Complete Guide: Revenue Calculator

Quick Summary

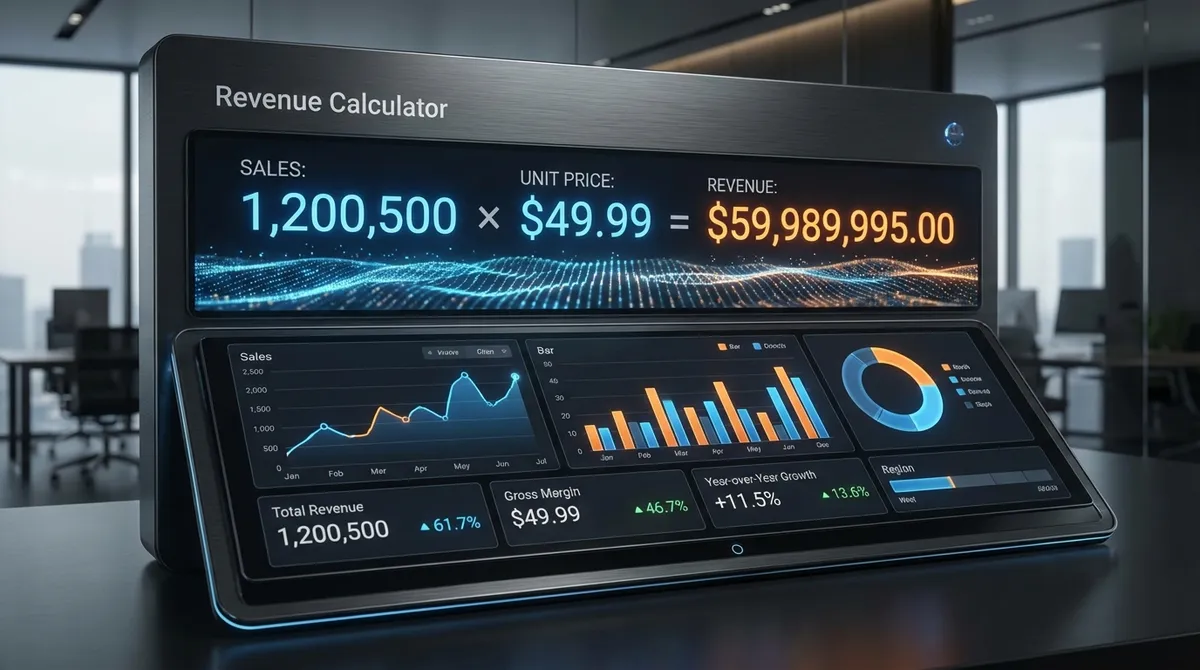

Revenue is the total income your business generates from selling goods or services. Our revenue calculator helps you determine total revenue by entering units sold and average price per unit for each product. This tool provides instant calculations, detailed breakdowns, and visual charts to help you understand your sales performance and make informed business decisions.

Understanding Revenue

Revenue represents the total income generated from selling goods or services during a specific period. It is often referred to as the "top line" of your income statement because it appears at the top before any expenses are deducted. Understanding your revenue is crucial for evaluating business performance, making strategic decisions, and ensuring long-term sustainability.

Key Revenue Terms

- Gross Revenue: Total income from sales before any deductions or expenses.

- Net Revenue: Gross revenue minus returns, discounts, and allowances.

- Recurring Revenue: Predictable, ongoing income from subscriptions or contracts.

- Revenue Stream: A specific source of income for your business.

- Revenue Recognition: The accounting principle that determines when revenue is recorded.

The Revenue Formula

Calculating revenue is straightforward using this fundamental formula:

For businesses with multiple products or services, total revenue is the sum of all individual product revenues:

Example Calculation

Let's say you run an online store selling electronics. You should also consider using a sales tax calculator to price your items correctly.

- • 50 headphones sold at $75 each = 50 × $75 = $3,750

- • 30 Bluetooth speakers sold at $50 each = 30 × $50 = $1,500

- • 20 phone cases sold at $25 each = 20 × $25 = $500

How to Use This Calculator

Our revenue calculator is designed to be intuitive and powerful, allowing you to calculate revenue for multiple products simultaneously. Follow these steps to get accurate results:

Enter Product Details

For each product, enter the name, number of units sold, and the price per unit. The calculator will compute the revenue for each product automatically.

Add Multiple Products

Click "Add Another Product" to include additional items in your calculation. This is useful for businesses with diverse product lines.

Review Calculated Results

See your total revenue, total units sold, average price, and a breakdown of each product's contribution to your revenue.

Analyze and Export

Use the charts to visualize your revenue distribution and export the detailed breakdown as a CSV file for further analysis.

Understanding Your Results

The calculator provides several key metrics to help you analyze your revenue performance:

Total Revenue

The sum of revenue from all products. This is your gross revenue before any expenses, returns, or discounts.

Total Units Sold

The complete number of products sold across all items. Useful for understanding sales volume.

Average Price

The average selling price across all products. Helps identify pricing trends and opportunities.

Top Performer

The product generating the most revenue, including its dollar amount and percentage of total sales.

Revenue Analysis Strategies

Revenue Growth Strategies

- Increase Sales Volume: Focus on marketing, lead generation, and conversion rate optimization.

- Optimize Pricing: Test different price points and consider value-based pricing strategies.

- Expand Product Lines: Add complementary products or variations to capture more market share.

- Improve Customer Retention: Increase repeat purchases through loyalty programs and excellent service.

- Enter New Markets: Explore different customer segments or geographic locations.

Revenue Forecasting

Use historical revenue data to predict future performance. Track trends, identify seasonal patterns, and set realistic growth targets. Regular forecasting helps with budgeting, staffing, and inventory management decisions.

Revenue vs. Profit

Remember that revenue is not profit. You must subtract all expenses (cost of goods sold, operating expenses, taxes, etc.) from revenue to determine profitability. A business can have high revenue but still be unprofitable if expenses exceed income. Always analyze both revenue and profit margins for complete financial health. Use our break-even calculator to find your safety zone.

Common Revenue Calculation Mistakes

- • Including Non-Sales Income: Don't count loans, investments, or asset sales as revenue.

- • Ignoring Returns and Refunds: Subtract returned items and refunds from gross sales.

- • Mixing Cash and Accrual Accounting: Record revenue when earned, not necessarily when cash is received.

- • Double-Counting: Avoid counting the same sale multiple times or including partner revenue.

- • Forgetting Discounts: Subtract any discounts or promotional pricing from regular prices.

Real-World Revenue Examples

Example 1: E-commerce Store

An online clothing retailer sells three main products in one month:

- 150 t-shirts at $25 each = $3,750

- 75 hoodies at $45 each = $3,375

- 200 accessories at $15 each = $3,000

Total Monthly Revenue: $10,125

Example 2: Software Company

A SaaS company has multiple revenue streams:

- 200 monthly subscriptions at $50/month = $10,000

- 50 annual subscriptions at $500/year = $25,000

- Professional services revenue = $8,000

Total Quarterly Revenue: $43,000

Example 3: Restaurant

A restaurant tracks revenue by meal category:

- Appetizers: $8,500

- Main courses: $32,000

- Desserts: $4,200

- Beverages: $12,800

Total Weekly Revenue: $57,500

Revenue Recognition Principles

Understanding when and how to recognize revenue is crucial for accurate financial reporting:

Key Principles

- Earned Revenue: Revenue is recognized when goods are delivered or services are performed.

- Realizable Revenue: Payment must be reasonably assured before recognizing revenue.

- Accrual Accounting: Record revenue when earned, not necessarily when cash is received.

- Matching Principle: Match revenue with the expenses incurred to generate it.

Best Practices for Revenue Management

- 1. Track revenue regularly (daily, weekly, or monthly) to spot trends early.

- 2. Categorize revenue by product, service, customer type, and sales channel.

- 3. Compare actual revenue to forecasts and budgets to measure performance.

- 4. Analyze which products or services generate the highest revenue and profit margins.

- 5. Monitor customer lifetime value alongside immediate revenue.

- 6. Use revenue data to make informed decisions about pricing, marketing, and expansion.

Revenue Calculator Limitations

While our revenue calculator is a powerful tool for quick calculations, consider these limitations:

- Gross Revenue Only: The calculator shows gross revenue, not net revenue after returns, discounts, or fees.

- Point-in-Time Calculation: It calculates revenue for a specific period; ongoing tracking requires multiple calculations.

- No Expense Tracking: Revenue alone doesn't indicate profitability—you must consider all costs.

- Currency Conversion: The calculator doesn't handle multiple currencies or exchange rates.

- Complex Revenue Models: Subscription, usage-based, or tiered pricing may require additional calculations.

For comprehensive financial management, use this calculator alongside accounting software and consider consulting with a financial professional for complex business models or tax implications.

Frequently Asked Questions

What is revenue and why is it important for businesses?

Revenue is the total income generated from selling goods or services during a specific period. It is the top line of your income statement and represents the lifeblood of your business. Without adequate revenue, businesses cannot cover expenses, invest in growth, or generate profit. Tracking revenue helps you understand sales performance, identify trends, make informed pricing decisions, and evaluate the effectiveness of your marketing strategies.

How do you calculate total revenue from multiple products?

Total revenue is calculated by summing the revenue from each product or service. For each product, multiply the number of units sold by the price per unit. The formula is: Total Revenue = Σ(Unit Price × Quantity Sold). For example, if you sell 100 units of Product A at $50 each ($5,000) and 200 units of Product B at $30 each ($6,000), your total revenue would be $5,000 + $6,000 = $11,000.

What's the difference between gross revenue and net revenue?

Gross revenue is the total income from sales before any deductions. <Link href='/net-income-calculator' className='text-primary hover:underline'>Net revenue</Link> (also called net sales) is gross revenue minus returns, discounts, and allowances. For example, if your gross revenue is $100,000 but you offer $5,000 in discounts and have $3,000 in returns, your net revenue would be $92,000. The revenue calculator shows gross revenue, which is the starting point for understanding your business performance.

Can this calculator track revenue over time?

The current version of the revenue calculator shows revenue for a specific period or calculation. To track revenue over time, you would need to run separate calculations for each time period (daily, weekly, monthly, quarterly, annually) and compare the results. Regular revenue tracking helps identify seasonal patterns, growth trends, and the impact of business decisions on sales performance. Consider creating a spreadsheet or using accounting software for ongoing revenue tracking.

How can I increase my business revenue?

To increase revenue, focus on several strategies: 1) Increase sales volume by attracting more customers or encouraging larger purchases, 2) Raise prices strategically by offering premium features or bundling products, 3) Expand your product line to meet more customer needs, 4) Improve marketing to reach new markets, 5) Enhance customer retention to increase lifetime value, 6) Optimize sales processes to reduce lost opportunities, and 7) Analyze which products generate the most revenue and focus your efforts accordingly. Always balance revenue goals with customer satisfaction and market conditions.

What are common mistakes when calculating revenue?

Common revenue calculation mistakes include: 1) Including non-sales income like loans or investments, 2) Forgetting to account for returns and refunds, 3) Mixing up cash received with revenue earned (accrual accounting), 4) Double-counting revenue from partnerships or affiliates, 5) Not tracking revenue by product line to identify top performers, 6) Confusing <Link href='/markup-calculator' className='text-primary hover:underline'>markup</Link> with <Link href='/profit-margin-calculator' className='text-primary hover:underline'>margin</Link> when setting prices, and 7) Failing to update calculations as prices or quantities change. Accurate revenue tracking is essential for reliable financial planning and business decisions.