Complete Guide to Georgia Paycheck Calculations (2025)

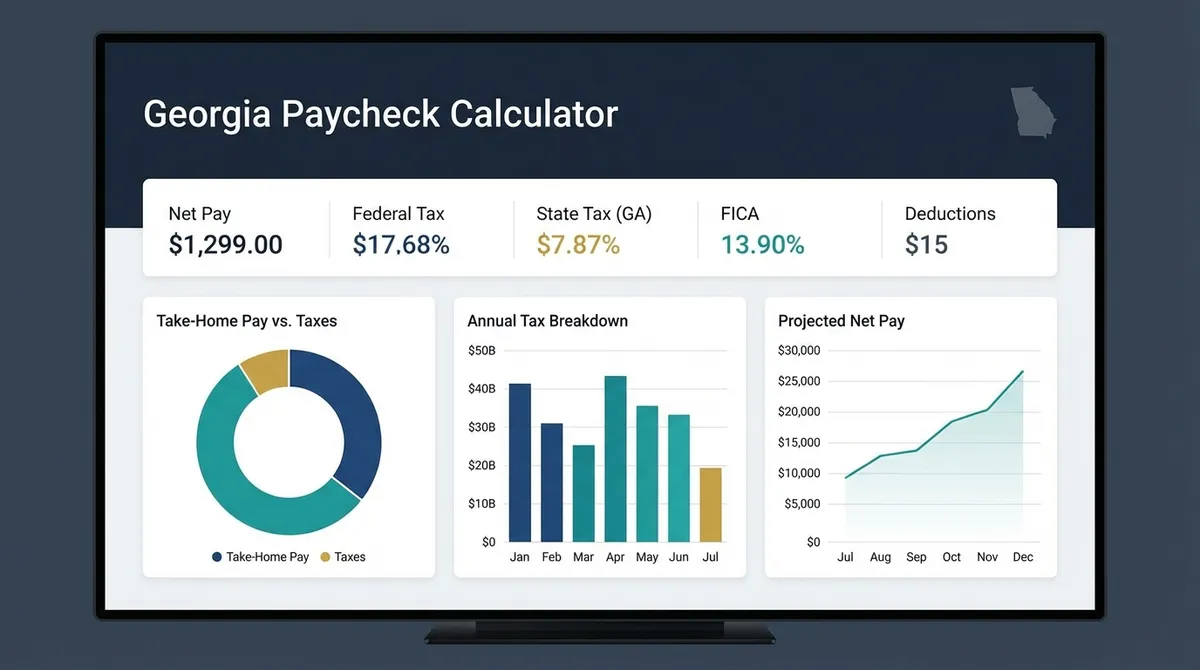

Navigating your finances in the Peach State requires a clear understanding of your take-home pay. Georgia's tax landscape has evolved significantly for the 2025 tax year, moving to a unified flat tax rate that simplifies calculations but changes how exemptions and deductions work. Whether you're planning a move to Atlanta, budgeting for a new home in Savannah, or just checking your latest pay stub, our Georgia Paycheck Calculator provides precise estimates based on the latest 2025 legislation.

How Georgia's 2025 Flat Tax Works

Starting in 2025, Georgia has transitioned to a flat income tax rate of 5.19% for all individual taxpayers. This replaces the previous graduated bracket system, meaning whether you earn $50,000 or $500,000, every taxable dollar is taxed at the same percentage.

However, "flat tax" doesn't mean you pay 5.19% on your entire income. The state provides generous standard deductions that shield a portion of your earnings from taxation entirely:

2025 Georgia Standard Deductions

- •Single / Head of Household: $12,000 tax-free

- •Married Filing Jointly: $24,000 tax-free

- •Married Filing Separately: $12,000 tax-free

- •Dependent Exemption: $4,000 per qualifying dependent

Step-by-Step: Understanding Your Paycheck

Your net pay is calculated by subtracting pre-tax deductions and taxes from your gross pay. Here is the exact order of operations used by payroll systems (and our calculator):

1. Gross Pay & Pre-Tax Deductions

Your calculation begins with your gross wages. Before taxes are touched, "pre-tax" contributions are subtracted. This includes 401(k) contributions and medical insurance premiums. These deductions lower your "taxable income" for both federal and state purposes, directly saving you money.

2. Federal Income Tax

The IRS uses a progressive tax system. For 2025, rates range from 10% to 37%. Our calculator uses the annualized percentage method (IRS Revenue Procedure 2024-40) to estimate withholding based on your filing status and Standard Deduction ($15,750 for singles, $31,500 for married couples). Note that "Allowances" are no longer used for federal withholding; the system focuses on your filing status and extra deductions.

3. Georgia State Income Tax

We calculate your Georgia taxable income by taking your Federal Adjusted Gross Income (AGI) and subtracting the Georgia Standard Deduction and Dependent Exemptions. The remaining amount is taxed at the flat 5.19% rate.

4. FICA Taxes

FICA consists of Social Security (6.2% on earnings up to $176,100) and Medicare (1.45% on all earnings). These are mandatory federal payroll taxes that fund retirement and healthcare systems.

Real-World Example (2025)

Let's look at a practical example. Sarah lives in Atlanta, files as Single, and earns $65,000 per year. She contributes 5% to her 401(k) and pays $150/month for health insurance. She has no dependents.

Sarah's Monthly Paycheck Breakdown

* Georgia Tax Calculation: ($4,995.84 Monthly Taxable - $1,000 Monthly Std Ded) * 5.19% = $207.38

Strategies to Maximize Your Paycheck

Boost Pre-Tax Deductions

Every dollar you put into a 401(k) or HSA avoids both Federal (up to 37%) and Georgia (5.19%) taxes. It is the most effective way to lower your tax bill immediately.

Check Your Withholding

If you consistently get large refunds, you are giving the government an interest-free loan. Use form G-4 to adjust your state withholding allowances to keep more money in each paycheck.

Dependent Exemptions

Don't forget to claim your dependents. Each qualifying child or relative reduces your Georgia taxable income by $4,000, saving you approximately $208 in state taxes per year per child.

Frequently Asked Questions

Is Georgia's tax rate really flat now?

Yes. As of January 1, 2024 (and continuing into 2025), Georgia replaced its graduated brackets with a flat rate. The rate for 2025 is scheduled to be 5.19%.

Does Georgia tax Social Security benefits?

Generally, no. Georgia is very retiree-friendly. It allows a retirement income exclusion of up to $65,000 for those aged 65 or older, which typically covers Social Security and other retirement income entirely.

Do I pay local income taxes in Georgia?

No. Georgia does not have city or county-level income taxes. You only pay federal and state income tax.

Bonus and Supplemental Wage Taxation in Georgia

One of the most confusing aspects of paychecks is how bonuses are handled. You might notice that a $1,000 bonus results in a much smaller deposit than a $1,000 regular salary payment. This is due to Supplemental Wage Withholding.

Federal: The IRS often mandates a flat 22% withholding rate on supplemental income (bonuses, commissions, severance). This is higher than the effective rate for most workers.

State: Georgia treats bonuses as ordinary income. However, employers often withhold state tax at the flat 5.19% rate immediately on the entire bonus amount, without applying the standard deduction pro-rated for that period.

Good News: If your employer over-withholds on your bonus (taking out 22% federal + 5.19% state), you aren't "losing" that money. You will get the excess back as a refund when you file your annual tax return.

Overtime Rules in Georgia

Georgia follows federal FLSA guidelines for overtime. This means:

- Threshold: Overtime is paid for any hours worked over 40 in a single workweek.

- Rate: The rate is 1.5x your regular hourly rate ("Time and a half").

- Taxes: Overtime pay is taxed as ordinary income. However, a large overtime check might push that specific pay period's annualized estimate into a higher phantom tax bracket for federal withholding math, causing a temporarily smaller paycheck percentage-wise. As with bonuses, this evens out at tax time.

Advanced FAQ: Troubleshooting Your Paycheck

Why is my net pay different than the calculator?▼

Small discrepancies are normal. Common reasons include:

1. Benefits: We might not know about a specific Life Insurance or LTD deduction you have.

2. Pay Frequency: Weekly vs Bi-weekly tax tables vary slightly in rounding.

3. W-4 Settings: If you requested "Extra Withholding" on your W-4 or G-4, your check will be smaller.

What is Form G-4?▼

Form G-4 is the Georgia equivalent of the Federal W-4. It tells your employer how to calculate your state tax withholding. Since Georgia moves to a flat tax with standard deductions, accurate completion of the G-4 is key to ensuring you don't owe money in April. You should update this form if you get married or have a child.

I moved to Georgia halfway through the year. How is my tax calculated?▼

You will file as a Part-Year Resident. You will only pay Georgia income tax on the income earned while living in Georgia or income sourced from Georgia (like rental income). When you file your return, you will prorate your standard deduction based on the percentage of the year you were a resident.

Are my 401(k) contributions taxed by Georgia?▼

No. Traditional 401(k) contributions are "pre-tax" for both Federal and Georgia purposes. This means if you earn $1,000 and put $100 in a 401(k), Georgia only taxes you on $900. Roth 401(k) contributions, however, are made with after-tax dollars and do not lower your current tax bill.

Minimum Wage in Georgia

The federal minimum wage is $7.25 per hour. Georgia state law technically has a minimum wage of $5.15, but because federal law supersedes state law for almost all employment, the effective minimum wage is $7.25. If you are a tipped employee, the direct cash wage must be at least $2.13, provided that tips bring your total hourly earnings up to the $7.25 minimum. For more official details, visit the Georgia Department of Revenue.