What Are Inherited IRA RMDs and Why They Matter in 2025?

Inherited IRA Required Minimum Distributions (RMDs) are mandatory annual withdrawals that beneficiaries must take from inherited retirement accounts. Unlike regular IRAs where the original owner takes RMDs starting at age 73 (calculated via standard RMD calculator), inherited IRAs follow complex IRS rules that depend on your relationship to the deceased, their age at death, and when they passed away.

In 2025, with the SECURE Act 2.0 changes fully implemented, understanding these rules is critical. A single missed RMD can trigger a 25% excise tax on the amount you should have withdrawn—a penalty that can cost thousands of dollars. Whether you inherited from a parent, spouse, or non-family member, knowing your specific distribution timeline can save you from IRS penalties and help you maximize tax-deferred growth.

Key Statistic: The IRS collected over $1.2 billion in RMD penalties in 2023 alone. With the new 10-year rule affecting most non-spouse beneficiaries, understanding your obligations has never been more important.

- Original Owner's Death: If the owner died after their Required Beginning Date (RBD), you generally must continue their RMD schedule or take more. If they died before, the 10-Year Rule starts immediately.

- Beneficiary Type: Spouses, minor children, disabled individuals, and those less than 10 years younger than the decedent have different flexible options (Eligible Designated Beneficiaries).

- Account Type: Roth IRAs (inherited) have the 10-Year Rule but no annual RMDs, making them powerful for passing wealth. See Roth IRA Calculator.

The "10-Year Rule" Explained

For most non-spouse beneficiaries inheriting an IRA after 2019 (SECURE Act), the "Stretch IRA" is dead. You must deplete the entire account balance by the end of the 10th year following the year of death.

Does this mean annual withdrawals?

- Yes: If the original owner had already started RMDs.

- No: If the original owner had NOT started RMDs (you can wait until year 10 to take it all, though that might cause a huge tax bomb).

Eligible Designated Beneficiaries (The Exceptions)

Certain groups can still "stretch" distributions over their own life expectancy, reducing the annual tax hit:

- Surviving Spouses: Can treat the IRA as their own.

- Minor Children: Can stretch until they reach age 21 (then the 10-Year Rule kicks in).

- Disabled or Chronically Ill: Can stretch over their lifetime.

- Beneficiaries <10 Years Younger: E.g., a sibling close in age. Can stretch over their lifetime.

Tax Implications of Inherited IRAs

Distributions from a Traditional Inherited IRA are taxed as ordinary income.

Warning: Taking a large lump sum can push you into a higher tax bracket. It's often smarter to spread withdrawals evenly over the 10 years to manage your Effective Tax Rate.

Inherited Roth IRA distributions are generally tax-free, provided the account was open for at least 5 years.

Estate Tax vs. Income Tax

Don't confuse RMDs with estate taxes. Estate taxes are paid on the total value of the decedent's assets if they exceed the federal exemption (approx. $13.6M in 2024). Income tax is paid by YOU, the beneficiary, when you withdraw money. Estate Tax Calculator.

Strategic Advice

- Don't Forget the RMD: The penalty for missing an RMD is up to 25% of the amount not withdrawn. Use our Standard RMD Calculator for your own accounts.

- Consider Your Own Retirement: If you are still working, adding inherited IRA income might complicate your tax situation. Consult a professional. check your progress with our Retirement Calculator.

- Roth Conversions? You generally cannot convert an inherited Traditional IRA to a Roth IRA. You're stuck with the tax status you inherited (unless you're a spouse).

Non-Eligible Beneficiaries

- •Adult children

- •Siblings

- •Other relatives

- •Most common category

How RMD Calculations Work: The IRS Life Expectancy Method

The IRS uses a standardized method called the Life Expectancy Method for calculating most inherited IRA RMDs. This approach ensures beneficiaries cannot indefinitely defer taxes on inherited retirement funds while providing a systematic way to spread distributions over time.

The life expectancy factor comes from the IRS Single Life Expectancy Table (Table I in Publication 590-B). Each year, you reduce the factor by 1.0, creating a declining balance approach that eventually distributes the entire account.

Example Calculation:

Scenario: Sarah, age 45, inherits a $500,000 IRA from her father who died at age 75 in 2024. It's now 2025, and Sarah needs to calculate her first RMD.

• Account Balance: $500,000

• Sarah's Age: 45

• Life Expectancy Factor: 37.9 years

• RMD = $500,000 ÷ 37.9 ≈ $13,193

• New Factor: 36.9 (37.9 - 1)

• Account Balance: ~$510,000

• RMD = $510,000 ÷ 36.9 ≈ $13,821

The 10-Year Rule: What Most Beneficiaries Need to Know

The SECURE Act of 2019 fundamentally changed inherited IRA rules for most non-spouse beneficiaries. The 10-year rule now applies to most inherited IRAs, creating a critical deadline that beneficiaries must understand.

The 10-Year Rule Basics

If you're a non-eligible designated beneficiary (most adult children, siblings, friends), you must withdraw the entire inherited IRA balance by the end of the 10th year after the owner's death. No annual RMDs are required, but procrastination can create massive tax bills.

Critical Tax Planning Opportunity

While no annual RMDs are required, strategic planning is essential. Taking equal distributions over 10 years often minimizes taxes compared to waiting until year 10 and withdrawing everything at once. Consider your current tax bracket, expected future income, and overall financial goals.

Year 10 Deadline

In year 10, you must withdraw 100% of the remaining balance. Missing this deadline results in a 25% penalty on the undistributed amount. Mark your calendar and plan ahead to avoid this costly mistake.

Real-World Scenarios: Common Inherited IRA Situations

Scenario 1: Spouse Inherits IRA

Background: John, age 60, inherits a $300,000 IRA from his wife Mary who died at age 58 in 2024. Mary died before her required beginning date.

• Treat as his own IRA

• Roll into his existing IRA

• Continue as beneficiary

• Life expectancy method

John should treat the IRA as his own and roll it into his existing IRA. This gives him the most flexibility and allows him to delay RMDs until he reaches age 73.

Scenario 2: Adult Child Inherits IRA (10-Year Rule)

Background: Lisa, age 50, inherits a $400,000 IRA from her father who died in 2024 at age 80. This is a classic 10-year rule situation.

• Years 1-9: No RMDs required

• Year 10: Withdraw full balance

• Strategic planning essential

• Tax bracket management critical

Consider taking ~$40,000/year for 10 years to spread the tax burden. This avoids a massive $400,000 tax bill in year 10.

Scenario 3: Minor Child Inherits IRA

Background: Emma, age 15, inherits a $200,000 IRA from her grandfather. As a minor child, she qualifies as an eligible designated beneficiary.

• Use life expectancy until age 21

• Then switch to 10-year rule

• Must withdraw full balance by age 31

• Different calculation for minors

Emma has significant flexibility until age 21. Parents should consider using distributions for education expenses or other needs before the 10-year rule kicks in.

Expert Tips from Jurica Šinko

1. Understand Your Beneficiary Category First

Before calculating anything, determine which beneficiary category you fall into. This single factor determines your entire distribution strategy and timeline.

2. Document Everything

Keep detailed records of the original owner's age at death, date of death, and account balances. You'll need these for accurate calculations every year. This is also crucial for any estate tax considerations.

3. Consider Roth Conversions

If you expect higher tax rates in future years, consider converting portions to Roth IRAs during low-income years, especially under the 10-year rule.

4. Plan for Year 10

Under the 10-year rule, don't wait until year 10 to withdraw everything. Plan distributions strategically to minimize your lifetime tax burden.

5. Coordinate with Other Income

Time your distributions to coincide with lower-income years. This is especially important for large inherited IRAs that could push you into higher tax brackets. Check your bracket with a tax bracket calculator.

Common RMD Mistakes to Avoid

1. Missing the Deadline

The 25% penalty on missed RMDs is one of the harshest IRS penalties. Set calendar reminders and work with your custodian to automate distributions when possible.

2. Using Wrong Life Expectancy Table

Many beneficiaries mistakenly use the Uniform Lifetime Table instead of the Single Life Expectancy Table. Always use Table I for inherited IRAs.

3. Not Aggregating Multiple IRAs

If you inherit multiple IRAs from the same person, you must calculate RMDs separately but can aggregate distributions from traditional IRAs.

4. Forgetting Year 10 Under 10-Year Rule

Many beneficiaries forget that year 10 requires withdrawing 100% of the balance. This oversight creates massive tax bills and penalties.

5. Not Updating Beneficiaries

After inheriting an IRA, review and update your own beneficiary designations to ensure smooth succession planning for your heirs.

IRS Penalties: Understanding the 25% Excise Tax

The IRS imposes severe penalties for RMD failures. Understanding these penalties and the correction procedures can save you thousands of dollars and prevent IRS scrutiny.

25% Excise Tax on Missed RMDs

If you fail to take your full RMD by December 31, the IRS imposes a 25% excise tax on the amount you should have withdrawn but didn't. Starting in 2023, this penalty was reduced from 50% to 25%, and can be further reduced to 10% if corrected promptly.

Example: If your RMD was $10,000 but you only withdrew $6,000:

- • Shortfall: $4,000

- • Penalty: $4,000 × 25% = $1,000

- • If corrected within 2 years: $4,000 × 10% = $400

Self-Correction Procedures

The IRS allows self-correction of missed RMDs if you act promptly. File Form 5329 with your tax return and include a reasonable cause explanation. Common acceptable reasons include serious illness, erroneous advice from custodian, or natural disasters.

Action Steps: Withdraw the missed RMD amount immediately, file Form 5329, pay the reduced 10% penalty if applicable, and maintain documentation of the correction.

Understanding Your RMD Results: What the Numbers Mean

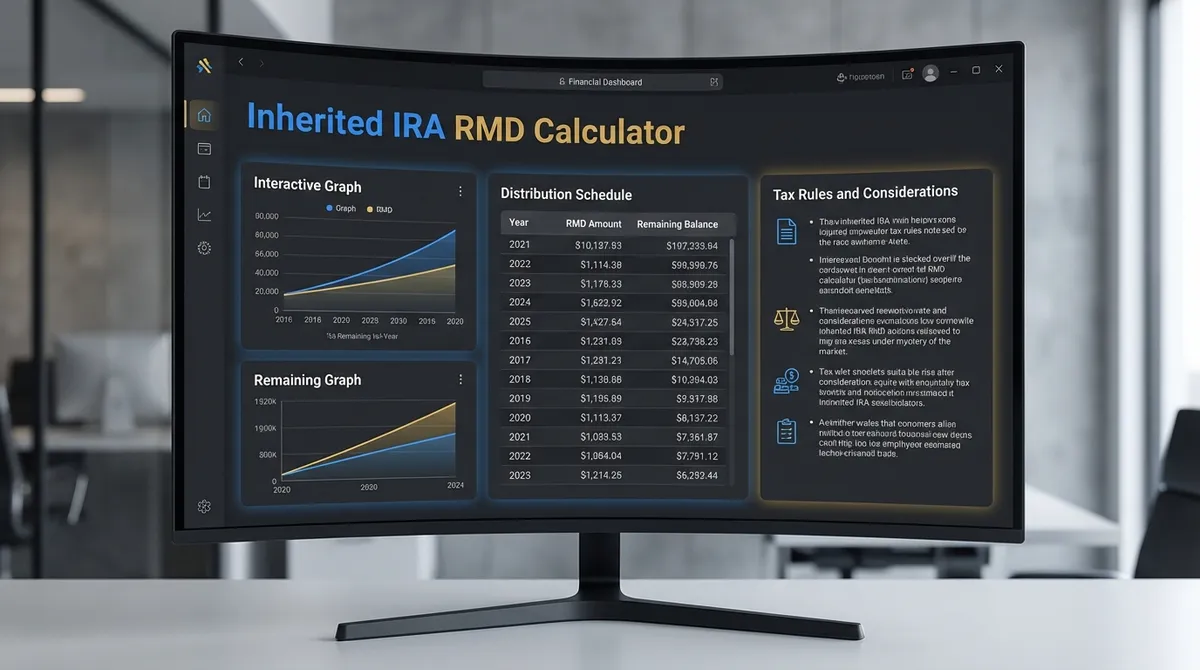

When you use our Inherited IRA RMD calculator, you receive specific numbers and recommendations. Here's how to interpret your results and what actions to take next.

Interpreting Your RMD Amount

The calculator provides your exact RMD amount based on IRS rules. This is the minimum you must withdraw by December 31 of the current year. You can always withdraw more, but never less without triggering penalties.

Understanding Your Distribution Period

The life expectancy factor determines your distribution period. This number decreases by 1.0 each year, meaning your RMDs will generally increase as the account balance is spread over fewer remaining years.

Rule Applied Explanation

The calculator identifies which IRS rule applies to your situation (spouse, eligible designated beneficiary, or 10-year rule). This determines your entire distribution strategy and timeline.

Next Steps: Creating Your Distribution Strategy

Step 1: Verify Your Beneficiary Status

Confirm your beneficiary category and gather documentation including the death certificate and account statements.

Step 2: Calculate Annual RMDs

Use our calculator each year to determine your exact RMD amount based on current account balances and updated life expectancy factors.

Step 3: Set Up Automated Distributions

Work with your IRA custodian to establish automatic RMD distributions before December 31 each year to avoid penalties.

Step 4: Review Tax Implications

Consult with a tax advisor to understand how RMDs affect your overall tax situation and explore strategies for tax-efficient distributions.

Step 5: Plan for Future Years

Develop a long-term distribution strategy that considers your retirement goals, other income sources, and tax bracket management.

Final Thought: Inherited IRA RMD rules are complex, but understanding your obligations is essential for avoiding costly penalties and maximizing the value of your inheritance. Our calculator provides the precise calculations you need, but always consult with qualified tax and financial advisors for personalized guidance tailored to your specific situation.