Mastering Customer Lifetime Value (LTV) in 2025

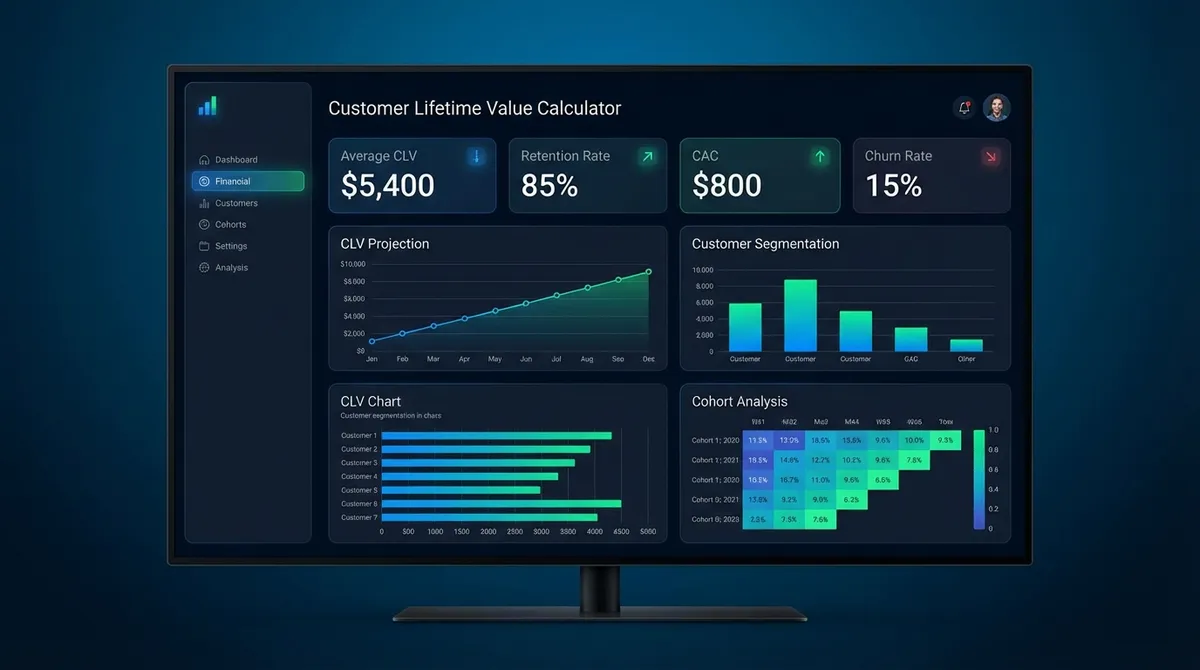

In the data-driven landscape of 2025 business, Customer Lifetime Value (CLV or LTV) is the single most important metric for sustainable growth. It answers the fundamental question: How much is one customer worth to your bottom line?

Knowing your LTV isn't just about accounting—it's the strategic compass that dictates how much you can afford to spend on marketing (CAC), which customer segments to prioritize, and how to price your products. Whether you run a high-frequency e-commerce store or a sticky B2B SaaS platform, optimizing LTV is the difference between burning cash and building a profitability engine.

Why it matters now: With ad costs on platforms like Google and Meta rising year-over-year, the "growth at all costs" era is over. Investors and founders now prioritize unit economics. A healthy LTV:CAC ratio (typically 3:1 or higher) proves that your business model works.

Choosing the Right LTV Model

Not all businesses are the same. Our calculator provides two distinct models to match your revenue structure:

1. Retail / E-commerce

Best for businesses with discrete, irregular purchases (e.g., fashion, electronics, coffee shops).

2. Subscription / SaaS

Best for recurring revenue models (e.g., software, gym memberships, box subscriptions).

Decoding the Variables

The average amount a customer spends in a single transaction. Increasing AOV via bundles or upsells is often the fastest way to boost LTV.

Crucial but often ignored. LTV must be calculated on gross profit, not revenue. If you sell a $100 item but it costs $60 to make and ship, your LTV calculation bases itself on the $40 profit. See Gross Margin Calc.

The percentage of subscribers who cancel each month. Churn is the "leaky bucket" of SaaS. Reducing churn from 5% to 2.5% literally doubles your LTV.

Money today is worth more than money in 3 years. Our calculator applies a discount rate (default 8-10%) to future cash flows to give you the "Present Value" LTV—a more conservative and accurate figure for financial planning.

Real-World Scenarios

Scenario A: The Boutique Coffee Roaster (Retail)

A customer buys a $20 bag of coffee (AOV) every 3 weeks (~17 times/year). They stay loyal for 3 years. The margin is 60%.

Math: $20 × 17 × 3 × 0.60 = $612 LTV.

Insight: Knowing this, the roaster can comfortably spend $50 to acquire a new customer (CAC), achieving a massive 12:1 return (ROI). Learn more about LTV on Shopify's Blog.

Scenario B: The Project Management Tool (SaaS)

Users pay $50/month (ARPU). Margin is high at 90% ($45 profit). However, churn is high at 10% per month.

Math: $45 / 0.10 = $450 LTV.

Insight: If they reduce churn to 5%, LTV jumps to $900. This shows why retention teams are often more valuable than sales teams in SaaS.

Expert Tips for Maximizing LTV

1. Segment Your Customers: "Average" LTV lies. Your "Whales" might have an LTV of $5,000 while "Minnows" are $50. Calculate LTV by segment to know who to target.

2. Focus on the First 90 Days: Churn often happens early. Improving onboarding and "time to value" is the highest-leverage way to extend lifespan and boost LTV.

3. Cross-Sell Strategically: Don\'t just sell more of the same. Sell complementary products. If you sell running shoes, selling socks adds pure margin and increases AOV without increasing acquisition cost.

4. Monitor Payback Period: High LTV is great, but cash flow is king. If it takes 18 months to recover your CAC, you might run out of cash before you see the profit. Aim for a payback period under 12 months.

Common Calculation Pitfalls

- ✕Using Revenue instead of Profit: This is the #1 mistake. If you ignore COGS, you will overspend on ads and lose money on every sale.

- ✕Ignoring Discounts: If you offer 20% off to acquire a customer, that reduces their LTV. Factor in your average discount rate.

- ✕Assuming Infinite Lifespan: In subscription models, 1/Churn implies mathematically infinite tails. In reality, products become obsolete. Cap your LTV calculations at 3-5 years to be conservative.

LTV Benchmarks: How Do You Compare?

"Is my LTV good?" is a relative question. An LTV of $50 is a disaster for a car dealership but a miracle for a mobile game. Below are 2025 industry standards for average Customer Lifetime Value.

| Industry | Average LTV | Good LTV:CAC |

|---|---|---|

| E-commerce (Fashion) | $150 - $250 | 3:1 |

| B2B SaaS (SMB) | $3,000 - $10,000 | 4:1 |

| B2B SaaS (Enterprise) | $50,000+ | 5:1 |

| Subscription Box | $250 - $400 | 3:1 |

| Mobile Apps | $0.50 - $2.00 | 2:1 |

The Holy Grail: LTV to CAC Ratio

Calculating LTV in isolation is useless. Its true power comes when you compare it to your Customer Acquisition Cost (CAC).

Ratio < 1:1

The Death Spiral. You are losing money on every customer. Stop scaling immediately and fix your product or pricing.

Ratio 3:1

The Sweet Spot. This is the industry standard for a healthy business. You have enough margin for overhead and R&D.

Ratio 5:1+

Too Conservative? While profitable, you might be under-spending on growth. Competitors could out-bid you for market share.

Frequently Asked Questions (FAQ)

What is a good LTV retention rate?

For SaaS, a monthly retention rate of 95% (5% churn) is considered good for SMBs, while enterprise should aim for 98-99%. For e-commerce, a 25-30% repeat purchase rate is a strong benchmark. High retention directly correlates to exponential LTV growth.

Should I include overhead in LTV?

Generally, no. LTV should include COGS (Cost of Goods Sold) to get to Gross Margin LTV, but should typically exclude fixed operating costs like rent or R&D salaries. This keeps the metric focused on unit economics.

How do discounting and refunds affect LTV?

They lower it significantly. Always subtract refunds and returns from your gross revenue before calculating LTV. If you have a high return rate (e.g., in fashion), your "Gross" LTV will be dangerously misleading.

What is "Predictive LTV" vs. "Historical LTV"?

Historical LTV looks at what past customers actually spent. Predictive LTV uses machine learning algorithms to guess what new customers will spend based on early signals. Predictive models are powerful but prone to error; historical data is accurate but backward-looking.

Can LTV be infinite?

Mathematically, if churn is 0%, LTV is infinite. However, in the real world, no one stays forever. Most financial models cap the customer lifespan at 3 to 5 years to keep valuations realistic and account for market disruption.

5 Proven Strategies to Increase LTV

Implement a Loyalty Program

Reward repeat purchases with points or exclusive access. Sephora's Beauty Insider is a classic example of how gamification locks customers in for years.

Switch to Subscription

Can your product be auto-shipped? Amazon "Subscribe & Save" increases LTV by removing the friction of re-ordering. Even 5% off for a subscription beats a one-time full-price sale.

Improve Customer Support

Bad support kills LTV. 80% of customers will churn after one bad experience. Fast, empathetic support turns angry users into loyal advocates.

Raise Prices (Sensibly)

If you haven't raised prices in 2 years, you are leaving LTV on the table. A 10% price increase often flows 100% to the bottom line profit.

Personalized Email Marketing

Don't blast everyone. Send "Time to Restock" emails based on their specific usage patterns. Relevance drives conversion.