Complete Guide: Immediate Annuity Calculator

Key Takeaway:

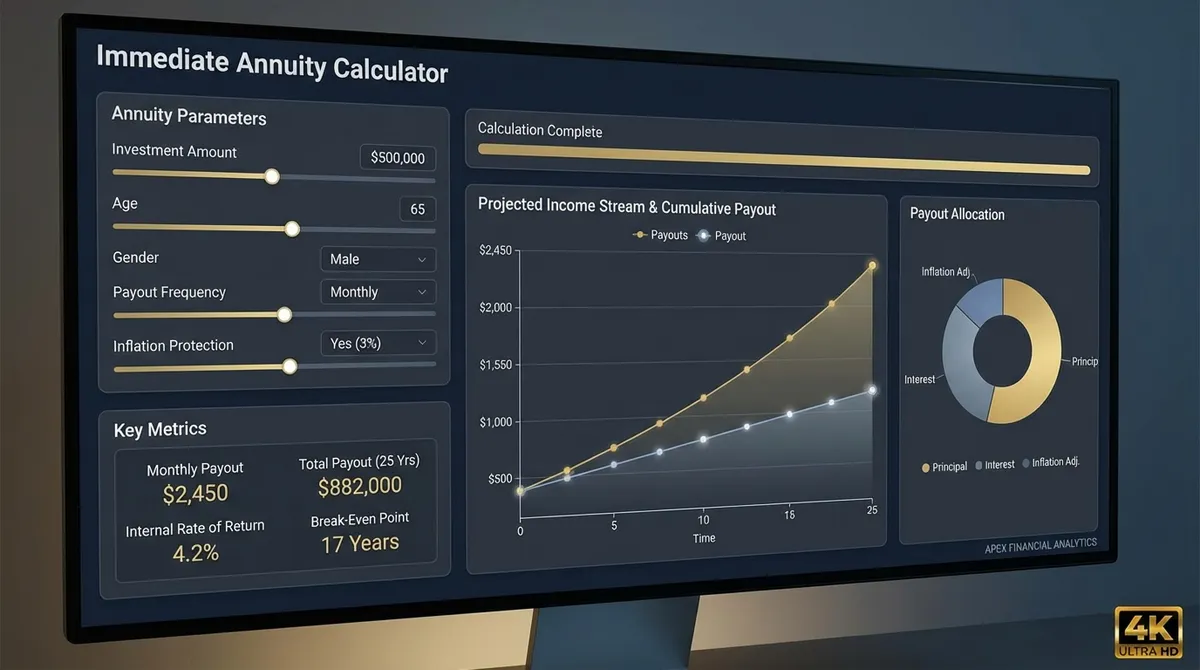

An immediate annuity calculator helps you estimate guaranteed lifetime income from a lump-sum investment. Based on a $100,000 premium at age 65 with a 5.25% assumed interest rate, our default scenario shows roughly $7,900 per year in guaranteed income—about $660 per month. The actual amount varies based on your age, gender, payout option, and prevailing interest rates, with older annuitants receiving higher payments due to shorter life expectancy and insurer-specific pricing.

What is an Immediate Annuity?

An immediate annuity—also called a Single Premium Immediate Annuity (SPIA)—is a contract between you and an insurance company where you make a one-time lump-sum payment (the premium) in exchange for guaranteed lifetime income payments that begin within one year and continue for a specified period, typically for the rest of your life. Unlike deferred annuities, immediate annuities skip the accumulation phase and convert your savings into predictable income right away. For more details on annuities, see Investor.gov.

Who Should Consider an Immediate Annuity?

Immediate annuities are ideal for retirees aged 60-80 who want to convert a portion of their retirement savings into guaranteed lifetime income they cannot outlive. They provide peace of mind by protecting against longevity risk—the risk of running out of money in retirement.

How Immediate Annuity Payments Are Calculated

The Basic Annuity Formula

The monthly payment from an immediate annuity is calculated using this formula (similar to our Present Value of Annuity logic):

Where:

- Lump Sum = Your initial premium amount

- Interest Rate = Annual rate of return (current SPIA rates are 5-6%)

- N = Expected number of payments based on life expectancy

Factors That Determine Your Payment Amount

📊 Interest Rates

When interest rates are higher, insurance companies can generate more income from your premium, resulting in higher annuity payments. A 1% increase in interest rates can increase your payment by 8-12%. Current SPIA rates range from 5.0% to 6.5% depending on the insurer and payout option.

🎂 Age and Life Expectancy

The older you are when you purchase an immediate annuity, the higher your monthly payments because the insurance company expects to make payments for a shorter period. A 75-year-old receives significantly more than a 65-year-old for the same premium.

⚥ Gender

Since women statistically live longer than men, insurance companies offer slightly lower monthly payments to women of the same age. The difference is typically 4-6% at age 65, decreasing with age as the life expectancy gap narrows.

👥 Payout Option

Single life annuities provide the highest payments since payments stop at death. Adding period certain or joint life provisions reduces payments by 5-20% but provides important protection for beneficiaries or spouses.

Payout Options: Making the Right Choice

1. Single Life Only (Highest Payments)

Provides the highest monthly income but payments stop when you die, regardless of how much principal remains. Best for maximizing personal income without concern for leaving money to heirs.

Trade-off: +15-20% higher payments, but no death benefit for beneficiaries.

2. Life with Period Certain (Balanced Protection)

Guarantees payments for your lifetime or a minimum period (e.g., 10-20 years), whichever is longer. If you die during the period certain, your beneficiaries continue receiving payments.

Trade-off: -5-10% lower payments, but provides legacy protection for beneficiaries during the guaranteed period.

3. Joint Life (Spousal Protection)

Payments continue as long as either you or your spouse is alive, ensuring income security for both partners. Payment amounts are based on both ages, with the younger spouse's age significantly impacting the payment.

Trade-off: -10-25% lower payments (depending on spouse age difference), but ensures income continues for both spouses' lifetimes.

Real-World Examples

Example 1: 65-Year-Old Male, $100,000 Premium

Based on 5.25% interest rate and standard mortality tables. Payments begin 30 days after purchase and continue for life.

Example 2: Changing Age and Interest Rate Impact

| Age | 4.5% Rate | 5.25% Rate | 6.0% Rate | Difference |

|---|---|---|---|---|

| 60 | $512/month | $548/month | $585/month | +$73 |

| 65 | $573/month | $613/month | $655/month | +$82 |

| 70 | $658/month | $704/month | $752/month | +$94 |

| 75 | $782/month | $837/month | $894/month | +$112 |

Shows monthly payments for $100,000 premium, single life male. Notice how both age and interest rates significantly impact payments.

Tax Treatment of Immediate Annuities

Non-Qualified Annuities (After-Tax Money)

If you purchase an immediate annuity with non-qualified funds (money you've already paid taxes on), each payment consists of two parts:

- Return of Principal: Not taxable (this portion represents your original investment being returned to you)

- Interest/Earnings: Taxable as ordinary income

The IRS uses the "exclusion ratio" to determine the taxable portion. For example, if 30% of each payment is considered earnings, only that 30% is taxable.

Qualified Annuities (Pre-Tax Money)

If you fund your immediate annuity with qualified funds from an IRA or 401(k), 100% of each payment is taxable as ordinary income since you haven't paid taxes on the money yet. This includes rollovers from traditional retirement accounts.

Tax Planning Tip

Consider a Roth IRA conversion before purchasing an annuity. While you'd pay taxes upfront on the conversion, all future annuity payments from the Roth would be completely tax-free, potentially saving thousands in taxes over your lifetime.

Consult a tax advisor for personalized advice, as individual situations vary significantly.

Pros and Cons of Immediate Annuities

✓Advantages

- →Guaranteed income for life you cannot outlive

- →No market risk—payments continue regardless of market conditions

- →Higher payouts than bonds or CDs for the same principal

- →Simple and transparent—no complex terms or hidden fees

- →Can create a "personal pension" to supplement Social Security

- →Various payout options to match your needs and legacy goals

✗Disadvantages

- →Irrevocable—you lose access to your principal forever

- →No inflation protection (unless you purchase a rider)

- →Payments may be lower than what you could earn in the market

- →Commission fees (1-3%) reduce your effective payout

- →Single life option leaves nothing for heirs

- →Insurance company credit risk (choose highly-rated insurers)

How to Shop for an Immediate Annuity

Step 1: Compare Quotes from Multiple Insurers

Use our calculator to estimate payments, but always get actual quotes from at least 3-5 highly-rated insurance companies. Payments can vary by 5-15% between insurers for the same premium. Work with an independent agent or use online comparison tools to shop the entire market, not just one company.

Step 2: Check Financial Strength Ratings

Only consider insurers with top-tier financial strength ratings:

- A.M. Best: A or A+ (Excellent)

- Standard & Poor's: AA- or higher

- Moody's: Aa3 or higher

- Fitch: AA- or higher

Step 3: Understand All Costs and Features

Immediate annuities are relatively straightforward, but understand: commission structure (usually 1-3%), surrender charges (not applicable once payments begin), any riders or optional features, and whether payments are fixed or have inflation adjustments. Ask about the "free look" period (typically 10-30 days) during which you can cancel without penalty.

Step 4: Consider Timing and Interest Rates

Since payments are locked in at purchase, timing matters. Consider laddering your annuity purchases—buying multiple smaller annuities over time rather than one large annuity. This strategy helps you benefit from potentially higher interest rates in the future and provides more flexibility for changing financial needs.

Alternatives to Immediate Annuities

Before committing to an immediate annuity, consider these alternatives that may better suit your needs:

Bond Ladder

Create a portfolio of bonds with staggered maturity dates to generate predictable income while preserving principal access. Provides more flexibility than annuities but carries interest rate and credit risk.

Dividend Stock Portfolio

Build a portfolio of high-quality dividend stocks that provide growing income over time and potential capital appreciation. Offers inflation protection but carries market risk and no guarantees.

Systematic Withdrawal Plan

Set up automatic withdrawals from a diversified investment portfolio. Provides flexibility and growth potential, but payments aren't guaranteed and you could run out of money.

CD Ladder + Social Security Bridge

Use laddered CDs for short-term income needs while delaying Social Security to maximize benefits. FDIC-insured safety with optimized Social Security timing.

Final Thoughts: Is an Immediate Annuity Right for You?

Immediate annuities serve a specific purpose: converting a lump sum into guaranteed lifetime income. They excel at providing peace of mind and protection against outliving your money, but they come at the cost of flexibility and potential upside.

✓ Consider an Immediate Annuity If:

- •You want guaranteed income you cannot outlive

- •You value security over maximum returns

- •You have sufficient liquid assets elsewhere

- •You want to simplify retirement income

- •You're age 60-80 with good health

✗ Consider Alternatives If:

- •You need access to your principal

- •You seek maximum growth potential

- •You have health concerns or shorter life expectancy

- •You want to leave a large inheritance

- •Inflation protection is a priority

Next Steps

- Use our calculator to estimate payments for your specific situation

- Get quotes from at least 3-5 top-rated insurance companies

- Compare immediate annuities to other retirement income strategies

- Consult with a fee-only financial advisor for personalized advice

- If purchasing, consider laddering annuities over time for flexibility

- Review your decision carefully during the free-look period