Missouri Paycheck Calculator 2025: Your Guide to MO Take-Home Pay

Whether you're starting a new job in Kansas City, eyeing a promotion in St. Louis, or just trying to budget better in Columbia, understanding exactly how much of your salary lands in your bank account is crucial. Missouri's tax system is generally straightforward, but 2025 brings new federal adjustments and nuances—especially if you live or work in the state's major metro areas where local earnings taxes apply.

This comprehensive guide breaks down the 2025 Missouri paycheck calculation, including the latest federal brackets, state tax nuances, and the often-overlooked local earnings taxes that can catch newcomers by surprise.

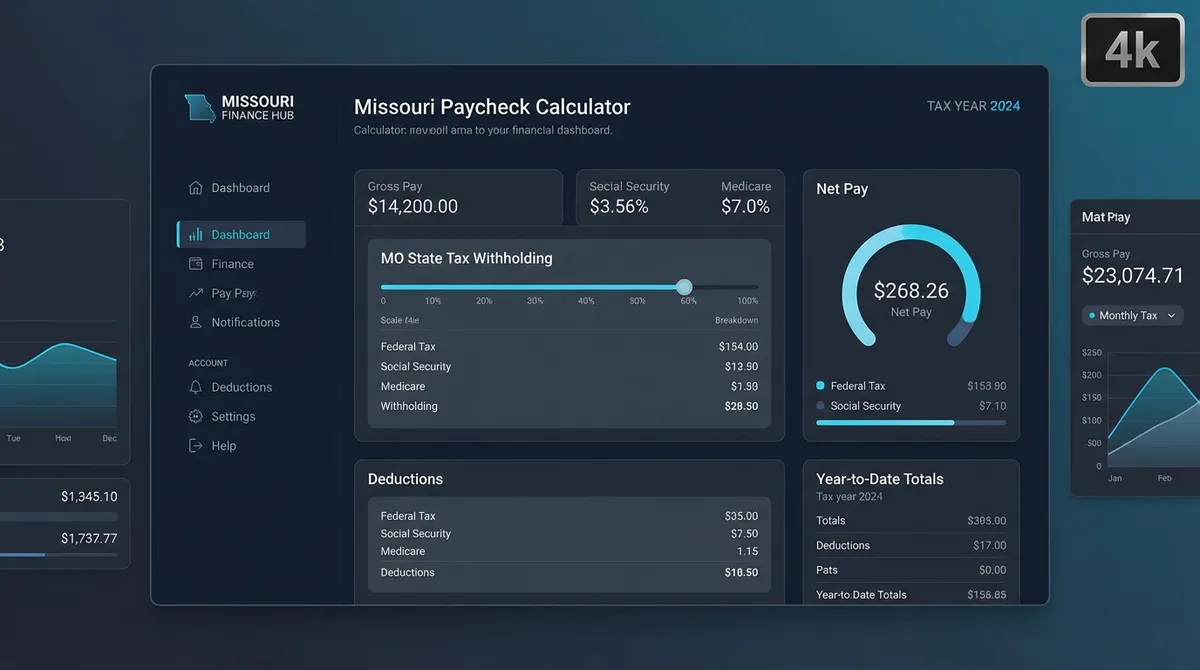

How We Calculate Your Missouri Paycheck in 2025

The difference between your "Gross Pay" (the big number in your offer letter) and your "Net Pay" (the actual deposit) comes down to a specific stack of withholdings. Here is exactly what our calculator accounts for:

1. Federal Income Tax (2025 Update)

The IRS has adjusted tax brackets for inflation in 2025. This generally means you can earn a bit more before jumping into a higher tax bracket. Our calculator also applies the new 2025 Standard Deductions. For more details on brackets, check our Federal Income Tax Calculator:

- Single: $15,000

- Married Filing Jointly: $30,000

- Head of Household: $22,500

2. Missouri State Income Tax

Missouri uses a graduated income tax system. While the top rate has historically been higher, legislative changes have capped the top marginal rate at roughly 4.7% (often effectively 4.8% in some tables, though recent legislation targets 4.7% or lower depending on revenue triggers). Compare this with other states using our Income Tax Calculator. Effectively, nearly all full-time workers in Missouri will pay this top rate on income over roughly $9,000.

However, Missouri does offer a deduction for a portion of your federal tax liability, which can slightly lower your effective state tax rate compared to the raw bracket percentage.

3. FICA Taxes (Social Security & Medicare)

These are standardized across the US, but the limits change annually:

- Social Security: You pay 6.2% on the first $176,100 of your earnings (2025 limit). Income above that is tax-free for Social Security purposes.

- Medicare: You pay 1.45% on all earnings, with no cap.

- Additional Medicare Tax: High earners (single filers over $200k, married over $250k) pay an extra 0.9% surtax on excess earnings.

Deep Dive: Missouri Tax Brackets 2025

While many people refer to Missouri's tax as "basically flat" for middle-income earners, it is technically progressive. Here is how the brackets scale up for 2025 (estimates based on inflation adjustments):

| Taxable Income | Tax Rate |

|---|---|

| $0 - $115 | 0.00% |

| $116 - $1,158 | 1.5% |

| $1,159 - $2,316 | 2.0% |

| $2,317 - $3,474 | 2.5% |

| $3,475 - $4,632 | 3.0% |

| $4,633 - $5,790 | 3.5% |

| $5,791 - $6,948 | 4.0% |

| $6,949 - $8,106 | 4.5% |

| Over $8,107 | ~4.7% (Top Rate) |

*Note: Tax brackets are adjusted annually. Most full-time workers earn above $9,000, meaning every extra dollar is taxed at the top rate.

Does a Paycheck Go Further in Missouri?

One reason people flock to Missouri is the cost of living. Earning $60,000 in Kansas City buys you a lifestyle that might require $95,000 in Chicago or $140,000 in San Francisco. Check these differences with our Cost of Living Calculator.

The "Real" Value of $100 Ex.

According to BEA data, goods usage in Missouri is roughly 90% of the national average. This means your "Net Pay" has roughly 10% more purchasing power than the national baseline.

Choosing the Right Filing Status

Your filing status on your W-4 and MO-W-4 determines your standard deduction and tax brackets.

- S

Single

The default for unmarried individuals. Highest effective tax rate usually.

- MFJ

Married Filing Jointly

Best for couples where one earns significantly more. Doubles the bracket widths.

Important: Local Earnings Taxes in MO

Do you work or live in St. Louis or Kansas City?

Both Kansas City and St. Louis impose a 1% earnings tax. This is one of the most unique aspects of Missouri payroll.

- Kansas City (Form RD-109): All residents of KCMO and non-residents working within the city limits pay 1% on gross earnings.

- St. Louis City (Form E-234): Similarly, a 1% earnings tax applies to residents and non-residents working in the city.

- Remote Work Rule: If you work remotely from outside the city limits for a company based in KC or STL, you may be eligible for a refund of the tax withheld for the days you physically worked outside the city. This requires filing a specific return at year-end.

Tip: Use the "Extra State Withholding" field in our calculator to account for this 1% if your employer doesn't break it out automatically. For more forms information, visit the Missouri Department of Revenue.

Understanding Your Pay Stub: A Line-by-Line Guide

When you receive your paycheck, it often comes with a bewildering array of acronyms. Here is what they mean for a Missouri employee:

Inflow

- Gross Pay: Your total earnings before any taxes.

- Imputed Income: Non-cash benefits (like life insurance over $50k) that you are taxed on but don't receive in cash.

- Reimbursements: Non-taxable payments for expenses (mileage, internet) that are added back to net pay.

Outflow

- FED TAX / FIT: Federal Income Tax.

- MO ST TAX / SIT: Missouri State Income Tax.

- OASDI / SS: Social Security (6.2%).

- MED / HI: Medicare (1.45%).

- Pre-Tax Ded: 401(k), Health Insurance, HSA.

Retirement & Tax Advantages in Missouri

One of the best ways to increase your net worth—and ironically, your net pay efficiency—is to leverage pre-tax deductions. Missouri calculates its tax based on your Federal Adjusted Gross Income (AGI).

This means that contributions to a Traditional 401(k), 403(b), or Health Savings Account (HSA) are subtracted from your income before the state takes its ~4.7% cut.

- You save ~$220 in Federal Tax (22% bracket)

- You save ~$47 in Missouri State Tax

- Total Savings: ~$267

Example: A $60,000 Salary in Missouri

Let's say you earn $60,000 a year, are single, and contribute 5% to your 401(k). Here is a rough breakdown of where that money goes in 2025:

- Gross Monthly Pay: $5,000

- Pre-Tax 401(k): -$250 (Lowers your taxable income)

- Federal Tax: ~$350 (Estimated)

- FICA (SS + Medicare): ~$360

- Missouri State Tax: ~$175

- Net Monthly Pay: ~$3,865

*This is an estimate. Your actual tax obligation depends on specific deductions and credits.

Common Questions

Why is my refund huge (or why do I owe money)?

The goal of withholding is to break even. If you verify your W-4 (Federal) and MO-W-4 (State) regularly, you should come close to zero at tax time. A huge refund basically means you loaned the government money interest-free all year. Use our Budget Calculator to allocate that extra cash flow properly instead.

Does Missouri tax 401(k) contributions?

No. Traditional 401(k) contributions are deducted from your income before state and federal taxes are calculated. This is why maximizing your 401(k) is one of the most effective ways to lower your immediate tax bill.

How do bonuses get taxed in Missouri?

Bonuses are considered "supplemental wages." Employers often withhold federal tax at a flat 22% rate and Missouri tax at the top marginal rate (4.95% or the current year's stat max) to ensure you don't underpay. While it feels like you are taxed "higher" on a bonus, it all reconciles when you file your annual return.

Final Tips for Accuracy

To get the most out of this calculator:

- Check your latest paystub: Look for any "Point of Service" health deduction costs you might have missed.

- Review allowances: If you got married or had a child in 2024/2025, your allowances likely need updating.

- Consider the local tax: Don't forget that 1% if you are in the big metro areas!

- Review Remote Status: If you are fully remote for a KC/STL company, coordinate with HR to stop city withholding if applicable.