Complete Guide to Understanding Your Paycheck and Take-Home Pay

Understanding your paycheck is fundamental to financial wellness. Whether you're starting a new job, negotiating salary, or planning your monthly budget, knowing exactly how much money you'll take home after taxes and deductions empowers you to make informed financial decisions.

What Is a Paycheck Calculator and Why You Need One

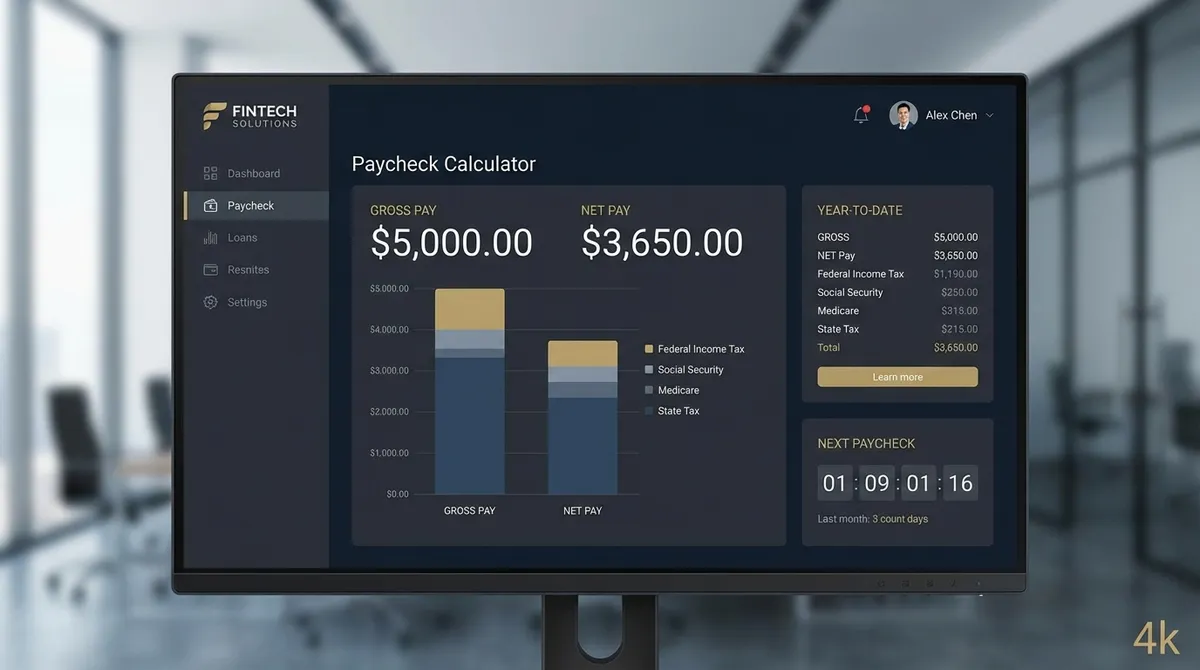

A paycheck calculator is a powerful financial tool that estimates your net take-home pay after accounting for federal income tax, state income tax, Social Security and Medicare contributions (FICA), and various pre-tax deductions. Unlike basic salary calculators that only divide your annual salary by pay periods, a comprehensive paycheck calculator provides a detailed breakdown of every deduction from your gross pay.

The difference between your gross salary and net pay can be substantial—often 25-35% of your earnings go toward taxes and benefits. For someone earning $60,000 annually, this could mean $15,000 to $21,000 in deductions throughout the year. Understanding these numbers helps you budget accurately, plan for major purchases, and optimize your tax situation.

How Your Paycheck Is Calculated: The Complete Breakdown

1. Gross Pay: Your Starting Point

Gross pay represents your total earnings before any deductions. For hourly workers, it's calculated as: Hourly Rate × Hours Worked. For salaried employees, it's your annual salary divided by the number of pay periods. For example, if you earn $52,000 annually and are paid bi-weekly (26 pay periods), your gross pay per paycheck is $2,000.

However, gross pay can also include overtime pay, bonuses, commissions, and other forms of compensation. The Fair Labor Standards Act (FLSA) requires that non-exempt employees receive 1.5 times their regular hourly rate for hours worked beyond 40 in a workweek, which significantly impacts gross pay calculations.

2. Pre-Tax Deductions: Reducing Your Taxable Income

Pre-tax deductions are amounts subtracted from your gross pay before taxes are calculated. These deductions lower your taxable income, which means you pay less in federal and state income taxes. Common pre-tax deductions include:

- 401(k) or 403(b) Retirement Contributions: Traditional contributions reduce your current taxable income while saving for retirement

- Health Insurance Premiums: Medical, dental, and vision insurance premiums paid through employer plans

- Health Savings Account (HSA): Triple tax-advantaged accounts for high-deductible health plan participants

- Flexible Spending Account (FSA): Pre-tax dollars for medical expenses and dependent care

- Commuter Benefits: Pre-tax transit and parking expenses

For example, if you earn $60,000 annually and contribute 6% ($3,600) to your 401(k) plus $2,400 in health insurance premiums, your taxable income drops to $54,000. This could save you approximately $850 in federal taxes annually, depending on your tax bracket. To explore different contribution scenarios, try our 401(k) calculator to see how different contribution rates affect both your retirement savings and current take-home pay.

3. Federal Income Tax Withholding: The Biggest Deduction

Federal income tax is typically the largest deduction from your paycheck. The amount withheld depends on several factors. According to the IRS federal income tax rates and brackets, the U.S. uses a progressive tax system where rates increase as income rises.

- Taxable Income: Your gross pay minus pre-tax deductions and the standard deduction

- Filing Status: Single, Married Filing Jointly, Married Filing Separately, or Head of Household

- Tax Brackets: The U.S. uses a progressive tax system with rates ranging from 10% to 37% in 2025

The 2025 federal tax brackets are adjusted annually for inflation. For single filers, the brackets start at 10% for income up to $11,600, then 12% up to $47,150, 22% up to $100,525, and so on. Importantly, only the income within each bracket is taxed at that rate—not your entire income. The Tax Foundation provides detailed 2025 tax bracket analysis showing how these rates apply to different filing statuses.

2025 Federal Tax Brackets for Single Filers:

| Tax Rate | Income Range | Tax on $60,000 Example |

|---|---|---|

| 10% | $0 - $11,600 | $1,160 |

| 12% | $11,601 - $47,150 | $4,266 |

| 22% | $47,151 - $100,525 | $2,827 |

Total federal tax on $60,000 (after $15,750 standard deduction): $8,253

4. State Income Tax: Varies Dramatically by Location

State income tax rates vary from 0% in nine states (Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming) to over 13% in California for high earners. Some states use progressive tax brackets like the federal system, while others have flat rates. Our ADP paycheck calculator and Gusto paycheck calculator can help you compare different payroll systems and their state tax implications.

For example, if you live in Texas (no state income tax) versus California (approximately 8% effective rate on $60,000), your take-home pay could differ by $400+ per month. This is why our calculator includes all 50 states plus Washington D.C.—location significantly impacts your net pay.

5. FICA Taxes: Social Security and Medicare

The Federal Insurance Contributions Act (FICA) requires employees to contribute to Social Security and Medicare programs. For 2025, the rates are:

- Social Security: 6.2% on wages up to $176,100 (wage base limit for 2025)

- Medicare: 1.45% on all wages with no limit

- Additional Medicare Tax: 0.9% on wages over $200,000 (single) or $250,000 (married filing jointly)

On a $60,000 salary, you'll pay $3,720 in Social Security tax and $870 in Medicare tax annually, totaling $4,590 in FICA contributions. Your employer matches these contributions, effectively doubling the amount paid into these programs. The IRS Topic 751 on Social Security and Medicare withholding provides official guidance on current rates and wage base limits. For self-employed individuals, our self-employment tax calculator can help calculate the full 15.3% FICA tax responsibility.

6. Post-Tax Deductions: Final Subtractions

After all taxes are calculated and withheld, some employees have additional post-tax deductions:

- Roth 401(k) Contributions: Retirement contributions made with after-tax dollars

- Life Insurance Premiums: Voluntary life insurance beyond basic employer coverage

- Wage Garnishments: Court-ordered deductions for child support, student loans, or other debts

- Union Dues: Membership fees for union representation

Real-World Examples: Paycheck Calculations in Action

Example 1: Hourly Worker in Texas

Sarah earns $22/hour working 40 hours per week in Texas (no state income tax). She's single, claims the standard deduction, and contributes 5% to her 401(k) with $120/month in health insurance premiums.

401(k) Contribution: $2,288

Health Insurance: $1,440 (Pre-tax)

FICA Tax: $3,390

Net Annual: $35,720

Net Per Paycheck: $1,374 (bi-weekly)

*Note: FICA tax is calculated on gross pay minus health insurance ($44,320), as 401(k) contributions are not FICA-exempt.

Example 2: Salaried Professional in California

Michael earns $85,000 annually in California, is married filing jointly, and contributes 8% to his 401(k) with $200/month in health insurance and $100/month to his HSA.

Pre-Tax Deductions: $10,400

Taxable Income (Fed): $74,600

State Tax (Est. 8%): $5,968

FICA Tax: $6,227

Net Annual: $57,697

Net Per Paycheck: $2,219 (bi-weekly)

Pay Frequency: How It Affects Your Budget

Your pay frequency determines how many paychecks you receive annually and how much you take home each time:

- Weekly (52 paychecks): Smaller, more frequent payments—best for tight budgets

- Bi-Weekly (26 paychecks): Most common; two paychecks per month, with two months having three

- Semi-Monthly (24 paychecks): Paid twice per month on set dates (e.g., 1st and 15th)

- Monthly (12 paychecks): Largest individual paychecks; requires careful monthly budgeting

Bi-weekly and semi-monthly may seem similar, but there's a key difference: bi-weekly employees receive 26 paychecks annually, while semi-monthly receive 24. This means bi-weekly employees get two "extra" paychecks per year, which can be strategically used for savings, debt payoff, or large purchases.

Advanced Strategies to Optimize Your Paycheck

1. Maximize Pre-Tax Contributions

Every dollar contributed to pre-tax benefits reduces your taxable income. In 2025, you can contribute up to $23,500 to your 401(k) ($31,000 if you're 50 or older). HSAs allow up to $4,300 for individuals or $8,550 for families, with an additional $1,000 catch-up contribution if you're 55 or older.

The tax savings can be substantial: A single filer in the 22% federal tax bracket who contributes $10,000 to their 401(k) saves $2,200 in federal taxes alone, plus additional state tax savings and the benefit of tax-deferred growth on investments.

2. Adjust Your Tax Withholding

If you consistently receive large tax refunds, you're essentially giving the government an interest-free loan. Adjusting your Form W-4 to withhold less can increase your take-home pay throughout the year. Use the IRS Tax Withholding Estimator to optimize your withholding. For more detailed tax planning, explore our comprehensive tax calculator or use the tax refund calculator to estimate your year-end refund or balance due.

Conversely, if you owe taxes annually, increasing withholding prevents underpayment penalties and helps you budget more effectively. The key is finding the right balance that aligns with your financial goals.

3. Understand the Marriage Penalty/Bonus

Getting married can significantly impact your tax situation. Some couples experience a "marriage bonus" and pay less tax combined than when single, while others face a "marriage penalty" and pay more. This typically affects couples with similar high incomes or certain deduction scenarios. Our calculator shows you both scenarios so you can plan accordingly.

4. Consider Roth vs. Traditional Contributions

While traditional 401(k) contributions reduce your current taxable income, Roth contributions use after-tax dollars but grow tax-free. If you're in a low tax bracket now but expect to be in a higher bracket in retirement, Roth contributions may be advantageous despite the lower current paycheck. Our Roth IRA calculator and 401(k) calculator can help you compare the long-term impact of different contribution strategies.

Common Paycheck Mistakes to Avoid

- ✗Not accounting for all deductions: Many people budget based on gross salary rather than net pay, leading to overspending and debt accumulation.

- ✗Ignoring the impact of bonuses: Bonuses are typically taxed at higher supplemental rates (22% federal withholding), which can surprise recipients expecting a larger net amount.

- ✗Forgetting about benefit enrollment periods: Missing open enrollment can leave you with inadequate coverage or paying more in taxes than necessary.

- ✗Not updating withholding after major life changes: Marriage, divorce, having children, or buying a home all affect your optimal withholding amount.

The Bottom Line: Knowledge Is Financial Power

Understanding your paycheck isn't just about knowing how much money you'll receive—it's about gaining control over your financial future. By using our comprehensive paycheck calculator, you can:

- Accurately budget based on actual take-home pay, not gross salary

- Evaluate job offers and salary negotiations with complete information

- Optimize pre-tax contributions to minimize tax liability

- Plan for major financial decisions like home purchases or starting a family

- Understand the true cost of benefits and whether they're worth the deduction

- Prepare for tax season without surprises

Your paycheck represents your most valuable financial resource—your time and skills converted into income. Every deduction represents a choice: taxes fund public services, Social Security and Medicare provide retirement and healthcare security, and benefits like health insurance and retirement contributions invest in your future well-being.

By understanding each component of your paycheck, you can make informed decisions that align with your values and financial goals. Whether you're just starting your career, planning for retirement, or anywhere in between, our paycheck calculator gives you the clarity and confidence to make the most of every dollar you earn. For comprehensive financial planning, explore our budget calculator to allocate your net pay effectively, or use our savings calculator to set aside money for emergencies and future goals.

Ready to Take Control of Your Finances?

Use our advanced paycheck calculator above to see exactly how much you'll take home based on your specific situation. Experiment with different scenarios—change your 401(k) contribution, adjust your withholding, or compare different states—to find the optimal strategy for your financial goals.

Remember: This calculator provides estimates based on current tax rates. For personalized tax advice, consult with a qualified tax professional or financial advisor.