Complete Guide: Loan Rate Calculator & Interest Rate Analysis (2025)

Understanding the true cost of borrowing is the first step toward financial freedom. In today's lending market, interest rates can fluctuate wildly based on your credit score, loan type, and economic conditions. Our Loan Rate Calculator is designed to cut through the confusion, helping you reverse-engineer the interest rate from a monthly payment or determine exactly what your monthly payment will be at a given rate.

Whether you are shopping for a new car, planning a home renovation, or consolidating high-interest debt, knowing the numbers puts you in the driver's seat during negotiations. This guide breaks down how loan rates are calculated, what affects them, and how you can secure the lowest possible rate in 2025.

2025 Market Snapshot

- • Personal Loans: Average rates hovering around 12.18%, with excellent credit borrowers seeing ~7-8%. Compare rates with our Personal Loan Calculator.

- • Auto Loans: New car rates average 7.65%; used car rates average 11.38%. See the impact of extra payments with our Loan Payoff Calculator.

- • The "Prime" Gap: Borrowers with scores above 760 are paying nearly 5% less in interest than those with scores below 640.

How This Calculator Works

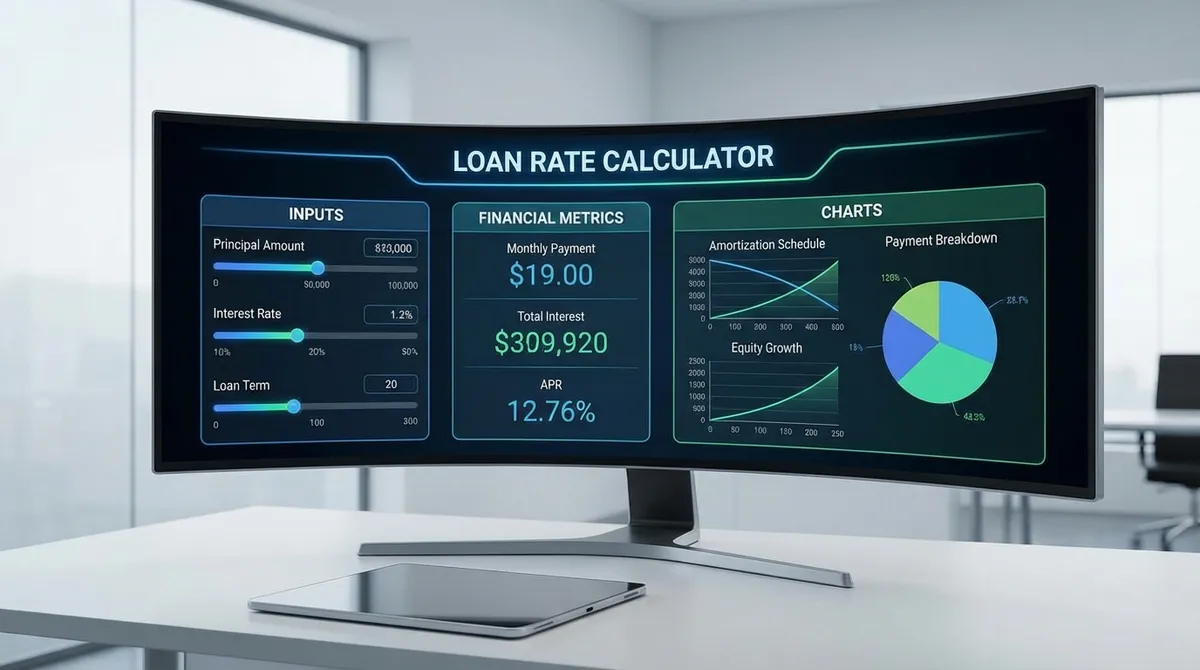

Most calculators only tell you the monthly payment. Ours goes a step further by offering two distinct modes:

Mode 1: Find Rate

Perfect when a dealer quotes you a monthly payment (e.g., "$450/month for 60 months") but hides the interest rate. Enter the loan amount and term to reveal the actual Annual Percentage Rate (APR) you are being charged.

Mode 2: Find Payment

The classic amortization calculator. Enter your loan amount, interest rate (from a bank advertisement or pre-approval), and term to see your exact monthly principal and interest payment.

The Math Behind the Numbers

While we handle the heavy lifting, it is helpful to understand the formula governing your loan. The standard amortization formula is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1 ]Where M is your monthly payment, P is the principal, i is the monthly interest rate, and n is the number of months.

When solving for the interest rate (Mode 1), there is no simple algebraic solution. Our calculator uses the Newton-Raphson method, a powerful numerical algorithm that iteratively refines the estimated rate until it finds the precise value that matches your inputs.

4 Factors That Determine Your Rate

Credit Score

Your FICO score is the single biggest factor. A score of 760+ gets you the "prime" rate. A score below 600 often means subprime rates, which can be 2-3x higher.

Debt-to-Income (DTI) Ratio

Lenders want to see that you can afford the payments. Ideally, your total monthly debt payments should be less than 36% of your gross monthly income. Check yours with our Debt-to-Income (DTI) Ratio Calculator.

Loan Term

Shorter loans (36-48 months) typically come with lower interest rates because they are less risky for the lender. Longer loans (72-84 months) have higher rates.

Collateral (Secured vs. Unsecured)

Secured loans (like auto loans or mortgages) have lower rates because the asset backs the loan. Unsecured personal loans have higher rates to offset the higher risk of default.

Case Study: The Cost of 2%

Let's look at how a small difference in rate affects your wallet. Consider a $35,000 auto loan for 60 months.

Borrower A (780 Credit Score)

- Rate: 6.00%

- Monthly Payment: $676

- Total Interest: $5,599

Borrower B (660 Credit Score)

- Rate: 8.00% (Only 2% higher)

- Monthly Payment: $710 (+$34/mo)

- Total Interest: $7,581 (+$1,982)

Takeaway: That 2% difference costs Borrower B nearly $2,000 extra. Improving your credit score before applying pays off directly.

Strategic Tips for Lower Rates

- Shop Around: Never take the first offer. Check with a credit union, a traditional bank, and an online lender. Rates can vary by 1-2% for the same borrower.

- Pay Down Revolving Debt: Lowering your credit card utilization before applying can boost your score by 20-50 points quickly.

- Shorten the Term: If you can afford the higher monthly payment, opting for a 48-month term instead of 60 can save you significant interest.

APR vs. Interest Rate: The Hidden Money Trap

One of the biggest mistakes borrowers make is confusing the Interest Rate with the APR (Annual Percentage Rate). They are NOT the same thing, and the difference can cost you thousands.

| Feature | Interest Rate | APR |

|---|---|---|

| Definition | The cost of borrowing the principal amount. | The total cost of the loan, including interest AND fees. |

| Includes | Only interest. | Interest + Origination Fees + Closing Costs + Discount Points. |

| Use For | Calculating monthly payment. | Comparing loan offers from different lenders. |

Pro Tip: Always compare loans by APR, not the interest rate. A lender might offer a low 5% interest rate but slap on a $1,500 "origination fee," which pushes the effective APR up to 7% or more. The APR reveals the naked truth of the loan's cost.

Fixed vs. Variable Rates in a Volatile Economy

Should you lock in a rate now or gamble on a variable one?

- Fixed-Rate Loans: Your rate never changes. Your payment is $500 today and $500 five years from now. This offers stability and is generally recommended for long-term debt like mortgages or student loans, especially when rates are historically low.

- Variable-Rate Loans (ARM): The rate floats with the market (usually tied to the Federal Reserve Prime Rate). You might start with a lower "teaser" rate, but if the Federal Reserve raises rates, your monthly payment shoots up. These are risky but can be smart for short-term loans (less than 3 years) if you plan to pay them off quickly before rates rise.

The "Prepayment Penalty" Trap

Some lenders penalize you for being responsible. A Prepayment Penalty is a fee charged if you pay off your loan early. Lenders do this to ensure they collect a minimum amount of interest profit.

Before signing any loan agreement, scan the fine print for this clause. If it exists, walk away. You should always retain the freedom to accelerate your payments and become debt-free faster without being punished for it. This is especially common in "subprime" auto loans and personal loans, but federal law prohibits it for most student loans and mortgages.

Frequently Asked Questions

Why is the rate I got higher than the one advertised?

Advertised rates are typically "teaser rates" reserved for the "perfect" borrower: 800+ credit score, low debt, and a short loan term. If your credit is average (650-700), lenders add "risk adjustments" to your rate.

How does a co-signer affect my interest rate?

Tremendously. If you have a low credit score but bring on a co-signer with excellent credit, the lender views the loan as less risky because both of you are on the hook to pay. This can often drop your offered interest rate by 5-10 percentage points, saving you thousands.

Does applying for many loans hurt my credit score?

Not if you do it correctly. FICO scoring models treat multiple inquiries for the same type of loan (auto, mortgage, student) as a single inquiry if they happen within a 14-45 day window. This is called "rate shopping." So, do all your applications in one week to minimize the impact.

Can I negotiate the interest rate?

Yes, especially for auto loans and mortgages. If you have a pre-approval from a credit union for 6%, show it to the dealership. They will often try to beat that rate to earn your financing business. You have less wiggle room with personal loans, which are more algorithmic.