What Is Dividend Reinvestment (DRIP) and Why It's Your Secret Wealth-Building Weapon in 2025

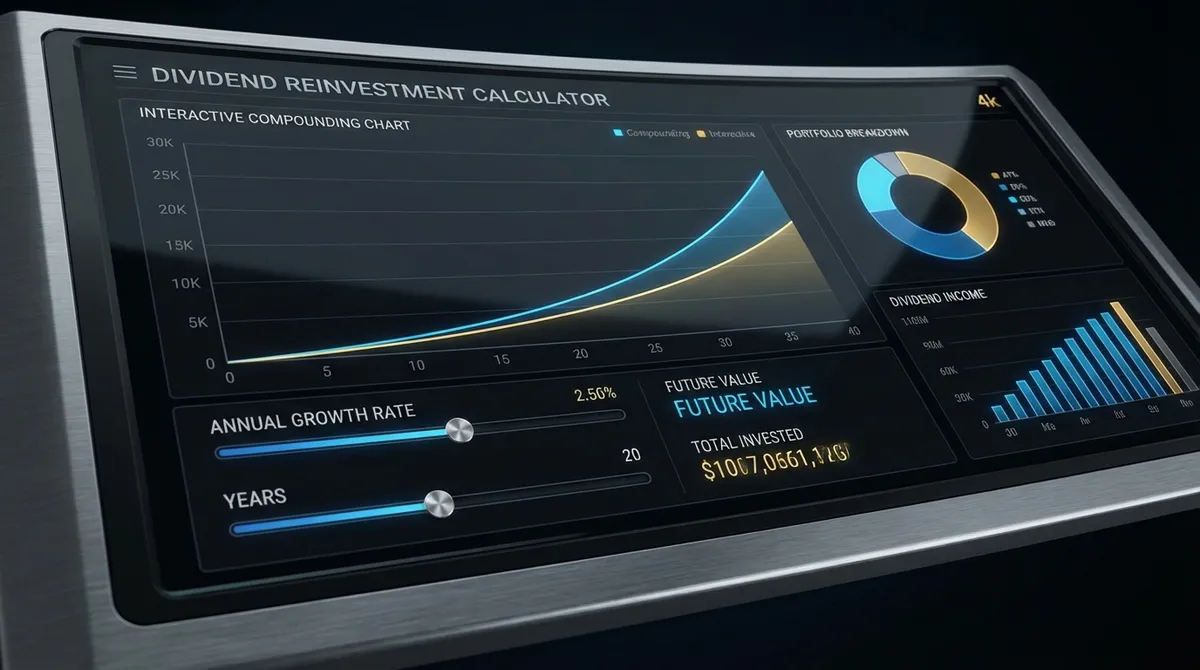

Dividend reinvestment is the financial strategy where you automatically use your dividend payments to purchase additional shares of the same stock instead of taking the cash. This simple yet powerful approach harnesses the magic of compound interest, turning modest dividend income into substantial long-term wealth. In 2025, with dividend aristocrats yielding 2-4% annually and many blue-chip stocks offering consistent dividend growth, DRIP investing has become one of the most reliable paths to financial independence.

Key Insight: A $10,000 investment in a stock with a 3.5% dividend yield, growing at 5% annually, can generate over $8,700 in additional wealth over 20 years through dividend reinvestment alone—even without any stock price appreciation. Add in capital appreciation and dividend growth, and you're looking at a potential 300-400% total return.

Unlike simple buy-and-hold strategies, dividend reinvestment plans (DRIPs) systematically increase your ownership stake, creating a self-reinforcing cycle: more shares = more dividends = more shares purchased. In this comprehensive guide, we'll explore how dividend reinvestment works, why it outperforms cash dividend strategies, and how to optimize your DRIP investments for maximum long-term growth.

Reinvested dividends buy more shares, which generate more dividends, creating exponential growth over time.

DRIP programs automatically reinvest dividends, removing emotion and ensuring consistent investing discipline.

DRIP investors naturally adopt a long-term mindset, benefiting from market volatility and dollar-cost averaging.

How Dividend Reinvestment Plans Work: The Mechanics Behind the Magic

Dividend reinvestment transforms passive income into active wealth building through a systematic, automated process. When a company pays dividends, instead of receiving cash in your account, the dividend amount automatically purchases additional shares—or fractional shares—at the current market price. This creates a powerful compounding effect that accelerates your portfolio growth over time.

The 5-Step DRIP Process

Initial Investment

You purchase shares of a dividend-paying stock. For example, 200 shares at $50 each = $10,000 investment.

Dividend Declaration

The company declares a quarterly dividend. With a 4% annual yield, that's 1% per quarter, or $0.50 per share.

Dividend Payment

You receive $100 in dividends (200 shares × $0.50), but instead of cash, it's automatically allocated for reinvestment.

Share Purchase

The $100 buys 2 additional shares at $50 each (assuming constant price), increasing your holdings to 202 shares.

Compounding Cycle

Next quarter, you receive dividends on 202 shares ($101), buying even more shares. The cycle accelerates exponentially.

Why This Compounds So Powerfully

The mathematical magic happens because each dividend payment buys slightly more shares than the last. In year 1, a 4% yield on $10,000 might buy $400 worth of shares. But by year 10, that same 4% yield generates dividends based on your $15,000+ portfolio, potentially buying $600 worth of shares. By year 20, it might generate $1,000+ in dividends to reinvest.

Critical Advantage: No Transaction Costs

Most DRIP programs charge zero commissions on reinvested dividends. This means 100% of your dividend income works for you, unlike manual buying where $5-10 trading fees can eat up 5-10% of a typical dividend payment.

What Factors Determine Your DRIP Success? The 7 Key Variables

Your dividend reinvestment results depend on several interconnected factors. Understanding how each variable impacts your long-term returns helps you select the right stocks and set realistic expectations for your DRIP portfolio.

Higher yields generate more dividend income to reinvest initially. However, extremely high yields (>8%) often signal distress. The sweet spot is 3-5% for established companies.

This is the most critical factor long-term. Companies that grow dividends at 5-7% annually create exponentially higher returns. Track records matter—look for 10+ years of consistent growth.

Price appreciation increases your total return. DRIP works best when stock prices grow 5-8% annually. This combines with dividend growth for powerful total returns.

Qualified dividends in taxable accounts face 0-20% tax rates. In IRAs or 401(k)s, DRIP grows completely tax-free until withdrawal, dramatically accelerating returns.

DRIP is a long-term strategy. The compounding effect becomes dramatic after 15-20 years. Starting early—even with small amounts—matters more than starting large late.

DRIP only works with reliable dividend payers. Focus on companies with strong balance sheets, low debt-to-equity ratios, and consistent earnings growth across market cycles.

The key to DRIP success is never interrupting the cycle. Even during market downturns, reinvesting dividends buys more shares when prices are low, setting you up for greater gains during recoveries.

The Multiplier Effect

When these factors align—a 4% yield with 5% dividend growth and 6% price appreciation—you're not just adding returns, you're layering them. After 20 years, this combination typically generates total returns of 350-450% compared to 200-250% without DRIP.

Real-World Example: Maria's 25-Year DRIP Journey to Financial Freedom

Meet Maria, a 30-year-old nurse who decided to build a dividend growth portfolio with $15,000 in 2000. She chose a diversified mix of dividend aristocrats with an average 3.5% yield, 5% dividend growth, and 6% stock price appreciation. She set up automatic DRIP participation in her IRA to maximize tax efficiency. Let's track her journey over 25 years.

Maria's DRIP Investment Timeline

What We Can Learn from Maria's Success

The Power of Consistency

Maria never sold during the 2008 financial crisis or 2020 pandemic. She kept reinvesting, buying more shares when prices were low. This discipline added an estimated $25,000+ to her final portfolio value.

Tax-Advantaged Growth

By using an IRA, Maria avoided paying taxes on dividends for 25 years. In a taxable account at 15% tax rate, her final portfolio would have been approximately $128,000—$14,800 less due to taxes.

The DRIP Dividend Growth Explosion

Notice how Maria's annual dividend income grew from $525 in year 1 to $5,082 in year 25—that's a 867% increase! This isn't just from dividend growth; it's because she owned more shares (1,348 vs. 200) that each paid higher dividends. This dual compounding effect is unique to DRIP investing and explains why it outperforms simply collecting dividends as cash.

Key Takeaway

Maria's $15,000 investment grew to $142,800—a 852% total return. Without DRIP (simply collecting dividends as cash with no reinvestment), she would have ended with approximately $82,000 portfolio value, missing out on $60,800 in additional wealth.

Advanced DRIP Strategies for Maximum Returns

1. Selective DRIP Activation

Not all stocks belong in a DRIP program. Set up automatic reinvestment only for your highest-quality holdings. For overvalued stocks, consider taking dividends as cash to deploy elsewhere. This selective approach prevents automatically buying overpriced shares while maximizing compounding in your best investments.

2. Tax-Advantaged Account Prioritization

Always prioritize DRIP in Roth IRAs and retirement accounts. Tax-free compounding eliminates the 15-20% drag on reinvested dividends, potentially adding 25-30% to your final portfolio value over 20 years compared to taxable DRIP investing. You can learn more about the tax benefits of retirement accounts at Investor.gov.

3. Dollar-Cost Averaging Enhancement

Combine DRIP with additional monthly investments. This works similarly to compound interest, accelerating your path to wealth. Use our stock profit calculator to see how price appreciation works with dividend growth. If you only want to see yield, use the standard dividend calculator.

4. Sector Diversification

Run DRIP programs across multiple sectors (consumer staples, healthcare, utilities, financials). This diversifies your compound growth and protects against sector-specific downturns. Aim for 8-10 different DRIP stocks across at least 4 sectors for optimal risk-adjusted returns.

Key Takeaways: Your DRIP Action Plan

Start early—even small amounts compound powerfully over 20+ years

Focus on dividend growth rate over current yield (5%+ growth is ideal)

Use tax-advantaged accounts to eliminate the tax drag on reinvested dividends

Never interrupt the DRIP cycle—keep reinvesting through all market conditions

Diversify across 8-10 high-quality dividend growth stocks in different sectors

Ready to start your DRIP journey? Use our dividend reinvestment calculator above to model different scenarios, understand the impact of each variable, and create a personalized DRIP strategy tailored to your investment timeline and goals.