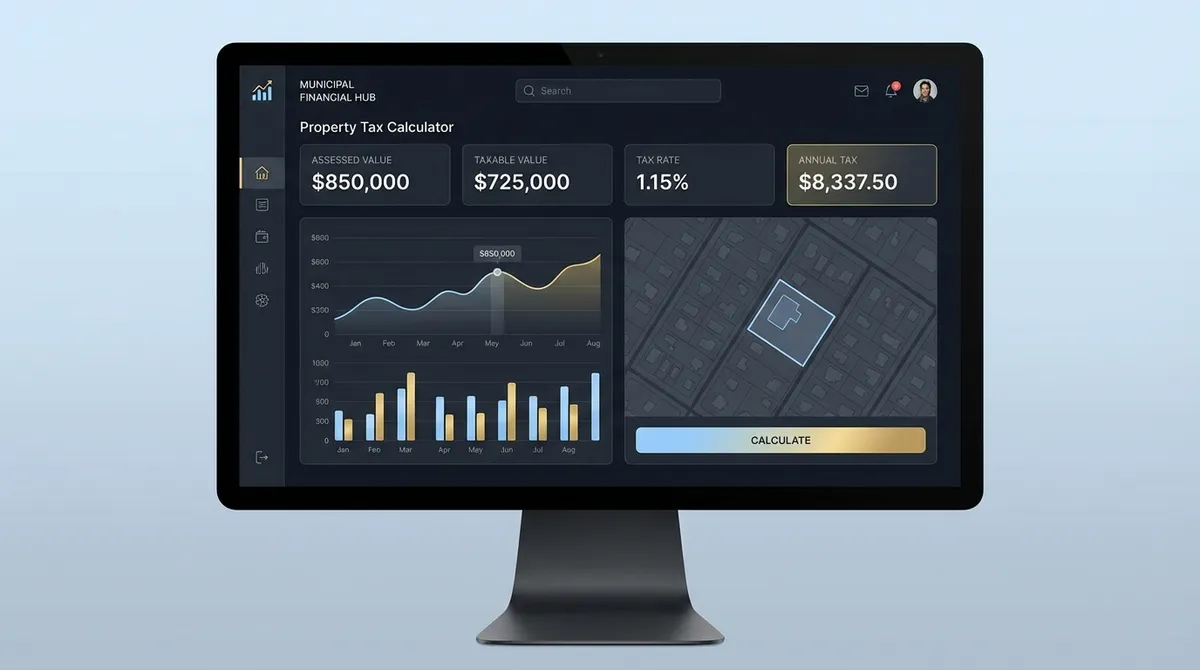

Complete Guide: Property Tax Calculator

Property taxes are often the second largest ongoing expense for homeowners, right after their mortgage. Yet, the formula generally used to calculate them—involving mill rates, assessment ratios, and equalization factors—can feel like a black box. Our property tax calculator breaks down these variables so you can estimate your annual liability accurately and identify opportunities to save.

Why Calculate Your Property Tax?

Whether you are buying a new home, budgeting for an existing one, or estimating payments for an escrow account, knowing your true tax liability helps you avoid surprises. It also allows you to audit your official tax bill for errors—which happen more often than you might think.

How Property Taxes Are Calculated

While every jurisdiction has its own quirks, the core formula for property tax is universal across the United States. It is not simply your home's value multiplied by a tax rate; there are intermediate steps that determine what is actually taxable.

- Assessed ValueA percentage of market value (e.g., 85% or 100%). Your assessor determines this.

- ExemptionsDollar amounts subtracted from your assessment (e.g., Homestead, Senior).

- Tax Rate (Mill Rate)The tax amount charged per $1,000 of taxable value.

What is a "Mill Rate"?

You will often see tax rates expressed in "mills". Can be confusing, but one mill simply equals one dollar of tax per $1,000 of assessed value ($0.001).

Property Tax Rates by State (2025)

Location is the single biggest factor in your property tax bill. States with no income tax (like Texas) often rely heavily on property taxes to fund schools and services, resulting in higher rates. Conversely, states like Hawaii have high property values but very low effective tax rates.

| State | Avg. Effective Rate | Median Tax |

|---|---|---|

| Hawaii | 0.31% | $1,821 |

| Alabama | 0.39% | $674 |

| Colorado | 0.53% | $1,476 |

| Nevada | 0.64% | $1,642 |

| Texas | 1.74% | $4,617 |

| New Jersey | 2.49% | $9,048 |

The Secret Weapon: Exemptions

The most effective way to lower your property tax bill is not to move, but to claim every exemption you are entitled to. Exemptions directly reduce your Assessed Value, which lowers the base amount upon which you are taxed.

Available in most states for your primary residence. It knocks off a fixed amount (e.g., $25,000) or a percentage from your assessment.

For homeowners over 65 (age varies). Often has income limits but offers substantial savings, sometimes freezing the assessment value entirely.

Partial or full exemptions for military veterans, with significantly increased amounts for those with service-connected disabilities.

Reductions for homeowners with permanent disabilities. Requirements for medical documentation are strict, but the savings can be permanent.

When (and How) to Appeal Your Assessment

Local assessors are human, and mass-appraisal computer models make mistakes. If your Assessed Value is higher than what you could actually sell your home for today, you are likely being overtaxed.

The Appeal Strategy Checklist

- 1Check the Record Data: Look at your property record card online. Does it say you have 4 bathrooms when you only have 3? Errors here are the easiest to win.

- 2Find Your "Comps": Search for 3-5 similar homes in your immediate neighborhood that sold recently for less than your assessment value.

- 3File Before the Deadline: You typically have a short window (30-60 days) after receiving your assessment notice to file. Mark your calendar.

The Mechanics of Payment: Escrow vs. Direct

Once you know how much you owe, you have to pay it. There are two primary ways homeowners handle this expense:

Option 1: Escrow (The "Set It and Forget It")

Your lender creates a savings account for you. Every month, a portion of your mortgage payment goes into this bucket. When tax bills arrive, the bank pays them for you.

- No large lump-sum bills.

- "Escrow Shortages" can raise mortgage payments unexpectedly.

Option 2: Direct Payment

You pay the county treasurer directly, usually twice a year (semiannual installments). You keep the cash in your own interest-bearing account until the due date.

- You earn interest on your money.

- Requires strict discipline to save huge sums.

The SALT Deduction Cap (2025 Update)

Homeowners in high-tax states (NY, NJ, CA, IL) must be aware of the State and Local Tax (SALT) Deduction cap. Under current federal tax law:

The $10,000 Limit

You can only deduct a combined total of $10,000 for state income taxes and property taxes on your federal return. Read more about the SALT cap limit on the IRS website.

Example: If you pay $8,000 in state income tax and $9,000 in property tax (Total: $17,000), you can still only deduct $10,000. The remaining $7,000 provides no federal tax benefit.

Warning for New Construction Buyers

Buying a brand new home? Do not trust the current tax listing.

The current tax bill is likely based on the value of the vacant land before the house was built. Once the county assessor reassesses the property with the new completed structure, your tax bill could jump from $500/year to $10,000/year. Always estimate taxes based on the purchase price (or home value), not the history.

Frequently Asked Questions

How often do property taxes change?

Most counties reassess values every 1-3 years. However, mill rates can change annually based on the budgets of local schools, fire departments, and libraries.

Do improvements increase my taxes?

Yes. Permitted work (like adding a deck, finishing a basement, or adding a bedroom) triggers a reassessment. Cosmetic updates (painting, new appliances) typically do not.

What happens if I don't pay?

The county puts a tax lien on your home. After a grace period (often 1-3 years), they can auction off your home to pay the debt. It is the topmost lien, superior even to your mortgage.

What is an "ad valorem" tax?

Property tax is an "ad valorem" tax, Latin for "according to value." This means the tax is based solely on the assessed value of the property, not on your income or ability to pay. This is why retirees with expensive homes but low income can struggle with property tax bills.

Do renters pay property tax?

Indirectly, yes. While the landlord receives the bill, they factor this cost into the monthly rent. In high-tax areas, a significant portion of your rent check is simply passed through to the county treasurer.

Are property taxes deductible?

Yes, but with limits. You can deduct property taxes paid on your primary residence and other real estate on your federal income tax return (Schedule A), subject to the $10,000 SALT cap (combined w/ state income tax). If you take the Standard Deduction, you cannot deduct property taxes.

Does the "Assessed Value" match my "Market Value"?

Rarely. In many jurisdictions, the "Assessed Value" is a statutory percentage of the market value (e.g., 80% or 90%). Furthermore, assessments often lag behind the real market by a year or two. In a rapidly rising market, your assessed value might be surprisingly low; in a declining market, it might be frustratingly high until you appeal.

Final Thoughts

Property taxes pay for the community you live in—schools, roads, and emergency services—but you should never pay more than your fair share. Use this calculator to verify your bills, plan for future home purchases, and confirm that your exemptions are being applied correctly. A few minutes of analysis today can save you thousands of dollars over the life of your homeownership.