The 20% Down Payment Myth in 2025

If you think you need 20% down to buy a home, you might be waiting years longer than necessary. This is one of the most pervasive myths in real estate. In 2025, the median down payment for first-time homebuyers is actually just 6-7%, and for repeat buyers, it hovers around 17%. The days of needing 20% cash upfront are long gone for most buyers.

While putting 20% down does avoid Private Mortgage Insurance (PMI) and lowers your monthly payment, waiting to save that massive lump sum often costs significantly more in lost home appreciation than the PMI itself. This comprehensive guide breaks down the real math behind down payments, how PMI actually works, and strategies to buy sooner with less cash upfront.

Did you know?

Qualified first-time buyers can purchase a home with as little as 3% down on a Conventional loan, or 3.5% on an FHA loan. Veterans and USDA-eligible rural buyers can often buy with 0% down.

Understanding the Numbers

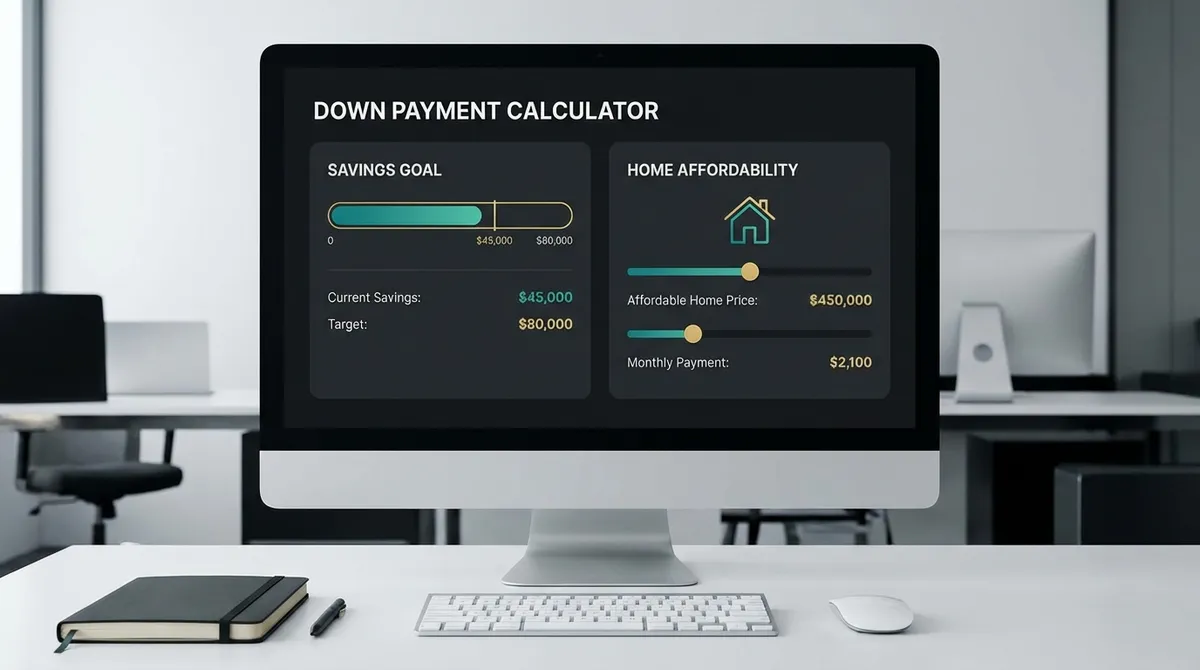

Our calculator works alongside our home affordability calculator to help you find the "sweet spot" between your available cash and your monthly budget goals. It's crucial to understand how shifting your down payment affects your long-term costs.

Input Variables

- Home Price: The negotiated purchase price of the property, not necessarily the listing price.

- Down Payment: Cash paid upfront. This equity protects the lender and determines your Loan-to-Value (LTV) ratio.

- Loan Term: Duration of the mortgage. 30-year fixed is standard, but 15-year terms offer lower rates.

Key Outputs

- LTV Ratio: Loan-to-Value. Lenders use this to price risk. (e.g., $10k down on $200k = 95% LTV).

- PMI Cost: Estimated monthly mortgage insurance. This drops off once you build enough equity.

- Total Monthly: The real number you need to budget for—including Principal, Interest, Taxes, Insurance, and PMI.

Minimum Down Payments by Loan Type

Choosing the right loan program is the single biggest factor in your down payment requirement. Each program is designed for a specific buyer profile.

| Loan Program | Min. Down | Credit Score | Best For |

|---|---|---|---|

| Conventional 97 | 3% | 620+ | First-time buyers with good credit. PMI is removable and often cheaper than FHA. |

| FHA Loan | 3.5% | 580+ | Buyers with lower credit (down to 500 with 10% down) or higher debt ratios. |

| VA Loan | 0% | N/A* | Veterans & active military. Often the best loan available due to 0% down and no PMI. |

| USDA Loan | 0% | 640+ | Buyers in eligible rural/suburban areas with moderate income boundaries. |

| Jumbo Loan | 10-20% | 700+ | Luxury homes exceeding conforming loan limits. Requirements are stricter. |

*VA loans don't have a strict minimum credit score set by the VA, but most private lenders look for 620+ as an "overlay".

The Truth About PMI (It's Not Evil)

Myth: "PMI is throwing money away."

Reality: PMI is the tool that allows you to buy a home years earlier than otherwise possible. It is the cost of leveraging the bank's money to secure an appreciating asset.

Think of PMI (Private Mortgage Insurance) as the "fee" for borrowing the down payment you haven't saved yet. Usually costing between 0.5% and 1.5% of the loan amount annually, it's often far cheaper than the cost of waiting.

The "Cost of Waiting" Analysis

Let's look at the math. Suppose you want to buy a $400,000 home. You have 5% ($20,000) saved. Historically, real estate appreciates about 4-5% per year.

Option A: Buy Now (5% Down)

- Purchase Price: $400,000

- Down Payment: $20,000

- Monthly PMI: ~$150

- 3 Years of PMI Cost: -$5,400

- Equity Gained (5% growth): +$63,000

- Net Win: +$57,600

Option B: Wait 3 Years

- Future Price (5% growth): $463,000

- New 20% Down Needed: $92,600

- Monthly PMI: $0

- Rent Paid ($1.5k/mo): -$54,000

- Equity Gained: $0

- Net Loss: Missed Opportunity

*This is a simplified example. Taxes, maintenance, and closing costs also factor in, but the opportunity cost of missed appreciation is often the dominant factor in rising markets.

Don't Forget Closing Costs!

A common tragedy in real estate is saving exactly 3.5% for an FHA down payment, only to realize you need another 3-5% for closing costs. Closing costs are separate from your down payment.

On a $400,000 home, closing costs typically run $8,000 to $15,000 depending on your state's tax laws. These pay for:

Strategy: You can often negotiate for the seller to pay your closing costs (known as "Seller Concessions"). FHA allows sellers to contribute up to 6% of the sale price, while Conventional allows up to 3% (if putting less than 10% down).

How Down Payment Affects Your Rate

Your down payment doesn't just lower your loan amount; it lowers your risk profile. Lenders offer better interest rates to borrowers with more "skin in the game." This creates a double-saving effect:

- Direct Saving: You borrow less, so you pay interest on a smaller principal.

- Rate Saving: You get a lower rate, so you pay less interest on every remaining dollar.

Scenario: 740 Credit Score, $400k Home

*Rates are hypothetical examples for illustration. Actual adjustments (LLPAs) vary daily.

Buying an Investment Property?

Warning: The rules change completely if you won't live in the home. "Owner-occupied" loans (primary residence) get the cheap 3-5% down options. Investment properties (rentals) typically require 20-25% down to secure a conventional loan.

- Single Family Rental: Usually 15% minimum, but 20-25% gets a much better rate.

- 2-4 Unit Multi-Family (Living in one unit): This is the "House Hacking" loophole. You can use an FHA loan with 3.5% down to buy a 4-plex, live in one unit, and rent the other three.

- Vacation Home: Usually requires 10% down minimum.

3 Proven Strategies to Boost Your Down Payment

Gift Funds

Family members can gift you 100% of the down payment for practically any loan type. A simple "gift letter" is all lenders require. This is the #1 way first-time buyers bridge the gap.

401(k) Leverage

First-time buyers can withdraw up to $10,000 penalty-free from IRAs. Better yet, many can take a loan against their 401(k) for up to $50,000, paying the interest back to themselves.

HFA Programs

State Housing Finance Agencies (HFAs) offer grants and "silent second" mortgages to cover down payments. These often have 0% interest and no monthly payments until you sell.

Deep Dive: Down Payment Assistance (DPA) Programs

Did you know there are over 2,500 DPA programs across the US? Many are state-specific, but they generally fall into three buckets:

- 1Grants (Free Money)

Funds that never have to be repaid. These are rare and usually income-restricted, often reserved for buying in "revitalization areas" or for specific professions like teachers/police (Good Neighbor Next Door).

- 2Forgivable Loans (0% Interest)

A second mortgage with 0% interest that is forgiven over time (e.g., 20% per year for 5 years). If you stay in the home for the full term, you pay nothing. If you move early, you repay the pro-rated balance.

- 3Deferred Payment Loans

A second mortgage that covers your down payment. You make no monthly payments on it, but you must repay the full amount when you sell the home or refinance. This is great for cash flow but reduces your net proceeds at sale.