Complete Guide: New York Paycheck Calculator: 2025 Tax Rates & Withholding

Understanding your paycheck in New York can be complicated. Between federal taxes, the progressive New York State tax, and potential local taxes for NYC or Yonkers, the difference between your gross salary and your net take-home pay is significant. For 2025, changes to standard deductions and tax brackets mean your paycheck might look different than last year.

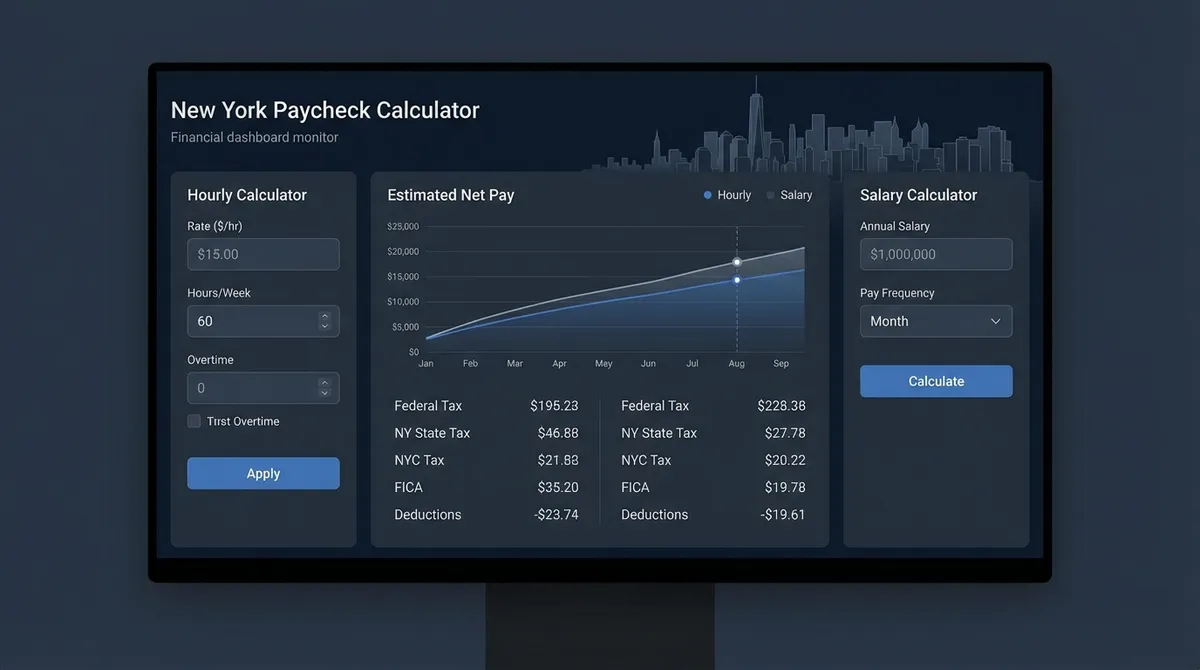

This calculator is designed to provide highly accurate estimates for 2025, factoring in the updated standard deductions (Federal and NYS), current FICA limits, and specific mandates like New York Paid Family Leave (PFL). Whether you live in Manhattan, Buffalo, or anywhere in between, knowing your true buying power is the first step in effective financial planning.

How We Calculate Your NY Paycheck

We use a comprehensive 6-step process to ensure accuracy:

1. Pre-Tax Deductions

We subtract 401(k) contributions and medical premiums first, as these lower your taxable income.

2. Federal Taxes (2025)

We apply the 2025 Standard Deduction ($15,750 for singles) before calculating progressive federal tax.

3. FICA Taxes

Social Security (6.2%) is capped at the 2025 wage base of $176,100. Medicare is 1.45% uncapped.

4. NY State & Local

We apply NY State brackets (4% - 10.9%) and NYC local tax (3.078% - 3.876%) if applicable.

Key 2025 Tax Updates for New York

- Standard Deductions Increased: The federal standard deduction rose to $15,750 for singles (up from $14,600). This shields more of your income from federal tax.

- Paid Family Leave (PFL): The 2025 employee contribution rate is 0.388% of gross wages, capped at an annual maximum contribution of approximately $354.53.

- FICA Wage Base: Social Security tax now applies to the first $176,100 of earnings, an increase from 2024.

New York State Income Tax Brackets (2025 Est.)

New York has a progressive tax system. However, it also has a unique "tax benefit recapture" rule, which means high earners effectively pay a flat tax at the top rate on all income, not just the income in the top bracket.

| Taxable Income (Single) | Tax Rate |

|---|---|

| $0 - $8,500 | 4.00% |

| $8,501 - $11,700 | 4.50% |

| $11,701 - $13,900 | 5.25% |

| $13,901 - $80,650 | 5.50% |

| $80,651 - $215,400 | 6.00% |

| $215,401 - $1,077,550 | 6.85% |

| $1,077,551 - $5,000,000 | 9.65% |

| $5,000,001 - $25,000,000 | 10.30% |

| Over $25,000,000 | 10.90% |

New York Standard Deductions

Your NYS Standard Deduction depends on your filing status. Note that you can claim the NYS Standard Deduction even if you itemize on your federal return.

The NYC & Yonkers Factor

One unique aspect of New York taxation is the hyper-local income tax.

New York City Residents

If you live in one of the five boroughs (Manhattan, Brooklyn, Queens, Bronx, Staten Island), you pay an additional city income tax ranging from **3.078% to 3.876%**. This is on top of state and federal taxes.

Yonkers Residents

Yonkers residents pay a surcharge equal to **16.75% of their Net State Tax**. Non-residents working in Yonkers pay a smaller "earnings tax" of 0.50% on wages earned there.

How Bonuses Are Taxed in NY

Receiving a bonus is great, but the tax withholding can be a shock. Employers often use the "supplemental rate" method for bonuses, commissions, and overtime.

The Withholding Rates:

- Federal: 22% flat rate (for bonuses under $1 million).

- New York State: 11.7% flat withholding rate (guideline).

- New York City: 4.25% flat withholding rate (guideline).

- Yonkers: 1.95975% flat withholding rate (guideline).

*Note: This is just withholding. When you file your tax return, the bonus is added to your regular income and taxed at your actual bracket. If 11.7% was too high for your bracket, you'll get a refund.

Maximizing Your Take-Home Pay

Pre-Tax Deductions

Contributions to a 401(k), 403(b), or HSA are removed from your gross pay before taxes are calculated. This lowers your taxable income for Federal and NY State taxes (though FICA still applies).

Tip: Maxing out your 401(k) in 2025 can save you thousands in taxes at your top marginal rate.

Commuter Benefits

If you work in NYC, take advantage of pre-tax commuter benefits for transit cards (like MetroCard or OMNY) and parking.

Tip: This money avoids Federal, State, Local, AND FICA taxes, making it one of the most efficient ways to pay for your commute.

Example: NYC Salary Breakdown

Scenario: $100,000/year, Single, Living in Brooklyn (2025)

Assuming 5% 401(k) contribution and $150/mo medical premium.

*Estimates are rounded for simplicity. Actual taxes depend on specific withholdings and updated brackets.

The "Convenience of the Employer" Rule Explained

New York is famous for its aggressive taxation of remote workers. Under the "Convenience of the Employer" rule, if you work for a New York-based company but choose to work remotely from another state (like New Jersey or Connecticut) for your own convenience rather than your employer's necessity, you still owe New York income tax on those wages.

Exception: If your employer requires you to work from a home office out-of-state (e.g., to cover a sales territory in that region), those days may be exempt from NY tax. Proper documentation is critical.

Frequently Asked Questions (FAQ)

Why is my paycheck lower than expected in NYC?

New York City is one of the few municipalities in the US with its own personal income tax. This ranges from 3.078% to 3.876% on top of the NY State tax (4%-10.9%) and Federal tax. If you live in NYC, this triple taxation layer significantly reduces your net pay compared to living in a neighboring county like Nassau or Westchester, even with the same gross salary.

Do I pay NY tax if I live in NJ/CT but work in NY?

Yes. New York follows the "convenience of the employer" rule. If your office is in NY, you generally owe NY nonresident income tax on wages earned there, even if you work remotely from NJ or CT. However, you typically get a tax credit on your home state return to avoid double taxation, though the specifics depend on your state's reciprocity laws.

What is the NY Paid Family Leave (PFL) deduction?

New York State law requires most private employees to contribute to PFL insurance. For 2025, the rate is 0.388% of your gross wages, but checks are capped at the statewide average weekly wage. This money funds paid time off for bonding with a new child or caring for a sick family member. It is a mandatory deduction for most workers.

Are bonuses taxed differently in NY?

Bonuses are considered "supplemental wages." Employers often withhold federal tax at a flat 22% and NY state tax at a flat 11.7% (guideline rate). However, when you file your annual return, the bonus is added to your total income and taxed at your actual marginal rate. You may get a refund if the 11.7% withholding was too high for your bracket.

How can I increase my take-home pay?

While you can't change tax rates, you can lower your taxable income. Contributing to a traditional 401(k), FSA, or HSA reduces the amount of income subject to Federal and State taxes. Additionally, ensuring your W-4 and NY IT-2104 forms are accurate helps prevent over-withholding, giving you more money in each paycheck rather than waiting for a refund.