Complete Guide: Overtime Calculator: Calculate Your Time and a Half Earnings

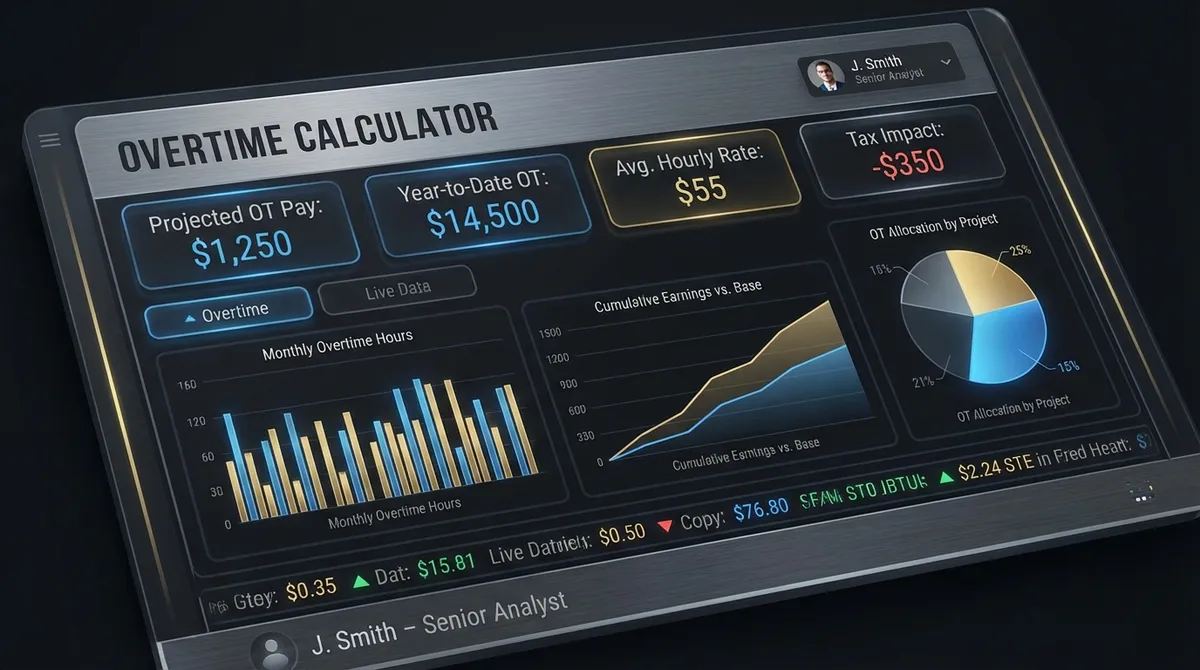

Are you getting paid every dollar you've earned? Overtime pay isn't just a bonus—it's your legal right. Whether you're grinding through a busy season, covering extra shifts, or working on holidays, ensuring your paycheck accurately reflects those long hours is critical. Our intelligent Overtime Calculator does the math for you, instantly breaking down your regular earnings, time-and-a-half, and double-time pay.

Federal laws under the Fair Labor Standards Act (FLSA) protect your right to fair compensation, but the calculations can get tricky—especially with variable rates, bonuses, or state-specific rules like California's daily overtime limits. This guide simplifies the complex world of payroll law into actionable insights, helping you verify your paystub and plan your financial future with confidence.

At a Glance: Overtime Rules

- The Golden Rule: Standard overtime is 1.5x your regular hourly rate for hours worked over 40 in a single workweek.

- Double Time: Some states and contracts require 2.0x pay for excessively long shifts (e.g., over 12 hours) or 7th consecutive workdays.

- Salary Exemptions: Not all salaried employees are exempt. If you earn under $684/week, you may still qualify for overtime.

- Bonuses Count: Non-discretionary bonuses must be included when calculating your "regular rate" for overtime purposes.

How Overtime Works: The Math Behind the Paycheck

The concept is simple: employers must pay a premium for hours that exceed the standard full-time schedule. This premium is designed to discourage overworking employees and to fairly compensate you for the loss of free time.

The Formula

The standard FLSA calculation follows this logic:

Regular Pay = Regular Hours × Hourly Rate

Overtime Rate = Hourly Rate × 1.5

Overtime Pay = Overtime Hours × Overtime Rate

Total Gross Pay = Regular Pay + Overtime Pay

Am I Exempt? The "White-Collar" Exemptions

To be denied overtime pay (Exempt status), you typically must meet all three of these tests:

- Salary Basis Test: You are paid a predetermined and fixed salary that is not subject to reduction because of variations in the quality or quantity of work performed.

- Salary Level Test: You are paid at least $844 per week ($43,888 annually) as of July 1, 2024 (increasing to $1,128/week in 2025).

- Duties Test: Your primary duty must be Executive, Administrative, or Professional (e.g., managing 2+ people, exercising independent judgment, or requiring advanced knowledge).

Real-World Examples

Let's look at how this plays out in real scenarios.

Scenario A: The 50-Hour Week

John earns $20/hr and works 50 hours.

- Regular (40 hrs): 40 × $20 = $800

- Overtime (10 hrs): 10 × $30 = $300

- Total Pay: $1,100

Scenario B: Holiday Double Time

Sarah earns $30/hr and works 8 hours on a double-time holiday.

- Regular Rate: $30.00 / hr

- Double Rate: $60.00 / hr

- Total Pay (8 hrs): $480

State-Specific Overtime Rules

While federal law is the floor, states can set a higher ceiling. Here are the key exceptions:

California

- Daily Overtime: 1.5x pay after 8 hours in a day.

- Double Time: 2.0x pay after 12 hours in a day.

- 7th Day: 1.5x pay for the first 8 hours on the 7th consecutive workday.

Colorado

- Daily Overtime: 1.5x pay after 12 hours in a day.

- Weekly Overtime: 1.5x pay after 40 hours.

Alaska

- Daily Overtime: 1.5x pay after 8 hours in a day.

- Weekly Overtime: 1.5x pay after 40 hours.

- Any voluntary flexible work plan must be approved by the Department of Labor.

Nevada

- Daily Overtime: 1.5x pay after 8 hours in a 24-hour period (if earning less than 1.5x minimum wage).

- Otherwise, standard 40-hour rule applies.

Common Questions & Edge Cases

Does Salary Mean No Overtime?

Not necessarily. "Salaried" does not automatically mean "exempt." If you earn less than $35,568 per year (as of 2024 regulations) or your duties are primarily non-managerial, you are likely entitled to overtime pay regardless of your salaried status.

California & Daily Overtime

Most states follow the federal "40-hour weekly" rule. California, however, is stricter: overtime kicks in after just 8 hours in a single day, and double time applies after 12 hours. Alaska, Nevada, and Colorado also have unique daily overtime rules.

Are Bonuses Included? (The "Weighted Average" Math)

This is where employers often make mistakes. If you receive a performance bonus ($100) and work 50 hours in a week, that $100 must be spread across all 50 hours to find your "Regular Rate."

Total Straight Time / 50 Hours = New Regular Rate

New Regular Rate × 0.5 × 10 Overtime Hours = Additional Overtime Due

This usually results in a small "retro update" check because the bonus effectively raised your hourly rate for that week.

Frequently Asked Questions

Is overtime pay taxed higher?▼

No, overtime is taxed at the same federal operational tax brackets as your regular income. However, because your paycheck is larger for that period, the withholding algorithm might withhold more tax temporarily, assuming you make that much every week. You'll get any excess back when you file your annual tax return.

Can my employer force me to work overtime?▼

Generally, yes. Under the FLSA, there is no limit to the number of hours employees aged 16 and older can be required to work. You can be fired for refusing overtime, unless you have a contract stating otherwise or there are safety regulations involved (e.g., for truck drivers or pilots).

What is unauthorized overtime?▼

If you work overtime without permission, your employer must still pay you for those hours. They cannot withhold pay for work performed. However, they can discipline or fire you for violating company policy regarding unauthorized work.

What about "Comp Time" instead of pay?▼

For private sector employees, offering compensatory time off (comp time) instead of cash overtime pay is generally illegal. Public sector (government) employees, however, may be able to accrue comp time at a rate of 1.5 hours off for every overtime hour worked.

Do salaried employees get double time?▼

Typically, exempt salaried employees do not receive overtime or double time. However, non-exempt salaried workers are eligible. Some companies may voluntarily offer double time for holidays or special circumstances as a benefit, even to exempt staff, but this is company policy, not federal law.

What counts as "Off-the-Clock" work?▼

Work performed "off-the-clock" is compensable. This covers preparation time (donning protective gear), cleaning up after a shift, or answering work emails from home. If your employer knows (or should know) you are working, you must be paid for that time, potentially at overtime rates.

How does "On-Call" time work?▼

It depends on how restricted you are. if you must stay on premises and cannot use time for your own purposes ("Engaged to Wait"), you must be paid. If you simply must carry a pager but can go to the movies ("Waiting to be Engaged"), you generally only get paid for actual time worked when called.

Remote Work & "Ghost" Overtime?▼

With remote work, the line between "home" and "work" blurs. Checking Slack at 8 PM or finishing a report on Saturday morning counts as work hours. Employers are legally required to track this time, but the burden often falls on you to report it accurately. Never under-report hours just to "look productive"—it sets a dangerous precedent and cheats you out of pay.