Complete Guide to Gross Rent Multiplier (GRM)

The Gross Rent Multiplier (GRM) is one of the fastest "back-of-the-napkin" calculations used by real estate investors to screen potential properties. While not as detailed as a full cash flow analysis, it provides an immediate snapshot of value relative to income. In this guide, we'll cover exactly how to calculate it, what a "good" GRM looks like in 2025, and the critical difference between GRM and Cap Rate.

What's Covered in This Guide

What is Gross Rent Multiplier?

The Gross Rent Multiplier (GRM) represents the number of years it would take for a property to pay for itself using gross rental income alone. It is a ratio of the property price to its annual rental income before any expenses.

Investors use GRM primarily as a screening tool. If you are looking at 50 potential properties, you can't run a full pro-forma analysis on all of them. GRM helps you quickly filter the list down to the most promising 3-5 candidates.

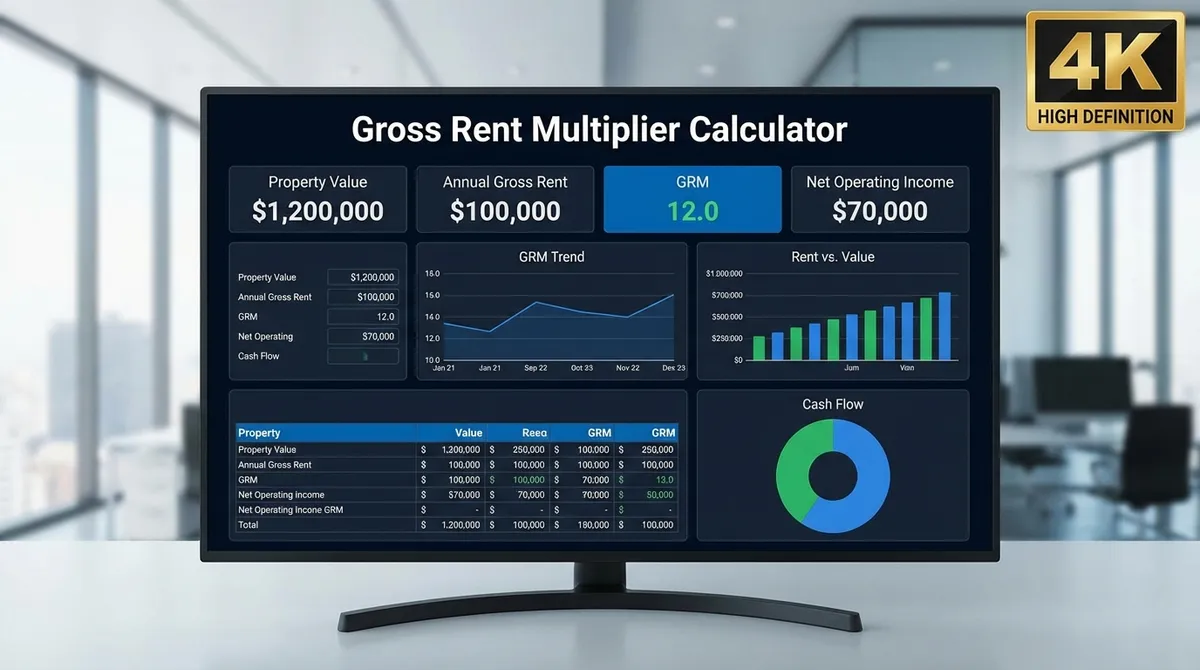

The GRM Formula

GRM = Property Price / Gross Annual Rent

Where Gross Annual Rent = Monthly Rent × 12

Calculation Example

Let's say you're looking at a duplex listed for $400,000. Each unit rents for $2,000 per month.

- Monthly Rent: $4,000 ($2,000 × 2)

- Annual Rent: $48,000 ($4,000 × 12)

- GRM: $400,000 / $48,000 = 8.33

This means the price is 8.33 times the gross annual income.

What is a Good GRM in 2025?

A "good" GRM is relative to the market. In general, the lower the GRM, the better, because it means you are paying less for every dollar of rental income.

Excellent (Below 6)

Rare in major cities. Usually indicates high cash flow potential or an undervalued asset. Common in Midwest or rural markets.

Average (6 - 10)

Typical for stable markets. A balance of reasonable cash flow and appreciation potential.

High (Above 10)

Common in high-appreciation coastal markets (e.g., California, NYC). Cash flow will likely be thin or negative.

Critical Multiplier: GRM vs. Cap Rate

This is where most beginners get confused. Both metrics measure value, but they use different income numbers.

| Feature | Gross Rent Multiplier (GRM) | Capitalization Rate (Cap Rate) |

|---|---|---|

| Formula | Price / Gross Income | Net Operating Income (NOI) / Price |

| Includes Expenses? | No | Yes |

| Includes Vacancy? | Usually No (Potential Income) | Yes |

| Best For | Initial Screening (Seconds) | Deep Analysis (Hours) |

Key Takeaway: Never buy a property based on GRM alone. A property might have a fantastic GRM of 5, but if the expenses are 80% of the rent (due to old age, high taxes, or utilities), it could still be a terrible investment.

GRM by Property Class

GRM expectations vary wildly depending on the "Class" of the property. Knowing these baselines helps you spot a good deal in any market segment.

Class A (Luxury/New)

Typical GRM: 12 - 15+

New construction in prime locations. Investors pay a premium (high GRM) for stability, quality tenants, and low maintenance. Cash flow is usually low.

Class B (Standard)

Typical GRM: 8 - 12

Older but well-maintained buildings in decent neighborhoods. The "sweet spot" for many investors seeking a balance of cash flow and appreciation.

Class C (Working Class)

Typical GRM: 6 - 8

Functional older properties in lower-income areas. High cash flow potential, but higher maintenance and tenant turnover risks.

Class D (Distressed)

Typical GRM: 4 - 6

Properties in blighted areas or needing major rehab. On paper, the numbers look amazing. In reality, non-paying tenants and massive repairs often kill the profit.

Case Study: The "Low GRM" Trap

The Setup

Investor Mark finds a property for $100,000 that generates $2,000/month in rent.

GRM = 4.16. This looks like a home run deal.

The Reality

Mark buys it. He soon realizes:

- The $2,000 rent includes all utilities (Owner pays $400/mo).

- The furnace is from 1985 and dies month 2 ($6,000 cost).

- Tenants stop paying and eviction takes 6 months ($0 income).

Because Mark only looked at the Gross Income (GRM) and not the Net Income (Cap Rate), he bought a money pit. Lesson: A suspiciously low GRM often hides high expenses or high risk.

Historical GRM Trends (2000 - 2025)

GRM is not static. It fluctuates with interest rates and market cycles.

- 2008-2012

Low GRMs (4-6): During the crash, prices plummeted while rents remained relatively stable. It was a golden era for cash flow investors.

- 2015-2020

Rising GRMs (8-12): As the economy recovered and interest rates stayed low, property prices rose faster than rents, compressing yields.

- 2021-2022

Peak GRMs (15-20+): The post-COVID boom saw prices skyrocket. Investors bought for appreciation, ignoring cash flow entirely.

- 2023-2025

Stabilizing GRMs (8-10): Higher interest rates forced prices to cool (or stagnate) while rents caught up, bringing GRMs back to more historical averages.

Beyond GRM: The Investment Metric Ecosystem

GRM is just the front door. Once a property passes the GRM test, you need to open the door and check the foundation with these advanced metrics:

Cash-on-Cash Return (CoC)

Formula: Annual Cash Flow / Total Cash Invested.

This measures the velocity of your money. If you invest $25k and get $2.5k back in year 1, that's a 10% CoC return. It is superior to GRM for financed properties because it accounts for debt service.

Internal Rate of Return (IRR)

Formula: Complex (Time Value of Money).

IRR looks at the total profit over the entire life of the investment, including monthly cash flow, tax benefits (depreciation), principal paydown, and the final sale profit.

Debt Service Coverage Ratio (DSCR)

Formula: Net Operating Income / Annual Debt Payments.

Lenders care about this most. A DSCR of 1.25 means the property produces 25% more income than the cost of the mortgage. If DSCR < 1.0, the property loses money every month.

Value-Add Strategy: Forcing the GRM Down

Smart investors don't just "find" good GRMs; they create them. This is called a "Value-Add" strategy. By renovating a property to increase rents, you effectively lower your purchase GRM.

Before Renovation

- Purchase Price: $500,000

- Current Rent: $4,000/mo ($48k/yr)

- GRM: 10.4 (Average)

After $50k Renovation

- Total Cost: $550,000

- New Rent: $6,000/mo ($72k/yr)

- Effective GRM: 7.6 (Excellent!)

When NOT to Use GRM

- •

Differences in Expense Ratios: If comparing a brand new building (low maintenance) to an old one (high maintenance), GRM is misleading because it ignores costs.

- •

Utility Structures: A property where tenants pay utilities is far more profitable than one where the landlord pays, but GRM treats them exactly the same.

- •

Vacancy Issues: If a property is 50% vacant, standard GRM based on "market rent" might look great, but the reality is much harsher.

How to Use the Calculator for Offers

You can work backwards from GRM to determine your offer price.

- Find the Market GRM: Ask a local broker or look at recent sales comparable to your subject property. Let's say similar 4-plexes sell at a GRM of 8.

- Calculate Subject Income: The property generates $60,000 in gross annual rent.

- Determine Value: $60,000 × 8 = $480,000.

If the list price is $550,000, you know instantly it's overpriced relative to the market GRM, and you have data to justify a lower offer.