Why This Calculator Matters

Most investors underestimate the impact of fees. A 0.75% expense ratio might sound small, but on a $100,000 portfolio, it can cost you over $40,000 in lost returns over 25 years compared to a low-cost 0.05% ETF. Our calculator reveals these hidden costs instantly.

Understanding ETF Growth: More Than Just Stock Prices

Exchange-Traded Funds (ETFs) are powerful wealth-building tools because they combine the diversification of mutual funds with the trading flexibility of stocks. But calculating their true long-term growth requires looking at three distinct engines of return:

Price Appreciation

The increase in the share price of the underlying companies. For the S&P 500, this has historically averaged around 7-8% annually (inflation-adjusted).

Dividend Yield

Cash payouts from companies in the fund. Reinvesting these dividends (DRIP) is crucial—it can account for nearly 40% of your total long-term return.

Compound Interest

The "interest on interest" effect. As your portfolio grows, your returns generate their own returns, creating an exponential growth curve.

The Silent Wealth Killer: Expense Ratios

The Expense Ratio is the annual fee charged by the ETF provider to manage the fund. It is deducted automatically from the fund's assets, meaning you never see a bill—you just see lower returns.

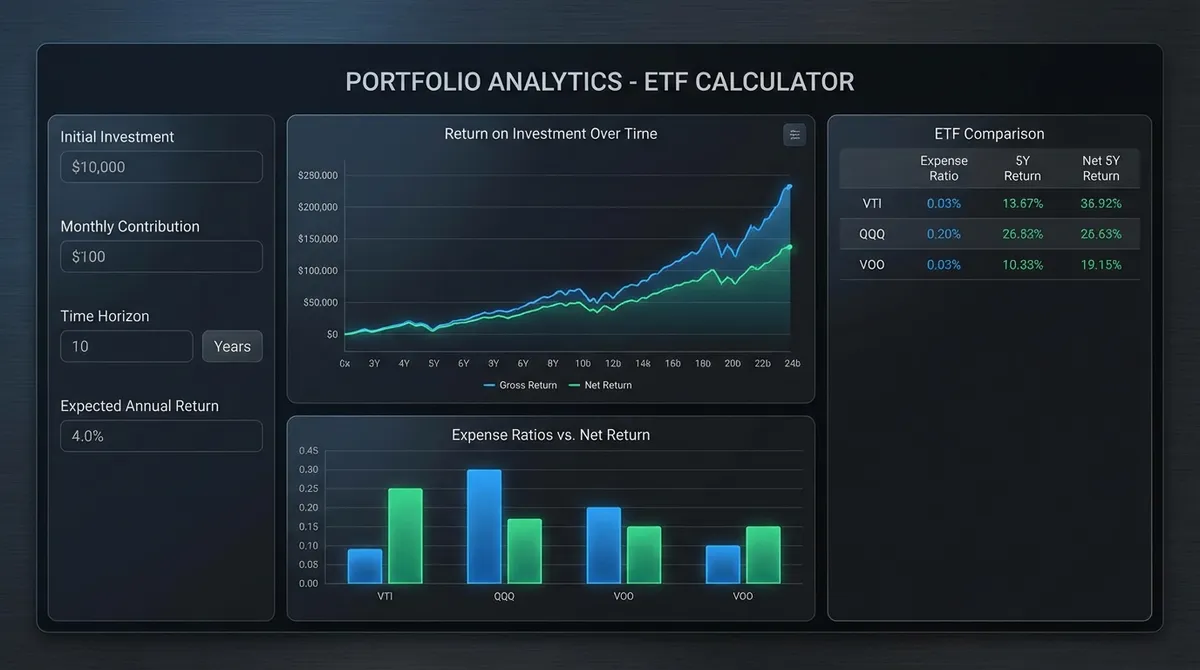

While 0.50% or 1.00% seems negligible, the compound effect is massive. Here's a comparison of a $10,000 investment over 30 years (assuming 8% annual growth):

| ETF Type | Expense Ratio | Final Value | Fees Lost |

|---|---|---|---|

| Low-Cost Index (e.g., VTI) | 0.03% | $100,300 | ~$300 |

| Average Active Fund | 0.75% | $81,600 | ~$19,000 |

| High-Fee Niche Fund | 1.50% | $65,300 | ~$35,300 |

How to Use This Calculator Effectively

- Set Realistic Expectations: The S&P 500 has historically returned about 10% annually before inflation. For conservative planning, use 7-8%.

- Check Your ETF's Yield: Look up the "SEC 30-Day Yield" for your specific ETF. Growth ETFs (like QQQ) often have low yields (0.5%), while Dividend ETFs (like SCHD) may yield 3-4%.

- Account for Taxes: If investing in a taxable brokerage account, remember that dividends are taxable each year, which can create a "tax drag" on your returns. In an IRA or 401(k), growth is tax-deferred.

Common Pitfall: Chasing Past Performance

Just because an ETF returned 30% last year doesn't mean it will do so again. In fact, top-performing sectors often revert to the mean. Stick to a diversified strategy rather than chasing the "hot" fund of the moment.

Types of ETFs: Which One Fits Your Goal?

Not all ETFs are created equal. In 2025, there are over 3,000 ETFs available in the US market alone. Understanding the different categories is the first step to building a resilient portfolio.

Equity (Stock) ETFs

The most common type. They track stock indices like the S&P 500 (large cap), Russell 2000 (small cap), or specific sectors like Technology or Healthcare. They offer high growth potential but come with higher volatility.

Bond (Fixed Income) ETFs

These hold government treasuries, corporate bonds, or municipal bonds. They pay regular interest (dividends) and are generally less volatile than stocks, acting as the "ballast" in a portfolio.

Commodity ETFs

Track the price of physical goods like Gold, Silver, Oil, or Corn. These are often used as a hedge against inflation or economic ambiguity, rather than for long-term compound growth.

Thematic & Crypto ETFs

Focus on niche trends like AI, Clean Energy, or Bitcoin. While they can offer massive short-term gains, they are speculative and carry significant risk of loss.

ETF vs. Mutual Funds: The Modern Showdown

For decades, Mutual Funds were the king of retirement accounts. But ETFs have rapidly taken over. Why? It comes down to flexibility, cost, and tax efficiency.

| Feature | ETF (Exchange-Traded Fund) | Mutual Fund |

|---|---|---|

| Trading | Trade instantly throughout the day (like a stock). | Trade only once a day (after market close). |

| Minimum Investment | Price of 1 share (or fractional shares). | Often $3,000+ initial minimum. |

| Tax Efficiency | High (Structure avoids capital gains triggers). | Lower (Manager sales trigger taxes for you). |

| Expense Ratios | Generally Lower (Passive). | Generally Higher (Active management costs). |

The Secret Weapon: Tax Efficiency

One of the biggest advantages of ETFs is how they handle taxes. In a traditional Mutual Fund, when other investors panic and sell, the fund manager might be forced to sell profitable stocks to raise cash to pay them out. This triggers Capital Gains Taxes that are passed on to YOU—even if you didn't sell a single share!

ETFs use a mechanism called "In-Kind Creation/Redemption" to avoid this. When selling happens, the ETF provider swaps shares of stock for shares of the ETF with a market maker, rather than selling for cash. This tax loophole (which is perfectly legal) means ETFs rarely distribute capital gains to shareholders.

Bottom Line: If you are investing in a taxable brokerage account (not a 401k or IRA), ETFs are almost always the superior choice for minimizing your tax bill.

Frequently Asked Questions

Does this calculator account for inflation?

This calculator shows nominal returns (before inflation). To see "real" purchasing power, subtract the expected inflation rate (typically 2-3%) from your "Expected Annual Return" input. For example, use 7% instead of 10%.

Should I reinvest dividends?

Absolutely. For long-term growth, reinvesting dividends is essential. If you take dividends as cash, you break the compound growth cycle. Most brokerages offer a free "DRIP" (Dividend Reinvestment Plan) setting to do this automatically.

What is a good expense ratio?

For broad market index funds (like S&P 500 or Total Stock Market), look for ratios under 0.10%. Many top funds charge as little as 0.03%. For specialized or international funds, 0.20% to 0.50% is common. Be very wary of anything above 0.75%.

What is ETF Liquidity and why does it matter?

Liquidity refers to how easily you can buy or sell shares without affecting the price. High liquidity (seen in popular ETFs like SPY or VOO) means tight bid-ask spreads and instant execution. Low liquidity in niche ETFs can lead to "slippage," where you pay slightly more to buy or receive slightly less when selling. Always check the average daily trading volume before investing heavily in a smaller fund.

Glossary of Key ETF Terms

- NAV (Net Asset Value)

- The actual value of an ETF's underlying assets per share. If an ETF trades at a price higher than its NAV, it's trading at a "premium." If lower, it's at a "discount."

- AUM (Assets Under Management)

- The total market value of assets held by the fund. Higher AUM usually means better liquidity (easier to buy/sell) and lower spreads.

- Expense Ratio

- An annual fee expressed as a percentage of your investment. A 0.50% ratio means you pay $50 per year for every $10,000 invested.

- Yield (SEC 30-Day Yield)

- A standard measure of the dividend and interest income earned by the fund over the last 30 days, annualized.

Deep Dive: Why ETFs Are Winning the Investment War

The shift from traditional mutual funds to ETFs is one of the biggest financial trends of the 21st century. Why? It's not just about lower fees—it's about control.

With a mutual fund, you only know the price you paid after the market closes. If the market crashes at 10 AM and you want to sell, you're stuck until 4 PM, potentially losing significantly more value. With an ETF, you can sell instantly at current market prices. This liquidity is invaluable during volatile market periods.

Furthermore, the transparency of ETFs is superior. Most ETFs publish their full holdings daily. Mutual funds typically only disclose their holdings quarterly. This means with a mutual fund, you might not even know what you own until months later.