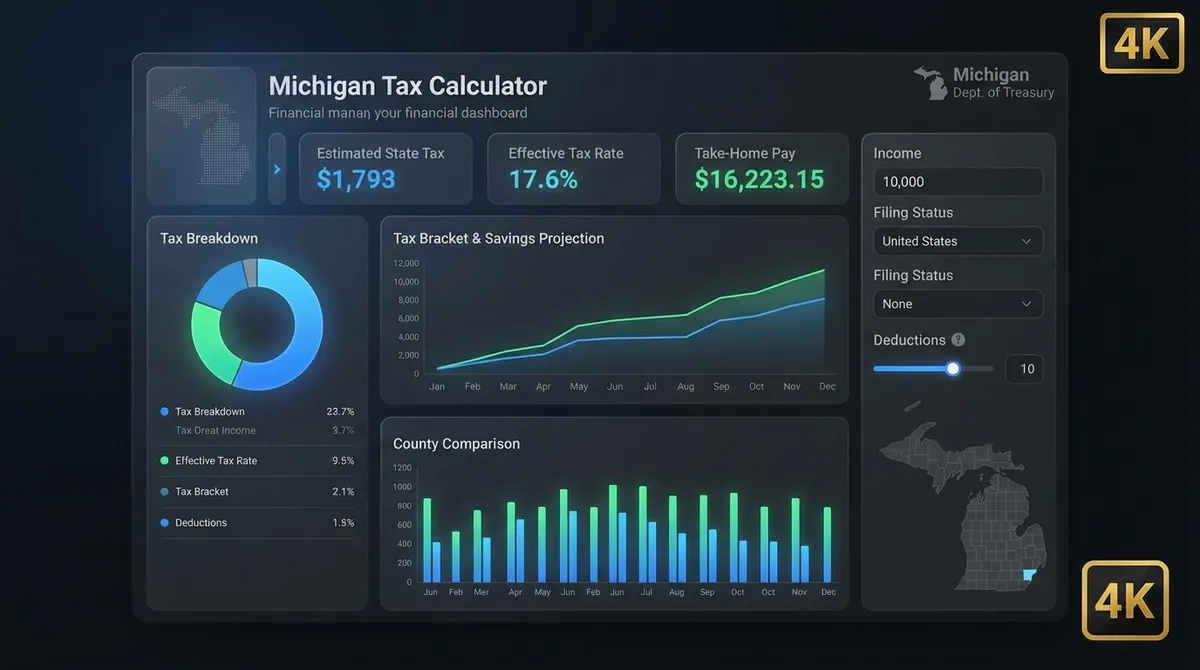

Complete Guide: Michigan Income Tax Calculator 2025

With the return to a flat 4.25% state income tax rate for 2025, Michigan's tax system remains one of the simplest in the country to understand, yet complex to optimize due to a pervasive layer of local city taxes. While the temporary 4.05% rate cut from 2023 has expired, robust personal exemptions and targeted relief for retirees and families continue to provide significant savings. This comprehensive guide helps you navigate state liabilities, local city taxes in Detroit, Grand Rapids, and beyond, and maximize every available exemption. To estimate your specific take-home pay, use our Michigan Paycheck Calculator.

Michigan Tax Fast Facts (2025)

What's New for Michigan Taxes in 2025?

The headline for 2025 is stability. The state income tax rate sits at 4.25%, having moved up from the temporary 4.05% trigger rate seen in previous years. Inflation adjustments have solidified the personal exemption at $5,600, which provides a meaningful deduction for every taxpayer and dependent.

The "Retirement Tax" Rollback: The most significant ongoing change is the phasing out of the tax on retirement income. For tax year 2025, the phase-in of the new deduction rules continues. This means more pension and 401(k) income is becoming deductible for seniors born after 1945, moving toward full parity with the generous pre-1946 rules by 2026. If you are a retiree, pay close attention to the "Tier 2" and "Tier 3" birth year changes on form MI-1040.

Pro Tip: From 2025 onwards, public and private pension limits are unified, simplifying the code for many retirees who previously faced disparate treatment.

The 2025 Retirement Tax Rollback: Explained

Michigan is in the middle of a major tax overhaul for retirees. The "Retirement Tax" instituted in 2011 is being phased out via the "Lowering MI Costs Plan." For the 2025 tax year, the deduction limits depend heavily on your birth year.

| Retiree Category | Birth Year | 2025 Tax Rule |

|---|---|---|

| Tier 1 (Seniors) | Before 1946 | Social Security is exempt. Public pensions are exempt. Private pensions/401(k) up to roughly $61k (Single) / $123k (Joint) are exempt. |

| Tier 2 (Transition) | 1946 – 1952 | Big Change: You can now deduct up to $20,000 (Single) or $40,000 (Joint) of any retirement income, OR use the standard deduction. |

| Tier 3 (Younger) | After 1952 | Generally fully taxable until age 67, though the new phase-in allows for partial deductions that increase annually until 2026. |

*By 2026, the plan is for all retirees to largely return to pre-2012 exemption levels, restoring significant tax savings for those born after 1945.

The Complexity of City Income Taxes

Michigan is one of the few states with a pervasive system of local city income taxes. While the state return is simple, your local return can be tricky. Over 20 cities, including Detroit, Grand Rapids, and Lansing, levy their own income tax.

Residents

If you live in a taxing city, you pay the resident rate (typically 1.0% to 2.4%) on all your income, regardless of where it was earned. This includes interest, dividends, and capital gains in many jurisdictions.

Non-Residents

If you live outside but work inside a taxing city, you pay the non-resident rate (typically 0.5% to 1.2%) only on income earned within that city limits.

| City | Resident Rate | Non-Resident Rate |

|---|---|---|

| Detroit | 2.40% | 1.20% |

| Grand Rapids | 1.50% | 0.75% |

| Highland Park | 2.00% | 1.00% |

| Lansing | 1.00% | 0.50% |

| Saginaw | 1.50% | 0.75% |

| Most Others | 1.00% | 0.50% |

*Note: "Most Others" includes cities like Flint, Pontiac, Battle Creek, and Muskegon.

Homestead Property Tax Credit

One of Michigan's most valuable tax breaks isn't an income tax deduction at all—it's a credit based on your property taxes or rent. For more details on property levies, visit our Property Tax Calculator.

Who Qualifies?

If your total household resources are less than roughly $67,300 (adjusted annually), you may qualify. The credit refunds a portion of property taxes paid that exceed 3.2% of your income.

Renters qualify too! If you rent, Michigan considers 23% of your rent to be "property tax." If that amount typically exceeds 3.2% of your income, you can claim this credit and receive a refund check, even if you owe no income tax.

How to Calculate Your Property Tax Credit

Many Michigan residents leave money on the table by ignoring this credit. It serves as a "circuit breaker" to prevent property taxes from consuming too much of your income.

The Formula

*The credit is capped at $1,700 for 2025.

Example: The Renter

- Rent: $1,200/mo ($14,400/yr)

- "Property Tax": 23% of rent = $3,312

- Income: $40,000

- Threshold: 3.2% of $40k = $1,280

- Excess: $3,312 - $1,280 = $2,032

- Credit: 60% of $2,032 = $1,219 Refund

Investing in Education (MESP)

Michigan offers a robust tax incentive for saving for college via the Michigan Education Savings Program (MESP).

- State Deduction: You can deduct up to $5,000 (Single) or $10,000 (Joint) of contributions from your Michigan taxable income annually.

- Tax-Free Growth: Earnings grow free of federal and state taxes if used for qualified education expenses.

- Rollovers: You can often roll over a 529 from another state to MESP to capture the deduction, subject to specific holding rules. Plan your education savings with our Retirement Calculator (also great for long-term compounding).

Maximizing Your Exemptions

Because Michigan is a flat-tax state, exemptions are your primary tool for reducing tax liability. Unlike deductions which only reduce taxable income, exemptions in Michigan are robust and stackable.

Personal Exemption ($5,600)

Every taxpayer gets this. A family of four claims $22,400 off the top before passing a penny to the state. This is indexed to inflation.

Special Exemptions ($3,300)

Added on top of the personal exemption for individuals who are deaf, blind, hemiplegic, paraplegic, quadriplegic, or totally and permanently disabled.

Disabled Veteran ($500)

An extra deduction for veterans with a service-connected disability. The state also offers a separate property tax exemption for 100% disabled veterans.

Real-World Scenarios

Scenario 1: Single in Lansing

Scenario 2: Family of 4 in Detroit

Michigan Tax FAQ

When are Michigan taxes due?

The due date is typically April 15th. If April 15 falls on a weekend or holiday, it moves to the next business day. Michigan accepts the federal extension (Form 4868) for filing time, but you must still pay your estimated tax liability by April 15 to avoid penalties.

Is unemployment income taxable in Michigan?

Yes. Unemployment compensation is subject to Michigan income tax. You can elect to have state tax withheld from your unemployment checks to avoid a surprise bill at the end of the year.

Can I deduct federal taxes on my Michigan return?

No. Michigan does not allow a deduction for federal income taxes paid. However, the generous personal exemption and low flat rate are designed to offset this limitation compared to states with higher effective rates. For more on state rules, see the Michigan Department of Treasury.

Michigan vs. Neighbors

How does the Wolverine State stack up against its Midwestern neighbors? Generally, Michigan is competitive due to its flat tax structure, though high earners might prefer it over Wisconsin's progressive rates.

| State | Tax System | Top Rate |

|---|---|---|

| Michigan | Flat Tax | 4.25% |

| Ohio | Progressive | ~3.50% |

| Indiana | Flat Tax | 3.05% |

| Illinois | Flat Tax | 4.95% |

| Wisconsin | Progressive | 7.65% |