Complete Guide: Index Fund Investing Calculator

Index funds have revolutionized investing for millions of Americans, offering a simple, low-cost way to build wealth through broad market exposure. With over $7 trillion invested in index funds globally, these passive investment vehicles now account for more than 50% of all U.S. stock fund assets, fundamentally changing how individuals approach long-term financial planning.

Unlike actively managed mutual funds that attempt to beat the market through stock picking and market timing, index funds aim to match the performance of a specific market benchmark, such as the S&P 500 or Total Stock Market Index. This passive approach eliminates the need for expensive fund managers and research teams, resulting in dramatically lower costs for investors.

Index Funds vs. Mutual Funds: The Ultimate Smackdown

The debate is settled for most investors: active management rarely wins. Here is a direct comparison showing why index funds are the superior choice for long-term wealth building:

| Feature | Index Funds (Passive) | Mutual Funds (Active) |

|---|---|---|

| Goal | Match the market | Beat the market |

| Expense Ratio | 0.02% - 0.20% | 0.50% - 2.0% |

| Performance | Consistent average | 85% underperform |

| Tax Efficiency | High (Low turnover) | Low (High turnover) |

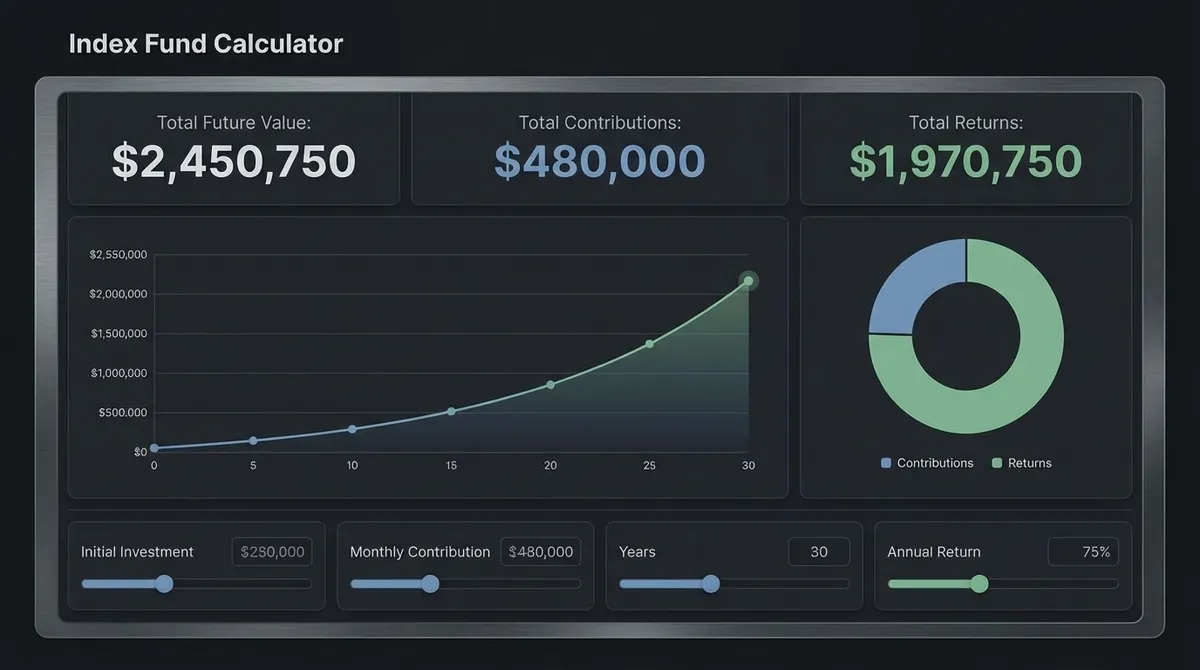

What Is an Index Fund Calculator and Why Does It Matter?

An index fund calculator is a sophisticated financial tool that projects your investment growth over time, accounting for regular contributions, expected returns, and most importantly, the impact of expense ratios on your long-term wealth. While many investors focus solely on potential returns, the compounding effect of fees can silently erode thousands of dollars from your portfolio over decades.

Consider this: A seemingly small difference of 0.50% in expense ratios doesn't sound significant, but over 30 years on a $10,000 initial investment with $500 monthly contributions, it translates to over $50,000 in lost returns. Our calculator reveals these hidden costs and helps you make informed decisions about which funds truly offer the best value.

💡 Key Insight

Warren Buffett, one of history's most successful investors, has repeatedly advocated for index fund investing. In his 2013 letter to Berkshire Hathaway shareholders, he revealed that his will instructs that the cash delivered to his family be invested 90% in a very low-cost S&P 500 index fund.

How Index Fund Returns Are Calculated

Understanding the mathematics behind index fund growth helps you set realistic expectations and make better investment decisions. The calculation combines several factors:

Index Fund Growth Formula

Where:

• r = Monthly return rate (annual return ÷ 12)

• t = Total months invested

• Contribution = Monthly investment amount

However, this calculation becomes more complex when factoring in expense ratios. The expense ratio acts as a silent drag on your returns, deducted daily from the fund's assets. Our calculator shows both scenarios: growth with the actual expense ratio deducted and theoretical growth without fees, revealing the true cost of fund management.

The Critical Impact of Expense Ratios

Expense ratios represent the percentage of fund assets used for administrative, management, advertising, and other operational expenses. While these fees seem minimal when expressed as a percentage, their compounding effect over time can be devastating to your wealth accumulation.

Average Index Fund

0.15%

Industry average

Low-Cost Leader

0.03%

Vanguard S&P 500

The difference between a 1.0% expense ratio and 0.03% might appear trivial—a mere 0.97% difference. However, over 30 years, this compounds dramatically. On a $500,000 portfolio, that small percentage difference costs you over $200,000 in lost returns, equivalent to more than four years of additional work and savings.

The Hidden Benefit: Tax Efficiency

Beyond low fees, index funds offer a massive advantage often overlooked by beginners: tax efficiency. Because index funds simply track a benchmark, they buy and sell stocks far less frequently than actively managed funds. This low "turnover" means fewer capital gains distributions, which translates to a lower tax bill for you each year.

💰 Tax Drag Explained

Active funds often generate taxable events even when you don't sell your shares, potentially reducing your after-tax returns by 1-2% annually. Index funds, by design, defer most taxes until you decide to sell, allowing your money to compound more effectively over decades.

Historical Performance and Realistic Expectations

Setting realistic return expectations is crucial for long-term financial planning. Historical data provides valuable guidance, though past performance never guarantees future results.

| Index | Period | Nominal Return | Inflation-Adjusted |

|---|---|---|---|

| S&P 500 | 1928-2024 | 10.2% annually | 7.0% annually |

| S&P 500 | 1980-2024 | 11.8% annually | 8.5% annually |

| Total Stock Market | 1970-2024 | 10.7% annually | 6.8% annually |

Most financial planners recommend using conservative estimates of 6-7% annual returns for long-term planning. This accounts for inflation and provides a buffer against market volatility and sequence-of-returns risk—the danger of experiencing poor returns early in retirement or during critical accumulation phases.

When Should You Use an Index Fund Calculator?

This calculator serves multiple purposes throughout your investing journey:

Retirement Planning

Determine if you're saving enough to reach your retirement goals. Test different contribution levels and time horizons to find your target savings rate.

Fund Comparison

Evaluate the long-term cost difference between high-fee and low-fee index funds. Quantify exactly how much that 0.50% difference costs over decades.

Goal Setting

Calculate the monthly contributions needed to reach specific financial goals, whether buying a house, funding education, or achieving financial independence.

Financial Independence

Determine your "FI number" and calculate how many years until you can retire based on your current savings rate and expected returns.

Common Index Fund Mistakes to Avoid

Chasing Past Performance

Many investors select index funds based on recent stellar performance, not understanding that mean reversion often follows exceptional years. The S&P 500's 26% gain in 2023 doesn't guarantee similar returns in 2024-2025.

Solution: Focus on low costs and broad diversification rather than recent performance. Stick to your long-term asset allocation regardless of short-term market movements.

Ignoring Expense Ratios

A 1% expense ratio might seem negligible compared to potential 10% returns, but over 30 years, it consumes nearly 25% of your potential wealth on a $500,000 portfolio.

Solution: Always prioritize funds with expense ratios below 0.20%, and ideally below 0.10%. The difference compounds exponentially over time.

Inconsistent Contributions

Market volatility causes emotional reactions. Many investors stop contributing during downturns, missing the opportunity to buy shares at discount prices—the exact opposite of sound investment strategy.

Solution: Automate your investments and maintain contributions during all market conditions. Dollar-cost averaging works best when consistently applied.

Overcomplicating with Too Many Funds

Some investors believe more funds equal better diversification, holding 10-15 different index funds. This creates unnecessary complexity, overlapping holdings, and higher total expense ratios.

Solution: A simple three-fund portfolio (Total Stock Market, International Stock Market, Total Bond Market) provides complete global diversification with minimal complexity.

How to Choose the Right Index Fund

With hundreds of index funds available, selection criteria matter enormously. Follow this systematic approach:

Index Fund Selection Checklist

- ✓Expense Ratio: Below 0.20% for broad market funds, below 0.10% for S&P 500 funds

- ✓Tracking Error: Minimal deviation from the index it follows

- ✓Fund Size: Larger funds ($1B+ assets) typically have better liquidity and lower costs

- ✓Index Replication: Full replication preferred over sampling for accuracy

- ✓Provider Reputation: Established companies (Vanguard, Fidelity, Schwab, iShares) with proven track records

The Bottom Line

Index fund investing remains one of the most powerful wealth-building strategies available to everyday investors. The combination of broad diversification, ultra-low costs, and tax efficiency creates a compelling case for making index funds the foundation of your investment portfolio.

This calculator empowers you to see beyond marketing messages and understand the true long-term impact of your investment choices. Use it regularly to track your progress, test different scenarios, and ensure your investment strategy aligns with your financial goals. Remember, successful investing isn't about finding the next hot stock—it's about consistently saving, minimizing costs, and letting compound interest work its magic over decades.

📊 Action Steps

- Use this calculator to project your current savings trajectory

- Compare your current fund's expense ratio to low-cost alternatives

- Increase your savings rate by 1-2% if you're behind on retirement goals

- Automate your investments to maintain consistency

- Review and rebalance your portfolio annually