Complete Guide: Understanding Your FHA Loan in 2025

The FHA loan remains one of the most powerful tools for first-time homebuyers in 2025, offering a path to ownership with as little as 3.5% down. However, the true cost of an FHA loan involves more than just the interest rate—you must carefully account for the Mortgage Insurance Premium (MIP).

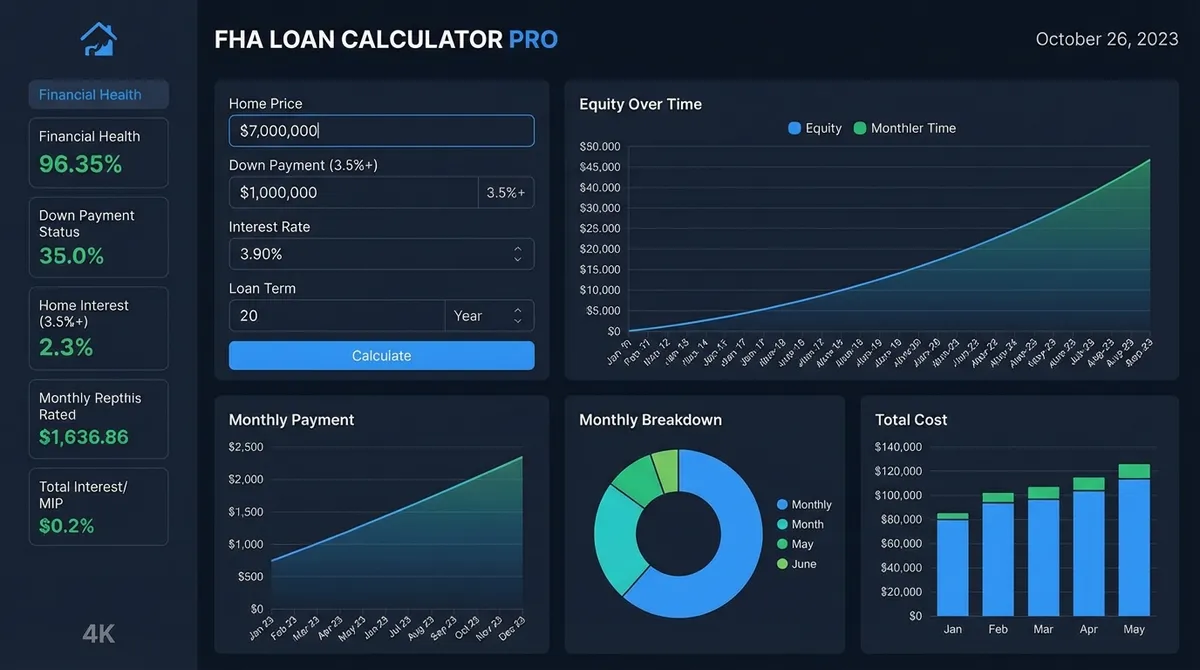

Our 2025 FHA Loan Calculator is designed to give you the complete picture. Unlike basic mortgage calculators, it automatically factors in the Upfront MIP (1.75%) and the recently reduced Annual MIP (0.55% for most borrowers).

1How FHA Mortgage Insurance Works (2025 Update)

FHA loans are insured by the Federal Housing Administration. This insurance protects the lender, not you, but you pay the premiums. In 2023, HUD significantly reduced annual MIP rates, making FHA loans much more affordable—a change that remains in effect for 2025.

The Two Types of FHA Insurance

- Upfront MIP (UFMIP): A one-time fee of 1.75% of your loan amount. Most buyers choose to roll this into their loan balance rather than paying it out of pocket at closing.

- Annual MIP: A monthly premium added to your mortgage payment. For most 30-year loans with less than 5% down, this is now 0.55% annually (down from 0.85% previously).

Current 2025 Annual MIP Rates

Your annual MIP rate depends on your loan term (15 or 30 years), your loan amount, and your Loan-to-Value (LTV) ratio. Here are the standard rates for 2025:

30-Year Fixed (Low Down Payment)

2How to Calculate Your Payment

Using the calculator above is simple, but understanding the inputs ensures accuracy:

- Home Price: Enter the purchase price. FHA loan limits vary by county (approx. $498k to $1.15m in 2025), so ensure the home is eligible.

- Credit Score Impact: Your credit score determines your minimum down payment.

- 580+ Score: Eligible for 3.5% down.

- 500-579 Score: Requires 10% down.

- Property Taxes & Insurance: Don't overlook these! They can add $300-$800 to your monthly payment depending on where you live.

3FHA vs. Conventional: Which is Better in 2025?

With the reduced MIP rates, FHA loans are now more competitive with Conventional loans (which require PMI if you put less than 20% down).

Choose FHA If...

- Your credit score is below 700.

- You have a higher Debt-to-Income (DTI) ratio (>43%).

- You are buying a multi-unit property (2-4 units) to live in.

Choose Conventional If...

- Your credit score is 740+.

- You can put 20% down to avoid insurance entirely.

- You want to avoid the 1.75% Upfront Mortgage Insurance fee.

Remember: For FHA loans with less than 10% down, MIP is for the life of the loan. It does not fall off automatically when you reach 20% equity like conventional PMI. The only way to remove it later is to refinance into a conventional loan once your credit improves and you have enough equity.

4Detailed FHA Loan Requirements for 2025

Beyond the down payment and MIP, there are other strict requirements you must meet to qualify for an FHA loan. These are "federal backstops" designed to ensure you can afford the home.

Borrower Requirements

- • Credit Score: Minimum 500 (with 10% down) or 580 (with 3.5% down).

- • Employment: 2-year solid work history (verified via W-2s).

- • DTI Ratio: Generally capped at 43%, though up to 57% is possible with strong compensating factors.

- • Occupancy: Must be your primary residence (no investment properties).

Property Requirements

- • Safety: Home must be safe, sound, and secure.

- • Appraisal: An FHA appraiser must inspect for specific defects (like peeling paint or safety hazards).

- • Type: Single-family, 2-4 unit multifamily, FHA-approved condos, or manufactured homes.

5The FHA Appraisal: Health & Safety Focus

One of the biggest misconceptions is that FHA appraisers are "picky." While they are stricter than conventional appraisers, they are primarily focused on safety, security, and soundness. They follow the HUD "3 S's" rule.

Common FHA Inspection Flags

- Peeling Paint: In homes built before 1978, this is a major red flag due to lead risks. It must be scraped and repainted.

- Handrails: Missing handrails on stairs (usually 3+ steps) must be installed.

- Roofs: Must have at least 2 years of remaining life.

- Utilities: Electric, water, and gas must be turned on and functional during inspection.

- Windows: Must open and close (fire escape).

- Crawl Spaces: Must have adequate access and ventilation.

*If these issues are found, the seller usually must fix them before closing. You cannot buy the house "as-is" with an FHA loan unless you use a 203(k) loan.

6Fixer-Uppers: The FHA 203(k) Loan

Found a home that needs work but has "good bones"? The FHA 203(k) loan allows you to wrap renovation costs into your primary mortgage.

Instead of taking out a high-interest personal loan for repairs later, you borrow based on the future value of the home after repairs.

Limited 203(k)

Best for cosmetic updates.

- Max $35,000 in repairs.

- New appliances, painting, flooring, minor remodeling.

- No structural changes allowed.

Standard 203(k)

Best for major rehabs.

- Minimum $5,000 in repairs (no max limit mostly).

- Structural repairs, room additions, landscaping.

- Requires a HUD consultant to oversee the project.

FHA Loan Limits 2025

You cannot borrow an unlimited amount. The FHA sets "floors" and "ceilings" based on the cost of living in your county.

- The Floor (Low-Cost Areas): $498,257

- The Ceiling (High-Cost Areas): $1,149,825

- Alaska, Hawaii, Guam, Virgin Islands: $1,724,725

If you need to borrow more than the limit in your county, you will need a Jumbo Loan, which typically requires a higher credit score and larger down payment.

Frequently Asked Questions (FAQ)

Can I remove FHA Mortgage Insurance (MIP)?

If you put down 10% or more, MIP falls off after 11 years. If you put down less than 10% (which most borrowers do), MIP is permanent for the life of the loan. See how this affects your total cost with our amortization calculator. The only way to remove it is to refinance into a Conventional loan once you have 20% equity.

Is it hard to pass an FHA inspection?

It is stricter than a standard inspection. The appraiser looks for "health and safety" issues. Common deal-breakers include peeling paint (lead risk in homes pre-1978), broken windows, lack of handrails, or major roof damage. However, sellers can often fix these issues to pass the inspection.

Can I use an FHA loan for an investment property?

Not for a pure investment property. You must live in the home as your primary residence for at least one year. However, you can buy a multi-unit property (duplex, triplex, or fourplex), live in one unit, and rent out the others. This is a popular strategy known as "house hacking."

What is the "flipper rule"?

FHA has a rule against buying a home that was sold less than 90 days ago. This is to prevent quick "flips" with shoddy work. If the seller has owned the home for less than 90 days, you cannot use an FHA loan to buy it.

Can I get an FHA loan after bankruptcy?

Yes, and sooner than with other loans. You generally need to wait 2 years after a Chapter 7 discharge (compared to 4 years for Conventional) or 1 year of on-time payments during a Chapter 13 repayment plan.