Complete Guide: Days Payable Outstanding (DPO) for Business Cash Flow Optimization

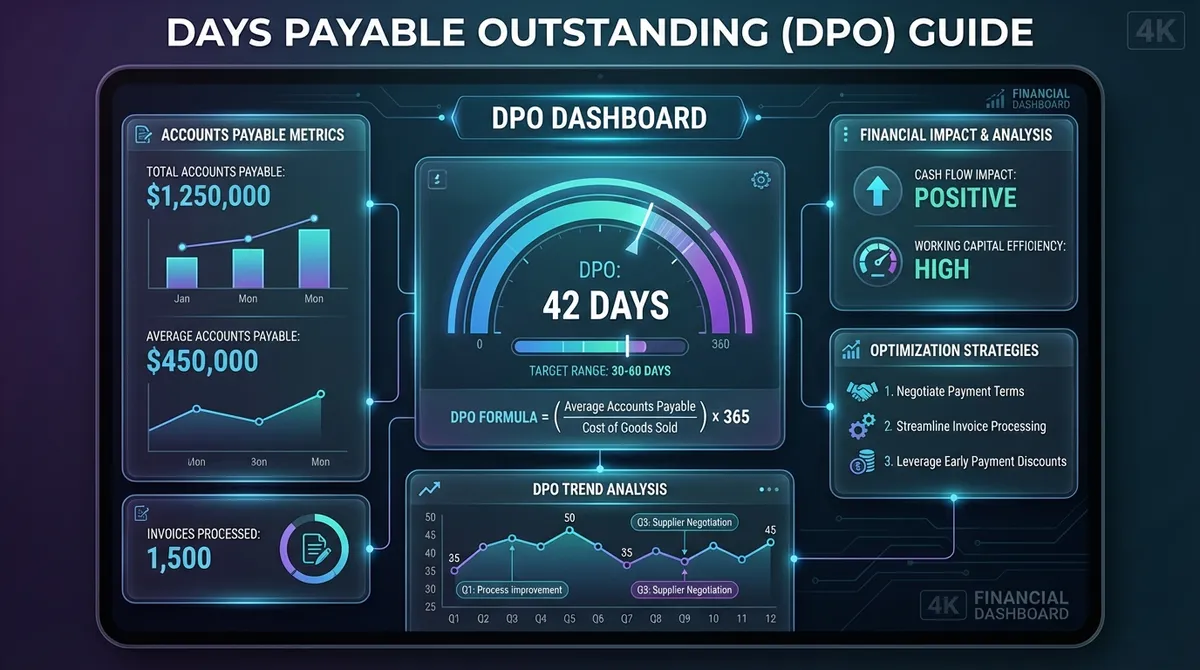

Days Payable Outstanding (DPO) is a critical financial metric that measures the average number of days a company takes to pay its suppliers. As businesses face increasing pressure to optimize cash flow in 2025, understanding and managing DPO has become more important than ever for financial success.

This comprehensive guide will walk you through everything you need to know about DPO—from basic calculations to advanced optimization strategies that can transform your business's cash flow management.

Key Statistic: Companies that optimize their DPO can improve working capital by 15-25% without changing operations. For a mid-size business with $2 million in annual purchases, this translates to $300,000-$500,000 in additional cash flow.

What Is Days Payable Outstanding and Why It Matters in 2025?

Days Payable Outstanding (DPO) represents the average number of days a company takes to pay its outstanding supplier invoices for purchases made on credit. This working capital metric provides crucial insights into a company's cash flow management efficiency and its bargaining power with suppliers. Learn more on Investopedia.

In essence, DPO measures how long a company can hold onto its cash before paying suppliers. During this period, the company can use that cash for other operational needs, short-term investments, or growth initiatives—essentially receiving an interest-free loan from suppliers.

In 2025, with rising interest rates and increased focus on working capital optimization, DPO has become a critical KPI for CFOs and finance teams. Understanding your DPO and benchmarking against industry standards isn't just financial reporting—it's strategic cash flow management that directly impacts your company's liquidity, profitability, and growth potential.

How DPO Calculations Work: The Math Behind Cash Flow Optimization

The DPO formula is straightforward but powerful. Understanding each component helps you identify levers for improving your cash flow:

- •Accounts Payable: The total amount your company owes suppliers for purchases made on credit. Found on your balance sheet as a current liability.

- •Cost of Goods Sold (COGS): Direct costs attributable to production of goods sold. Includes materials, labor, and overhead directly tied to production. Calculate with our COGS Calculator.

- •Number of Days: The period you're analyzing—typically 365 days for annual calculations, 90 days for quarterly.

- •Total Purchases: All purchases made on credit during the period. For service businesses, this includes all expenses paid on credit, not just COGS.

- •Average Accounts Payable: (Beginning AP + Ending AP) ÷ 2. Smooths out fluctuations for more accurate analysis.

The real power of DPO lies in its relationship to the Cash Conversion Cycle (CCC). By increasing DPO, you directly reduce your CCC, which means faster conversion of investments into cash. For every day you extend DPO, you improve cash flow by one day's worth of purchases.

Real-World Example: TechFlow Solutions' DPO Transformation Journey

Meet TechFlow Solutions, a growing SaaS company that transformed its cash flow by optimizing DPO. Starting with $250,000 in accounts payable and $1.2 million in annual expenses, they implemented strategic changes over 18 months that revolutionized their working capital management.

• Accounts Payable: $250,000

• Annual Expenses: $1,200,000

• DPO: 76 days (industry average: 45 days)

• Cash Tied Up: Already optimized

• Supplier Relationships: Strained

• Accounts Payable: $180,000

• Annual Expenses: $1,500,000

• DPO: 44 days (aligned with industry)

• Supplier Satisfaction: Improved 40%

• Working Capital Freed: $95,000

The remarkable aspect isn't just the improved supplier relationships—it's how strategic DPO management freed up $95,000 in working capital while maintaining healthy cash flow. TechFlow used this capital to invest in new product development, generating additional revenue that more than offset any interest savings from extended payment terms.

Key Insight: The goal isn't maximizing DPO—it's optimizing DPO. TechFlow learned that strategic supplier relationships and growth investments often provide better returns than simply holding cash. They now benchmark against industry standards and focus on sustainable, relationship-friendly DPO levels.

💡 Expert Tips from Jurica Šinko to Optimize Your DPO

1. Segment Your Suppliers Strategically: Not all suppliers deserve the same payment terms. Categorize them by criticality, relationship strength, and invoice amount. Pay strategic suppliers early to strengthen partnerships, while extending terms with transactional suppliers. This balanced approach optimizes cash flow without damaging key relationships.

2. Implement Dynamic Discounting: Negotiate early payment discounts that benefit both parties. Offer to pay in 10 days for a 2% discount (equivalent to 36% annual return). For suppliers needing cash flow, this is cheaper than bank financing. For you, it's an excellent short-term investment of excess cash.

3. Use Technology for Precision Timing: Modern AP automation systems allow you to schedule payments exactly on due dates, maximizing cash retention while maintaining perfect compliance. This alone can improve DPO by 3-5 days without any supplier negotiations.

4. Leverage Payment Terms in Contract Negotiations: When negotiating new supplier contracts, make payment terms a key discussion point. Many suppliers prefer longer terms over price reductions, especially if they're confident in your payment reliability. This preserves margins while improving cash flow.

5. Monitor DPO Weekly, Not Monthly: In fast-moving businesses, weekly DPO tracking helps you identify trends and issues before they become problems. Set up automated dashboards that flag when DPO moves more than 2-3 days from your target range, enabling proactive management.

⚠️ Common DPO Mistakes That Destroy Supplier Relationships and Cash Flow

Mistake 1: Maximizing DPO Without Considering Supplier Health

Pushing DPO to 90+ days might improve your cash flow, but if key suppliers struggle with cash flow and raise prices or reduce quality, you lose more than you gain. Always assess supplier financial health before extending terms. A strategic 45-day term with a healthy supplier beats a 90-day term with a struggling one.

Mistake 2: Ignoring Early Payment Discounts

A 2/10 net 30 discount equals 36% annual return—far exceeding most companies' cost of capital. Many finance teams focus on extending DPO but miss these high-return opportunities. Always calculate discount annualized rates and compare to your weighted average cost of capital.

Mistake 3: Treating All Suppliers the Same

Your strategic widget supplier who provides custom components deserves different terms than your office supplies vendor. One-size-fits-all DPO strategies damage critical relationships while overpaying transactional suppliers. Segment suppliers and tailor approaches.

Mistake 4: Not Aligning DPO with Industry Benchmarks

A manufacturing company with 30-day DPO is paying too fast and hurting cash flow. A retailer with 90-day DPO is damaging supplier relationships. Know your industry benchmarks and target ±10 days, not extreme outliers.

Mistake 5: Failing to Consider the Full Cash Conversion Cycle

Optimizing DPO in isolation can hurt overall business performance. If extending DPO forces you to hold more inventory (increasing DIO) or damages customer relationships (increasing DSO), you may lose more than you gain. Always optimize the entire CCC, not just one component.

DPO Variations by Industry: What Success Looks Like in Your Sector

DPO benchmarks vary dramatically by industry due to different business models, supply chain structures, and competitive dynamics. Understanding your industry's typical range is crucial for setting realistic targets and avoiding supplier relationship damage.

Manufacturing

Long production cycles and strategic supplier relationships enable extended terms. Success means strong supplier partnerships and JIT inventory systems.

Technology & SaaS

Lower inventory needs but significant operational expenses. Use purchase-based DPO calculation for accuracy with software licenses and cloud services.

Retail & E-commerce

Fast inventory turnover requires quick supplier payments. Large retailers leverage volume for extended terms, but must balance with inventory needs.

Healthcare

Regulatory compliance and supply chain complexity create moderate terms. Focus on reliability and compliance over extreme DPO optimization.

Construction

Long project timelines and milestone-based payments naturally extend DPO. Success means managing progress payments and retainage effectively.

Food & Beverage

Perishable inventory requires rapid turnover and quick supplier payments. Focus on freshness and supplier reliability over extended terms.

Industry-Specific Success Strategies:

- • Manufacturing: Leverage volume and long-term contracts for 60-75 day terms with strategic suppliers.

- • SaaS: Use purchase-based DPO calculation and negotiate extended terms for software licenses and cloud services.

- • Retail: Balance inventory turnover needs with payment terms; consider vendor financing for seasonal inventory.

- • Healthcare: Prioritize compliance and reliability; optimize other CCC components more aggressively.

- • Construction: Structure payment terms around project milestones and owner payment schedules.

Implementing Your DPO Optimization Strategy: A 90-Day Action Plan

Ready to optimize your DPO? This practical 90-day plan will help you implement systematic improvements while maintaining strong supplier relationships.

1Days 1-30: Assessment & Benchmarking

- •Calculate your current DPO using 12 months of data

- •Research industry benchmarks for your specific sector

- •Segment suppliers into strategic, important, and transactional categories

- •Identify which suppliers offer early payment discounts

- •Set up weekly DPO tracking dashboard

2Days 31-60: Quick Wins & Automation

- •Implement automated payment scheduling for exact due date payments

- •Take advantage of all early payment discounts (quick ROI)

- •Begin discussions with top 5 strategic suppliers about optimized terms

- •Consolidate purchasing to preferred suppliers for better leverage

- •Set up supplier portals for better communication and payment tracking

3Days 61-90: Strategic Negotiations & Process Refinement

- •Formalize new payment terms with strategic suppliers

- •Implement dynamic discounting for suppliers needing faster payments

- •Review and refine DPO targets based on initial results

- •Document policies and train AP team on new processes

- •Calculate ROI and present results to leadership

Advanced Concept: DPO in the Cash Conversion Cycle

Days Payable Outstanding doesn't exist in isolation—it's one of three critical metrics that determine your Cash Conversion Cycle (CCC), the ultimate measure of working capital efficiency.

The Relationship: DPO is subtracted in the CCC formula because paying suppliers later (higher DPO) improves cash flow. However, this must be balanced with the other components:

- •Days Sales Outstanding (DSO): How quickly you collect from customers. Lower is better.

- •Days Inventory Outstanding (DIO): How long inventory sits before selling. Lower is better.

- •Days Payable Outstanding (DPO): How long you take to pay suppliers. Higher is better (with limits).

Strategic Insight: For inventory-based businesses, optimizing all three components creates exponential working capital improvements. For service businesses, DPO becomes even more critical as it's often the primary lever for cash flow optimization. A retail company that reduces DSO by 5 days, DIO by 3 days, and increases DPO by 7 days improves CCC by 15 days—freeing up 15 days of operating expenses as working capital.

Key Takeaways & Next Steps

Days Payable Outstanding is more than a financial metric—it's a strategic tool that directly impacts your company's liquidity, supplier relationships, and growth potential. By understanding the formulas, benchmarking against industry standards, and implementing systematic optimization strategies, you can transform your working capital management.

✓Calculate your current DPO using at least 12 months of data for accuracy.

✓Research industry benchmarks and target the optimal range for your sector.

✓Segment suppliers strategically and tailor payment terms to relationship value.

✓Implement technology for automated payment scheduling and DPO tracking.

✓Monitor weekly and adjust strategies based on results and supplier feedback.

Remember: The goal isn't maximizing DPO—it's optimizing DPO while maintaining healthy supplier relationships and supporting business growth. Use our calculator above to model different scenarios, benchmark your performance, and develop a data-driven DPO strategy that works for your specific situation.