Complete Guide: Net Present Value (NPV) Analysis

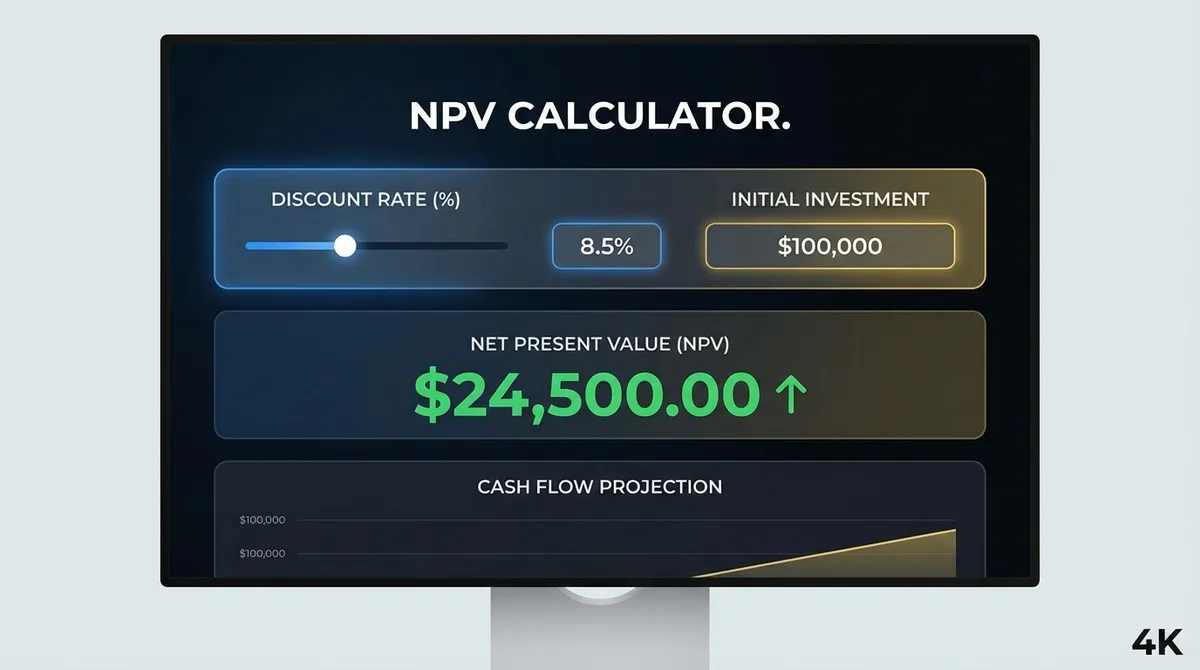

Making smart investment decisions requires more than just intuition—it demands rigorous financial analysis. Net Present Value (NPV) stands as the gold standard for evaluating investment opportunities, used by Fortune 500 companies, financial institutions, and sophisticated investors worldwide. Our NPV calculator transforms complex discounting calculations into clear, actionable insights that can mean the difference between profitable ventures and costly mistakes.

Whether you’re evaluating a business expansion, analyzing real estate opportunities, or comparing equipment purchases, understanding NPV gives you a powerful framework for making data-driven decisions. This comprehensive guide will walk you through everything you need to know about Net Present Value, from basic concepts to advanced applications.

What Is Net Present Value and Why Does It Matter?

Net Present Value is a financial metric that calculates the difference between the present value of cash inflows and the present value of cash outflows over a specific period. In simpler terms, NPV tells you whether an investment will make you money in today’s dollars.

The core principle behind NPV is the time value of money—the concept that money available today is worth more than the same amount in the future due to its earning potential. This fundamental financial principle explains why receiving $1,000 today is preferable to receiving $1,000 five years from now.

Why NPV Matters for Your Financial Decisions

- •Objective Comparison: NPV provides a single dollar figure that allows you to compare completely different investment opportunities on equal footing

- •Risk Assessment: By incorporating a discount rate, NPV automatically accounts for the risk and opportunity cost of your capital

- •Long-term Perspective: NPV forces you to think through all future cash flows, promoting comprehensive financial planning

- •Value Creation Focus: Positive NPV projects create shareholder value, while negative NPV projects destroy it

How Net Present Value Calculations Work

The NPV calculation might seem intimidating at first, but breaking it down into components makes it accessible. The formula accounts for three critical elements: the timing of cash flows, the magnitude of cash flows, and the appropriate discount rate.

The standard NPV formula for multiple periods is:

NPV = Σ [CFt / (1 + r)^t] - Initial Investment

Where:

What This Means:

- •Each future cash flow is divided by (1 + discount rate) raised to the power of the time period

- •This discounting accounts for both time value of money and risk

- •The initial investment is subtracted at face value (time = 0)

- •Positive result = value creation; Negative result = value destruction

Critical Factors That Impact NPV Calculations

Understanding what drives NPV helps you make more accurate projections and better investment decisions. Several key factors can dramatically change your NPV results:

1. Discount Rate Selection

The discount rate is arguably the most sensitive input in NPV calculations. Small changes can dramatically alter results:

- • Too Low: May accept risky projects that appear profitable

- • Too High: May reject viable projects due to excessive conservatism

- • Just Right: Reflects your true opportunity cost and risk tolerance

Common approaches: WACC for corporations, required return for investors, risk-free rate plus risk premium

Deep Dive: How to Choose the Right Discount Rate

Selecting the correct discount rate is the "art" within the science of NPV. Here is a framework for 2025 (often used alongside ROI calculations):

Corporate Projects

Use Weighted Average Cost of Capital (WACC), typically 8-12%. This represents the blended cost of debt and equity financing. Internal Rate of Return (IRR) is often compared against this.

Real Estate

Use Cap Rate or Desired Rate of Return, typically 6-10%. Adjust higher for riskier development deals.

Personal Finance

Use your "Opportunity Cost"—what could you earn in the stock market? Typically 7-8% (historical market average).

Startup/VC

Use extremely high rates (30-50%) to account for the high probability of failure.

2. Cash Flow Timing and Magnitude

The timing of cash flows significantly impacts present value due to compounding effects:

- • Early Cash Flows: Worth more in present value terms

- • Later Cash Flows: Heavily discounted, worth substantially less

- • Large Amounts: Have magnified effects on overall NPV

Accelerating cash inflows or delaying outflows can significantly improve NPV

3. Project Duration and Terminal Value

Longer projects and their ending values require careful consideration:

- • Longer Horizons: Increase uncertainty and discounting impact

- • Terminal Value: Often represents significant portion of total NPV

- • Growth Assumptions: Perpetuity growth rates dramatically affect valuations

Be conservative with long-term projections and justify terminal value assumptions

Common NPV Calculation Mistakes to Avoid

Even experienced analysts can make errors in NPV calculations. Avoid these common pitfalls to ensure your investment decisions are based on solid analysis:

Mistake #1: Using Undiscounted Payback Period

The Error: Evaluating projects based on how quickly you get your money back without discounting future cash flows

The Problem: Ignores time value of money and cash flows beyond payback period

The Solution: Always use discounted cash flow analysis; supplement NPV with payback period, not replace it

Mistake #2: Incorrect Discount Rate Selection

The Error: Using arbitrary interest rates or cost of capital without reflecting true opportunity cost

The Problem: Leads to accepting marginal projects or rejecting good opportunities

The Solution: Base discount rate on WACC, required return, or risk-adjusted opportunity cost

Mistake #3: Ignoring Sunk Costs

The Error: Including money already spent in the initial investment figure

The Problem: Sunk costs shouldn't affect future decisions; they distort NPV analysis

The Solution: Only include incremental future cash outflows in initial investment

Mistake #4: Overly Optimistic Cash Flow Projections

The Error: Basing calculations on best-case scenarios without considering uncertainties

The Problem: Leads to accepting projects that underperform in reality

The Solution: Use base-case, optimistic, and pessimistic scenarios; apply sensitivity analysis

Mistake #5: Forgetting Working Capital Changes

The Error: Ignoring cash tied up in inventory, accounts receivable, or required cash balances

The Problem: Understates true investment requirement, overstates NPV

The Solution: Include working capital investments as cash outflows and releases as inflows

Strategies to Maximize NPV and Investment Returns

Improving NPV isn’t just about finding better projects—it’s about optimizing every aspect of your investments. Use these proven strategies to enhance your NPV analysis and investment outcomes:

Accelerate Cash Inflows

The Strategy: Move cash receipts earlier in the project timeline

Why It Works: Money received sooner has higher present value due to less discounting

Implementation: Offer early payment discounts, streamline billing, negotiate milestone payments

Optimize Discount Rates

The Strategy: Use project-specific rather than company-wide discount rates

Why It Works: Matches risk assessment to actual project characteristics, avoiding over-conservative hurdle rates

Implementation: Lower rates for proven business lines, higher rates for experimental ventures

Improve Cash Flow Accuracy

The Strategy: Develop more precise cash flow projections through better data. Verify assumptions with a future value calculator.

Why It Works: Reduces overestimation that leads to disappointing results

Implementation: Use historical data, consult industry benchmarks, validate with experts

Structure for Tax Efficiency

The Strategy: Optimize investment structure and depreciation timing

Why It Works: After-tax cash flows directly impact NPV; tax shields from depreciation add value

Implementation: Accelerate depreciation, maximize deductible expenses, consider pass-through entities

Key Takeaways for NPV Analysis Success

Net Present Value analysis remains the cornerstone of intelligent investment decision-making because it accounts for the most critical element in finance: time. By discounting future cash flows to their present value, NPV provides a clear, objective measure of whether an investment creates or destroys wealth. For further reading, check Investopedia's guide on NPV.

Critical Success Factors:

- • Accurate discount rate selection based on true opportunity cost

- • Realistic cash flow projections with multiple scenarios

- • Comprehensive analysis including all relevant costs and benefits

- • Regular reassessment as market conditions change

Next Steps:

- 1. Start with our NPV calculator above to analyze your investment

- 2. Test multiple scenarios with different discount rates

- 3. Validate assumptions with historical data or expert input

- 4. Combine NPV with other metrics like IRR and payback period

Remember: A positive NPV indicates value creation, but the magnitude matters too. A $10,000 NPV on a $1 million investment differs significantly from the same NPV on a $100,000 investment. Always consider NPV in context with investment size, risk profile, and strategic objectives.