Complete Guide to Required Minimum Distributions (RMDs) in 2025

What Are RMDs and Why Do They Matter?

Required Minimum Distributions (RMDs) are mandatory annual withdrawals that the IRS requires from traditional retirement accounts. Starting at age 73, you must withdraw a specific percentage of your retirement savings each year—whether you need the money or not. These rules apply to traditional IRAs, 401(k)s, 403(b)s, and other tax-deferred retirement accounts.

Key Takeaway: RMDs ensure the government eventually collects taxes on money that has grown tax-deferred for decades. Failure to take your full RMD triggers a steep 25% penalty, making accurate calculation essential for retirement planning.

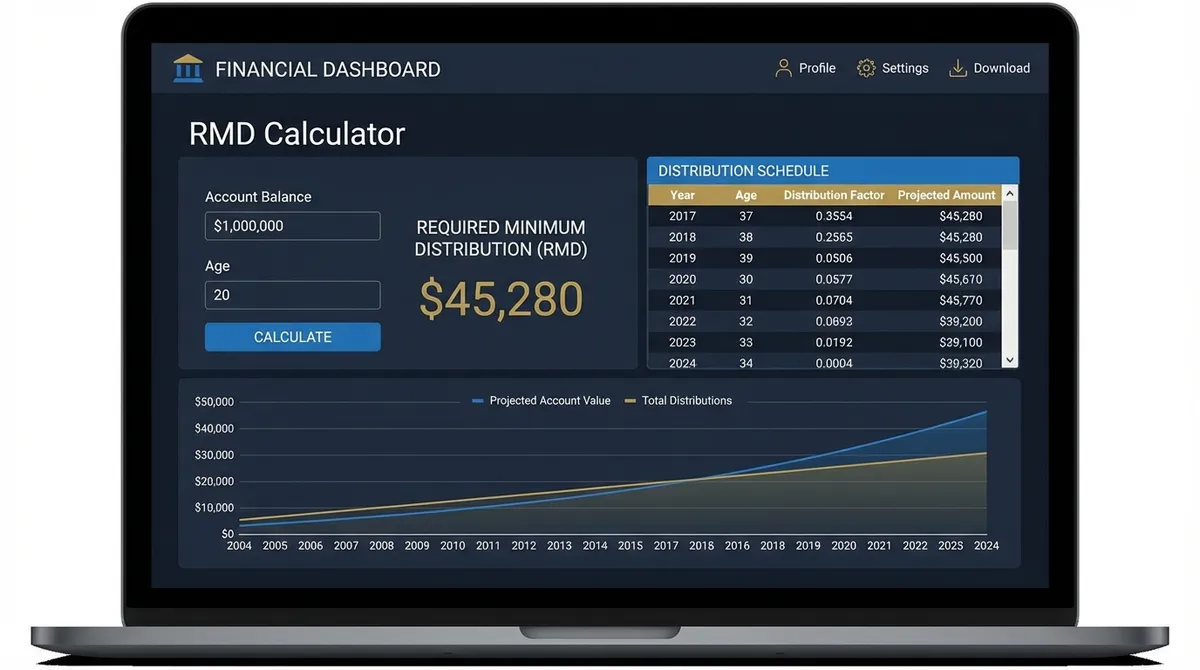

How Our RMD Calculator Works

Our Required Minimum Distribution calculator applies current IRS rules using the official Uniform Lifetime Table and an approximation of the Joint Life and Last Survivor Table to estimate how much you must withdraw from your retirement accounts each year. The calculation is straightforward but critical: divide your prior year-end account balance by your life expectancy factor from the applicable IRS table.

RMD Formula: RMD = Prior Year-End Balance ÷ Life Expectancy

The life expectancy factor comes from the IRS Uniform Lifetime Table (for most people) or, when your spouse is the sole beneficiary and more than 10 years younger, from the IRS Joint Life rules (approximated in this calculator for educational planning).

The calculator automatically determines which IRS table rules apply based on your birth date, spouse information, and beneficiary status. It provides your estimated RMD amount, the percentage this represents, and the potential penalty if you fail to comply. For complex situations or precise tax filing, always confirm your numbers against the official IRS tables or with a qualified tax professional.

Understanding IRS Life Expectancy Tables

Uniform Lifetime Table (Most Common)

Used by unmarried individuals, married individuals whose spouse isn't the sole beneficiary, or whose spouse is less than 10 years younger. The table starts at age 73 with a 26.5-year life expectancy.

Example: At age 80, your life expectancy is 20.2 years

RMD = $100,000 ÷ 20.2 = $4,950.50 (4.95% of balance)

Joint Life and Last Survivor Table

Only used when your spouse is the sole beneficiary AND more than 10 years younger. This table results in lower RMDs, as it uses the joint life expectancy of you and your spouse.

Benefit: Lower annual distributions mean more money stays invested longer

Example: A 75-year-old with a 62-year-old spouse uses a longer joint life expectancy

Critical RMD Deadlines You Must Know

Your First RMD

Deadline: April 1 of the year after you turn 73

Example: Turn 73 in 2025 → First RMD due April 1, 2026

All Subsequent RMDs

Deadline: December 31 every year

Example: Second RMD due December 31, 2026 (and every year after)

Double RMD Warning in First Year

If you delay your first RMD to April 1, you'll take two RMDs in that calendar year (the delayed first one and the second one by December 31). This could push you into a higher tax bracket.

RMDs and Your Tax Bill: The "Tax Torpedo"

Required Minimum Distributions can do more than just increase your taxable income; they can trigger a cascade of other tax consequences known as the "Tax Torpedo." Understanding these interactions is critical for preserving your wealth.

1. Social Security Taxation

RMDs increase your "Provisional Income," which determines how much of your Social Security benefits are taxable. For many retirees, a large RMD can push up to 85% of their Social Security benefits into the taxable column, significantly increasing their effective marginal tax rate.

2. Medicare IRMAA Surcharges

Medicare Part B and Part D premiums are based on your income from two years prior. A large RMD at age 73 could trigger an Income-Related Monthly Adjustment Amount (IRMAA) at age 75, potentially doubling or tripling your Medicare premiums.

Strategy: Unlike tax brackets which are progressive, IRMAA is a "cliff." Earning just $1 over the threshold triggers the higher premium for the entire year. Careful RMD management is essential.

3. Net Investment Income Tax (NIIT)

While RMDs themselves aren't subject to the 3.8% NIIT, they increase your Modified Adjusted Gross Income (MAGI). This can push you over the threshold ($200k for singles, $250k for couples), exposing your other investment income (dividends, capital gains) to this surtax.

Advanced Strategies for High-Net-Worth Retirees

If you have a large tax-deferred balance, RMDs can force you to withdraw far more than you spend, creating an unnecessary tax drag. Here are advanced strategies to mitigate this:

QLAC (Qualified Longevity Annuity Contract)

You can use up to $200,000 (indexed for inflation) of your IRA to buy a QLAC. This removes that money from your RMD calculation immediately. Income payments (and taxes) are deferred until as late as age 85, providing longevity protection and current tax relief.

Strategic "Un-Retirement"

If you return to work for a company with a 401(k), you might be able to roll your IRA into the new 401(k). If you don't own 5% of the company, you can often delay RMDs on that 401(k) balance until you retire again, effectively pausing RMDs.

Roth Conversion Ladder

Implement a systematic Roth conversion plan between retirement (e.g., age 60) and RMD age (73). By filling up lower tax brackets with conversions each year, you reduce the traditional IRA balance that will eventually be subject to RMDs.

In-Kind Distributions

You don't have to sell your stocks to take an RMD. You can transfer shares directly from your IRA to your taxable brokerage account. You'll owe taxes on the value at transfer, but you avoid transaction costs and keep the asset invested.

RMD Penalties: The Cost of Non-Compliance

25%

Penalty Rate (Reduced in 2023)

The SECURE Act 2.0 reduced the penalty for missed RMDs from 50% to 25% starting in 2023. This penalty applies to the amount you should have withdrawn but didn't.

Example: If your RMD was $10,000 but you only took $6,000:

Penalty = ($10,000 - $6,000) × 25% = $1,000

Reasonable Cause Waiver

You can request a penalty waiver by filing Form 5329 and attaching a letter of explanation if you can show:

- The shortfall was due to reasonable error

- You're taking steps to remedy the shortfall

- You file the waiver promptly

If corrected within 2 years, the penalty may be reduced to 10%

Real-World Example: Sarah's RMD Calculation

Sarah's Situation

- •Age: 75 years old in 2025

- •Total IRA Balance: $500,000 (as of Dec 31, 2024)

- •Spouse: John, age 73 (not 10+ years younger)

- •Beneficiary: John is sole beneficiary

RMD Calculation

Table Used: Uniform Lifetime Table

Life Expectancy at Age 75: 24.6 years

RMD = $500,000 ÷ 24.6 = $20,325.20

Sarah must withdraw $20,325 by December 31, 2025, or face a $5,081 penalty (25%)

Key Insight: Even though Sarah's IRA might grow during 2025, her RMD is based on the December 31, 2024 balance. She cannot use the current balance to reduce her RMD.

The New Inherited IRA Rules (SECURE Act 2.0)

If you inherit an IRA from a parent or non-spouse after 2019, the rules have changed drastically. The old "Stretch IRA" strategy is mostly dead.

The 10-Year Rule

Most non-spouse beneficiaries must empty the entire account within 10 years following the year of death. There are no annual RMDs required unless the original owner had already started taking RMDs (in which case, you must continue taking annual distributions AND empty the account by year 10).

Eligible Designated Beneficiaries (Exceptions)

These groups can still stretch RMDs over their lifetime:

- Surviving Spouses

- Minor children of the account owner (until they reach age 21)

- Disabled or chronically ill individuals

- Individuals not more than 10 years younger than the decedent

Strategies to Manage RMDs

1. Roth Conversions

Convert traditional IRA funds to Roth IRAs before age 73. Roth IRAs have no RMDs during your lifetime, and withdrawals are tax-free. This reduces your traditional IRA balance subject to RMDs.

2. Qualified Charitable Distributions (QCDs)

After age 70½, you can donate up to $100,000 directly from your IRA to qualified charities. QCDs count toward your RMD but aren't included in your taxable income.

3. Strategic Withdrawals Before 73

If you're in a lower tax bracket before RMDs begin, consider taking withdrawals to reduce your future RMD base. This can spread tax liability over more years.

4. Continue Working Exception

If you're still working at 73 and don't own 5% of the company, you can delay RMDs from your current employer's 401(k) until retirement. IRAs don't qualify for this exception.

Common RMD Questions

Do Roth IRAs have RMDs?

No. Original Roth IRA owners are exempt from RMDs during their lifetime. However, beneficiaries who inherit Roth IRAs must take RMDs, though the withdrawals are tax-free.

Can I aggregate RMDs from multiple accounts?

Traditional IRAs: You can calculate RMDs for each IRA but withdraw the total from one or more IRAs.

401(k) plans: You must take RMDs separately from each 401(k) account.

403(b) plans: Similar to 401(k)s, RMDs must come from each account separately.

What happens if my spouse inherits my IRA?

Spouses have special options: They can treat the inherited IRA as their own (delaying RMDs until they reach 73), roll it into their existing IRA, or remain as beneficiary. The choice affects when RMDs begin and how they're calculated.

How do market fluctuations affect RMDs?

Your RMD is based on your account's December 31st balance from the previous year. Market losses don't reduce that year's RMD, which may force you to sell investments at a loss. Conversely, market gains increase your RMD for the following year.

Final Thoughts

Understanding and properly calculating your Required Minimum Distributions is crucial for retirement planning and tax management. The rules are complex, and penalties for mistakes are significant. While our calculator provides accurate calculations based on IRS tables, consider consulting with a tax professional or financial advisor for personalized guidance, especially if you have multiple retirement accounts, inherited IRAs, or complex beneficiary situations.

Remember: RMD rules change periodically. The SECURE Acts have already increased the RMD age from 70½ to 73, with provisions to increase it to 75 by 2033. Stay informed and review your retirement distribution strategy annually.