Understanding IRA Withdrawal Rules and Tax Implications in 2025

Individual Retirement Accounts (IRAs) are powerful tools for building long-term wealth, but understanding the withdrawal rules is crucial to avoid costly penalties and unexpected tax bills. In 2025, IRA withdrawal rules continue to evolve with changing legislation, making it more important than ever to plan your distributions strategically. Whether you're approaching retirement, facing a financial emergency, or planning your legacy, knowing when and how you can access your IRA funds can save you thousands of dollars in taxes and penalties.

This comprehensive guide explores the complex landscape of IRA withdrawals, including traditional vs. Roth IRA rules, early withdrawal penalties and exceptions, Required Minimum Distributions (RMDs), and strategies to minimize your tax burden. With the SECURE Act 2.0 bringing significant changes to retirement account rules in recent years, staying informed about the latest regulations ensures you can make confident, compliant decisions about your retirement savings.

Key Statistic: Americans hold over $13.9 trillion in IRAs as of 2024, yet a 2023 survey found that 62% of IRA owners don't fully understand withdrawal rules and penalties. This knowledge gap results in millions of dollars paid unnecessarily in early withdrawal penalties each year. Our calculator helps you navigate these complex rules and make informed decisions about your retirement funds.

IRA Withdrawal Fundamentals: The Critical Difference Between Traditional and Roth

The fundamental difference between Traditional and Roth IRAs lies in their tax treatment, which directly impacts how withdrawals are taxed. Traditional IRAs offer tax-deductible contributions but require you to pay ordinary income tax on all withdrawals. Roth IRAs, conversely, are funded with after-tax dollars, allowing for tax-free qualified withdrawals in retirement. This distinction creates vastly different withdrawal strategies and tax implications that every IRA owner must understand.

Traditional IRA Withdrawals

- Fully Taxable: Every dollar withdrawn is taxed as ordinary income

- Early Withdrawal Penalty: 10% penalty on withdrawals before age 59½

- RMD Requirements: Must begin at age 73 (SECURE Act 2.0)

- Exceptions Available: Several penalty exceptions for early withdrawals

Roth IRA Withdrawals

- Tax-Free Qualifying Withdrawals: Contributions and earnings after age 59½ + 5-year rule - see Roth IRA calculator

- Contribution Withdrawals: Always tax-free and penalty-free (return of principal)

- No RMDs: Original owners have no Required Minimum Distributions

- Non-Qualified Earnings: Taxed as income plus 10% penalty if withdrawn early

Critical 5-Year Rule for Roth IRAs

Even if you're over 59½, your Roth IRA earnings withdrawals are only tax-free if you've held the account for at least 5 years. This 5-year clock starts on January 1st of the year you made your first Roth IRA contribution (or converted). For example, if your first Roth contribution was December 2020, your 5-year period began January 1, 2020, and ended December 31, 2024. Understanding this rule is crucial—many Roth IRA owners mistakenly think age alone qualifies them for tax-free withdrawals.

The ordering rules for Roth IRA withdrawals are also important: contributions come out first (always tax-free), then conversions (potentially subject to 5-year rule), and finally earnings (subject to both age 59½ and 5-year rules). This ordering works in your favor, as you can often access significant funds from a Roth IRA before triggering taxes or penalties.

Avoiding the 10% Early Withdrawal Penalty: Understanding IRS Exceptions

The IRS imposes a 10% early withdrawal penalty on most IRA distributions taken before age 59½, but recognizing that life circumstances sometimes require access to retirement funds, they've created several important exceptions. Understanding these exceptions can save you thousands of dollars and provide crucial financial flexibility when you need it most. It's important to note that while these exceptions waive the 10% penalty, they don't eliminate the ordinary income tax owed on traditional IRA withdrawals.

Medical Expenses

Unreimbursed medical expenses exceeding 7.5% of your adjusted gross income are penalty-free.

Total Disability

Complete waiver for individuals with total and permanent disability.

Higher Education

Qualified education expenses for you, spouse, or dependents.

First-Time Homebuyer

Up to $10,000 for first-time home purchase (includes building or rebuilding). Use our mortgage calculator to plan.

Birth or Adoption

Up to $5,000 for qualified birth or adoption expenses.

Health Insurance

Premiums during unemployment (must receive unemployment compensation for 12+ weeks).

Substantially Equal Periodic Payments (SEPP) - The 72(t) Exception

One of the most powerful early withdrawal strategies is the 72(t) exception, which allows you to take substantially equal periodic payments (SEPP) from your IRA penalty-free before age 59½. This strategy requires committing to a payment schedule for at least 5 years or until you reach age 59½, whichever is longer. The IRS provides three calculation methods (Required Minimum Distribution, Fixed Amortization, and Fixed Annuitization) with varying flexibility levels.

While SEPP provides penalty-free access, it comes with significant risks. Modifying or stopping payments before the required period ends triggers retroactive penalties plus interest on all previous distributions. Additionally, market volatility can deplete your account faster than expected if you're taking fixed payments from a declining balance. This strategy is best suited for individuals with substantial IRA balances and a clear long-term financial plan.

Essential Caution: Consult with a qualified financial advisor and tax professional before implementing a 72(t) SEPP strategy. The IRS strictly enforces these rules, and mistakes can be extremely costly.

Required Minimum Distributions: The IRS Deadline You Can't Afford to Miss

The IRS requires Traditional IRA owners to begin taking Required Minimum Distributions (RMDs) at age 73 (increased from 72 by the SECURE Act 2.0). This requirement ensures that tax-deferred retirement savings eventually get taxed. Missing an RMD results in one of the steepest penalties in the tax code—up to 50% of the amount you should have withdrawn. Understanding RMD rules, calculation methods, and planning strategies is essential for avoiding costly mistakes and optimizing your retirement tax strategy.

RMD Penalty Enforcement

- • 50% Penalty: The steepest penalty for missed RMDs

- • Retroactive Application: Penalty applies to all missed amounts

- • Tax Reporting: Must file Form 5329 with your tax return

- • Potential Waiver: IRS may waive penalty for reasonable cause

Current RMD Timeline

- • Age 73: Must start RMDs (SECURE Act 2.0)

- • First RMD: Due by April 1 of following year

- • Subsequent RMDs: Due by December 31 each year

- • Life Expectancy: Based on IRS Uniform Lifetime Table

RMD Calculation Simplified

Your annual RMD is calculated by dividing your IRA balance on December 31 of the previous year by your life expectancy factor from the IRS Uniform Lifetime Table. For example, if you're 73 with a $500,000 IRA balance and a 26.5-year life expectancy, your RMD is $18,868 ($500,000 ÷ 26.5). As you age and your life expectancy decreases, the percentage you must withdraw increases.

Example RMD Percentages:

Strategic RMD Planning Opportunities

RMDs don't have to be a tax burden—they can be an opportunity for strategic planning. Qualified Charitable Distributions (QCDs) allow you to donate up to $100,000 annually directly from your IRA to qualified charities, satisfying your RMD requirement while avoiding income tax on the distribution. This strategy is particularly valuable for charitably inclined individuals in higher tax brackets. Additionally, converting portions of your Traditional IRA to a Roth IRA in earlier retirement years can reduce future RMDs and create tax-free legacy assets for your heirs.

Another powerful strategy involves coordinating RMDs with your overall tax situation. In years with lower taxable income, you might accelerate distributions beyond the minimum to take advantage of lower tax brackets. Conversely, in high-income years, you might limit withdrawals to the required minimum. This tax bracket management can significantly reduce your lifetime tax burden and preserve more wealth for your goals.

Advanced IRA Withdrawal Strategies for 2025

Sophisticated IRA withdrawal strategies can significantly enhance your retirement financial outcomes, reduce lifetime taxes, and optimize your legacy. These strategies require careful planning and often involve coordinating multiple financial decisions, but the potential benefits make them worth considering for IRA owners with substantial balances or complex financial situations. The key is understanding how different strategies interact with each other and with your overall financial plan.

Roth Conversion Ladder Strategy

The Roth conversion ladder is a powerful strategy for early retirees who want to access their retirement funds before age 59½ while minimizing taxes and penalties. This approach involves converting portions of your Traditional IRA to a Roth IRA each year, paying taxes on the conversion amount, then waiting five years to withdraw those converted amounts tax-free and penalty-free. By creating a "ladder" of conversions over several years, you can build a pipeline of accessible funds for early retirement while ultimately creating a tax-free retirement income stream.

Key Benefits: Avoids 10% early withdrawal penalty, creates tax-free income, provides flexibility for early retirement. Best implemented during low-income years when your tax bracket is temporarily reduced.

Tax Bracket Management

Coordinate IRA withdrawals with your overall tax situation to smooth income across years and avoid spikes that push you into higher tax brackets. This might involve accelerating withdrawals in low-income years or delaying them in high-income years.

- • Fill up lower tax brackets strategically

- • Avoid Medicare premium surcharges (IRMAA)

- • Optimize Social Security taxation

Spousal IRA Coordination

Married couples can optimize their combined IRA strategy by coordinating withdrawals, conversions, and beneficiary designations. Spouses can treat inherited IRAs as their own, providing additional planning flexibility.

- • Coordinate conversion timing

- • Optimize spousal beneficiary rules

- • Balance withdrawal amounts

Common IRA Withdrawal Mistakes to Avoid

Mistake 1: Prohibited Transactions

Never use IRA funds for personal benefit before withdrawal (no self-dealing, personal loans, or prohibited investments).

Mistake 2: Missing the 60-Day Rollover Deadline

Indirect rollovers must be completed within 60 days. Missing this deadline makes the entire distribution taxable plus potential penalties.

Mistake 3: Violating SEPP Rules

Modifying SEPP payments before the required period ends triggers retroactive penalties on all distributions.

Mistake 4: Incorrect RMD Calculations

Using wrong life expectancy tables or forgetting to aggregate multiple IRAs can result in incorrect RMDs and steep penalties.

Key Takeaways and Next Steps

IRA withdrawal rules are complex but navigable with proper planning and understanding. The most critical distinction is between Traditional and Roth IRAs—Traditional accounts provide tax deferral but create taxable income in retirement, while Roth accounts offer tax-free withdrawals after meeting qualifying conditions. Age 59½ remains the key milestone for avoiding early withdrawal penalties, though numerous exceptions provide flexibility for legitimate financial needs.

The SECURE Act 2.0 has modernized many retirement account rules, including raising the RMD age to 73 and eliminating RMDs for original Roth IRA owners. These changes provide more flexibility for retirement planning but also require updated strategies. Whether you're planning for retirement, facing an emergency, or optimizing your legacy, understanding IRA withdrawal rules is essential for maximizing your wealth and minimizing unnecessary taxes and penalties.

Next Steps:

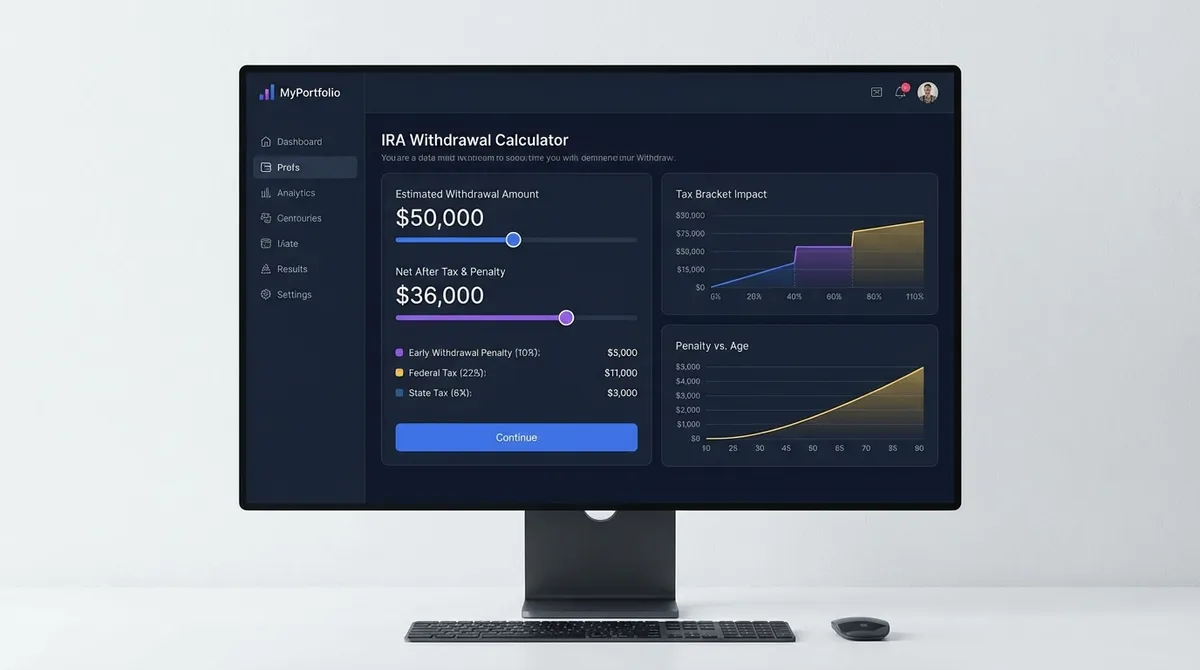

- 1Use our IRA Withdrawal Calculator above to model different scenarios and understand potential tax implications

- 2Review your current IRA beneficiaries and ensure they align with your estate planning goals

- 3Consider consulting with a qualified financial advisor and tax professional for personalized guidance

- 4Stay informed about legislative changes that may affect IRA rules and withdrawal strategies

About the Author

Marko Šinko is a finance expert at EFinanceCalculator and a CPA with extensive experience in retirement planning and tax optimization. He specializes in IRA strategies, withdrawal planning, and helping individuals maximize their retirement wealth while minimizing tax burdens.

This article was last updated on September 12, 2025 to reflect the latest IRS rules and regulations for 2025.