What Is SCHD Dividend Investing and Why It Matters in 2025?

SCHD (Schwab U.S. Dividend Equity ETF) has become one of the most popular dividend-focused ETFs among income investors, offering a powerful combination of high dividend yield, quality stock selection, and potential for dividend growth. The ETF focuses on companies with a strong track record of paying and growing dividends, making it an attractive option for investors seeking reliable passive income.

In 2025, with market volatility and economic uncertainty, SCHD dividend investing has gained even more traction. The ETF currently offers a competitive dividend yield around 3.8%, significantly higher than the S&P 500's average yield of 1.5%. More importantly, SCHD's underlying holdings are selected based on their ability to sustain and grow dividends over time, providing investors with a reliable income stream that can outpace inflation.

Key Statistic: With 100 shares of SCHD (approximately $7,500 investment at current prices), you can expect to receive roughly $260 annually in dividend income, paid quarterly. Over a 10-year period, assuming a 6% annual dividend growth rate, your annual dividend income could grow to over $465, demonstrating the power of dividend growth investing combined with the stability of quality dividend-paying stocks.

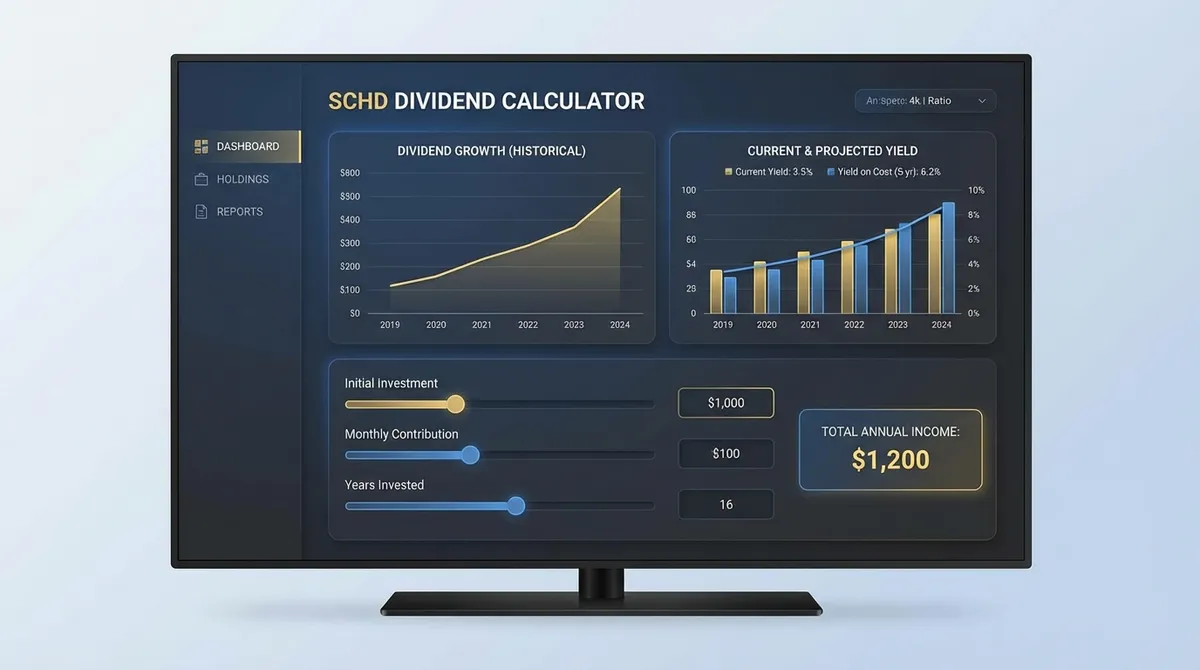

How SCHD Dividend Calculations Work: The Math Behind Your Income

Understanding how SCHD dividend calculations work is crucial for accurate income projections. The calculation involves several key variables that determine your actual dividend income:

However, this basic calculation doesn't account for dividend growth over time, which is one of SCHD's key strengths. A more comprehensive calculation considers:

- •Number of Shares: Your current SCHD position, which may increase over time through dividend reinvestment (DRIP) or additional purchases.

- •Quarterly Dividend per Share: SCHD typically pays dividends quarterly, with the amount varying based on the underlying holdings' performance.

- •Dividend Growth Rate: The annual percentage increase in dividend payments, which for SCHD has historically averaged around 6-8%.

- •Share Price Appreciation: While not directly affecting dividend income, share price growth impacts your total investment value and yield on cost.

- •Compounding Effect: Reinvesting dividends to buy more shares accelerates income growth through the power of compounding.

The power of SCHD dividend investing lies in its combination of current dividend yield and dividend growth. Even if the current yield seems modest, the dividend growth rate can significantly increase your income over time, often outpacing inflation and providing a growing income stream in retirement. Use our dividend calculator to project your future income. Combining this with a dividend reinvestment strategy enhances the compound interest effect. For tax efficiency, consider holding SCHD in a Roth IRA or Roth 401(k).

Real-World Example: Building a $10,000 SCHD Position Over 15 Years

Meet James, a 40-year-old engineer who wants to build a reliable dividend portfolio for supplemental retirement income. He decides to invest $10,000 in SCHD, purchasing approximately 133 shares at $75 per share. His plan is to hold the investment for 15 years, reinvesting all dividends to maximize compounding.

Initial Investment: 133 shares at $75.00 = $9,975

Assumptions:

• Current quarterly dividend: $0.65 per share

• Dividend growth rate: 6% annually

• Share price appreciation: 8% annually

• All dividends reinvested

15-Year Projection: By the end of 15 years, James's initial $9,975 investment would grow to approximately $31,722 in value, and his annual dividend income would increase to $1,245 per year, compared to $345 in the first year. This represents a 260% increase in dividend income, demonstrating the power of dividend growth combined with reinvestment.

This example shows why many investors consider SCHD a "sleep-well-at-night" investment—the combination of quality holdings, growing dividends, and potential capital appreciation provides multiple paths to wealth building.

Key Factors That Affect Your SCHD Dividend Income

Understanding the factors that influence SCHD's dividend payments is crucial for accurate projections and realistic expectations. Unlike individual stocks, SCHD's dividends are influenced by multiple factors:

1. Underlying Holdings Performance

SCHD tracks the Dow Jones U.S. Dividend 100 Index, which includes 100 high-dividend-yielding U.S. stocks. These companies must meet strict criteria including 10 years of consistent dividend payments and strong financial health metrics. However, individual company performance can affect the overall dividend yield.

2. Sector Allocation Changes

SCHD's sector weights can shift based on market conditions. For example, during economic uncertainty, defensive sectors like consumer staples and utilities might increase their weight, potentially affecting dividend stability and growth rates.

3. Dividend Sustainability Screens

The ETF methodology screens for companies with sustainable dividends, typically targeting those with payout ratios below certain thresholds. This focus on sustainability helps maintain consistent dividend payments even during economic downturns.

4. Interest Rate Environment

Interest rates significantly impact dividend-paying stocks. When rates rise, fixed-income investments become more attractive, potentially creating selling pressure on dividend stocks. Conversely, low interest rates make dividend yields more attractive, supporting share prices.

5. Economic Conditions

Broader economic conditions affect corporate earnings and, consequently, dividend payments. Recessions may force some companies to reduce or suspend dividends, while economic growth typically supports dividend increases.

6. Fund Expenses

SCHD has a low expense ratio of 0.06%, meaning very little of the dividend income is lost to management fees. This cost efficiency helps maximize the income investors receive from their investments.

Pro Tip: Monitor SCHD's quarterly dividend announcements and compare them to previous quarters. Consistent or increasing dividends indicate healthy underlying holdings, while significant decreases might signal broader market stress or changes in the ETF's methodology.

Common SCHD Dividend Investing Mistakes to Avoid

Even experienced investors can make mistakes when projecting dividend income. Here are the most common pitfalls to avoid:

1. Assuming Constant Dividend Growth

Mistake: Assuming SCHD's dividend will grow at the same rate every year.

Solution: Use conservative dividend growth estimates and plan for variability. Consider using a range of scenarios in your calculations.

2. Ignoring Tax Implications

Mistake: Not accounting for taxes on dividend income in taxable accounts.

Solution: Factor in your tax bracket when calculating net dividend income. Consider holding SCHD in tax-advantaged accounts like IRAs for better tax efficiency.

3. Overlooking Dividend Timing

Mistake: Not understanding that dividends are paid quarterly and may vary slightly each quarter.

Solution: Plan your cash flow needs around quarterly payments and maintain a buffer for months when expenses exceed dividend income.

4. Focusing Only on Yield

Mistake: Making investment decisions based solely on current dividend yield without considering dividend growth potential.

Solution: Evaluate both current yield and dividend growth rate. A lower yield with higher growth may provide better long-term income than a high yield with no growth.

5. Not Considering Inflation

Mistake: Failing to account for inflation eroding the purchasing power of dividend income.

Solution: Ensure your dividend growth expectations exceed inflation rates to maintain your standard of living over time.

6. Underestimating the Power of Reinvestment

Mistake: Not reinvesting dividends, missing out on compound growth.

Solution: Consider enabling dividend reinvestment (DRIP) during your accumulation phase to maximize compounding effects.

Critical Warning

Never invest in SCHD or any dividend ETF without understanding that dividends are not guaranteed. Market conditions, economic stress, and changes in index methodology can all affect dividend payments. Always maintain a diversified portfolio and don't rely solely on dividend income for essential expenses.

SCHD Dividend Optimization Strategies for Different Situations

For Young Investors (20s-30s): Growth Maximization

Strategy: Focus on dividend reinvestment and increasing your position size regularly.

- Enable DRIP to maximize compounding

- Add to your position monthly through dollar-cost averaging

- Consider working overtime or side hustles to increase investment capital

- Aim for 50-100 shares before focusing on other investments

For Mid-Career Professionals (40s-50s): Balance Income & Growth

Strategy: Balance current income needs with long-term growth objectives.

- Consider taking some dividends as cash while reinvesting a portion

- Use SCHD dividends to supplement income while maintaining growth

- Evaluate tax implications of dividend income versus growth

- Aim for 200-500 shares to generate meaningful income

For Retirees (60s+): Income Focus

Strategy: Maximize reliable income while preserving capital.

- Take all dividends as cash for living expenses

- Maintain 6-12 months of expenses in cash (not SCHD) for stability

- Monitor dividend sustainability regularly

- Consider SCHD as part of a diversified income portfolio

For Tax-Conscious Investors

Strategy: Minimize tax drag on dividend income.

- Hold SCHD in tax-advantaged accounts (IRA, Roth IRA, 401k)

- Consider timing share purchases around ex-dividend dates

- Understand qualified vs. non-qualified dividend tax treatment

- Coordinate with other income sources for tax efficiency

Key Takeaways

- •SCHD provides a compelling combination of current dividend yield (~3.8%) and dividend growth potential, making it suitable for various investment strategies.

- •Dividend reinvestment during your accumulation phase can significantly accelerate wealth building through compounding effects.

- •Always use conservative estimates when projecting future dividend income, and plan for variability in dividend payments.

- •Consider tax implications and use tax-advantaged accounts when possible to maximize your net dividend income.

- •Use our SCHD dividend calculator above to model different scenarios and understand how various factors affect your dividend income potential.