Complete Guide: Mastering Options Profit Calculations (2025)

Trading options without a clear profit target is like setting sail without a compass. You might catch a strong wind, but you have no idea where you'll end up. Whether you're buying your first call option or hedging a portfolio with puts, the difference between a lucky guess and a consistent strategy lies in the math.

This guide isn't just about plugging numbers into a box. It's about understanding the mechanics of risk and reward. We'll break down exactly how options pricing works, how to visualize your potential outcomes, and how to avoid the common traps that wipe out new traders.

The Math Behind the Trade

At its core, an option's profit isn't just "buy low, sell high." It's a function of the stock price relative to your strike price, minus the premium (cost) you paid. Let's strip away the jargon and look at the actual formulas.

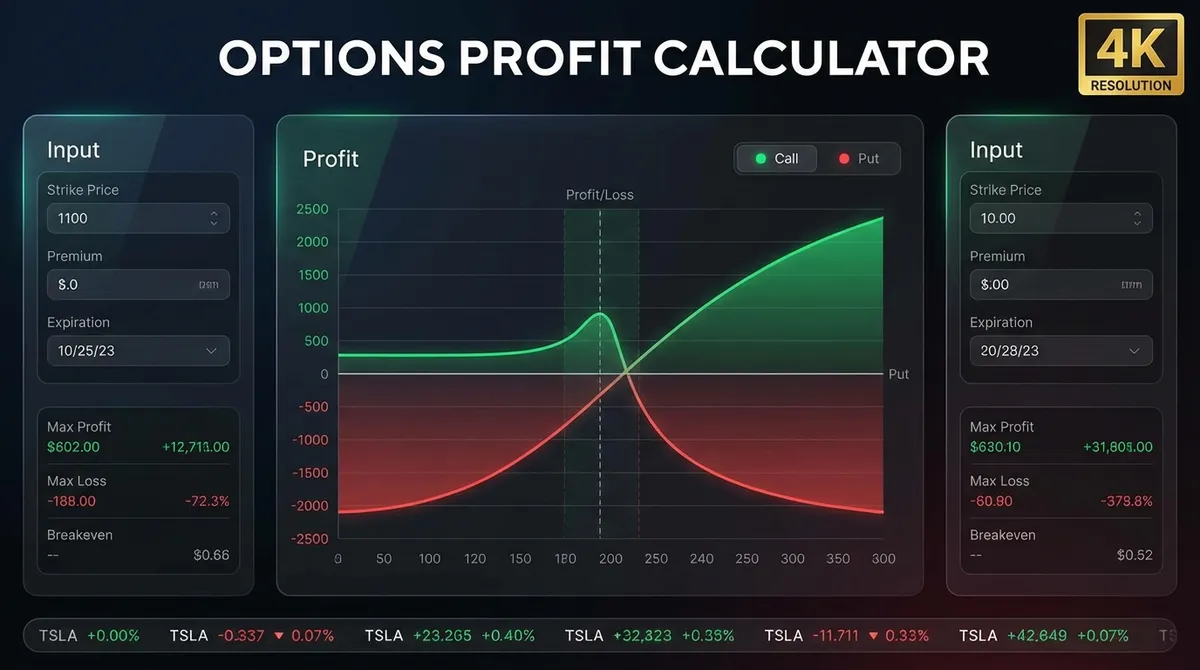

Call Options (Bullish)

You make money when the stock goes UP.

- ✓Max Profit: Unlimited (Stock can go to infinity)

- ✗Max Loss: Premium Paid (Limited risk)

- ?Breakeven: Strike + Premium

Put Options (Bearish)

You make money when the stock goes DOWN.

- ✓Max Profit: (Strike - Premium) × 100

- ✗Max Loss: Premium Paid (Limited risk)

- ?Breakeven: Strike - Premium

Why "Breakeven" Matters More Than You Think

New traders often think, "I bought a call at $100 strike, so if the stock hits $101, I make money." Wrong.

You paid a premium for that option. If you paid $2.00 per share, your actual cost basis is $102. If the stock is at $101 at expiration, you can exercise your option to buy at $100 and sell at $101, making $1.00 profit... but you paid $2.00 to get in. You still lost $1.00 per share.

Real-World Scenarios

Scenario 1: The "Moonshot" Call

You believe TechCorp (currently $150) is about to release a revolutionary product.

If TechCorp stays below $160, you lose your $500. If it hits $170, you make ($170 - $160 - $5) × 100 = $500 profit (100% return).

Scenario 2: The "Insurance" Put

You own 100 shares of SafeCo at $80, but earnings are coming up and you're nervous.

If SafeCo crashes to $50, your stock loses $3,000... but your put option gains ($75 - $50 - $2) × 100 = $2,300 profit. Your net loss is much smaller. You paid $200 to sleep well at night.

3 Traps That Kill Option Portfolios

The "Cheap" Option Fallacy

Buying "Out of the Money" (OTM) options looks cheap. "Only $0.10 per contract!" But if the probability of profit is 1%, that's not cheap—it's a lottery ticket. Most expire worthless.

Ignoring Theta (Time Decay)

Options are like ice cubes melting in the sun. Every day that passes, they lose value, even if the stock price doesn't move. Don't hold short-term options hoping for a miracle.

Over-Leveraging

Just because you can control 1,000 shares for $500 doesn't mean you should. One bad trade can wipe out your entire account if you go "all in" on options.

The Secret Language of Options: "The Greeks"

You can't drive a car just by looking at the speedometer. You need to check the fuel, the temperature, and the RPMs. In options trading, "The Greeks" are your dashboard. They tell you exactly why an option is priced the way it is.

Delta (Δ) - Speed

Measures how much the option price moves for every $1 move in the stock.

Example: If Delta is 0.50, and the stock goes up $1, your call option gains $0.50. It also roughly represents the probability of the option expiring In-The-Money.

Gamma (Γ) - Acceleration

Measures the rate of change of Delta. Gamma is highest for At-The-Money options near expiration. This is what causes "explosive" moves in option prices.

Theta (Θ) - Time Decay

Measures how much value the option loses per day just by existing. Theta is the enemy of the option buyer and the best friend of the option seller.

Vega (ν) - Volatility

Measures sensitivity to Implied Volatility (IV). If the market panics (IV spikes), Vega pumps up the price of both calls and puts, even if the stock price stays flat.

Advanced Strategies for 2025

Once you master the basics, you can combine calls and puts to create strategies for any market condition:

Covered Call

Own the stock? Sell a call against it to generate income. Lowers your risk but caps your upside.

Protective Put

Like buying insurance for your stock portfolio. Costs money, but limits downside.

Straddle

Buy a call AND a put. You profit if the stock moves massively in either direction.

Vertical Spread

Buy one option, sell another at a different strike. Defines your exact max profit and max loss.

Tax Treatment of Options: The Hidden Cost

Unlike holding stocks for the long term (which qualifies for lower Capital Gains rates), most options trades are short-term.

- Short-Term Capital Gains: Options held for less than a year (which is 99% of them) are taxed at your ordinary income tax rate. This can be as high as 37%.

- The Wash Sale Rule: Be careful! If you sell an option at a loss and buy a "substantially identical" one within 30 days, you cannot claim that loss on your taxes. This is a common trap for active traders.

- Section 1256 Contracts: Special index options (like SPX or NDX) get favorable "60/40" tax treatment (60% long-term, 40% short-term), regardless of holding period.

Glossary of Essential Options Terms

- Strike Price

- The specific price at which the option contract can be exercised.

- Expiration Date

- The date when the option contract becomes void and worthless.

- Premium

- The current market price to buy an option contract.

- Implied Volatility (IV)

- A metric that forecasts the likely movement of a stock's price.

- Delta

- How much an option's price changes for every $1 move in the stock.

- Theta

- The rate at which an option loses value as time passes.

Frequently Asked Questions

Do I need $25,000 to trade options?▼

No. The "Pattern Day Trader" (PDT) rule requires $25k minimal equity only if you make more than 3 day trades in a rolling 5-business-day period. If you hold positions overnight or trade less frequently, you can start with a much smaller account.

Can I lose more than I invest?▼

If you are buying calls or puts, your risk is limited to the premium paid. However, if you are selling (writing) naked calls, your risk is theoretically unlimited because the stock price can rise indefinitely. Always understand the risk profile before entering a trade.

What happens if my option expires in the money?▼

Most brokers will automatically exercise ITM options at expiration. This means you will buy (for calls) or sell (for puts) 100 shares of the stock at the strike price. If you don't have the funds to cover the shares, your broker may close the position for you before expiration.

Which options calculator is best for beginners?▼

Simple profit/loss calculators like this one are best for learning. As you advance, you may want to look at "Black-Scholes" calculators that factor in Greeks like Delta and Gamma to predict pricing changes more accurately.

Final Word

Options trading is a powerful tool for wealth generation, but it demands respect. Use this calculator to verify every single trade before you execute it. Know your max loss, know your breakeven, and never trade with money you can't afford to lose.