Itemized Deductions vs. Standard Deduction: 2025 Guide

Deciding whether to itemize deductions or take the standard deduction is one of the most important tax choices you'll make this year. It boils down to simple math: you want to choose the option that lowers your taxable income the most. While the standard deduction is faster and easier, itemizing can unlock thousands of dollars in tax savings if you have significant expenses like mortgage interest, state taxes, or charitable donations.

For the 2025 tax year, the rules remain largely defined by the Tax Cuts and Jobs Act (TCJA). This means the standard deduction is relatively high (projected over $15,000 for singles and $30,000 for couples), but expenses like SALT (State and Local Taxes) remain capped. Our calculator helps you navigate these specific thresholds to find your optimal tax strategy.

The Golden Rule: If your total qualifying expenses add up to even one dollar more than your standard deduction, you should itemize. It requires more paperwork (checking receipts and forms), but the tax refund difference can be substantial.

What Expenses Can You actually Deduct in 2025?

Not all expenses are tax-deductible. The IRS has very specific categories for what counts toward itemizing. Here is a breakdown of the "Big Four" that usually drive the decision to itemize.

- Charitable Contributions: Donations to qualified non-profits. The deduction is generally limited to 60% of your Adjusted Gross Income (AGI) for cash donations.

- Mortgage Interest: Interest paid on up to $750,000 of mortgage debt ($375,000 if married filing separately). Check our Mortgage Payment Calculator for amortization details.

- SALT (State and Local Taxes): A combined deduction for state and local income (or sales) taxes and property taxes, capped at $10,000 per year ($5,000 if married filing separately). This is a major factor for residents in high-tax states; see our Income Tax Calculator and Sales Tax Calculator.

Standard Deduction vs. Itemized Deduction

The Standard Deduction is a flat amount that reduces your taxable income, regardless of your actual expenses. It varies by filing status and is adjusted annually for inflation.

If your total itemized deductions are greater than your standard deduction, you save more money by itemizing. If they are less, you stick with the standard deduction.

2024/2025 Strategy: Due to the higher standard deduction introduced by the TCJA, fewer taxpayers itemize today (around 10% vs. 30% previously). However, if you have high mortgage interest or make significant charitable donations, itemizing could still be the winner.

Key Itemized Deduction Categories

1. Medical Expenses

You can deduct only the portion of your unreimbursed medical expenses that exceeds 7.5% of your AGI. This includes insurance premiums (if paid post-tax), doctors, dentists, and prescription drugs.

2. Taxes You Paid (SALT Limit)

The "State and Local Tax" (SALT) deduction lets you deduct state income taxes (or general sales taxes) plus property taxes. Property Tax Calculator. The catch? The total for all these combined is capped at $10,000.

3. Mortgage Interest

Homeowners can deduct interest on up to $750,000 of mortgage debt for their main or second home. (Ideally, use a calculator to find your exact annual interest). Note: Home equity loan interest is deductible only if the money was used to buy, build, or substantially improve the home.

4. Charitable Gifts

Cash gifts to qualified charities are deductible up to 60% of your AGI. Donating appreciated assets (like stocks) can also be a smart move, often limited to 30% of AGI.

5. Gambling Losses

You can deduct gambling losses, but only up to the amount of your gambling winnings. You cannot claim a net loss.

Common "Misconceptions" - What You CANNOT Deduct

The Tax Cuts and Jobs Act (TCJA) eliminated or restricted several miscellaneous deductions that were previously available:

- Unreimbursed Job Expenses: You can no longer deduct work uniforms, union dues, or home office expenses if you are a W-2 employee.

- Tax Preparation Fees: Fees paid to accountants or for tax software are no longer deductible for employees.

- Moving Expenses: Suspended (except for active-duty military).

- Alimony: For divorce agreements after 2018, alimony payments are not deductible by the payer.

Does Itemizing Audit-Proof My Return?

No. In fact, heavy itemization can slightly increase audit risk if your deductions are disproportionately high compared to your income.

Tip: Always keep detailed records. Bank statements, acknowledgement letters from charities (for gifts over $250), and Form 1098 for mortgage interest are essential. The IRS requires proof if they come knocking.

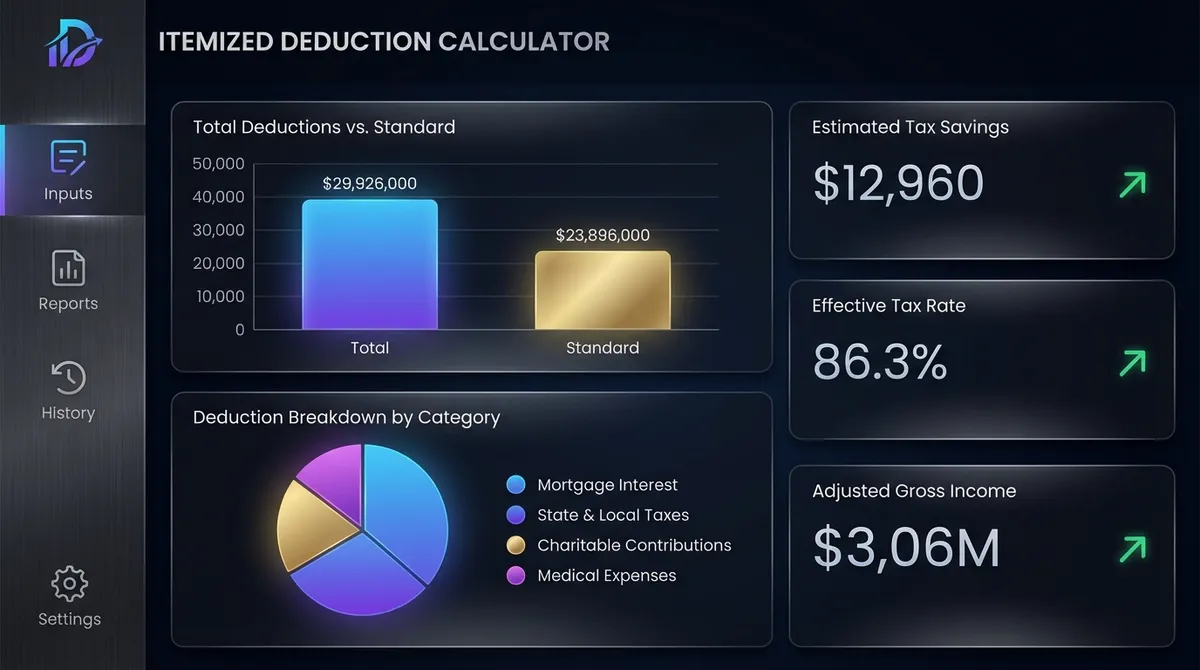

Effective Tax Rate Context

Itemizing lowers your taxable income, which in turn lowers your Effective Tax Rate. It essentially ensures that you aren't taxed on money you spent on essential items like healthcare, housing financing, or charity.

Impact on Investment Income

Investment interest expenses are another niche deduction. If you borrow money to invest (margin interest), you can deduct that interest up to the amount of your net investment income. Check our Investment Calculator to project your returns.

Final Thoughts on Filing

Don't just guess. Run the numbers. If your itemized expenses are close to the standard deduction, verify if you have any "bunching" opportunities—grouping two years' worth of charitable donations into one year to exceed the standard deduction threshold for that year.

Schedule A Walkthrough

If you itemize, you must attach Schedule A (Form 1040) to your tax return. Here is what the form looks like, section by section:

| Lines | Category | Key Rule |

|---|---|---|

| 1-4 | Medical & Dental | Only excess over 7.5% AGI |

| 5-7 | Taxes You Paid | $10k Cap applies here (SALT) |

| 8-10 | Interest You Paid | Home mortgage & investment interest |

| 11-14 | Gifts to Charity | Cash vs. Non-cash (Form 8283 maybe req.) |

| 15 | Casualty/Theft | Disaster areas only |

Audit Red Flags

Itemizing can increase your audit risk slightly because there is more "proof" required. Keep your nose clean by avoiding these common mistakes:

- Outsized Charitable Donations: Giving 50% of your income to charity is noble but suspicious. If your donations are way above the average for your income bracket, the IRS may ask for receipts.

- Non-Cash Donations > $500: If you drop off bags of clothes at Goodwill, you must value them at "thrift shop value," not what you paid for them. If over $500 total, you need Form 8283.

- deducting Home Improvements: You generally cannot deduct the cost of a new roof or kitchen. That is a capital improvement, not an expense. You add it to your home's "basis" to lower taxes when you sell, but you don't deduct it now (unless it's a specific energy credit or medical necessity).

Standard vs. Itemized: The Math

The decision usually comes down to simple arithmetic: Is the sum of your itemized expenses greater than the Standard Deduction?

Scenario A: The Renters

- Filers: Married Couple

- Mortgage Interest: $0 (Rent)

- State Taxes (SALT): $6,000

- Charity: $2,000

- Total Itemized: $8,000

Scenario B: The Homeowners

- Filers: Married Couple

- Mortgage Interest: $22,000

- State Taxes (SALT): $10,000 (Cap)

- Charity: $5,000

- Total Itemized: $37,000

Common Audit Triggers for Itemizers

Itemizing deductions is perfectly legal, but it does attract slightly more IRS scrutiny than taking the standard deduction. Avoid these common red flags:

🚩 Outsized Charity

Reporting charitable donations that exceed 30% of your income often triggers an automatic review. Always keep receipts for donations over $250.

🚩 Gambling Losses

You can only deduct losses up to the amount of your winnings. Claiming $50k in losses with only $5k in winnings is an instant flag.

🚩 Medical Travel

Deducting a "medical trip" to Hawaii? The IRS will want proof that the specific treatment wasn't available locally.

🚩 Non-Cash Donations

Donating a used car? You must use the Fair Market Value, not the original purchase price. Overvaluing donated goods is a common error.

Strategies: How to "Bunch" Your Deductions

A common strategy for those on the borderline between standard and itemized is "bunching." This involves grouping two years' worth of expenses into a single tax year to surmount the standard deduction threshold, then taking the standard deduction the following year.

Example of Bunching Strategy

Imagine a married couple typically donates $10,000/year to charity. If their other deductions (taxes, mortgage) sum to $20,000, their total is $30,000—roughly equal to the standard deduction. They gain no extra benefit.

The Strategy: Instead of giving $10k each year, they donate $20,000 in Year 1 (January and December) and $0 in Year 2.

• Year 1: $20k (Taxes/Interest) + $20k (Charity) = $40,000 Itemized Deduction ($10k benefit).

• Year 2: Take the ~$30k Standard Deduction.

Result: Over two years, they claim roughly $70k in total deductions versus ~$60k by doing nothing differently other than timing.

Important Tax Disclaimer

This calculator provides estimates based on 2025 IRS tax law projections. Tax laws are complex and subject to change. The information provided here is for educational purposes only and does not constitute professional tax advice. We strongly recommend consulting with a CPA (Certified Public Accountant) or tax professional before making significant financial decisions or filing your taxes.