Complete Guide: Understanding Your Mortgage Refinance

Refinancing your mortgage is like resetting the terms of your home loan. It’s a powerful move that can lower your monthly payments, save thousands in interest, or even unlock cash for major life expenses. But is it the right move for you right now? This guide breaks down the math, the strategy, and the potential pitfalls so you can decide with confidence.

What Actually Happens When You Refinance?

At its core, mortgage refinancing means taking out a brand-new loan to pay off your existing one. You aren't just "editing" your current mortgage; you are closing it and starting fresh with a new lender (or the same one) under new terms.

Why Reviewers Do It

- • Secure a lower interest rate

- • Lower their monthly payment

- • Shorten their loan term (e.g., 30y to 15y)

- • Switch from Adjustable (ARM) to Fixed rate

- • Cash out home equity

The Catch (Costs)

- • Origination fees (0.5% - 1.5%)

- • Appraisal fees ($300 - $600)

- • Title insurance and search

- • Recording fees

- • Total: Typically 2% - 6% of loan amount

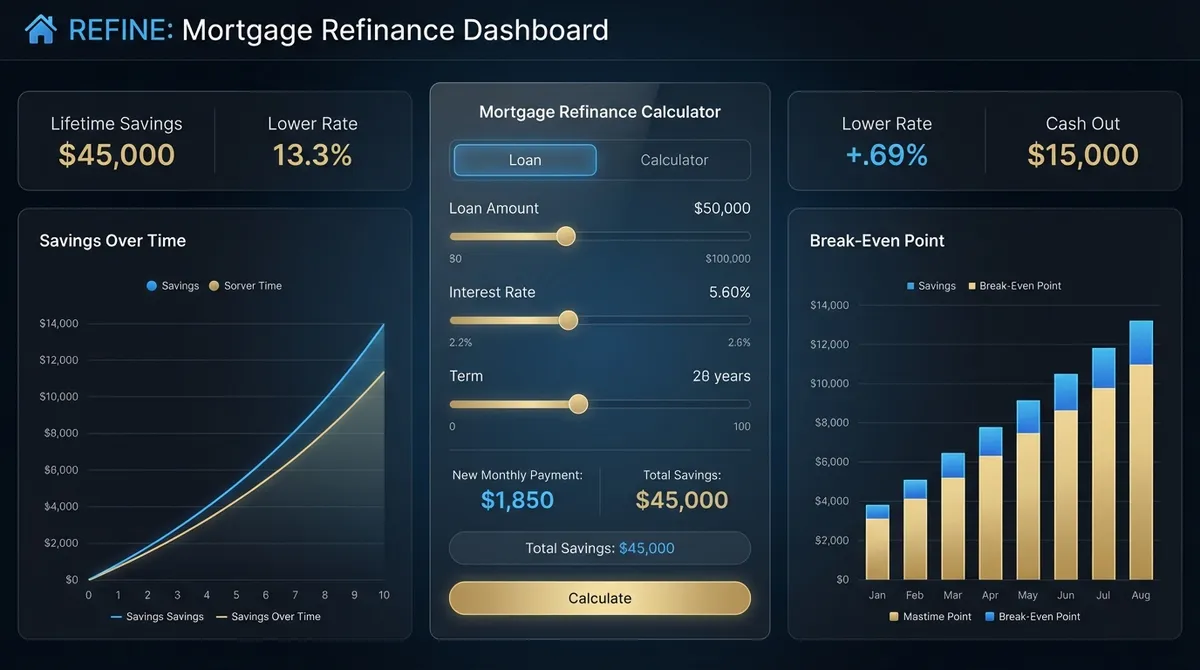

The Math Behind the Calculator

Our calculator cuts through the noise by focusing on the three numbers that matter most: Monthly Savings, Break-Even Point, and Lifetime Savings. Here is how we calculate them:

1. The Break-Even Formula

This is the "golden number" for refinancing. It tells you how many months it takes for your monthly savings to pay back the closing costs.

Example: If refinancing costs you $4,000 upfront but saves you $200 per month, your break-even point is 20 months. If you move out in 18 months, you lose money.

2. Lifetime Interest Savings

We compare the total interest you would pay on your current path (remaining years) versus the total interest of the new loan. This reveals the "hidden cost" of refinancing: extending your term.

Warning: If you have 20 years left on a mortgage and refinance into a new 30-year loan, you might lower your monthly payment but pay more interest over the long run because you've added 10 extra years of payments.

Strategic Guide: When to Pull the Trigger

Not every lower rate is worth taking. Conventional wisdom suggests refinancing if rates drop by 1%, but the real answer depends on your timeline.

The "Forever Home" Strategy

If you plan to stay in your home for 10+ years, prioritizing the lowest possible interest rate is key. Even high closing costs pay for themselves over a long decade of savings.

The "Cash Flow" Strategy

If money is tight, refinancing to a longer term (e.g., restarting a 30-year clock) can drastically lower monthly payments. You pay more interest long-term, but you gain immediate breathing room in your monthly budget.

The "Aggressive Payoff" Strategy

Refinancing from a 30-year to a 15-year mortgage usually secures the lowest possible rate. Your monthly payment might go up, but you will build equity effectively twice as fast and save massive amounts on interest.

Common "Gotchas" to Avoid

- Resetting the Clock Blindly: Don't refinance a 22-year-old loan into a 30-year loan without realizing you are adding 8 years of payments.

- Ignoring "No-Closing-Cost" Detail: These loans aren't free. Lenders typically charge a higher interest rate to cover the fees. Run the math to see if the higher rate is worth the upfront savings.

- Prepayment Penalties: Always check if your current loan charges a fee for paying it off early (refinancing counts as paying it off).

Refinancing FAQ

How often can I refinance my mortgage?▼

There is no legal limit to how often you can refinance. However, lenders may require a "seasoning" period (usually 6 months) between closing your last loan and opening a new one. More importantly, you need to ensure the closing costs of each refinance don't eat up your savings.

Does refinancing hurt my credit score?▼

Temporarily, yes. When you apply, lenders perform a "hard inquiry" which can drop your score by 5-10 points. However, if you make your new payments on time, your score will recover quickly. Properly managing a new loan can actually improve your credit mix over time.

What is a "Cash-Out" Refinance?▼

This involves taking out a new loan for more than you owe on your home and pocketing the difference in cash. It's often used for home improvements or debt consolidation. Be careful—this increases your total debt load and often comes with a slightly higher interest rate than a standard "rate-and-term" refinance.

Should I pay "points" to lower my rate?▼

Discount points are upfront fees paid to the lender to buy down your interest rate. One point costs 1% of the loan amount and typically lowers the rate by 0.25%. Calculate the break-even period specifically for the cost of the points. If you plan to stay in the home for 10+ years, paying points can save you significant money.

The Refinance Timeline: What to Expect

Refinancing isn't an overnight event. On average, it takes 30 to 45 days from application to closing. Understanding this timeline helps you avoid frustration and lock in rates at the right moment.

Weeks 1-2: Application & Locking the Rate

Once you choose a lender, you will submit a formal application. This triggers a Loan Estimate (LE), which details your rate, closing costs, and terms. Crucial Step: You must decide whether to "float" your rate (hope it goes lower) or "lock" it (guarantee it won't rise). In a volatile market, locking is usually safer.

Week 3: Underwriting & Appraisal

The "Underwriter" is the financial detective who verifies your income, assets, and debt. Simultaneously, an appraiser will visit your home to determine its current market value. If the appraisal comes in low (lower than your estimated value), it can derail the refinance or require you to bring cash to closing.

Week 4: The Closing Disclosure (CD)

By law, you must receive the Closing Disclosure 3 business days before you sign the final papers. This document mimics the Loan Estimate but contains the final numbers. Compare them line-by-line. If fees jumped unexpectedly, now is the time to ask "Why?".

Week 5: Closing & Funding

You sign the papers. However, for a primary residence refinance, the loan does not fund immediately. There is a mandatory 3-Day Right of Rescission period where you can cancel the loan for any reason without penalty. On the 4th business day, the old loan is paid off, and the new one begins.

Summary checklist before you apply

- Check your credit score (740+ gets the best rates).

- Calculate your home equity (usually need 20% to avoid PMI).

- Gather documents: Pay stubs, W-2s, and bank statements.

- Shop around: Get Loan Estimates from at least 3 lenders.

- Use this calculator to verify the "Break-Even" point on every offer.

The Final Verdict: Is it Worth It?

Refinancing is not free money—it's a strategic tool. It costs money to save money. The key is ensuring the savings outweigh the costs within a timeframe that makes sense for your life plans.

Use our calculator to run three scenarios:

- Scenario A: Conservative (Rate drops 0.5%, no points).

- Scenario B: Aggressive (Rate drops 1.0%, pay 1 point).

- Scenario C: Short Term (Switch to 15-year fixed).

The best deal isn't always the lowest rate—it's the one that aligns with how long you'll stay in the home.