Complete Guide to Ohio Paycheck Calculations & Take-Home Pay

If you live or work in Ohio, you already know that taxes here are a bit... different. Unlike most states where you just worry about federal and state taxes, Ohio adds a unique layer of complexity with its municipal and school district income taxes. This means your take-home pay can vary significantly depending on whether you live in Columbus, Cleveland, a township, or a specific school district. This guide breaks down every line item on your pay stub so you can understand exactly where your hard-earned money goes.

The "Ohio Difference": Why Your Location Matters

In most of the country, your tax rate is determined by how much you earn. In Ohio, it's determined by where you sleep at night. Ohio allows local governments to levy their own income taxes on top of the state rate. Here is the hierarchy:

Federal Taxes (Everyone Pays These)

- Federal income tax (progressive brackets from 10% to 37%)

- Social Security tax (6.2% on wages up to $168,600)

- Medicare tax (1.45% on all wages, plus 0.9% additional Medicare tax over $200,000)

- Standard deductions reduce taxable income ($14,600 single, $29,200 married filing jointly)

Ohio State Income Tax (Everyone in Ohio)

Ohio recently simplified its tax structure to a flat 3.5% rate for most taxpayers, down from progressive brackets. You can verify your specific liability with our Ohio Tax Calculator. This represents one of the lowest top state income tax rates in the Midwest, though Ohio's unique local tax structure means total state and local taxes are competitive with neighboring states.

Key point: Ohio state taxes are deductible on federal returns if you itemize, potentially reducing your effective federal tax rate.

Local Ohio Taxes (Location-Dependent)

- Municipal income taxes: 1% to 3.5% depending on city (Columbus: 2.5%, Cleveland: 2.5%, Cincinnati: 2.1%)

- School district taxes: Additional 0.5% to 2% in participating districts

- Total local burden: Can reach 4-5% in some areas of Ohio

Understanding Ohio Municipal Income Taxes

Ohio's municipal income tax system dates back to the 1960s and has become a significant revenue source for cities. Unlike most states where cities rely primarily on property taxes, Ohio municipalities use income taxes to fund essential services like police, fire departments, road maintenance, and public works.

How Municipal Taxes Work:

- Residency matters: You typically pay municipal tax to the city where you live, regardless of where you work

- Workplace withholding: If you work in a different city than you live, your employer may withhold for the work city, and you may owe additional taxes to your home city

- Tax credits: Many Ohio cities offer credits (usually 50% to 100%) for taxes paid to other municipalities

- Rates vary widely: From 0% in unincorporated areas to 3.5% in some cities

Example: Columbus Worker

If you live and work in Columbus with Columbus City Schools, your local tax burden is 2.5% (municipal) + 0.75% (school) = 3.25% local taxes. Combined with Ohio's 3.5% state rate, you're paying 6.75% in state and local taxes before federal taxes even begin.

Ohio School District Income Tax Explained

School district income taxes are perhaps Ohio's most unique feature. Over 200 school districts have voter-approved income taxes that fund education operations, infrastructure, and programs. These are separate from property taxes that fund school buildings and debt.

Key Facts About School District Taxes:

- Voter-approved: District residents vote to implement or renew these taxes

- Income-based: Calculated on your income, not property value

- Separate from property taxes: Both can apply simultaneously

- Flat rates: Typically 0.5% to 1.5%, with some districts up to 2%

- Residency determines liability: You pay if you live in the district on January 1st

How Pre-Tax Deductions Affect Your Ohio Paycheck

Pre-tax deductions are powerful tools for reducing your overall tax burden in Ohio. Because these deductions reduce your taxable wages before federal, state, and local taxes are calculated, they provide tax savings at every level.

401(k) Contributions

- Reduces federal, state, and local taxable income

- 2025 limit: $23,000 ($30,500 if age 50+)

- Saves approximately 25-30% in combined taxes per dollar contributed (Planning tip: use a 401(k) calculator to optimize)

- Grows tax-deferred until retirement

Health Insurance Premiums

- Typically 100% pre-tax for employee portions

- Reduces taxable wages at all levels

- Includes medical, dental, and vision premiums

- Family premiums can exceed $6,000 annually

The Ohio Tax Reform and Simplification (2024-2025)

Ohio recently underwent significant tax reform, gradually reducing and consolidating income tax brackets to reach a simplified flat rate. Understanding this history helps explain Ohio's current tax structure and future direction.

| Year | Top State Rate | Structure | Key Changes |

|---|---|---|---|

| 2023 | 3.99% | Progressive brackets | Multiple brackets from 0% to 3.99% |

| 2024 | 3.5% | Consolidated brackets | Reduced from 5 brackets to 2 |

| 2025 | 3.5% | Flat rate | Simplified to single flat rate |

Optimizing Your Ohio Paycheck: Smart Strategies

Maximize Pre-Tax Contributions

Every dollar you contribute to pre-tax accounts like 401(k)s, HSAs, or health insurance premiums reduces your taxable income at the federal, state, and local levels simultaneously. For a Columbus resident in the 22% federal bracket, each $100 of pre-tax contributions saves approximately $32 in combined taxes ($22 federal + $3.50 state + $6.50 local).

Understand Local Tax Implications Before Moving

Before relocating within Ohio, research the combined municipal and school district tax rates. Moving from a 0% local tax area to Columbus with Columbus City Schools increases your local tax burden by 3.25% of your income - that's $1,625 annually on a $50,000 salary. Use our calculator to compare scenarios before making housing decisions.

Review Your W-4 Allowances Annually

Life changes like marriage, having children, or buying a home affect your optimal withholding. Ohio uses federal allowances for state withholding purposes, so updating your federal W-4 automatically updates state withholding. Regular reviews prevent over-withholding (giving the government an interest-free loan) or under-withholding (owing penalties at tax time).

Common Ohio Paycheck Questions and Scenarios

Q: I work in Columbus but live in a suburb without municipal tax. Do I still owe Columbus tax?

A: Typically, Columbus requires non-resident workers to pay a reduced rate (usually 50-100% of the resident rate). However, your home suburb may offer credits that reduce or eliminate double taxation. Check with your employer's HR department or both city tax offices for specific requirements.

Q: How do I know what school district I live in?

A: School district boundaries don't always match city limits. You can find your school district by entering your address on the Ohio Department of Taxation website (via IRS) or checking your property tax bill. Many Ohio counties also have online school district lookup tools by address.

Q: Are bonuses taxed differently in Ohio?

A: Bonuses are considered supplemental wages and subject to the same federal and state income tax rates as regular wages. However, federal withholding on bonuses is typically at 22% (or 37% for amounts over $1 million), which may not match your actual tax bracket. Local taxes also apply to bonuses. Your actual tax liability depends on your total annual income, not the withholding rate.

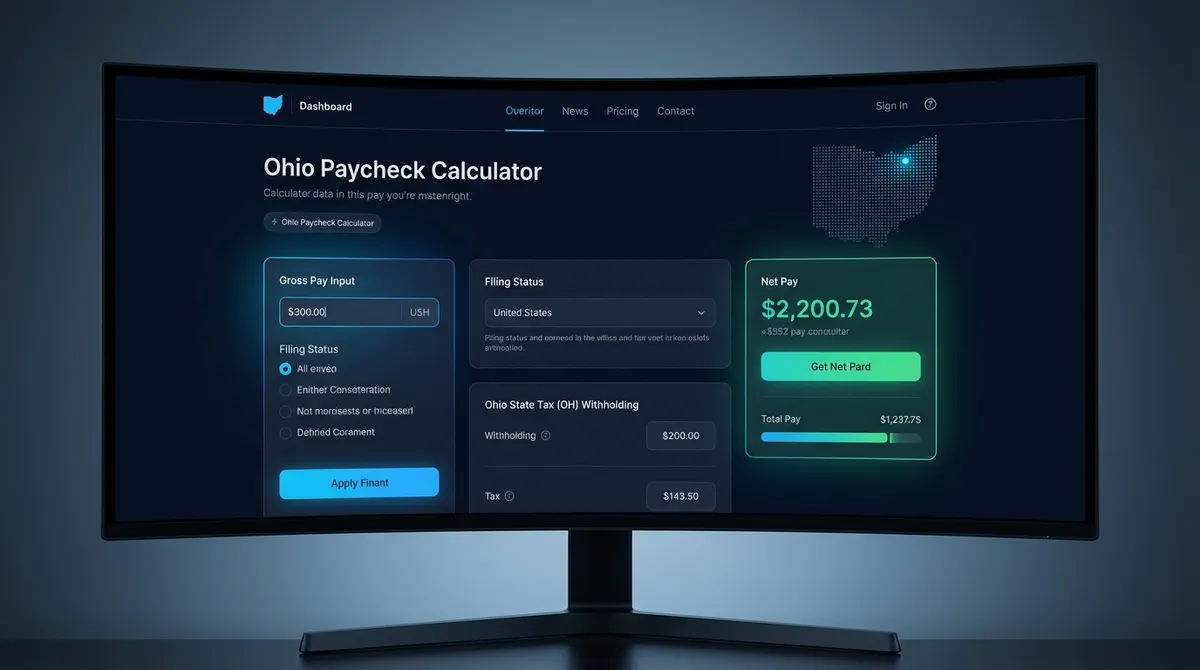

Using the Ohio Paycheck Calculator: What the Numbers Mean

Our calculator provides more than just a bottom-line net pay figure. Understanding each component helps you make informed financial decisions and spot potential errors on your actual paycheck.

Annual vs. Per-Paycheck Results

The calculator shows both annual totals and per-paycheck amounts based on your pay frequency. This helps you compare calculator results directly to your pay stub. Remember that per-paycheck amounts may vary slightly due to rounding or mid-year changes in tax laws or your personal situation.

Effective Tax Rates Explained

The calculator provides effective tax rates - the percentage of your income actually paid in taxes. This differs from marginal tax brackets, which are the rates applied to your last dollar earned. Your effective rate is always lower than your marginal rate because of deductions, credits, and progressive tax brackets. Use these rates to compare tax burdens across different income levels or locations.

Pre-Tax Deductions Impact

The calculator clearly shows how pre-tax deductions like 401(k) contributions affect multiple tax calculations simultaneously. A $5,000 401(k) contribution doesn't just save you $175 in Ohio state taxes (3.5% × $5,000). It also saves approximately:

- $750 in federal taxes (15% effective rate × $5,000)

- $125 in municipal taxes (2.5% × $5,000) if you live in Columbus

- $37.50 in school district taxes (0.75% × $5,000) in Columbus CSD

- Total savings: $1,087.50 annually, plus the $5,000 invested for retirement

Planning for Tax Changes and Life Events

Your Ohio paycheck will change throughout your career due to tax law changes, income adjustments, and life events. Our calculator helps you model these scenarios in advance.

Salary Increases

Before negotiating a raise or accepting a new job, use the calculator to estimate your new take-home pay. You might also find our hourly to salary calculator helpful. Remember that moving into a higher tax bracket only affects the income within that bracket - not your entire income.

401(k) Changes

Increasing your 401(k) contribution by 1% of your salary may only reduce your take-home pay by 0.6-0.7% due to tax savings. Use the calculator to find the optimal contribution rate that balances current cash flow with long-term retirement savings.

Relocation Within Ohio

Moving from a 0% local tax area to Columbus increases your local tax burden by 2.5-3.25% depending on school district. Over a 30-year career, that's equivalent to nearly a full year's salary in additional taxes - a factor worth considering in cost-of-living comparisons.

Conclusion: Mastering Your Ohio Paycheck

Understanding your Ohio paycheck is essential for effective financial planning. With federal, state, municipal, and school district taxes all impacting your take-home pay, accurate calculations require considering all four layers simultaneously. Our Ohio Paycheck Calculator simplifies this complexity, providing accurate estimates that account for Ohio's unique multi-layer tax structure.

Remember that tax planning is not a once-a-year activity. Review your paycheck calculations whenever you experience major life changes, receive raises, or when tax laws change. The difference between good and optimal withholding choices can amount to thousands of dollars annually - money that can fund retirement accounts, emergency savings, or other financial goals.

Disclaimer: This calculator provides estimates based on 2025 tax rates and should be used for planning purposes only. Individual circumstances, recent law changes, and specific local tax agreements may affect your actual tax liability. Consult a qualified tax professional for personalized advice and exact calculations.