Maryland Paycheck Calculator 2025 - Accurate MD Take-Home Pay Estimates

If you live or work in Maryland, you've likely noticed your paycheck has a unique line item that most Americans don't see: the local income tax. Unlike most states where income tax is uniform, Maryland authorizes its 23 counties and Baltimore City to levy their own "piggyback" income taxes on top of the state rate.

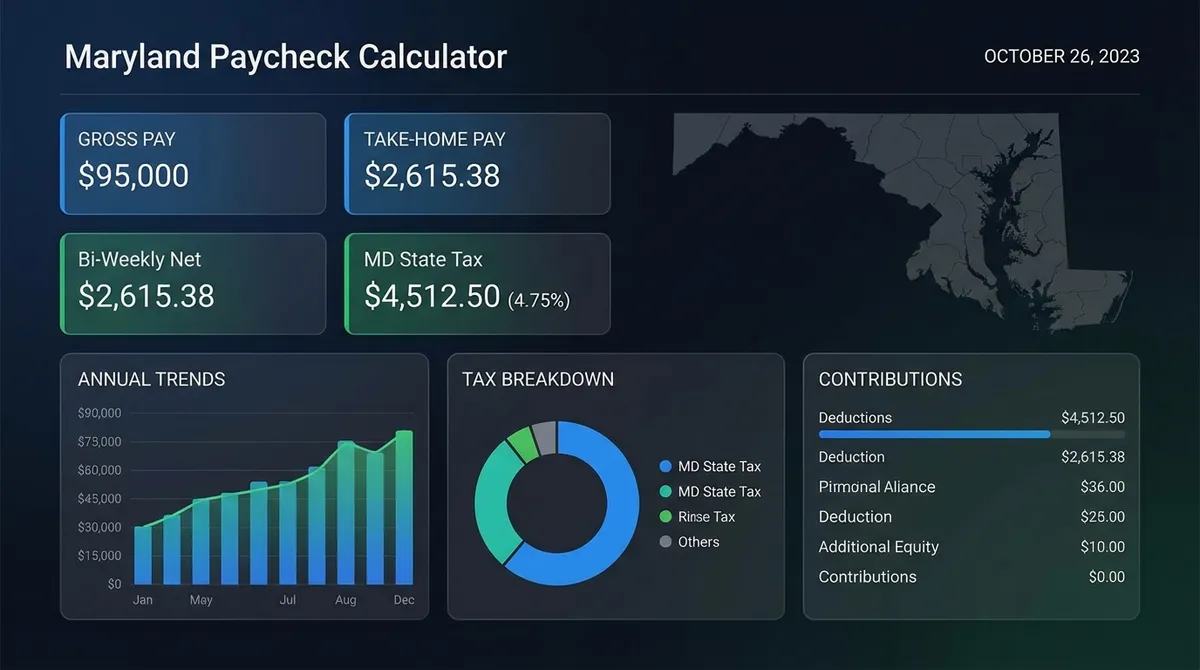

This dual-layer tax system can make estimating your take-home pay tricky. A $75,000 salary in Worcester County (2.25% local tax) looks very different from the same salary in Baltimore City (3.20% local tax). Our 2025 Maryland Paycheck Calculator cuts through the complexity, giving you a precise breakdown of your net pay after federal, state, and local taxes.

The 'Maryland Surprise': Understanding Local Taxes

In Maryland, where you sleep matters as much as what you earn. The local income tax is based on your county of residence, not where you work.

For 2025, these rates range from 2.25% in places like Worcester County to the maximum cap of 3.20% in high-population areas like Montgomery, Prince George's, and Howard counties. This tax is withheld directly from your paycheck alongside state taxes.

Why does this matter?

For an entry-level worker earning $50,000:

- Living in Worcester County: ~$94/month in local tax.

- Living in Baltimore City: ~$133/month in local tax.

That's nearly $470/year difference just for crossing a county line!

Deep Dive: The 'Piggyback' Tax System Explained

The formal name for Maryland's local tax is the "piggyback tax" because it riders on top of the state income tax return. You don't file a separate return for your county; it's all calculated on Form 502.

Historical Context: Maryland introduced this system to give counties more fiscal autonomy. Instead of relying solely on property taxes to fund schools, roads, and police, counties can tap into the income base of their residents. This creates a more diversified revenue stream but also means that high-income counties tend to have high tax rates to support extensive services.

It is crucial to ensure your employer has your correct address on file. If they are withholding based on an old address in a different county, you could face a surprise bill (or a refund) when you file your taxes. The discrepancy is reconciled on your annual return, but getting it right in your paycheck improves your monthly cash flow planning.

Moving During the Year?

If you move counties mid-year, the rule typically follows your domicile on the last day of the tax year (December 31st). This means if you move from valid low-tax Worcester County to high-tax Montgomery County on December 30th, you generally owe the higher rate for the entire year. Strategic timing of moves can save you money!

2025 Maryland County Tax Rates: Full List

Knowing your exact county rate is essential for accurate planning. Here is the complete list of local tax rates for the 2025 tax year. Note that these rates apply to your taxable income (after deductions).

- Allegany County 3.03%

- Anne Arundel County 2.81%

- Baltimore City 3.20%

- Baltimore County 3.20%

- Calvert County 3.00%

- Caroline County 3.20%

- Carroll County 3.03%

- Cecil County 2.80%

- Charles County 3.03%

- Dorchester County 3.20%

- Frederick County 2.96%

- Garrett County 2.65%

- Harford County 3.06%

- Howard County 3.20%

- Kent County 3.20%

- Montgomery County 3.20%

- Prince George's County 3.20%

- Queen Anne's County 3.20%

- St. Mary's County 3.00%

- Somerset County 3.20%

- Talbot County 2.40%

- Washington County 2.95%

- Wicomico County 3.20%

- Worcester County 2.25%

*Rates are subject to change by county legislation. Our calculator uses the most current certified rates for the 2025 tax year. Only Worcester County remains at the minimum 2.25% rate for 2025.

Maryland State Tax Bracket Guide (2025)

Maryland uses a progressive tax system with rates ranging from 2% to 5.75%. Unlike the federal system which has wide brackets, Maryland's brackets are relatively compressed. This means most middle-class earners hit the top marginal rates quickly.

| Taxable Income (Single) | Tax Rate | Cumulative Tax |

|---|---|---|

| $0 - $1,000 | 2.00% | $20.00 |

| $1,001 - $2,000 | 3.00% | $30.00 + $20.00 |

| $2,001 - $3,000 | 4.00% | $40.00 + $50.00 |

| $3,001 - $100,000 | 4.75% | $4,607.50 + $90.00 |

| $100,001 - $125,000 | 5.00% | Add 5.00% of excess |

| $125,001 - $150,000 | 5.25% | Add 5.25% of excess |

| $150,001 - $250,000 | 5.50% | Add 5.50% of excess |

| $250,001+ | 5.75% | Top Rate |

*Note: Married couples filing jointly have wider brackets, with the 4.75% rate extending up to $150,000 of taxable income before jumping to higher tiers. This effectively reduces the "marriage penalty" for middle-income couples.

Real-World Example: The Baltimore Nurse

Let's clarify these deductions with a realistic scenario. Meet Alex, a registered nurse working at Johns Hopkins. This example demonstrates how deductions interact with both state and local tax layers.

Alex's Profile

- Annual Salary: $82,000

- Location: Baltimore City

- Filing Status: Single

- 401(k): 5% ($4,100)

Estimated Take-Home

- Federal Tax: -$8,450

- FICA Taxes: -$6,273

- MD State Tax: -$3,550

- Local Tax (3.2%): -$2,380

- Net Pay:~$57,247

Notice that Alex pays nearly $2,400 in local taxes alone—almost as much as her state tax bill. This is why using a generic paycheck calculator often fails for Maryland residents; it misses that crucial local slice.

Maryland vs. Neighbors: A Tax Showdown

Is the grass greener on the other side of the Potomac? Or across the Mason-Dixon line? Maryland is often criticized for its high taxes, but the reality is nuanced depending on your income level and property ownership.

| State | Top Income Tax | Local Income Tax? | Verdict |

|---|---|---|---|

| Maryland | 5.75% + 3.20% Local | Yes (High) | High income tax, moderate property tax. |

| Virginia | 5.75% | No (Mostly) | Lower income tax, but Personal Property Tax on Cars can be a shock. |

| Pennsylvania | 3.07% (Flat) | Yes (Low/Varies) | Low state tax, but very high local real estate taxes in suburbs. |

| Delaware | 6.60% | Some Cities | No Sales Tax! Higher top rate but graduated slowly. |

| Washington DC | 10.75% (Top) | No | Very high for high earners ($250k+), but generous EITC for low earners. |

Key Takeaway: If you are a high earner ($150k+), Virginia generally offers shield from Maryland's high local taxes. However, Virginia's "Car Tax" (Personal Property Tax) can cost you thousands per year if you drive new vehicles, effectively clawing back some of those income tax savings. So while Maryland gets hit on the paycheck side, it may be cheaper on the asset side for some families.

Strategy Guide: Lowering Your Maryland Tax Bill

You can't change the tax rates (unless you move), but you can significantly lower your Maryland Taxable Income. Since both state and local taxes are calculated based on this number, every dollar you deduct saves you roughly 8-9 cents in total tax.

1. Max Out Pre-Tax Accounts

Contributions to a 401(k), 403(b), or Traditional IRA reduce your federal AGI, which automatically lowers your Maryland taxable base.

2. Use the HSA "Triple Threat"

Health Savings Accounts are triple-tax-advantaged. Contributions are tax-free, growth is tax-free, and withdrawals for medical costs are tax-free.

3. 529 Plan Deductions

Maryland allows a deduction of up to $2,500 per year per beneficiary for contributions to the Maryland College Investment Plan. This is a state-specific perk!

Frequently Asked Questions (FAQ)

Why is Maryland's tax so high compared to Virginia?

While both states have similar income tax maximums (5.75%), Maryland's additional local tax (up to 3.20%) makes the effective burden higher for many. Virginia does not have a local income tax on wages, although some independent cities have different structures.

Does the standard deduction reduce my local tax too?

Yes. Both portions of your Maryland tax (State and Local) are calculated based on your Maryland Taxable Income. Deductions that lower your taxable income reduce both your state and local tax liability.

I work in DC but live in Maryland. Where do I pay taxes?

Thanks to a reciprocity agreement, you will pay Maryland income taxes (including the local portion) on your wages, not DC taxes. You should file an exemption form (D-4A) with your DC employer so they withhold Maryland tax instead of DC tax.

What is the Maryland 'Poverty Level' credit?

Maryland offers a local tax credit for low-income earners. If your income is below the poverty line, your local tax rate is capped or eliminated. Our calculator assumes standard rates, so if you qualify for poverty exemptions, your actual take-home might be slightly higher.

Can I deduct my Maryland taxes on my federal return?

Yes, if you itemize deductions on your federal return, you can deduct state and local income taxes (SALT). However, the SALT deduction is currently capped at $10,000 per year, which affects many high-income Maryland homeowners.

Does Maryland tax active duty military pay?

Generally, yes, if you are a Maryland resident. However, Maryland offers a specific subtraction modification for military retirement income. For active duty pay earned outside the U.S. (up to $15,000), there is also an exemption. Check with a tax professional for specific military tax benefits.