Understanding Credit Card Debt Payoff in 2025

Credit card debt is one of the most expensive forms of borrowing, with average APRs hovering around 24% in 2025. Unlike a mortgage or student loan where the path to zero is fixed, credit cards are designed to keep you in debt indefinitely through low minimum payments. The math works against you: compound interest accrues daily, and minimum payments often cover barely more than the interest charges.

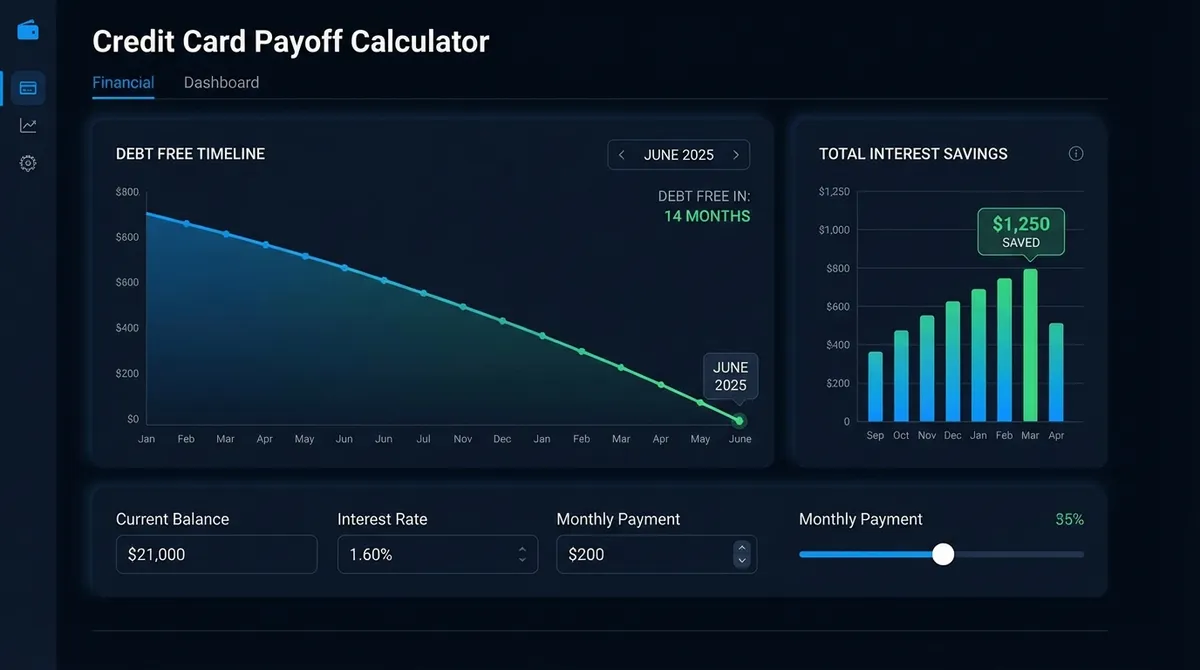

However, credit card debt is also solvable. By moving from "minimum payments" to a "strategic payoff plan," you can shave years off your timeline and save thousands of dollars. Whether you use the Avalanche Method (mathematically optimal) or the Snowball Method (psychologically powerful), the key is to attack the principal balance aggressively. This calculator helps you visualize exactly how much time and money you save by increasing your monthly payment.

How Credit Card Interest Works

Most people see an APR (e.g., 24%) and assume it's calculated once a year. In reality, credit card issuers calculate interest daily based on your average daily balance.

The "Minimum Payment Trap"

Minimum payments are typically calculated as 1% of your balance plus interest. On a $5,000 balance at 25% APR:

- • Interest Charge: ~$104

- • 1% of Principal: $50

- • Total Payment: $154

Of that $154, only $50 reduces your debt. This is why it takes over 15 years to pay off a balance making only minimum payments.

Strategy: Avalanche vs. Snowball

🏔️ The Debt Avalanche

Mathematically Optimal

You list your debts from highest APR to lowest APR. You pay minimums on everything else and throw every extra dollar at the debt with the highest interest rate.

- Saves the most money on interest

- Pays off debt fastest

- Requires discipline if the high-APR balance is large

❄️ The Debt Snowball

Psychologically Powerful

You list your debts from smallest balance to largest balance. You ignore interest rates. You attack the smallest debt until it's gone, then roll that payment into the next smallest.

- Quick wins build motivation

- Simplifies your financial life quickly

- Costs more in interest overall

Case Study: Breaking Free from $10,000 Debt

Let's look at "John," who has $10,000 in credit card debt across two cards with an average APR of 24%. He can afford $400/month for payments.

| Scenario | Monthly Payment | Time to Debt Free | Total Interest Paid |

|---|---|---|---|

| Minimum Payments | ~$250 (declining) | 24 Years | $14,500+ |

| Fixed Budget | $300 | 4 Years, 8 Months | $6,600 |

| Aggressive Plan | $500 | 2 Years, 2 Months | $2,800 |

By increasing his payment from the $250 minimum to a fixed $500, John saves over $11,000 in interest and becomes debt-free 22 years sooner. This illustrates the "Interest Tipping Point"—once your payment significantly exceeds the monthly interest charges, the principal balance collapses rapidly.

Debt Consolidation vs. Refinancing: A Strategic Guide

If your credit card interest rates are suffocating you (25%+), you might consider moving the debt to a lower-interest vehicle. This "refinancing" can save you thousands, but it comes with risks.

Option 1: Personal Loan

Best for: Fixed monthly payments

You take out a lump sum loan from a bank or credit union (e.g., $10,000 at 10% APR) to pay off your credit cards (at 25% APR).

- Pros: Fixed end date (e.g., 3 years), lower rate, one monthly bill.

- Cons: Requires good credit to qualify. Origination fees (1-6%) can be high.

Option 2: Balance Transfer Card

Best for: Aggressive short-term payoff

You move your debt to a new card offering 0% APR for 12-21 months.

- Pros: 0% interest means 100% of payment goes to principal.

- Cons: 3-5% transfer fee. If not paid in time, interest might skyrocket.

The "Shell Game" Warning: Debt consolidation only works if you stop using the original credit cards. If you pay off your cards with a loan but keep spending on them, you will end up with double the debt (the loan + new card balances). This is the most common reason for bankruptcy.

The Nuclear Option: Debt Settlement

If you are drowning and cannot make even the minimum payments, you might encounter ads for "Debt Settlement." This is very different from consolidation.

How it works:

You stop paying your bills. You let the accounts go to collections. Then, a company negotiates a lump-sum payoff for less than you owe (e.g., paying $5,000 to settle a $10,000 debt).

The Cost:

Your credit score will be tanked for 7 years. You will likely be sued by creditors before the settlement happens. The forgiven debt ($5,000) is often taxable as income by the IRS.

Better Alternative: A Non-Profit Debt Management Plan (DMP). These agencies work with creditors to lower your interest rates (often to 8-10%) without ruining your credit score, though you still have to pay back the full principal. You can find a list of government-approved credit counseling agencies on the CFPB website. Be aware that debt settlement can also restart the statute of limitations on your debt, allowing collectors more time to sue you.

DIY Option: The Spreadsheet Method

You don't need fancy software to get out of debt. A simple spreadsheet can be your most powerful tool.

- Column A: Creditor Name

- Column B: Balance

- Column C: APR

- Column D: Minimum Payment

Update this sheet every single Friday. The act of manually typing in the numbers forces your brain to confront the reality of the debt, which psychologists call "financial consciousness." It makes it harder to overspend on the weekend.

💡 Expert Tips for Faster Payoff

1. The "Bi-Weekly" Hack: Instead of paying once a month, split your payment in half and pay every two weeks. Because there are 52 weeks in a year, you end up making 26 half-payments, which equals 13 full monthly payments. This "phantom" extra payment reduces your principal faster without you feeling the pinch in your monthly budget.

2. Call for a Rate Reduction: If you have a history of on-time payments, call your issuer and ask for a lower rate. A drop from 24% to 19% on $10,000 saves you $500/year in interest—money that can go straight to principal.

3. Consider a Balance Transfer: If you have good credit (690+), look for a 0% APR balance transfer card. If you can pay off the debt within the 12-18 month promo period, you eliminate interest entirely. Just watch out for the 3-5% transfer fee.

4. Stop the Bleeding: You cannot get out of a hole while you are still digging. Remove the credit card from your digital wallets (Apple Pay, Amazon) while you are in payoff mode. Switch to debit or cash to break the cycle.

⚠️ Common Payoff Mistakes

Mistake 1: "Setting and Forgetting" Auto-Pay

If you set auto-pay to the "Minimum Due," you are falling into the issuer's trap. Always set auto-pay to a fixed dollar amount that is significantly higher than the minimum.

Mistake 2: Closing Cards immediately

Closing a card reduces your total available credit, which can spike your credit utilization ratio and hurt your credit score. Keep the account open with a $0 balance unless it has an annual fee.

Mistake 3: Saving while Drowning in Debt

Putting money in a savings account earning 4% while holding credit card debt costing 24% is a mathematical loss of 20%. Keep a small $1,000 emergency fund, but throw every other available dollar at the credit card.