The 2025 Guide to HELOC Payments & Strategy

In the high-interest environment of 2025, a Home Equity Line of Credit (HELOC) remains one of the most flexible tools for homeowners to tap into their equity. Whether you need funds for a major home renovation, debt consolidation, or emergency reserves, a HELOC offers a unique borrowing structure that differs significantly from a traditional home equity loan.

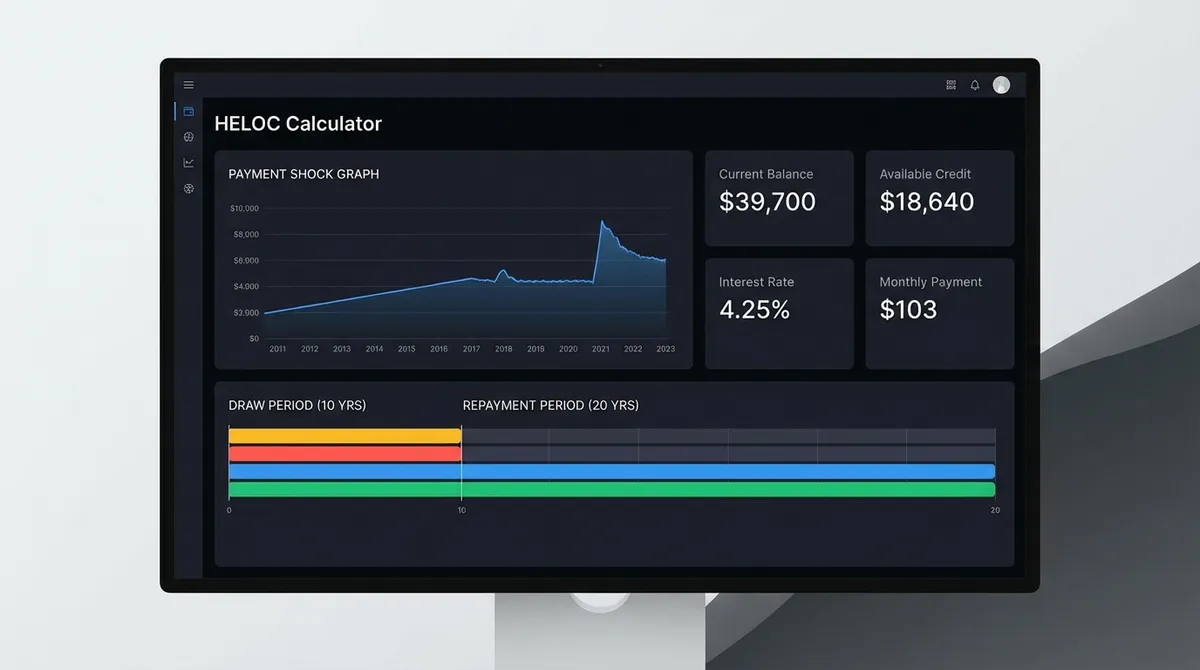

However, the flexibility of interest-only payments during the "draw period" often masks the reality of the "repayment period," where monthly costs can spike by 50% or more—a phenomenon known as payment shock. This calculator is designed to help you visualize that transition so you can borrow with confidence and avoid surprises down the road.

Quick Tip

Most HELOCs in 2025 carry variable interest rates tied to the Prime Rate. A 1% increase in rates on a $100,000 balance adds roughly $83 to your monthly interest-only payment.

How HELOC Repayment Works: The Two Phases

Unlike a standard mortgage with a fixed 30-year term, a HELOC is divided into two distinct phases. Understanding these phases is critical to managing your cash flow.

Phase 1: Draw Period

- Typically lasts 10 years.

- You can borrow, pay back, and re-borrow funds up to your limit.

- Minimum payments are usually interest-only.

Phase 2: Repayment Period

- Typically lasts 20 years.

- You can no longer borrow funds.

- Payments include principal AND interest, causing monthly costs to jump.

Real-World Scenario: The $50,000 Kitchen Remodel

Let's say you take out a HELOC to fund a kitchen remodel. You borrow $50,000 at an 8.5% interest rate. Here is what your payments would look like:

| Time Period | Monthly Payment | What You're Paying |

|---|---|---|

| Years 1-10 (Draw) | $354 | Interest Only (Debt stays at $50k) |

| Years 11-30 (Repayment) | $434 | Principal + Interest (Debt goes to $0) |

*Notice the $80/month increase? On larger loans, this gap widens significantly.

HELOC vs. Home Equity Loan: Detailed Comparison

Choosing between a HELOC and a Home Equity Loan depends entirely on your financial goals. While both use your home as collateral, their structures are fundamentally different. For a deeper dive into fixed payments, check our loan payoff calculator.

| Feature | HELOC | Home Equity Loan |

|---|---|---|

| Distribution | Revolving line of credit (draw as needed) | Lump sum upfront |

| Interest Rate | Variable (tied to Prime) | Fixed |

| Payments | Interest-only during draw period | Fixed principal + interest |

| Best For | Ongoing projects, emergency funds | Debt consolidation, single large purchase |

Pros and Cons of a HELOC

Pros

- • Only pay interest on what you use.

- • Flexibility to borrow and repay multiple times.

- • Lower initial payments during the draw period.

- • Potential tax benefits for home improvements.

Cons

- • Variable rates can increase payments unexpectedly.

- • Significant payment shock when repayment begins.

- • Risk of foreclosure if you default.

- • Some lenders charge inactivity fees.

Smart Strategies to Manage Your HELOC

1. Pay Principal During the Draw Period

Don't wait for year 11 to start paying down debt. Even adding $50 or $100 to your monthly payment during the draw period will directly reduce your principal, lowering your interest costs and softening the blow of the repayment period. This effectively turns your HELOC into a self-managed repayment plan.

2. Watch the Prime Rate

Since HELOC rates are variable, they move with the Fed. If rates are trending up, consider converting a portion of your HELOC balance to a fixed-rate loan option (if your lender offers it) to lock in stability. This "hybrid" option is becoming increasingly common.

3. Understand the "Call" Provision

While rare, some HELOC contracts allow the lender to "call" or demand full repayment of the loan if your credit score drops significantly or your home value plummets. Always maintain a healthy credit profile.

Closing Costs & Fees

HELOCs often have lower closing costs than home equity loans, but they aren't free. Here's what to expect:

- Appraisal Fee ($300-$500): To determine your home's current value.

- Application Fee ($0-$200): Charged to process your request.

- Annual Fee ($50-$100): A maintenance fee charged each year.

- Inactivity Fee: Some lenders charge this if you don't use the line of credit.

HELOC vs. Cash-Out Refinance: A Critical Comparison

Many homeowners debate between a HELOC and a full Cash-Out Refinance. The right choice depends on your existing mortgage rate. You can compare the math using our cash-out refinance calculator.

The "Golden Handcuffs" Rule

If you currently have a primary mortgage with a historic low rate (e.g., 3-4%), DO NOT do a cash-out refinance. You would be trading your entire low-rate loan for a new one at today's higher rates (6-7%+). A HELOC is far superior here because it sits on top of your first mortgage, leaving your low rate untouched.

However, if your current mortgage rate is already high, a cash-out refinance might make sense to consolidate everything into one fixed payment, avoiding the variable-rate risk of a HELOC.

HELOC for Home Improvements: 2025 ROI Guide

Since most HELOCs are used for home improvements, it is crucial to understand which projects offer the best Return on Investment (ROI). Not all renovations are created equal. According to the 2025 Cost vs. Value Report, exterior improvements often recoup more value than luxury interior upgrades.

| Project | Avg Cost | Resale Value | ROI |

|---|---|---|---|

| HVAC Conversion (Electrification) | $18,000 | $18,500 | 103% |

| Garage Door Replacement | $4,500 | $4,400 | 98% |

| Manufactured Stone Veneer | $11,000 | $10,500 | 95% |

| Minor Kitchen Remodel | $28,000 | $22,000 | 78% |

| Major Bathroom Addn (Upscale) | $100,000+ | $35,000 | 35% |

Data Sources: Aggregated from Zonda Media Cost vs. Value trends and NAR reports. *ROI varies significantly by local market conditions.

Frequently Asked Questions (FAQ)

Is HELOC interest tax-deductible in 2025?

It depends. Under current tax law (valid through 2025), you can typically deduct interest on a HELOC only if the funds are used to buy, build, or substantially improve your home. If you use the money for debt consolidation or a vacation, the interest is likely not deductible. Consult a tax professional for your specific situation.

Can I convert my HELOC to a fixed-rate loan?

Yes, many lenders offer a "fixed-rate partition" option. This allows you to take a chunk of your variable-rate balance and lock it in at a fixed rate for a specific term (e.g., 10 or 20 years). This is an excellent strategy to protect yourself if interest rates are rising.

What happens to my HELOC if I sell my home?

A HELOC is a lien on your property. When you sell your home, the HELOC must be paid off in full at closing, just like your primary mortgage. Any remaining equity proceeds will then be distributed to you.

Does a HELOC affect my credit score?

Yes. Applying for a HELOC triggers a hard inquiry, which may drop your score temporarily. Once open, it adds to your available credit, which can actually help your utilization ratio. However, racking up a high balance on it can hurt your score, similar to maxing out a credit card.

Can I rent out my home if I have a HELOC?

Most HELOC agreements require you to occupy the home as your primary residence. If you convert the property to a full-time rental, the lender may freeze your line of credit or require repayment. Always check your loan documents before changing your occupancy status.

How do I access my HELOC funds?

Accessing your funds is typically very easy. Most lenders provide a special debit card, checkbook, or online transfer capability linked directly to your HELOC account. This convenience is a double-edged sword; while it allows for quick access in emergencies, it also makes it tempting to spend on non-essentials. Discipline is key.

Can I refinance my HELOC later?

Yes, you can refinance a HELOC just like a primary mortgage. You might refinance it into a new HELOC with better terms, a fixed-rate home equity loan, or consolidate it into your primary mortgage via a cash-out refinance. Refinancing makes sense if you want to lock in a fixed rate or if your home's value has increased significantly, giving you access to more equity.

Is there a limit to how much I can borrow?

Yes. Lenders typically limit your total borrowing (primary mortgage + HELOC) to 80-85% of your home's appraised value. This is known as the Combined Loan-to-Value (CLTV) ratio. For example, if your home is worth $500,000, 80% is $400,000. If you owe $300,000 on your main mortgage, the maximum HELOC you could get is $100,000.