Complete Guide to Nevada Paycheck Calculations (2025)

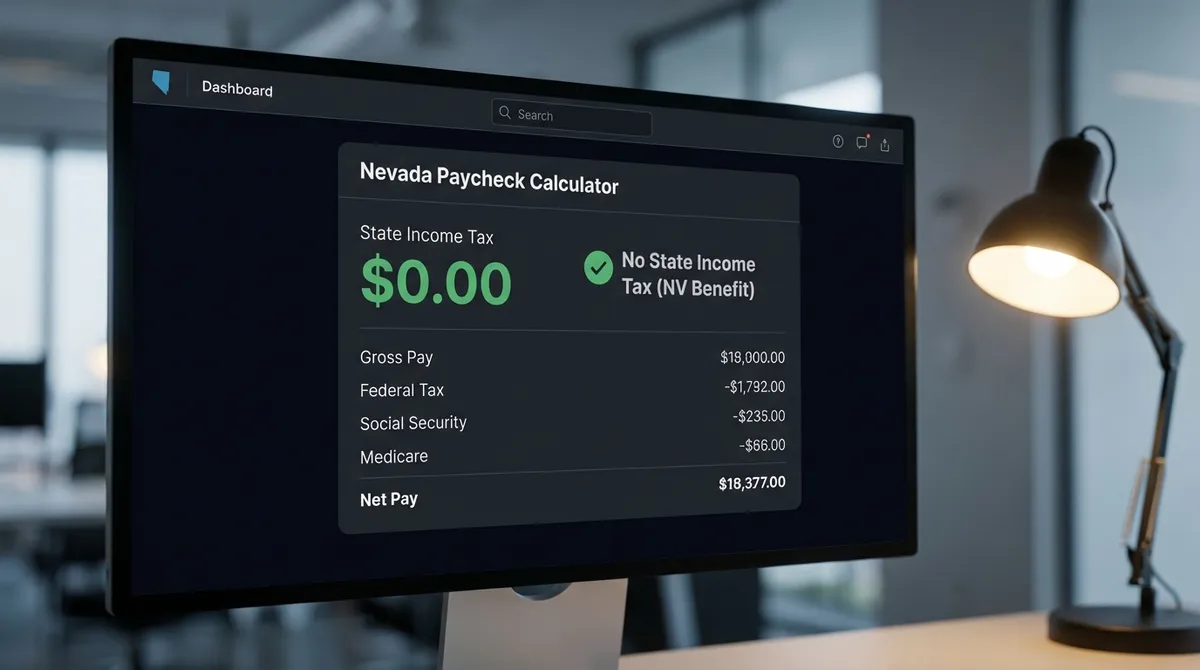

If you are working in Nevada, you are already ahead of the game. As one of only nine states with zero state income tax, Nevada allows you to keep a significantly larger portion of your earnings compared to residents in neighboring California or other high-tax states. However, understanding your take-home pay still requires navigating federal taxes and FICA deductions. Our 2025 Nevada Paycheck Calculator breaks down exactly where your money goes and helps you plan your financial future with precision.

The Nevada Advantage: Zero State Income Tax

The most powerful aspect of Nevada's tax code is its simplicity for employees: 0% state income tax. There are no brackets to calculate, no state returns to file in April, and no surprise bills from Carson City. This policy is enshrined in the state constitution, providing long-term stability for financial planning.

This lack of state tax acts as an automatic "raise" for workers moving from other states. For example, a move from California (with marginal rates up to 14.4%) or Oregon (up to 9.9%) to Nevada can effectively increase your disposable income by thousands of dollars annually without a change in gross salary.

💰 Comparison: Earning $100,000 Annually

State Tax: ~$6,500

Take Home: Significantly Lower

State Tax: $0

Take Home: +$6,500 more

Understanding Your Paycheck Deductions in 2025

While the state takes nothing, the federal government still requires its share. Here is a breakdown of the comprehensive deductions you will see on your pay stub:

1. Federal Income Tax (The Big One)

This is a progressive tax, meaning rates increase as you earn more. For the 2025 tax year, the IRS has adjusted brackets for inflation. Rates range from 10% to 37%. Your effective rate is usually much lower than your top marginal rate because of the standard deduction ($15,000 for singles, $30,000 for married couples in 2025). Employers use the information from your W-4 form to estimate how much to withhold from each paycheck.

2. FICA Taxes (Non-Negotiable)

Passed under the Federal Insurance Contributions Act, these taxes fund Social Security and Medicare. These are flat-rate taxes that apply to almost every employee:

- Social Security (6.2%): Applied to the first $176,100 of wages in 2025. This counts toward your future retirement benefits. Once you earn above this cap, this tax stops for the rest of the year.

- Medicare (1.45%): Applied to all wages with no limit. Unlike Social Security, there is no income cap.

- Additional Medicare Tax (0.9%): High earners (wages over $200k for singles, $250k for combined joint filers) pay this extra surtax on amounts above the threshold.

Nevada's Unique Overtime Rules

Nevada has one of the most unique overtime laws in the country. While federal law only requires overtime pay (1.5x regular rate) for hours worked over 40 in a week, Nevada adds a daily overtime requirement for certain employees.

If an employee earns less than 1.5 times the Nevada minimum wage, they must be paid overtime for any time worked over 8 hours in a single 24-hour period. This is crucial for shift workers in hospitality, gaming, and services. For employees earning above this threshold, the standard federal "over 40 hours per week" rule applies.

Strategic Moves to Lower Your Tax Bill

Since you don't have state taxes to worry about, you can focus entirely on optimizing your federal tax liability. Here are the most effective strategies for 2025:

Max Out Pre-Tax 401(k)

Every dollar contributed to a traditional 401(k) reduces your taxable income efficiently. For 2025, you can contribute up to $23,500 (plus catch-up contributions if 50+). This directly lowers the amount subject to federal income tax.

Utilize an HSA

If you have a high-deductible health plan, a Health Savings Account (HSA) offers a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses. It is often called the "ultimate retirement account."

Nevada vs. Neighbors: A Cost of Living & Tax Analysis

Choosing where to live involves more than just looking at the income tax rate. While Nevada's 0% state income tax is a massive headline benefit, it is crucial to understand the broader economic picture when comparing it to neighboring states like California, Arizona, and Utah.

Housing Costs and Property Taxes

Nevada's housing market has seen significant appreciation, particularly in the Las Vegas and Reno metro areas. However, compared to coastal California markets, Nevada still offers substantial value. Property taxes in Nevada are also relatively low, with a cap on how much the taxable value of a primary residence can increase each year (typically 3%). This abatement law prevents the massive spikes in property tax bills that homeowners in other states often face during real estate booms.

For instance, a $500,000 home in Nevada might have a property tax bill significantly lower than a similarly priced home in Texas or New Jersey, further compounding the savings from the lack of income tax. When you calculate your "all-in" tax burden—income tax, property tax, and sales tax—Nevada consistently ranks as one of the most taxpayer-friendly environments in the nation.

Sales Tax Considerations

To fund state services without an income tax, Nevada relies heavily on sales tax and gaming revenue. Sales tax rates in Nevada can be higher than the national average, often hovering around 8.375% in Clark County. This is a consumption tax, meaning you have more control over it than an income tax. By being mindful of large purchases, residents can manage this cost effective. Additionally, groceries and medicine are generally exempt from sales tax, which protects essential spending from this levy.

Advanced Tax Planning for Nevada Residents

For high-net-worth individuals and business owners, Nevada offers benefits that go beyond simple paycheck withholdings. The state's favorable trust laws and lack of estate tax make it a premier destination for wealth preservation.

Nevada Asset Protection Trusts

Nevada is famous for its "Self-Settled Spendthrift Trust," also known as the Nevada Asset Protection Trust (NAPT). This legal structure allows you to protect your assets from future creditors while still retaining some benefit from the trust assets. Unlike many other states, Nevada has a short statute of limitations for future creditors (typically two years), making it one of the strongest asset protection jurisdictions in the United States.

No Estate or Inheritance Tax

Nevada does not impose a state-level estate tax or inheritance tax. This is a critical distinction from states like Washington or Oregon, which tax estates at significant rates. For retirees and those planning their legacy, this ensures that more of your hard-earned wealth passes directly to your heirs rather than the state government.

Frequently Asked Questions

Does Nevada charge any "hidden" payroll taxes?

No. There are employer-side taxes like the Modified Business Tax (MBT) and Unemployment Insurance (UI), but these are paid by the company, not deducted from your wages. As an employee, your paycheck is free of any state-level deductions. You get to keep what you earn, minus federal obligations.

How does pay frequency affect my taxes?

Your pay frequency (weekly, bi-weekly, semi-monthly, monthly) does not change your total annual tax liability. However, it changes the size of each paycheck's withholding. Weekly checks have smaller withholdings per check, while monthly checks have larger ones. At the end of the year, the total tax paid should be identical regardless of frequency.

I work remotely for a California company. Do I pay CA tax?

Generally, no. If you live and physically perform your work in Nevada, you are subject to Nevada tax laws (which means $0 state tax). You should ensure your employer has updated your work location to Nevada in their payroll system to stop California withholding. If they continue to withhold CA tax, you will likely have to file a non-resident CA return to claim a refund, which can be a hassle.

Are gaming winnings taxable in Nevada?

Yes, but only at the federal level. Nevada does not tax lottery or gambling winnings. However, the IRS considers gambling winnings as taxable income. If you win a significant amount, the casino may issue you a Form W-2G. You can deduct gambling losses up to the amount of your winnings if you itemize deductions on your federal return.

What about tips? Are they taxable?

Yes. The IRS treats tips as regular income. You are required to report all cash and credit card tips to your employer. Your employer will then withhold federal income tax, Social Security, and Medicare taxes from your paycheck based on these reported tips. In Nevada's service-heavy economy, accurate tip reporting is vital.

Final Takeaway

Your Nevada location is a financial asset. By having zero state tax drag, your path to wealth building is shorter. Use the calculator above to verify your paychecks and ensure you are maximizing your federal tax savings through pre-tax contributions. Smart planning today means more money in your pocket tomorrow.