Complete Guide: Ohio Income Tax System (2025)

Ohio continues its transition toward a simpler tax structure in 2025, consolidating to just two main tax brackets for most earners. With the top marginal rate now at 3.125% and a completely tax-free bracket for income up to $26,050, Ohio's system is becoming increasingly competitive.

This comprehensive guide simplifies the 2025 Ohio income tax landscape. We'll break down the new bracket limits, explain the crucial difference between simple "residence" and "school district" taxes, and show you exactly how to calculate your liability. Whether you're a W-2 employee in Columbus or a freelancer in the suburbs, accurate planning now can prevent surprise bills at tax time.

2025 Update: Ohio has streamlined its brackets. The first $26,050 of taxable income is now taxed at 0%. Income above that affects your rate, but unlike a true flat tax, the progressive nature (currently) means higher earners still pay a slightly higher effective percentage—though the simplified structure is paving the way for future flat-tax goals.

Top State Rate

3.125% (over $100K)

Local Tax Avg

~1.50% (Varies)

Tax-Free Income

First $26,050 (0%)

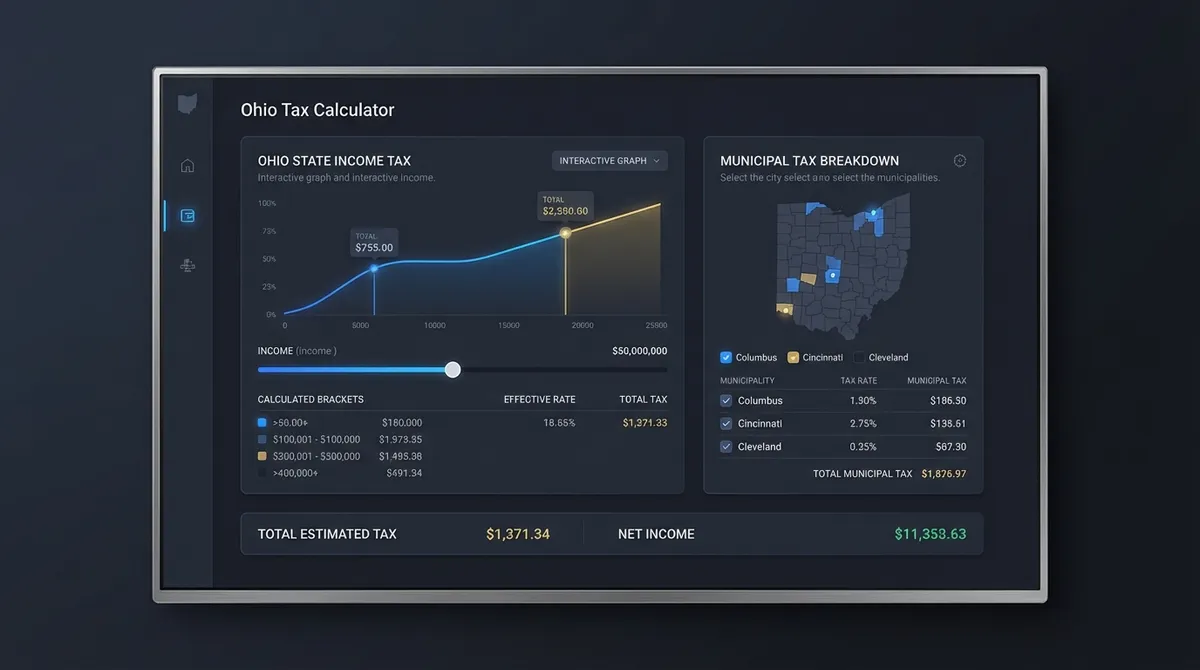

2025 Ohio Income Tax Brackets & Formula

The 2025 tax year features three distinct zones. If you earn less than $26,050, you owe no state income tax. Above that, the rates kick in progressively. Note that the "Base Tax" amounts have been updated to reflect the 0% rate on the initial income.

| Ohio Taxable Income | Tax Rate | Base Tax | How It Calculates |

|---|---|---|---|

| $0 - $26,050 | 0.00% | $0 | $0 tax due. |

| $26,051 - $100,000 | 2.75% | $0 | 2.75% of amount over $26,050. Check with our Tax Bracket Calculator. |

| Over $100,000 | 3.125% | $2,033.63 | $2,033.63 + 3.125% of excess > $100k. |

Real-World Calculation: Maria's $75,000 Income

Maria is a single filer living in Ohio with one child. She earns $75,000 annually. Since her income is between $40,000 and $80,000, her personal exemption is $2,150 per person (2 total). Here is her exact breakdown:

• Gross Income: $75,000

• Exemptions: 2 (Self + Child)

• Exemption Value: $2,150 each ($4,300 total)

• Local Tax Rate: 1.5% (Estimated)

• Taxable Income: $75,000 - $4,300 = $70,700

• Bracket: Level 2 (2.75%)

• Calculation: ($70,700 - $26,050) × 0.0275

• State Tax: $1,227.88

• Local Tax: $1,125.00 ($75k × 1.5%)

Key Insight: Notice how Maria's local tax ($1,125) is nearly as high as her state tax ($1,227). In Ohio, municipal taxes are assessed on gross wages (usually without exemptions), whereas state tax applies to adjusted income after exemptions. This "double layer" is why accurately calculating local tax is critical.

The "Other" Ohio Taxes: Municipal & School District

Ohio is unique in its heavy reliance on local income taxes. While the state rates have dropped, your total tax bill often depends more on your specific zip code than your salary.

Municipal (City) Income Tax

If you work in a city (like Columbus, Cleveland, or Cincinnati), you likely owe municipal tax to that city. If you live in a city with a tax, you owe it there too—though you often get a credit for taxes paid to your workplace city.

Common 2025 City Rates

- Columbus2.50%

- Cleveland2.50%

- Cincinnati1.80%

- Toledo2.50%

- Akron2.50%

Watch Out For:

Work-from-Home Rules: If you work remotely, you generally pay tax to your residence municipality, not the city where your company's HQ is located (unless you opt-in or specific local rules apply). Always verify your withholding if you've recently switched to remote work.

School District Income Tax (SDIT)

Over 200 school districts in Ohio levy an additional income tax. This is separate from property taxes.

- Traditional Base: Tax applies to the same income base as the state tax (wages, interest, etc.).

- Earned Income Only: Some districts only tax wages and self-employment income, exempting pensions/interest.

Check your paystub for a separate line item (often labeled "SDIT" or with a 4-digit district code). If it's missing and you live in a taxing district, you may owe a lump sum when filing.

Personal Exemptions & Deductions

Ohio's personal exemptions depend on your Adjusted Gross Income (AGI). As you earn more, the exemption amount slightly decreases.

Tier 1

$2,400

AGI ≤ $40,000

Tier 2

$2,150

$40,001 - $80,000

Tier 3

$1,900

AGI > $80,000

Valuable Deductions for 2025

Business Income Deduction (BID)

The "BID" is huge for small business owners. The first $250,000 of business income (Schedule C, LLC, etc.) is 100% deductible from Ohio state income tax. Any amount over $250k is taxed at a low flat rate of 3%.

Ohio 529 Plan

Contributions to Ohio's 529 CollegeAdvantage plan are deductible up to $4,000 per beneficiary, per year. Excess contributions can be carried forward to future years.

3 Smart Ways to Reduce Your Ohio Liability

Reciprocity Agreements

Ohio has reciprocity with neighboring states: Indiana, Kentucky, Michigan, Pennsylvania, and West Virginia.

If you live in Ohio but work in one of these states, you only pay Ohio income tax. You should file an exemption form with your employer so they withhold Ohio tax instead of the work state's tax. This saves you from filing two state returns (though local taxes may still apply).

School District Taxes

In addition to municipal taxes, some Ohio school districts levy their own income tax. This is separate from your city tax and property tax (or even sales tax).

Not every district has one, but if yours does, you must file Form SD 100. Rates typically range from 0.5% to 2.0%. Check the Ohio Department of Taxation's website (via IRS) to see if your residency address falls into a taxing school district.

1. Maximize the BID

If you have side hustle income, ensure you are classifying it correctly. The Business Income Deduction essentially makes the first $250k of profit tax-free at the state level (local taxes still apply). This is one of the most generous state tax perks in the US.

2. Check Municipal Credits

If you live in City A but work in City B, City B will withhold tax. City A implies you owe them too—but most cities offer a "credit" (often 50% or 100%) for taxes paid elsewhere. Verify this; if City A gives 100% credit, you shouldn't pay double tax.

Navigating RITA and CCA

Unlike many states where you file one local return, Ohio's system is decentralized. Many municipalities (over 300) use the Regional Income Tax Agency (RITA) or the Central Collection Agency (CCA) to handle collection.

What is RITA?

RITA collects taxes for approximately half of Ohio's municipalities. If you live or work in a RITA municipality, you must file a separate RITA return (Form 37) in addition to your state and federal returns.

What is CCA?

Similar to RITA, the CCA collects for Cleveland and dozens of other cities. You may need to file with CCA if your residence or workplace falls under their jurisdiction.

Pro Tip: Do not assume your tax software (like TurboTax) automatically files your RITA or CCA return. It often prepares the form but requires you to print and mail it, or file separately on the RITA/CCA website.

Important 2025 Deadlines

- Apr 15Federal and State Income Tax Filing Deadline.

- Apr 15Local Tax Filing Deadline (RITA/CCA/City).

- Oct 15Extended Filing Deadline (if extension filed).

Summary: Ohio Tax Cheat Sheet

- State Tax: 0% up to $26,050. Top rate 3.125% over $100k. Verify with Federal Income Tax Calculator.

- Local Tax: Flat rates (avg 1.5%), paid on gross wages. See Ohio Paycheck Calculator.

- Exemptions: $1,900 - $2,400 per person based on AGI.

- Business Income: First $250k is tax-free (state only).

- School District: Separate tax based on residency.