Complete Guide to Net Profit Calculation

Understanding your company's net profit is fundamental to making informed business decisions. Whether you're a small business owner evaluating quarterly performance or a financial analyst assessing corporate health, net profit calculation provides the clearest picture of bottom-line success.

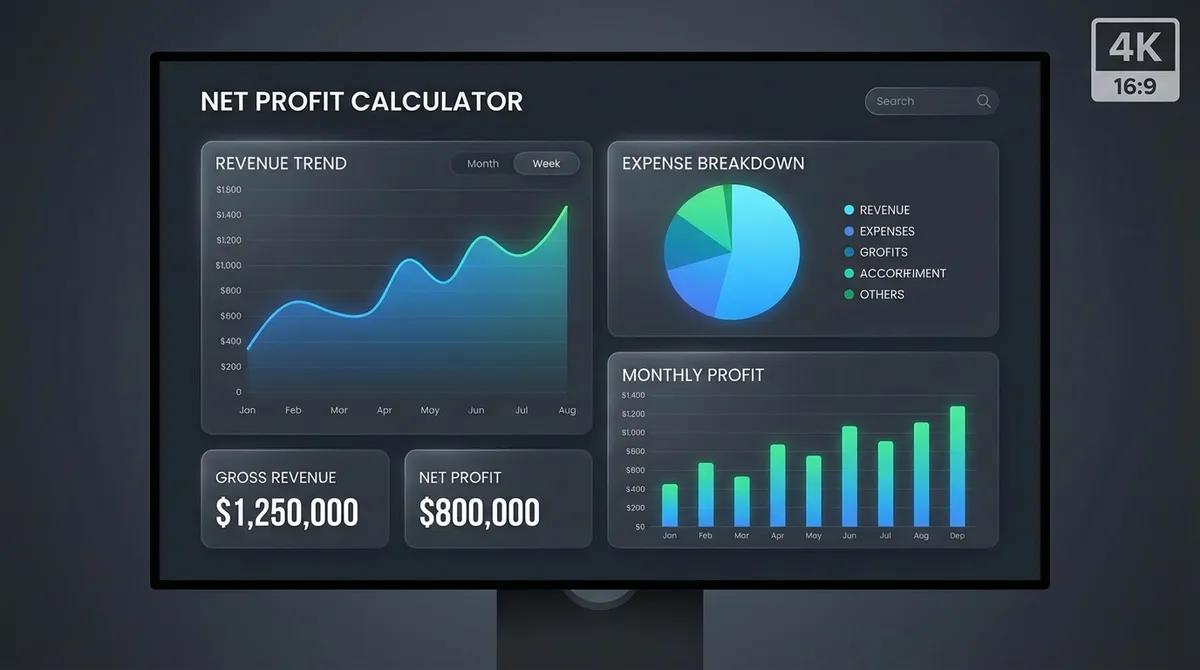

In 2025, with economic uncertainties and evolving market conditions, having an accurate grasp of your net profit margin isn't just helpful—it's essential for survival and growth. Our net profit calculator simplifies this critical calculation, helping you understand exactly how much profit your business generates after all expenses are accounted for.

What Is Net Profit and Why Does It Matter?

Net profit is the amount of money your business retains after subtracting all operating expenses, interest payments, taxes, and other costs from total revenue. It's often called the "bottom line" because it appears at the bottom of your income statement and represents the ultimate measure of profitability.

For Business Owners

- •Determines if your business model is sustainable

- •Guides pricing and cost-cutting decisions

- •Impacts your ability to secure financing

For Investors

- •Evaluates company financial health

- •Compares profitability across companies

- •Assesses long-term viability

How to Calculate Net Profit

Net Profit Formula

Net Profit = Revenue - COGS - Operating Expenses - Interest - Taxes

Net Profit Margin = (Net Profit ÷ Revenue) × 100

Breaking Down Each Component:

Revenue

Total income from sales of goods or services before any expenses are deducted.

Cost of Goods Sold (COGS)

Direct costs of producing goods or services, including materials and labor directly tied to production.

Operating Expenses

Indirect costs like rent, utilities, marketing, administrative salaries, and other overhead.

Interest

Cost of borrowing money, including loan interest, bond interest, and other financing costs.

Taxes

Federal, state, and local income taxes owed on business profits.

Real-World Example:

Let's say your business generated $1,000,000 in revenue last year. Your COGS was $400,000, operating expenses were $300,000, interest payments totaled $50,000, and you paid $80,000 in taxes.

Gross Profit = $1,000,000 - $400,000 = $600,000

Operating Profit = $600,000 - $300,000 = $300,000

Net Profit = $300,000 - $50,000 - $80,000 = $170,000

Net Profit Margin = ($170,000 ÷ $1,000,000) × 100 = 17%

What Your Net Profit Results Mean

Net Profit Margin Ranges

- Below 5%Low/Struggling

- 5-10%Average

- 10-20%Good

- Above 20%Excellent

Industry Benchmarks (2025)

- Technology15-25%

- Manufacturing5-15%

- Retail2-8%

- Professional Services10-20%

Note: Varies by sub-sector and business model

Interpreting Negative Net Profit

If your net profit is negative, your business is operating at a loss. This isn't automatically catastrophic—many startups and growth-stage companies operate at a loss while building market share. However, sustained losses require:

- •Careful cash flow management to ensure you can cover expenses

- •A clear path to profitability with specific milestones

- •Adequate funding or credit lines to sustain operations

Common Net Profit Calculation Mistakes

Mistake 1: Confusing Revenue with Profit

Many business owners celebrate high revenue figures without considering that net profit is what actually matters. A company with $10M in revenue but $9.9M in expenses has only $100,000 in net profit—a thin 1% margin.

How to avoid: Always calculate net profit margin alongside revenue growth. A smaller, profitable business often creates more value than a larger, unprofitable one.

Mistake 2: Ignoring Non-Cash Expenses

Depreciation and amortization are real expenses that impact net profit, even though they don't involve immediate cash outflow. Excluding these from calculations paints an inaccurate picture of profitability.

How to avoid: Include depreciation in operating expenses and amortization where applicable. While non-cash, they represent the consumption of business assets.

Mistake 3: Misclassifying Expenses

Putting expenses in wrong categories distorts your understanding of cost structure. For example, classifying marketing costs as COGS when they're actually operating expenses creates misleading gross profit calculations.

How to avoid: Understand the difference: COGS are direct production costs, while operating expenses are indirect business costs. Review expense classifications with your accountant quarterly.

Mistake 4: Not Accounting for Seasonal Variations

A single profitable quarter doesn't guarantee year-round success. Many businesses (retail, tourism, agriculture) experience significant seasonal fluctuations that affect annual net profit.

How to avoid: Calculate net profit monthly and annually. Compare same months year-over-year to identify true trends versus seasonal patterns.

The "Profit Trio": Gross vs. Operating vs. Net

Business owners often confuse these three metrics, but they tell completely different stories about your business's health. Understanding the nuance between them is the key to identifying where you are leaking money.

1. Gross Profit

Top Line EfficiencyRevenue - Cost of Goods Sold (COGS)

This measures how efficiently you produce your product. If this is low, your materials are too expensive or your pricing is too low. No amount of cost-cutting in the office can fix a broken gross margin.

2. Operating Profit (EBIT)

Core Business HealthGross Profit - Operating Expenses

This shows if your core business model works before financial engineering (interest) and government mandates (taxes) get involved. It includes rent, payroll, marketing, and software.

3. Net Profit

The Bottom LineOperating Profit - Interest - Taxes

The final scorecard. This is what you can actually put in the bank, distribute to shareholders, or reinvest. It accounts for debt service and tax liability, which can turn a profitable operating business into a net-loss business.

Strategies to Improve Net Profit Margin

Increase Revenue Smartly

- Upsell Priority: Focus on selling more to existing customers. It costs 5x more to acquire a new customer than to retain an existing one.

- Strategic Pricing: Use dynamic pricing or tiered packages. A small 1% price increase can improve net profit by 11% on average.

- Pareto Principle: Identify the 20% of products driving 80% of profit and double down. Ruthlessly cut low-margin SKUs.

Optimize Costs

- Zero-Based Budgeting: Don't just add 10% to last year's budget. Justify every expense from zero. This uncovers "zombie subscriptions" and waste.

- Vendor Negotiation: Re-quote your top 5 suppliers annually. Loyalty often leads to "price creep."

- Tech Stack Audit: Consolidate software tools. Are you paying for Zoom, Teams, and Slack? Pick one ecosystem.

Improve Operational Efficiency

- JIT Inventory: Reduce carrying costs by moving to Just-In-Time inventory, freeing up cash flow.

- Automate the Mundane: Use AI for customer support tier 1, data entry, and invoicing. Labor is often the highest operating expense.

- Remote Work: If feasible, reduce office footprint. Commercial real estate is a massive fixed cost.

Tax & Debt Optimization

- R&D Credits: Check if your business qualifies for federal R&D tax credits—it's not just for science labs.

- Refinance Debt: If rates drop, refinance high-interest loans immediately to lower interest expense.

- Harvest Losses: Sell underperforming assets to offset capital gains tax liability.

Key Takeaways

Net profit calculation is more than a simple subtraction—it's a window into your business's financial health and sustainability. By understanding each component of net profit, avoiding common calculation mistakes, and implementing strategic improvements, you can drive your business toward sustainable profitability.

Remember that net profit margin varies significantly by industry, business model, and economic conditions. Focus on improving your margin relative to your own historical performance and direct competitors rather than arbitrary benchmarks.

Next Steps to Improve Your Net Profit

- 1Use our net profit calculator above to establish your current baseline

- 2Identify your biggest expense categories and areas for potential reduction

- 3Calculate net profit monthly to track trends and measure improvement efforts

- 4Consult with financial professionals to optimize your business structure and tax strategy