More Than Just Withholding: Understanding Your Paycheck

We've all had that moment: you get your first paycheck from a new job, flip to the total, and think,"Wait, where did the rest of it go?" It’s the universal "welcome to the workforce" experience. Between Social Security, Medicare, federal income tax, and state levies, your gross pay can shrink significantly before it hits your bank account.

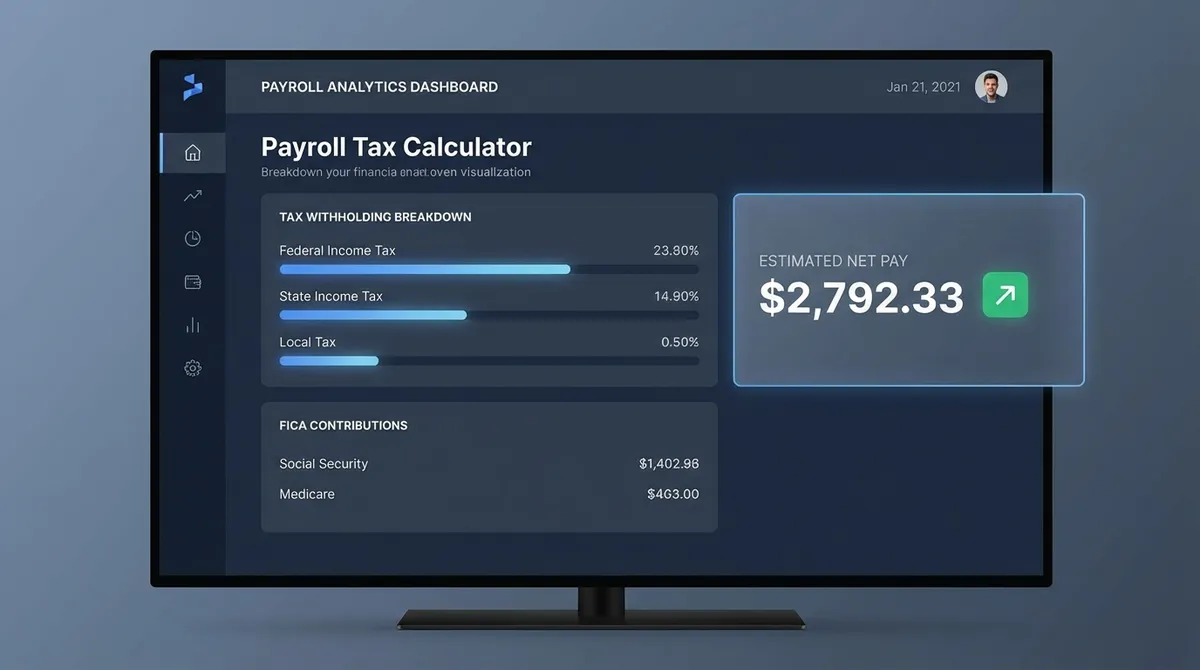

This Payroll Tax Calculator isn't just about showing you the bad news; it's about giving you clarity. By understanding exactly what is being deducted and why, you can better plan your budget, adjust your W-4 withholdings, and avoid surprises at tax time. Whether you're an employee trying to forecast your net pay or a small business owner clarifying employer costs, this tool breaks down the complex web of 2025 payroll taxes into clear, actionable numbers.

Employee Pays

• Social Security: 6.2% on earnings up to $176,100.

• Medicare: 1.45% on all earnings (plus 0.9% over $200k).

• Income Tax: Federal & State withholding based on W-4.

Employer Pays

• Social Security Match: 6.2% on earnings up to $176,100.

• Medicare Match: 1.45% on all earnings.

• FUTA & SUI: Unemployment taxes (Federal & State).

The "Big Three" Payroll Taxes Explained

Social Security (OASDI)

This is the big one. For 2025, the Social Security Wage Base is $176,100. This means you only pay the 6.2% tax on the first $176,100 you earn. Once you cross that threshold in a calendar year, your paycheck effectively gets a 6.2% raise because this deduction stops.

Medicare

Unlike Social Security, there is no cap on Medicare tax. You pay 1.45% on every dollar you earn. High earners need to watch out for the Additional Medicare Tax. If you earn over $200,000 (Single) or $250,000 (Married Filing Jointly), you'll pay an extra 0.9% surtax on the excess.

Income Tax Withholding

This isn't a fixed flat rate. It’s a progressive estimation based on how you filled out your W-4. Our calculator uses the 2025 tax brackets to estimate this, but your actual liability depends on deductions, credits, and other income sources. Check out our Income Tax Calculator for a fuller picture.

Hidden Cost of Employment

If you are an employer, you know that "salary" is just the starting point. The true cost of an employee includes the employer portion of FICA taxes plus unemployment insurance.

Self-Employed?

If you are a freelancer or contractor, you are both the employee AND the employer. You must pay both halves of Social Security and Medicare, totaling 15.3%. Use our Self-Employment Tax Calculator instead.

Employer Compliance: A 2025 Checklist

For business owners, getting payroll taxes wrong can lead to severe penalties from the IRS (the "Trust Fund Recovery Penalty"). It is not just about withholding the money; it is about depositing it on time and filing the correct forms.

Determine Your Deposit Schedule

You are either a Monthly or Semi-Weekly depositor. This status is determined by your total tax liability during a "lookback period" (July 1 to June 30 of the prior year). If you reported $50,000 or less in taxes, you deposit monthly. Above that, you deposit semi-weekly.

File Form 941 Quarterly

Form 941 is the "Employer's Quarterly Federal Tax Return." It reports wages paid, income tax withheld, and both the employer and employee share of FICA.

Due Dates: April 30, July 31, October 31, and January 31.

File Form 940 Annually

This reports your FUTA (Unemployment) tax liability. It is due once a year on January 31. Remember, only employers pay this; do not deduct it from employee wages.

Issue W-2s by Jan 31

You must provide Form W-2 to every employee and file Copy A with the Social Security Administration by January 31. Late filing penalties can range from $60 to $310 per form depending on how late you are. See IRS Pub 15 for details.

5 Costly Payroll Mistakes to Avoid

The IRS assumes you know the rules. Ignorance is not a defense against penalties. Here are the most common traps new employers fall into.

- 1. Misclassifying Employees as ContractorsThis is the #1 audit trigger. You cannot just call someone a "1099 contractor" to avoid paying payroll taxes. If you control their hours, tools, and methods, they are likely employees (W-2). Getting this wrong means you owe back taxes + massive penalties.

- 2. Missing Deposit DeadlinesFederal tax deposits are due on a rigid schedule (Monthly or Semi-Weekly). If you are one day late, the penalty starts at 2% and quickly climbs to 10%.

- 3. Forgetting to Report Gifts and BonusesDid you give everyone a $50 gift card for the holidays? That is taxable income! It must be reported on their W-2, and taxes must be withheld.

- 4. Not Keeping RecordsYou need to keep payroll records for at least 4 years. This includes timesheets, tax forms, and proof of deposits.

- 5. Borrowing from WithholdingNever, ever use the payroll tax money to pay other bills, thinking you'll "put it back" before the deposit is due. This is a criminal offense in extreme cases. That money belongs to your employees and the government, not you.

Don't Forget the State!

Federal taxes are just half the battle. Depending on your state, you may also need to withhold:

- State Income Tax (e.g., California PIT, New York SIT)

- State Unemployment Insurance (SUI/SUTA) - Employer paid

- State Disability Insurance (SDI) - Employee paid in states like CA, NJ, RI

- Local Taxes (e.g., Pennsylvania EIT, Ohio RITA, NYC Local Tax)

Pro Tip: Use a payroll service like Gusto or ADP. Trying to calculate these manually is a recipe for compliance disaster.

Common Questions about Payroll Taxes

What is the 2025 Social Security wage base?

Why doesn't my FICA tax match 7.65% exactly?

What is the difference between FOTA and FUTA?

Does this calculator handle state income tax?

How does the "Additional Medicare Tax" work?

EfinanceCalculator Team

Financial Modeling Experts

Last Updated: December 2024 • Reviewed by CPA

Final Thoughts on Payroll Taxes

Payroll taxes are a significant expense that every employer must budget for—usually adding 8% to 12% on top of gross wages. While it is tempting to focus on the complexity and cost, remember that these taxes fund the social safety net that your employees rely on. By understanding the breakdown of FICA, FUTA, and SUTA, you can better forecast your labor costs and ensure your business remains compliant and profitable. When in doubt, always consult with a qualified CPA or tax professional to navigate the specifics of your state and local obligations.