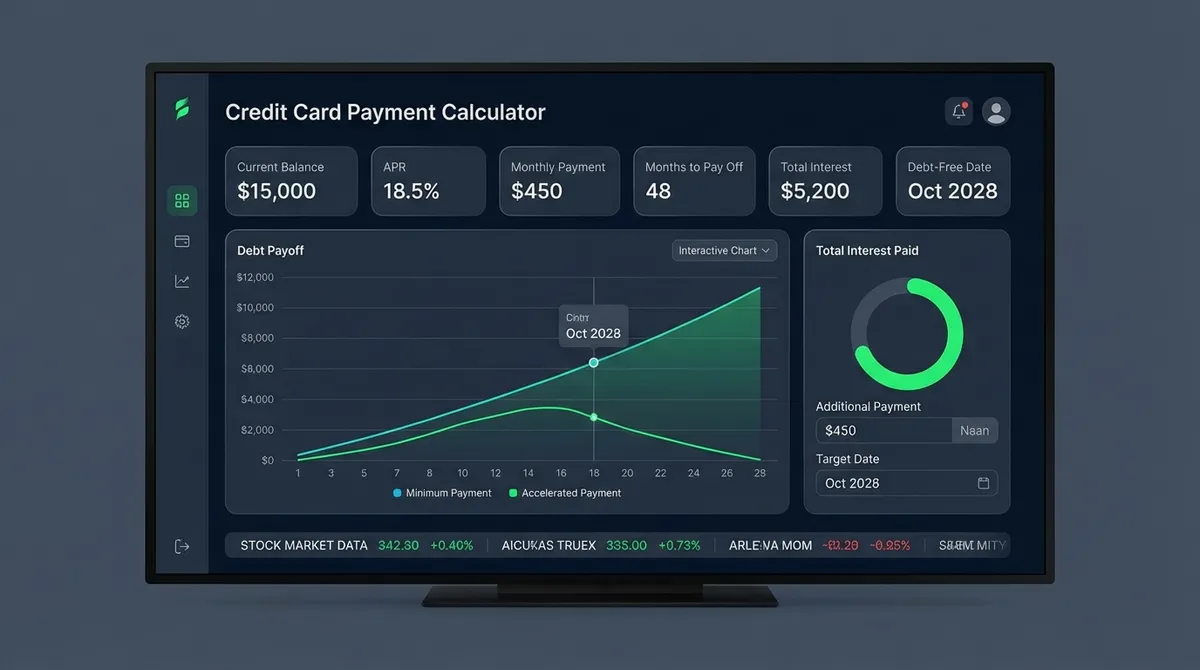

Carrying a balance on a credit card can feel like swimming upstream. With average interest rates often exceeding 20%, the math works against you—every dollar of interest you pay is a dollar that doesn't reduce your debt. The Credit Card Payment Calculator is designed to reverse this dynamic. It helps you answer the two most critical questions in debt management: "How much do I need to pay to be debt-free by a specific date?" and "If I can only afford $X per month, when will I be free?" (Compare scenarios with our Payoff Calculator).

Understanding Credit Card Interest (APR)

Credit card interest is expressed as an Annual Percentage Rate (APR). However, unlike a mortgage or car loan where interest is often pre-calculated, credit card interest is typically compounded daily based on your average daily balance.

To simplify planning, this calculator uses the monthly periodic rate (APR ÷ 12). While your actual statement might differ slightly due to the number of days in a specific month, this method provides a highly accurate baseline for payoff planning using our Interest Calculator logic.

The "Minimum Payment" Trap

Credit card issuers typically set minimum payments at just 1% to 3% of your balance (plus interest). Paying only the minimum is designed to keep you in debt for decades. For example, on a $5,000 balance at 20%, paying the minimum might take over 20 years to clear the debt, costing you thousands in interest. Always pay more than the minimum whenever possible.

Two Strategies to Clear Debt Faster

Once you have your numbers from the calculator, you need a strategy. The two most popular methods for tackling multiple credit cards are the Debt Avalanche and the Debt Snowball.

1Debt Avalanche

Mathematically optimal.

List your debts from highest interest rate to lowest. Pay minimums on everything else, and throw every extra dollar at the card with the highest APR. This method saves you the most money in interest over time.

2Debt Snowball

Psychologically rewarding.

List your debts from smallest balance to largest. Attack the smallest debt first regardless of the interest rate. The quick "win" of eliminating a debt motivates you to stick to the plan.

Real-World Scenarios

Scenario A: The Aggressive Payoff

Sarah has $10,000 in debt on a card with 24% APR.

Goal: Pay it off in 2 years (24 months).

Result: She needs to pay roughly $529/month.

Total Interest: She will pay about $2,690 in interest.

Scenario B: The Budget-Constrained

Mike has the same $10,000 debt at 24% APR, but can only afford $300/month.

Result: It will take him roughly 56 months (almost 5 years) to be debt-free.

Total Interest: He will pay over $6,700 in interest—more than half of the original loan amount!

How to Lower Your Interest Costs

- Balance Transfer Cards: Many cards offer 0% APR on balance transfers for 12-18 months. This allows 100% of your payment to go toward the principal. Be aware of transfer fees (usually 3-5%).

- Personal Loan: If your credit score is decent, you might qualify for a personal loan at 10-12% APR. You can use this loan to pay off the 24% credit card, instantly cutting your interest costs in half.

- Negotiation: Call your credit card issuer. If you have a history of on-time payments, simply asking "Is there a lower rate available for my account?" can sometimes result in a temporary or permanent APR reduction. For more tips, visit the FTC's Guide to Coping with Debt.

Frequently Asked Questions

What happens if I only pay the minimum?

Paying only the minimum extends your debt repayment timeline significantly—often by 10-20 years. Most of your payment goes to interest, barely scratching the principal balance.

Should I drain my savings to pay off credit card debt?

It depends. You should keep a small emergency fund ($1,000) for immediate needs. Beyond that, since credit card interest (20%+) is much higher than savings interest (4-5%), it usually makes mathematical sense to use excess savings to pay down high-interest debt.

Does this calculator include new purchases?

No. This calculator assumes you stop using the card for new purchases while paying it off. If you continue to add to the balance, the payoff date will keep moving further away.

Final Verdict: Take Control Today

Credit card debt is a financial emergency, but it is one you can solve. The math is simple: Debt = Principal + Interest + Time. You can't change the Principal overnight, but you can attack the Interest (by refinancing) and slash the Time (by increasing payments). Use the results from this calculator to set up an automatic payment plan today, and don't stop until the balance hits $0.00.

Debt Consolidation vs. Debt Management Plans

If the numbers from the calculator look overwhelming (e.g., payoff time greater than 5 years), you might need structural help. Two common paths exist, but they are very different:

Debt Consolidation Loan

You take out a new loan (usually personal or home equity) to pay off all cards.

- ✅ One fixed monthly payment

- ✅ Lower interest rate (10-15%)

- ❌ Requires good credit (660+)

Debt Management Plan (DMP)

You work with a non-profit agency. They negotiate lower rates with issuers and you pay the agency.

- ✅ Rates often cut to 8-10%

- ✅ Available with bad credit

- ❌ Accounts are closed (credit score dip)

The Impact of 2024-2025 Fed Rate Cuts

Credit card APRs are "Variable Rates" tied to the Prime Rate, which moves with the Federal Reserve's decisions. When the Fed cuts rates, your credit card interest drops—but usually only by 0.25% at a time.

Why you can't wait for the Fed:

Even if the Fed cuts rates by a massive 2.00% over the next year, a card with 24% APR will only drop to 22%. This is statistically insignificant for your payoff timeline compared to paying an extra $50/month.Actionable Advice: Do not rely on market conditions to save you. Aggressive principal payments are 10x more effective than hoping for rate cuts.

The Psychology of "Credit Limits"

Your credit limit is not a permission slip to spend; it's a debt trap waiting to snap. Credit card companies often increase your limit without asking. Why? Because behavior studies show that when consumers see a higher limit, they perceive they have more "spending power," even if their income hasn't changed.

The 30% Rule: To keep your credit score healthy, you should never use more than 30% of your limit. On a $10,000 card, that means never carrying a balance above $3,000. Crossing this threshold signals to credit bureaus that you are a "high-risk" borrower, which can drop your credit score by 50-100 points quickly.

How to Negotiate a Lower Interest Rate

Did you know 80% of people who ask for a lower APR get one? You don't need to be a financial guru; you just need a script.

// Call the number on the back of your card and ask for "Account Services"

"Hi, I've been a loyal customer for [X] years and I've made my payments on time. I'm reviewing my finances and noticed my APR is at 24%. I'm getting offers from other cards for 15%. I'd prefer to stay with you, but I need you to match that rate. What can you do for me today?"

// If they say no, ask to speak to a "Retention Specialist"

Even a 5% reduction can save you hundreds of dollars a year in pure interest, which you can then channel back into the principal payment to accelerate your debt-free timeline.