What Is Payback Period and Why It Matters in 2025?

Payback period is the financial metric that tells you exactly how long it takes to recoup your initial investment. Whether you're evaluating a new piece of equipment, a software upgrade, a marketing campaign, or an entire business acquisition, understanding your payback period helps you make smarter capital allocation decisions and manage cash flow effectively.

In 2025's uncertain economic climate, with interest rates fluctuating and capital becoming more expensive, knowing your payback period isn't just useful—it's essential for survival and growth. Unlike complex metrics like NPV or IRR, payback period gives you a simple, intuitive answer: "How many months or years until I get my money back?" This straightforward insight helps business owners, investors, and financial managers quickly screen opportunities and avoid cash flow traps.

Key Insight: A manufacturing company investing $200,000 in new automation equipment that generates $50,000 annual savings has a 4-year payback period. However, when you factor in a 10% discount rate for the time value of money, the discounted payback period stretches to 4.8 years—revealing the true cost of waiting for returns in today's dollars.

How Payback Period Calculations Work: Simple vs. Discounted

There are two ways to calculate payback period, and each tells a different story about your investment. Understanding both methods gives you a complete picture of your project's true timeline and profitability.

Simple Payback Period Formula

This formula works perfectly when cash flows are equal each year. For uneven cash flows, you calculate cumulative cash flow year-by-year until you reach the initial investment.

Discounted Payback Period Formula

Where r = discount rate, n = year. This method accounts for the time value of money, giving you the true break-even point in today's dollars.

Simple Payback Advantages

- • Easy to understand and calculate

- • Quick screening tool for projects

- • Focuses on cash flow recovery

- • Great for risk-averse companies

- • Helps with liquidity planning

Discounted Payback Benefits

- • Accounts for time value of money

- • More accurate financial picture

- • Considers opportunity cost

- • Better for long-term projects

- • Aligns with modern finance theory

Real-World Example: TechStart's Equipment Investment Decision

TechStart, a growing software development company, is considering investing $150,000 in new server infrastructure (potentially financed via a business loan). The CFO needs to determine if this investment makes financial sense and how long it will take to recover the initial cost.

Investment Details:

Initial Investment: $150,000

Year 1 Savings: $40,000 (reduced cloud costs)

Year 2 Savings: $45,000 (increased efficiency)

Year 3 Savings: $50,000 (full utilization)

Year 4 Savings: $35,000 (maintenance costs rise)

Year 5 Savings: $30,000 (technology refresh needed)

Company Discount Rate: 12%

The simple payback calculation shows the investment pays back in 3.4 years. However, when applying the 12% discount rate, the discounted payback period extends to 4.1 years. This 8-month difference might seem small, but it's crucial for cash flow planning and comparing against alternative investments that might offer better returns.

Decision Insight: TechStart's leadership decided to proceed with the investment because even the conservative discounted payback period of 4.1 years was well within their 5-year investment horizon. The project also offered strategic benefits beyond pure financial returns, including improved data security and faster development capabilities that weren't captured in the payback calculation.

Deep Dive: Solar Panel ROI Analysis

One of the most common consumer uses for this calculator is residential solar. Let's break down a complete 2025 scenario to show how tax credits influence the payback equation.

Costs & Incentives

- System Price (10kW):$25,000

- Federal Tax Credit (30%):-$7,500

- Net Investment:$17,500

Annual Savings

- Electricity Bill Savings:$2,400

- SREC Credits:$400

- Total Annual Cash Flow:$2,800

Common Payback Period Mistakes That Cost Real Money

Mistake #1: Ignoring Cash Flows Beyond Payback

A project with a 2-year payback that stops generating cash after year 3 might be worse than a project with a 4-year payback that generates cash for 10 years. Always consider total project life, not just payback period.

Mistake #2: Using Simple Payback for Long-Term Projects

For projects lasting more than 3-4 years, simple payback significantly understates the true investment timeline. A $1 million project with 5-year simple payback might actually take 7+ years when discounted.

Mistake #3: Setting Arbitrary Payback Thresholds

"We only approve projects with payback under 3 years" might cause you to reject profitable long-term investments. Different industries and project types warrant different payback expectations.

Mistake #4: Forgetting Working Capital Requirements

That new equipment might require additional inventory, spare parts, or trained staff. These hidden costs can extend your real payback period by months or even years.

Mistake #5: Not Updating Payback Calculations

Economic conditions change, costs evolve, and cash flow projections need updating. A payback calculation from 2023 probably doesn't reflect 2025 reality. Review and recalculate annually.

Payback Period Optimization Strategies for 2025

Accelerate Cash Flows

Structure contracts to receive payments earlier. Offer early payment discounts to customers. Implement faster billing cycles. Every month you pull cash forward can reduce payback time by 5-10%.

Stagger Implementation

Instead of one large upfront investment, consider phased rollouts. This spreads cash outflows over time while generating earlier returns from the first phase, improving overall payback.

Negotiate Better Terms

Negotiate extended payment terms with suppliers. Ask for progress-based payments instead of upfront costs. Lease equipment instead of buying to shift from CapEx to OpEx and improve short-term payback.

Bundle Projects Strategically

Combine quick-payback projects with strategic long-term investments. The fast-win projects can fund the longer-term initiatives, creating a portfolio approach that satisfies both cash flow and strategic needs.

When to Use Payback Period vs. Other Investment Metrics

Payback period is a valuable tool, but it's not always the right metric for every decision. Understanding when to use it—and when to supplement it with other analyses—makes you a more effective financial decision-maker.

Best Use Cases for Payback Period

- Project screening: Quickly filter out projects that take too long to return capital

- Cash flow management: When maintaining liquidity is critical for operations

- Risk assessment: Shorter payback generally means lower risk exposure

- Small investments: For projects under $50K, detailed NPV analysis may be overkill

- Uncertain environments: Predicting distant cash flows is unreliable

Supplement with Other Metrics When:

- Comparing different-sized projects: Larger projects naturally have longer paybacks

- Profitability is the priority: Use NPV or IRR for profit-focused decisions

- Projects have uneven cash flows: Complex patterns hide in simple payback

- Strategic benefits matter: Qualitative factors require broader analysis

- Making final approval decisions: Use payback as a filter, then thorough analysis

Key Takeaways: Master Payback Period Analysis in 2025

Use Both Calculations

Always calculate both simple and discounted payback. The gap between them reveals your project's sensitivity to the time value of money.

Consider Total Project Life

A fast payback doesn't guarantee a good investment. Projects with longer paybacks but higher total returns often create more value.

Match Metrics to Goals

Use payback for liquidity and risk assessment, but rely on NPV or IRR for profitability analysis. Smart managers use multiple metrics.

Update Regularly

Economic conditions change. Recalculate payback periods annually to ensure your investments stay on track and adjust strategies as needed.

Ready to Calculate Your Payback Period?

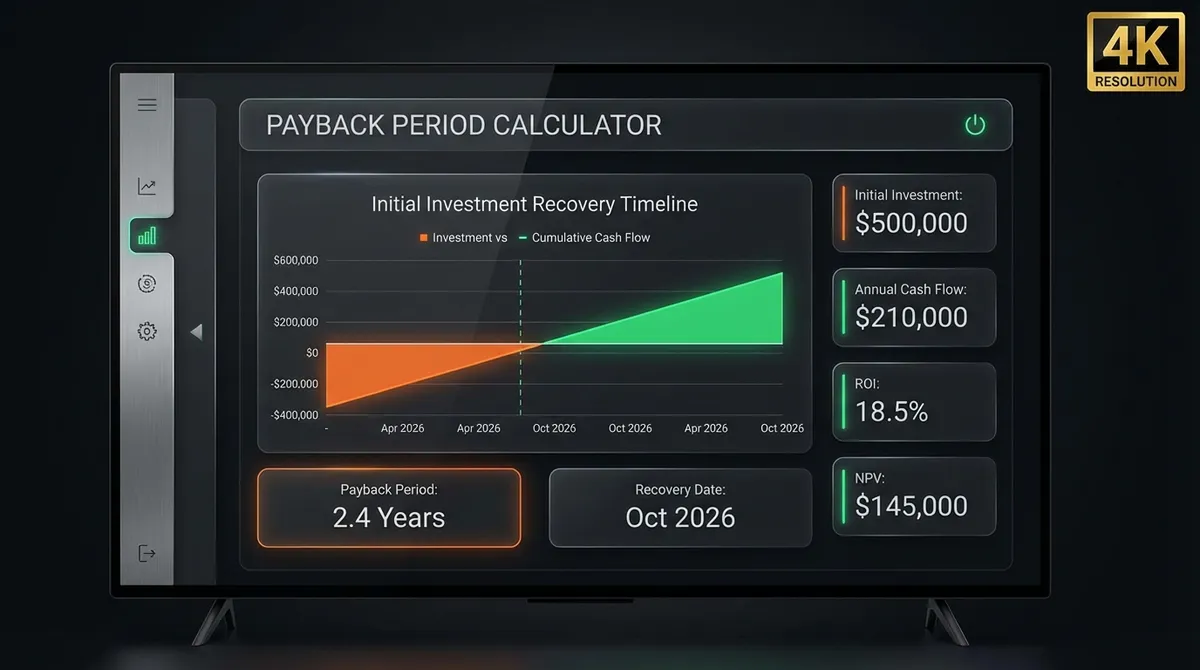

Whether you're evaluating a major equipment purchase, considering a new business location, or analyzing a marketing campaign investment, our payback period calculator gives you the insights you need to make confident decisions. Simply input your initial investment, estimated annual cash flows, and discount rate to instantly see both simple and discounted payback periods, complete with visual charts and detailed analysis.

Remember: The best financial decisions come from using multiple metrics together. Use payback period for quick screening and cash flow planning, but always complement it with NPV, IRR, and strategic considerations for major investments. Start calculating now and take control of your capital allocation strategy in 2025.