Complete Guide: Rental Property Calculator 2025: Cash Flow & ROI Analyzer — Analyze Real Estate Deals Like a Pro (2025)

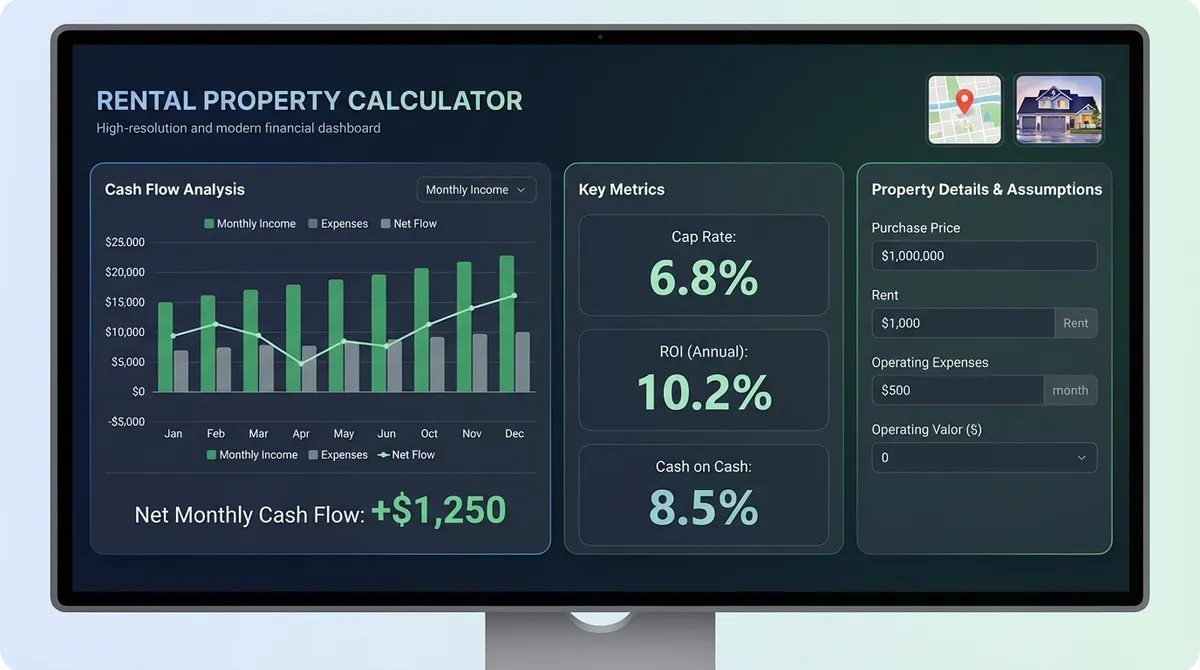

Investing in rental property remains one of the most reliable ways to build long-term wealth, but success isn't guaranteed. The difference between a portfolio that generates passive income and one that drains your bank account lies in the numbers. Our **Rental Property Calculator** is designed to give you a clear, honest look at the profitability of any potential investment.

Unlike simple mortgage calculators, this tool factors in the nuanced expenses that often catch new investors off guard—like vacancy rates, maintenance reserves, and property management fees. By analyzing metrics like **Cash flow**, **NOI**, and **ROI**, you can make data-driven decisions and avoid emotional purchases.

Core Metrics: What Every Investor Must Know

Understanding these three key indicators is crucial for evaluating any rental property:

1. Cash Flow

The net profit you pocket each month after paying all expenses and the mortgage.

Goal: Positive cash flow ($100-$300/unit).

2. Cap Rate

The annual return on the property inclusive of debt. It helps you compare the property's profitability to other investments.

Goal: 4% - 10% (Market dependent).

3. Cash-on-Cash

The annual return on the actual cash you invested (down payment + closing costs). This measures the efficiency of your capital.

Goal: 8% - 12%+.

How to Accurately Estimate Expenses

A common mistake for beginners is underestimating operating costs. Use these guidelines to enter accurate data into the calculator:

- Vacancy Rate: Always budget for vacancy. Even in hot markets, use 5% (about 18 days/year) to account for turnover. In slower markets, use 8-10%.

- Maintenance: Using 1% of the property value per year or 5-10% of gross rent is a safe rule of thumb. Older homes need higher reserves.

- Property Management: Even if you plan to self-manage, include 8-10% for management. This ensures the deal still works if you decide to hire a professional later.

- CapEx (Capital Expenditures): Big-ticket items like roofs and HVAC systems eventually need replacement. Smart investors set aside reserves monthly for these future costs.

The 1% Rule and Other Screening Tactics

Before running a full analysis, investors often use "napkin math" to quickly filter properties. The **1% Rule** suggests that a property's monthly rent should be at least 1% of the purchase price.

Example: A $200,000 home should rent for at least $2,000/month.

While the 1% rule is harder to find in high-cost-of-living areas today, it remains a solid benchmark for cash flow markets like the Midwest or South. If a property meets the 1% rule, it's a strong candidate for detailed analysis using this calculator.

Case Study: The "Good" vs. The "Bad" Deal

Let's compare two scenarios for a property listed at $300,000.

| Metric | Scenario A (Strong) | Scenario B (Risk) |

|---|---|---|

| Monthly Rent | $2,800 | $2,100 |

| Operating Exp. | $900 | $1,100 |

| Mortgage P&I | $1,500 | $1,500 |

| Net Cash Flow | +$400/mo | -$500/mo |

Scenario A represents a solid investment that pays you to own it. Scenario B is a liability that costs you $500 every month, relying entirely on appreciation to make a profit—a risky strategy known as "speculating," not investing.

The "Silent Killers" of Cash Flow: Hidden Expenses

New investors often calculate mortgage, taxes, and insurance (PITI) and stop there. To avoid negative cash flow surprises, account for these frequently overlooked costs:

Deep cleaning ($300+), re-painting ($500+), and re-marketing costs every time a tenant leaves add up.

LLC filing fees ($200-$800/yr) and CPA costs for tax preparation.

Seasonal costs like snow removal or termite treatments often fall on the landlord in multifamily properties.

An eviction can cost $3,000–$5,000 in lost rent and legal fees. Have a cash buffer ready.

Exit Strategies: Planning the End Game

You make your money when you buy, but you realize it when you sell. Don't buy a rental without knowing how you'll get out.

- Buy & Hold (Forever): The Warren Buffett approach. Pay off the mortgage over 30 years and live on the pure cash flow in retirement.

- The 1031 Exchange: Sell the property after 5-7 years of appreciation and roll the tax-free profits into a larger apartment complex to scale up.

- Seller Financing: When you retire, become the bank. Sell the property to a new investor but carry the note, creating passive income without landlord headaches.

- Cash-Out Refinance: Keep the property but pull out your equity tax-free to buy more deals or fund your lifestyle.

Strategies to Improve Cash Flow

If the numbers don't work initially, you can try to force appreciation or improve operations:

- Renovate to Rent: Strategic updates (kitchens, floors) can often justify rent increases of 10-20%.

- Reduce Expenses: Appeal property taxes, shop for cheaper insurance, or sub-meter utilities to tenants.

- Add Revenue Streams: Pet rent, laundry, covered parking, or storage units can add pure profit to the bottom line.

- Refinance: If rates drop, refinancing can lower your monthly payment and instantly boost cash flow.

Advanced Financing Strategies

Getting the capital to buy your first (or tenth) rental property is a hurdle. Here are proven strategies investors use:

1. House Hacking

Buy a small multifamily property (2-4 units) using an FHA loan with only 3.5% down. Live in one unit and rent out the others. The tenants pay your mortgage, allowing you to live for free or cheaply while building equity. This is optimal for beginners.

2. The BRRRR Method

Buy, Rehab, Rent, Refinance, Repeat. Buy a distressed property below market value with cash or hard money. Fix it up to increase its value (ARV). Rent it out. Refinance into a long-term mortgage based on the new higher value to pull your cash back out. Use that recycled cash to buy the next one.

3. DSCR Loans

Debt Service Coverage Ratio loans are based on the property's income, not your personal income. If the property's rent covers the mortgage (usually 1.25x coverage), lenders will fund it even if you have maxed out your personal debt-to-income ratio.

The Tax Advantages of Real Estate

The IRS tax code heavily favors real estate investors. "Phantom expenses" can often reduce your taxable rental income to zero, even if you made positive cash flow.

- Depreciation: The holy grail of real estate tax benefits. You can deduct the cost of the building (not land) over 27.5 years. This non-cash deduction often wipes out taxable profit.

- Mortgage Interest: Fully deductible as a business expense.

- Repairs & Maintenance: Deductible in the year they occur.

- 1031 Exchange: Sell one property and buy another "like-kind" property while deferring all capital gains taxes indefinitely. "Swap 'til you drop," then pass properties to heirs with a stepped-up basis.

Tenant Management 101

You are not just a property owner; you are a service provider. Good tenant relations are key to long-term profitability.

Set huge standards: 3x rent in income, 650+ credit score, no prior evictions. A bad tenant is 10x more expensive than a vacant unit.

Fix things fast. If you ignore a leak, your tenant will ignore care for the property. Good landlords attract and keep good tenants.

Frequently Asked Questions (FAQ)

What is a good cash-on-cash return for rental property?

While "good" is subjective, most seasoned investors target a Cash-on-Cash Return of 8% to 12%. This outperforms the historical average of the stock market (around 7-8% inflation-adjusted) while providing the additional benefits of tax depreciation and principal paydown. In highly competitive coastal markets, investors might accept 4-6% returns in exchange for higher expected property appreciation.

Should I use the 50% Rule?

The 50% Rule is a quick screening tool that assumes 50% of your gross rent will go toward operating expenses (taxes, insurance, repairs, vacancy, management), leaving the other 50% to pay the mortgage. If the remaining 50% covers the debt service with profit left over, it's worth a deeper look. However, never buy a property based solely on this rule—always run the specific numbers for taxes, insurance, and HOA fees in your specific area.

How much should I budget for CapEx?

Capital Expenditures (CapEx) are major replacements like roofs, HVAC systems, and water heaters. A safe practice is to budget 8-10% of monthly rent specifically for CapEx reserves. If you are buying a brand-new home, you might lower this to 5%, but for older homes with aging systems, 10% or more is prudent to avoid cash flow shock when a designated item breaks.

Is it better to pay cash or finance a rental?

Financing (leverage) usually produces higher returns on your invested cash. For example, buying one $100k house with cash might earn you 7% ROI. Buying four $100k houses with $25k down on each might yield a 15% Cash-on-Cash return due to leverage, plus you control $400k worth of assets appreciating in value instead of just $100k. However, all-cash deals reduce risk and improve cash flow security.

How does depreciation reduce my taxes?

The IRS allows you to deduct the cost of the residential building (excluding the land value) over 27.5 years. This is a "phantom expense" because you don't actually spend money each year, but it reduces your taxable income. Often, depreciation can wipe out your positive cash flow liability, meaning you pocket the cash tax-free until you sell the property.

What is the difference between Cap Rate and ROI?

Cap Rate measures the property's natural rate of return assuming you bought it all cash (NOI / Purchase Price). It helps compare the property itself against others. ROI (or Cash-on-Cash Return) measures the return on your specific cash investment after the mortgage is paid. ROI changes depending on your loan terms; Cap Rate does not.

Conclusion

Real estate investing is a game of numbers, not feelings. Use this **Rental Property Calculator** as your unbiased advisor. Run potential deals through it daily to train your eye. Remember: It's better to analyze 50 deals and buy none than to buy one bad deal that sets you back years. Happy investing!