Take Control of Your Debt in 2025

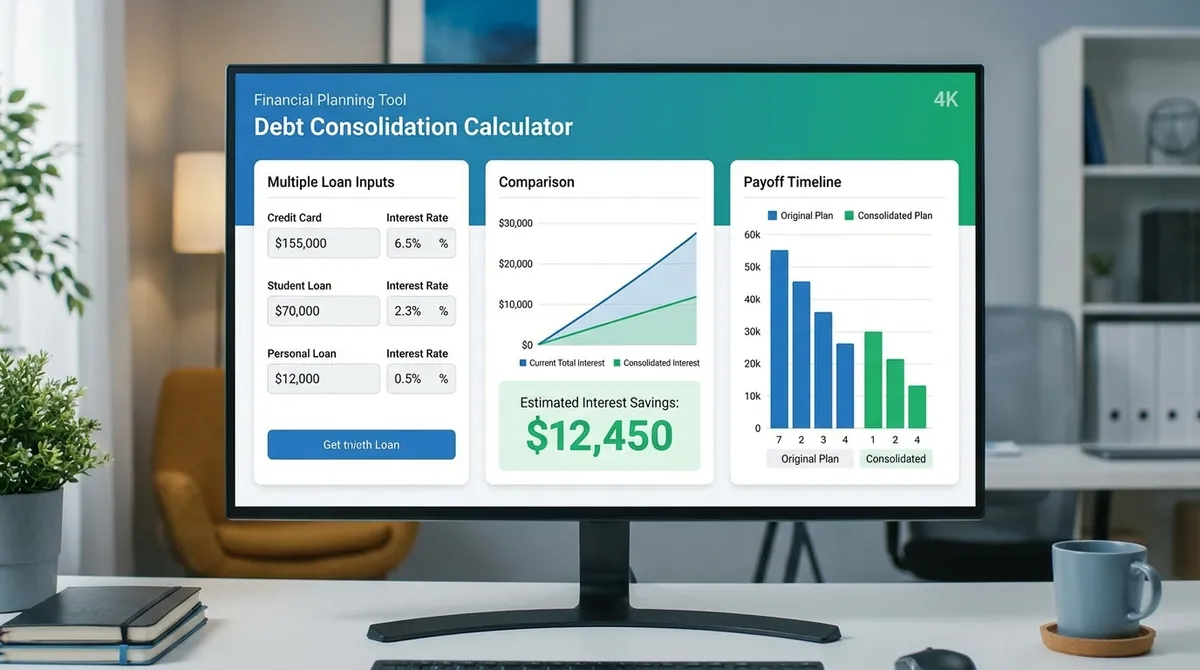

Managing multiple high-interest debts can feel overwhelming. Interest piles up, due dates are missed, and progress feels impossible. This Debt Consolidation Calculator is designed to cut through the noise. By comparing your current situation against five distinct consolidation strategies—from personal loans to balance transfers—you can identify the path that saves you the most money and gets you debt-free faster.

How Debt Consolidation Works

At its core, debt consolidation is about simplification and optimization. You take out a single new loan to pay off multiple smaller debts. This leaves you with one monthly payment, often at a lower interest rate, which means more of your money goes toward the principal balance rather than vanishing into interest charges.

Lower Interest Rates

Replacing 24% APR credit card debt with a 10% personal loan can save you thousands over the life of the repayment.

Fixed Timeline

Credit cards can drag on for decades. Consolidation loans have a set end date (e.g., 3 or 5 years), giving you a clear finish line.

Single Payment

One due date per month reduces the risk of missed payments and late fees, protecting your credit score.

Comparing Consolidation Methods

Not all consolidation loans are created equal. The best option depends entirely on your credit score, whether you own a home, and your discipline level.

Personal Loans

Best for: Good to Excellent Credit

Pros

- Fixed interest rates and monthly payments

- No collateral required (Unsecured)

- Quick funding (often 24-48 hours)

Cons

- Origination fees (1% - 8%) can be high

- Rates can be high for fair/poor credit

Balance Transfer Cards

Best for: Smaller Balances & Disciplined Payers

Pros

- 0% APR for introductory period (12-21 months)

- Aggressive debt reduction (100% to principal)

Cons

- Balance transfer fees (3% - 5%)

- Interest spikes to 20%+ if not paid in full

- Requires excellent credit to qualify

Home Equity Loans (HELOAN)

Best for: Homeowners with Significant Debt

Pros

- Typically the lowest interest rates

- Long repayment terms (10-20 years) lower payments

- High borrowing limits

Cons

- Risk of Foreclosure: Your home is collateral

- Closing costs can be expensive

- Takes weeks to process

Strategic Guide: How to Use This Calculator

Success Stories: It Is Possible

Sometimes math isn't enough. You need to see that real people have walked this path before you.

The "Balance Transfer" Win

"I had $15,000 on a card charging 22%. It was suffocating. I opened a card with 0% APR for 18 months. I took my old interest payment ($275/mo) and added it to the principal. I killed the debt in 14 months and never paid another cent of interest."

The "Personal Loan" Reset

"I had 5 cards with payments totaling $900/mo. I felt like I was drowning. Ideally, I would have snowballed them, but I needed breathing room. I got a loan for $300/mo. I took the extra $600 and built an emergency fund so I'd never use the cards again."

Real World Scenario

Case Study: Sarah's Credit Card Debt

Sarah has 5,000 in credit card debt across three cards with an average interest rate of 22%. Her minimum payments total $450/month. If she only pays the minimums, it will take her over 20 years to pay off, and she'll pay over $20,000 in interest alone.

Without Consolidation

With Personal Loan (10% APR)

The Trap of Recidivism (And How to Avoid It)

The dark side of debt consolidation is "recidivism"—the tendency to fall back into debt. Studies show that up to 70% of people who consolidate credit card debt end up with the same (or higher) debt load within two years.

Why Does This Happen?

- The "Clean Slate" Illusion: When you pay off a credit card with a loan, the balance shows $0. It feels like you have money again.

- Failure to Address Behavior: If you spent more than you earned before the loan, you will likely continue to do so after.

- Keeping Cards Open: Having $20,000 of available credit is tempting during "emergencies" that aren't really emergencies.

Consolidation vs. Debt Management Plans (DMP)

Many people confuse consolidation loans with Debt Management Plans. They are completely different strategies. Learn more at the CFPB website.

| Feature | Consolidation Loan | Debt Management Plan (DMP) |

|---|---|---|

| What is it? | A new loan to pay off old debts. | An agreement to pay creditors via an agency. |

| Interest Rates | Depends on credit score (8-25%). | Negotiated down (often 8-10%). |

| Credit Check? | Yes (Hard Inquiry). | No. |

| Credit Cards? | You can keep them open. | Accounts are typically closed. |

| Best For... | Good credit, need simplicity. | Bad credit, overwhelmed by rates. |

What If I Can't Qualify? (Alternatives)

Debt consolidation requires decent credit. If you are already behind on payments, you might not qualify for a loan with a lower rate. In that case, consider these "Nuclear Options."

Debt Settlement

You stop paying your creditors and hire a company to negotiate a lump-sum payoff (e.g., settling a $10k debt for $5k).

Bankruptcy (Chapter 7/13)

A legal process to wipe out or restructure debts. It stops collections and lawsuits immediately.

Impact on Credit Score: The Timeline

(1-2 Months)

Minor Drop (-5 to -15 points)

Applying for the loan triggers a "Hard Inquiry." Opening a new account also lowers your "Average Age of Accounts."

(3-6 Months)

Significant Rise (+20 to +50 points)

Paying off maxed-out credit cards drastically lowers your "Credit Utilization Ratio" (a huge factor, 30% of your score). This usually outweighs the inquiry dip.

(12+ Months)

Stability

Consistently making the fixed loan payment builds positive payment history. Your score stabilizes at a higher level as you pay down principal.

Glossary of Terms

Budgeting for Consolidation

The yearly cost of borrowing money, including interest and fees. Use this number, not the "interest rate," when comparing loans.

Origination Fee

A fee charged by a lender to process a new loan. It usually ranges from 1% to 8% of the loan amount and is deducted from the loan proceeds.

Secured vs. Unsecured Loan

A secured loan requires collateral (like a house or car). An unsecured loan (like a personal loan) relies only on your creditworthiness. Consolidation loans are typically unsecured.

Debt-to-Income Ratio (DTI)

The percentage of your gross monthly income that goes toward paying debts. Lenders look for a DTI below 36-43% to approve a consolidation loan.

Pre-payment Penalty

A fee charged if you pay off your loan early. Avoid loans with this penalty so you can pay off your debt faster if you get extra cash.

The Golden Rule of Consolidation

Debt consolidation only works if you stop creating new debt. If you pay off your credit cards with a loan but keep using the cards, you will end up with double the debt. Many experts recommend cutting up the cards (but keeping the accounts open to preserve credit age) once the transfer is complete. Choosing to consolidate your debt is a brave first step. It signifies that you are ready to take control of your financial narrative and rewrite your future.