Mastering Quarterly Estimated Taxes in 2025

If you've recently made the leap to self-employment or started earning significant income from investments, welcome to the world of quarterly estimated taxes. Unlike traditional W-2 employment where taxes are silently withheld from every paycheck, you are now the CEO, CFO, and payroll department of your own financial life.

The IRS operates on a "pay-as-you-go" system, meaning they expect their share of your income as you earn it, not just once a year in April. Failing to keep up with these quarterly payments isn't just a hassle—it's expensive. The IRS charges underpayment penalties that can add up quickly, effectively acting as high-interest debt you didn't ask for.

Key Insight for 2025: With the standard deduction rising to $15,000 for singles and $30,000 for couples, precise calculation is more important than ever. Overpaying hurts your cash flow, while underpaying triggers penalties. Our calculator helps you find that perfect "Goldilocks" number.

Who Actually Needs to Pay Quarterly?

The general rule of thumb is simple but strict: if you expect to owe **$1,000 or more** in tax when you file your annual return, you likely need to make estimated payments. This $1,000 threshold applies after subtracting any withholding you might have from W-2 jobs or refundable credits.

However, there are nuances. If you are a high earner (AGI over $150k), the safe harbor rules tighten. If you are a farmer or fisherman, you have special, more lenient rules (only one payment due Jan 15th). And if you are a corporation, the threshold is even lower ($500). For most solopreneurs and freelancers, though, the $1,000 projected tax liability is the red line you shouldn't cross without paying quarterly.

The Self-Employed

Freelancers, contractors, and sole proprietors. You are responsible for both income tax and the self-employment tax.

Investors & Landlords

Anyone with significant income from dividends, capital gains, or rental profits that isn't subject to automatic withholding.

Gig Workers

Drivers, delivery couriers, and task-based workers. Even "side hustles" can trigger the requirement if your 1099 income is profitable enough.

Retirees

Those with pension or IRA distributions who haven't elected voluntary withholding can often be caught off guard.

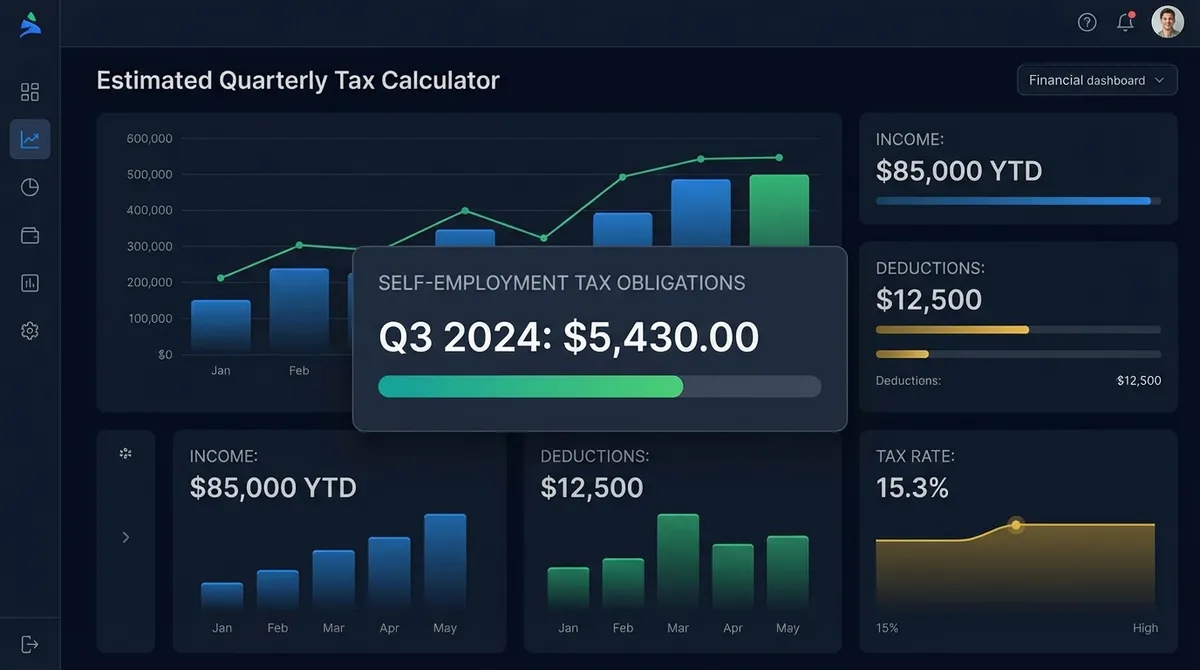

How the Calculation Works (The Math Behind the Tool)

Calculating your estimated payment involves peeling back several layers of tax liability. It's not just about your income tax bracket; it's about the full picture of what you owe the government.

1. Net Business Income

We start by taking your gross income and subtracting valid business expenses. This "net profit" is the number the IRS actually cares about.

2. Self-Employment Tax (The "Hidden" Tax)

This is often the shocker for new freelancers. You must pay 15.3% on 92.35% of your net earnings for Social Security and Medicare.

- • 12.4% for Social Security (capped at $176,100 for 2025)

- • 2.9% for Medicare (uncapped)

3. Income Tax

After calculating self-employment tax (and deducting half of it!), we apply your standard or itemized deduction to find your taxable income. Then, we run that number through the 2025 progressive tax brackets (10% to 37%).

The "Safe Harbor" Secret

Here is the most important thing to know: You don't have to be perfect. The IRS offers "Safe Harbor" rules. As long as you hit one of these targets, you are immune to underpayment penalties, even if you owe more money next April.

The 90% Rule

Pay at least 90% of the tax shown on your current year's return. This requires accurate forecasting.

The 100% Rule

Pay 100% of the tax shown on your prior year's return. If you made over $150k, this bumps to 110%.

*Most popular due to predictability.

2025 Quarterly Deadlines

Put these recurring dates in your calendar now. Missing them by even a day starts the penalty clock ticking.

| Quarter | Payment Period | Due Date |

|---|---|---|

| Q1 | Jan 1 – Mar 31 | April 15, 2025 |

| Q2 | Apr 1 – May 31 | June 16, 2025 |

| Q3 | Jun 1 – Aug 31 | Sept 15, 2025 |

| Q4 | Sep 1 – Dec 31 | Jan 15, 2026 |

*Note: June 15th falls on a Sunday in 2025, moving the deadline to Monday the 16th.

The Cost of Getting it Wrong: Underpayment Penalties

The IRS underpayment penalty is essentially an interest charge on the money you didn't pay on time. The rate changes quarterly based on the federal short-term rate plus 3 percentage points. In recent years, this has hovered around 7-8% annually.

It works like credit card interest—it accrues daily. If you miss the April 15th payment but catch up on June 15th, you owe two months of interest on that Q1 amount. This is why "doubling up" on a later payment doesn't fully erase the penalty for an earlier missed deadline, though it does stop the bleeding.

Form 2210: The Penalty Form

You'll calculate this penalty on Form 2210 when you file your annual return. However, the IRS can also calculate it for you and send a bill. Unless you qualify for a waiver (due to casualty, disaster, or recent retirement), it's best to avoid this form by hitting your Safe Harbor targets.

Logistics: How to Send Your Money to the IRS

Gone are the days of writing paper checks (though you still can with Form 1040-ES vouchers). The IRS strongly prefers digital payments, which are faster, more secure, and provide instant confirmation.

1. IRS Direct Pay (Best Choice)

Free, secure, and pulls directly from your bank account. No registration required.

- Instant verification

- Receipt for records

2. EFTPS (For Pros)

The "Electronic Federal Tax Payment System" requires enrollment but allows you to schedule payments up to 365 days in advance.

- Set it and forget it

- High limits

The State Tax Puzzle

While federal rules are universal, state rules vary wildly. Nine states have no income tax (Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, Wyoming). If you live elsewhere, you likely have a state estimated tax requirement too.

For example:

- California: Requires 30% in Q1, 40% in Q2, 0% in Q3, and 30% in Q4 (an odd 30-40-0-30 split).

- New York: Follows the federal quarterly schedule closely but has strict rules for high earners.

- New Jersey: Often requires estimated payments if you owe more than $400.

Pro Tip: Always make your state payments separately. Never bundle them with federal payments. Your state's Department of Revenue website will have a "Make a Payment" portal similar to IRS Direct Pay.

Record Keeping: Your Defense Against Audits

When you file your annual return next April, you must enter the exact dates and amounts of every estimated payment you made. If you guess, or if you lose the receipts, the IRS may claim you never paid.

Create a digital folder specifically for "2025 Tax Payments." Save every confirmation PDF. Ideally, track them in a spreadsheet with these columns:

| Quarter | Date Paid | Amount | Confirmation # | Method (Direct Pay/EFTPS) |

|---|---|---|---|---|

| Q1 | April 14, 2025 | $2,500 | 12345678 | Direct Pay |

| Q2 | June 13, 2025 | $2,500 | 87654321 | EFTPS |

Common Pitfalls to Avoid

The "Uneven Income" Trap

If you made $5,000 in Q1 and $50,000 in Q2, paying equal installments might not make sense. You can use the Annualized Income Installment Method (Form 2210) to pay based on actual earnings per quarter, but it requires meticulous record-keeping. Using an effective tax rate tool can help track your annual progress.

Ignoring State Taxes

Our calculator focuses on federal tax. Most states with income tax also require quarterly payments, usually on similar deadlines. Don't forget them!

Written by Jurica Šinko

Last updated: January 14, 2025